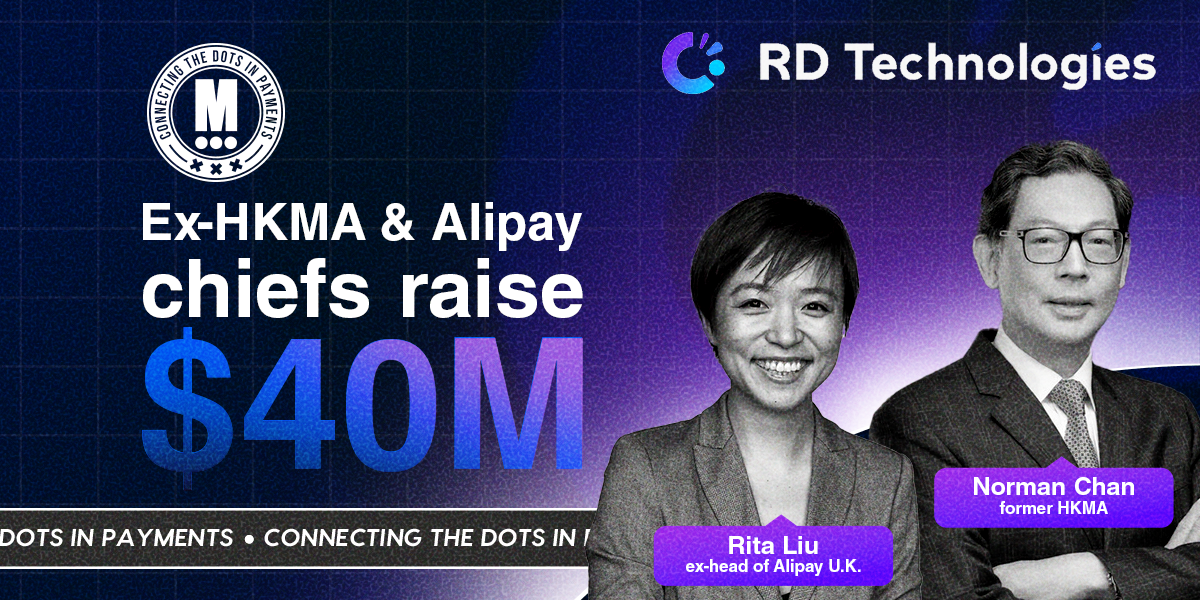

$40M Pushes RD Technologies Toward Hong Kong Stablecoin License

Hey Payments Fanatic!

RD Technologies just closed a $40 million Series A2 as it prepares to apply for a stablecoin issuer license under Hong Kong’s new rules, kicking in this Friday, August 1.

Led by Norman Chan, former HKMA chief, and Rita Liu, ex-head of Alipay U.K., the startup aims to reshape cross-border finance through enterprise-grade digital infrastructure.

But the story doesn’t end here. Scroll down for more details 👇

See you on Monday!

Cheers,

Get the Latest in Paytech! Join my new Telegram channel for daily updates on paytech trends and exclusive insights. Connect with industry enthusiasts and stay on top of innovation!

INSIGHTS

💰 The Future of Payments 2025.

NEWS

🇨🇳 HongShan-backed Hong Kong FinTech startup raises $40 million to advance stablecoin plan. RD Technologies said the fresh funding will support the company to “drive the next phase of digital currency transactions and asset tokenization through secure, enterprise-grade infrastructure.”

🇺🇸 Klarna prepares for autumn bid to revive $15bn New York float, months after being forced to abort a previous attempt amid tariff-induced market turmoil. The buy-now, pay-later company's Finance Chief has told investors that it is "closely monitoring market conditions and will move swiftly" when the timing is right to launch an IPO.

🇨🇦 Canada's Real-Time Rail set for testing phase. RTR will allow Canadians to initiate payments and receive irrevocable funds in seconds, 24/7/365. The system will also tap the ISO 20022 messaging standard to support payment information traveling with every payment.

🇺🇸 Tether-Focused Layer 1 'Stable' closes $28 million funding. The funding round comes on the heels of Stable's emergence from stealth and will be used to build out the network's infrastructure, grow its employee base, and increase worldwide USDT distribution.

🇮🇳 After RBI nod, FinTech Xflow plans global payments expansion. RBI’s in-principle approval to operate as an online payment aggregator for cross-border transactions is a major milestone in our mission to make global payments seamless for Indian SMBs, says Anand Balaji.

🇪🇬 ContactNow and PayTabs Egypt are integrating BNPL services to expand digital payment access. This integration aims to make digital payments more accessible for merchants and consumers across Egypt. The collaboration allows merchants using PayTabs Egypt’s platform to offer ContactNow’s BNPL solution at checkout.

🇸🇬 Ant International’s Antom and KASIKORNBANK announced the launch of K PLUS, a new local payment method on Google Play, marking the first time that a SEA mobile banking app is made available as a payment option in the platform. Android devices will be able to pay for global and local digital content on Google Play using their everyday banking app.

🇲🇽 Oxxo launches cash back tool. The tool is designed to enable businesses in Mexico that need to make refunds, make payments to customers, or offer cash pickups to quickly send money through Oxxo's nationwide network of more than 23,000 stores.

🇺🇸 Nuvei expands global platform to North America, unlocking 60% faster reconciliation with Granular, transaction-level Intelligence. U.S. and Canadian merchants now benefit from per-transaction interchange prediction, real-time settlement visibility, and a unified global experience across all payment operations.

🇺🇸 Visa expands stablecoin settlement support. As global interest in stablecoins takes center stage, Visa is building on its leadership in the space and enabling support for more stablecoins and more blockchains to facilitate settlement transactions for issuers and acquirers.

🇿🇲 Western Union, Zoona, and Chipper Cash launch money transfers in Zambia. Chipper Cash app enables customers in Zambia to send and receive money globally. In a joint statement, the partners said the service will empower customers to connect financially with over 200 countries and territories.

🇺🇸 Euronet and CoreCard announce merger agreement to unlock global opportunities in credit card issuing and processing. Acquisition aims to accelerate Euronet’s digital transformation strategy, expand the company’s U.S. footprint, and extend CoreCard’s access to global markets.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()