17 Billion Monthly Transactions — UPI’s Unstoppable Rise

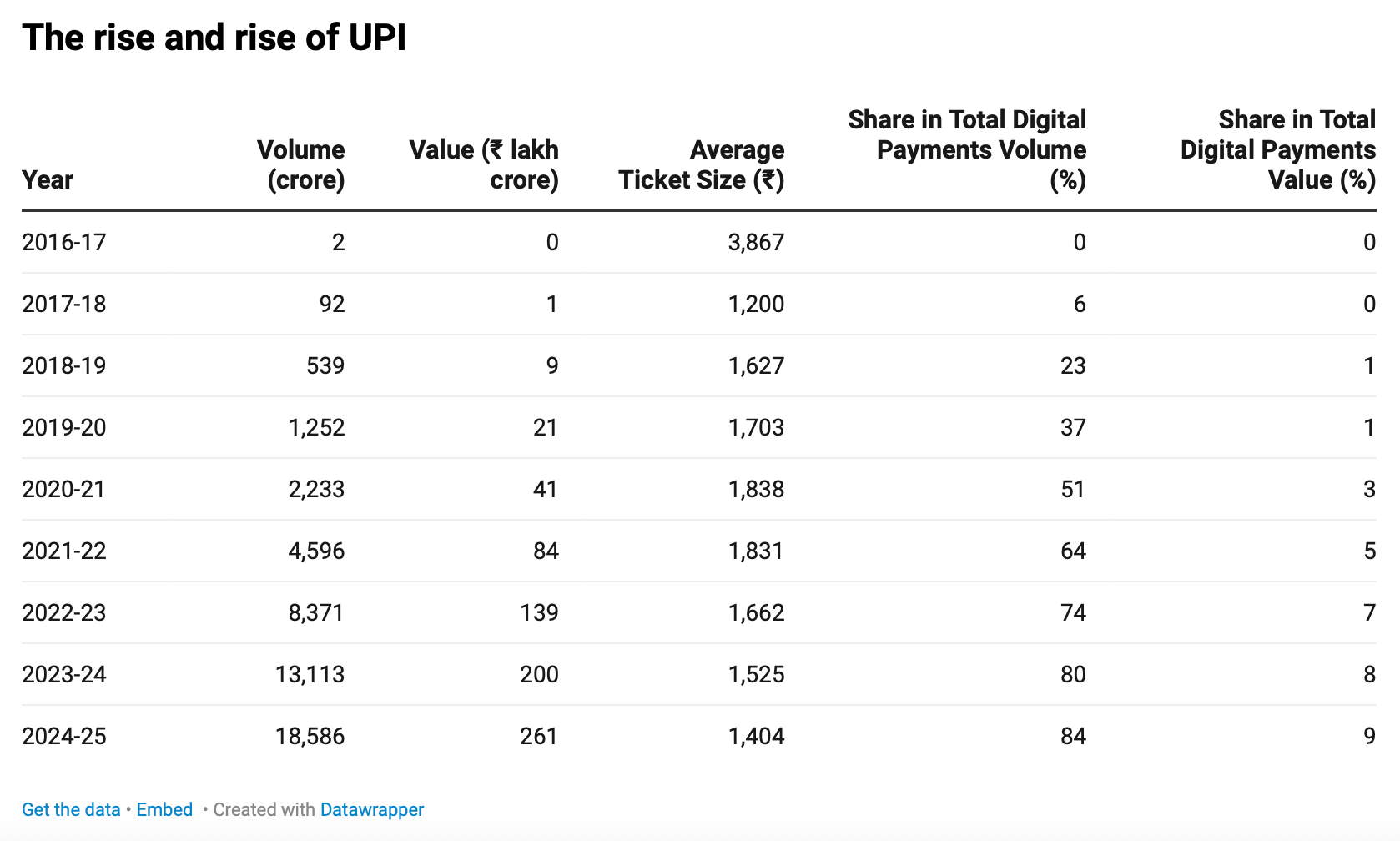

India’s UPI is absolutely eating the payments world. The country’s homegrown real-time payments system now powers 84% of all digital payment volumes — that’s 17 billion transactions every month 🤯

Hey Payments Fanatic!

India’s UPI is absolutely eating the payments world.

The country’s homegrown real-time payments system now powers 84% of all digital payment volumes — that’s 17 billion transactions every month 🤯

From chai stalls to luxury retail, UPI has replaced cash as the default, showing what’s possible when instant payments, QR codes, and scale collide.

The RBI even found that as UPI use rises, cash demand drops, a glimpse into what a truly digital economy looks like.

👀 And speaking of visibility, I’ve got a unique brand collab opportunity for companies that want to stay in front of hundreds of thousands of FinTech decision-makers every day, not just at events.

Want in? Let’s talk.

Cheers,

NEWS

🇬🇧 OSO is a Cellpoint Digital platform that is redefining airline payments. One Source Orchestration was developed as the first airline-native payments control platform, designed to unify orchestration, optimisation, and operations. It enables localized payment experiences, boosts profitability through smart routing, and reduces cost and complexity across the payment stack.

🇧🇷 Binance and Pomelo have formed a strategic partnership in Brazil, combining Pomelo’s infrastructure technology with the crypto exchange to launch innovative crypto-powered cards. This collaboration strengthens the connection between the crypto ecosystem and traditional finance, delivering regulated, scalable solutions ready for regional expansion across Latin America.

🌍 ACI Worldwide CEO, Thomas Warsop, said that risk Europe is left behind on stablecoins. In a wide-ranging interview, he said that ACI is well-positioned to support stablecoins and tokenized deposits as a new payment type, enabling interoperability and clearing capabilities for financial institutions, merchants, and billers globally.

🇪🇺 Key EU payment deadlines loom. Ahead of the EU’s October 2025 Instant Payments Regulation deadline, banks and PSPs must support real-time euro credit transfers and Verification of Payee (VoP). ACI Worldwide’s Jeremy McDougall highlights the complexity of integrating VoP and other regulatory demands, noting that banks are prioritizing back-office systems and compliance over user experience

🇮🇳 UPI races ahead, accounts for 84% of total digital payments in FY25. A recent study from the Reserve Bank of India showed that higher adoption of UPI is associated with lower cash demand at both national and subnational levels. Keep reading

🇺🇸 DailyPay named Chairman Nelson Chai its Chief Executive Officer. Chai, with experience at Uber, Merrill Lynch, and the New York Stock Exchange, takes over from Stacy Greiner, who will stay on as adviser. The leadership change comes amid continuing regulatory scrutiny of the earned‑wage access (EWA) sector.

🌍 Remitee has raised $20 million in a funding round led by Krealo, with participation from strategic and institutional investors. The investment will boost Remitee’s mission to enable embedded remittance solutions for banks, FinTechs, and retailers across Latin America, the US, and Europe.

🌍 Flutterwave CEO, Olugbenga “GB” Agboola, bets on Stablecoins as Africa’s next financial leap. He emphasized the company’s strategic pivot toward stablecoin payments, positioning them as foundational to Africa’s economic future through partnerships and infrastructure development.

🇮🇪 Irish banks to launch instant payments across the euro zone. Banks and credit unions have begun rolling out SEPA Instant payments, which will enable personal and business customers to make euro payments within ten seconds, 24 hours a day. Continue reading

🇮🇳 FinTech firm Kiwi launches interest-back EMI on UPI, allowing consumers to convert high-value purchases into instalments while receiving a portion or full interest refund as cashback. The feature comes ahead of the Diwali season, a period when festive spending across categories such as electronics, gold, home appliances, and travel typically rises.

🇹🇿 I&M Bank Tanzania, Mastercard, and OpenWay launch world elite debit and multi-currency cards. The cards aim to support Tanzania’s growing demand for digital payments, offering features such as enhanced payment security, lifestyle privileges, and multi-currency functionality.

🌍 Western Union appoints Nicolas Levi as regional VP, Middle East, Pakistan & Afghanistan. Levi brings 20 years of experience to his new role, spanning the FinTech, telecom, and financial services sectors, with a strong leadership and growth track record in digital finance.

GOLDEN NUGGET

💳 Navigating the Complex World of Tokenization in Retail Payments.

Tokens can vary in format, but generally, they fall into 𝙩𝙝𝙧𝙚𝙚 categories:

1️⃣ Non-Format Preserving:

The token doesn't look like the original data. For instance, a social security number could be represented as "T@%3N5."

2️⃣ Format Preserving:

The token retains the format of the original data but scrambles the numbers.

3️⃣ Selective Masking:

A hybrid approach, some original numbers are left unchanged for verification purposes, such as the last four digits of a credit card.

𝗦𝗶𝗻𝗴𝗹𝗲-𝘂𝘀𝗲 𝘃𝘀. 𝗠𝘂𝗹𝘁𝗶-𝘂𝘀𝗲 𝗧𝗼𝗸𝗲𝗻𝘀

Tokens can be transient or enduring. Single-use tokens expire after a single transaction, whereas multi-use tokens can be used for multiple transactions over an extended period.

𝗦𝗮𝗳𝗲𝘁𝘆 𝗙𝗲𝗮𝘁𝘂𝗿𝗲𝘀 𝗼𝗳 𝗧𝗼𝗸𝗲𝗻𝘀

Tokens are secure because they're infeasible to reverse-engineer.

Even if a data breach occurs, what is stolen are merely tokens, which are useless without access to the token vault. Industry standards like point-to-point encryption (P2PE) and PCI DSS guidelines add an extra layer of security.

𝗧𝗼𝗸𝗲𝗻𝗶𝘇𝗮𝘁𝗶𝗼𝗻 𝘃𝘀. 𝗘𝗻𝗰𝗿𝘆𝗽𝘁𝗶𝗼𝗻

While both methods aim to protect data, tokenization offers an edge in compliance and security. If sensitive information is encrypted rather than tokenized, the data could potentially be decrypted, bringing it back into the PCI DSS scope and increasing risks.

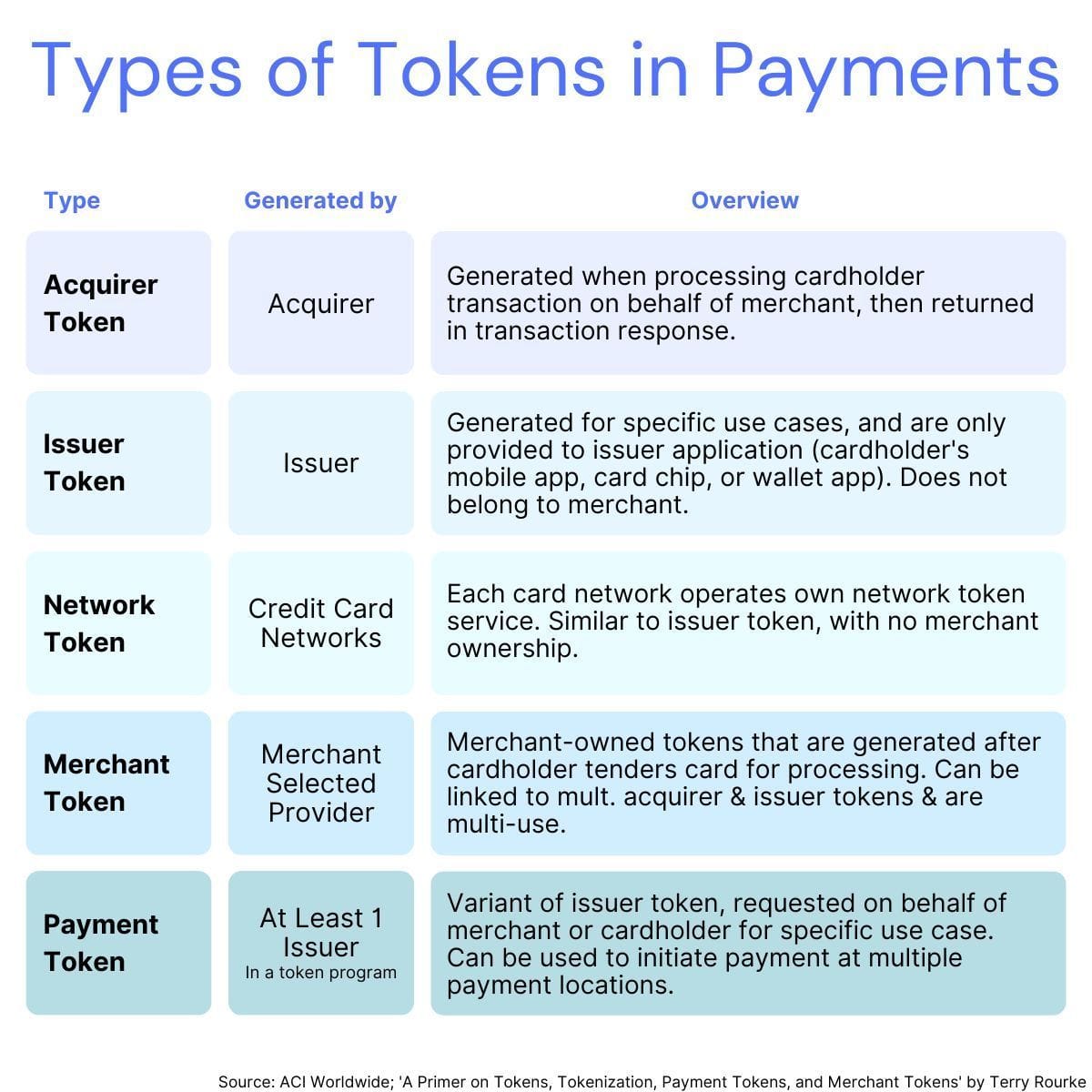

𝗧𝘆𝗽𝗲𝘀 𝗼𝗳 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀:

‣ 𝗔𝗰𝗾𝘂𝗶𝗿𝗲𝗿 𝗧𝗼𝗸𝗲𝗻𝘀: Generated by transaction processors, usually restricted to specific merchants.

‣ 𝗜𝘀𝘀𝘂𝗲𝗿 𝗧𝗼𝗸𝗲𝗻𝘀: Created by card issuers, like Visa or Mastercard, often for digital wallets such as Apple Pay or Google Pay.

‣ 𝗡𝗲𝘁𝘄𝗼𝗿𝗸 𝗧𝗼𝗸𝗲𝗻𝘀: Produced by credit card networks themselves, not bound to specific issuers.

‣ 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀: A newer category generated on behalf of issuers and merchants, usable across multiple locations.

‣ 𝗠𝗲𝗿𝗰𝗵𝗮𝗻𝘁 𝗧𝗼𝗸𝗲𝗻𝘀: Tailored for individual merchants, these can be integrated into a merchant's specific customer journey and can link to multiple other types of tokens.

I highly recommend reading the complete source article by Terry Rourke from ACI Worldwide

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()