ACI Worldwide Acquires European FinTech Payment Components

Hey Payments Fanatic!

ACI Worldwide announced its latest strategic move.

The U.S. payments firm has fully acquired Greek FinTech Payment Components, including its IP, staff, and customer relationships.

Payment Components is trusted by 65 banks and institutions across 25 countries, and specialises in AI‑powered financial messaging, open banking, and A2A (account‑to‑account) payments.

Their technology will be integrated into ACI’s cloud‑native platform ACI Connetic — the only unified payments stack that brings together A2A payments, card‑processing, and AI‑driven fraud‑prevention in a single modular architecture.

Financial terms were not disclosed for this one.

I have listed this and other important Payments stories for you 👇

Cheers,

INSIGHTS

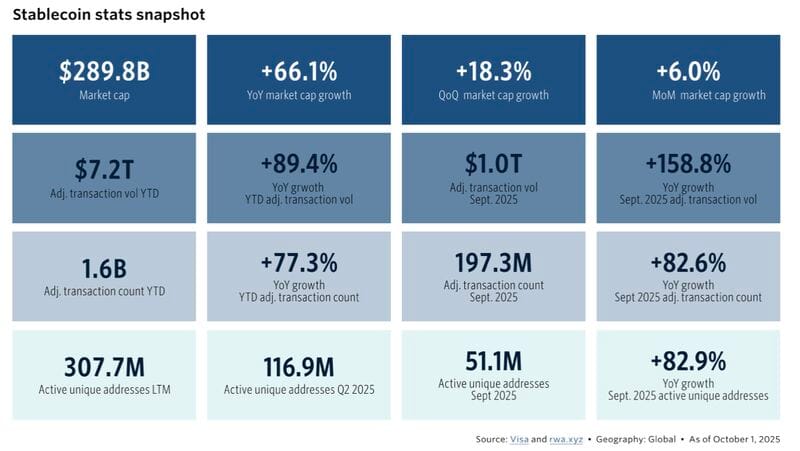

📈 YTD Stablecoin transaction volume has reached $7.2 trillion, now more than half of Visa’s total 2024 payments volume of $13.2 trillion 🤯

Here's a Stablecoin stats snapshot👇

NEWS

🇺🇸 ACI Worldwide acquires European FinTech Payment Components. ACI will integrate Payment Components technology into ACI Connetic, accelerating the roadmap of the industry's only cloud-native unified payments platform that seamlessly integrates account-to-account (A2A) payments, card processing, and AI-powered fraud prevention within a single, modular cloud-native architecture.

🇨🇳 Thunes powers WeChat Pay HK’s expansion in cross-border money transfers. Thanks to the collaboration, WeChat Pay HK users based in Hong Kong can now send money across the globe in real time and access faster, more affordable cross-border remittance options, enhancing the convenience of sending money abroad.

🇧🇷 Nium secures payment institution license to expand direct operations in Brazil. The license allows Nium to offer locally regulated services, including PIX, TEDs, boletos, and prepaid card issuance once operational. Nium can now onboard and operate directly in the country, improving efficiency and enabling faster domestic and cross-border transactions.

🇺🇸 Marqeta powers the expansion of Klarna debit card across Europe, enabling customers to choose between paying now or later, all through a single debit card experience. Through one integration with Marqeta’s platform, Klarna can accelerate time-to-market and scale efficiently across multiple countries.

🇮🇳 PayPal-backed Pine Labs seeks up to $439 million in Mumbai IPO. The company will offer shares at 210 rupees to 221 rupees apiece. Anchor investors will be able to place bids on Nov. 6, and other investors from Nov. 7 to Nov. 11. The offering includes a fresh issue of shares worth 20.8 billion rupees and the sale of about 82.35 million shares by founder and existing investors.

🇫🇷 Worldline partners with Fipto to enable the next generation of payment rails with stablecoin. Through this partnership, Worldline and Fipto aim to demonstrate how digital assets and traditional payment rails can coexist, enabling merchants, banks, and financial institutions to choose the solution that best serves their needs.

🇸🇦 Stream secures $4 million seed funding to transform B2B payments in MENA. With this round, Stream will fuel its product development in engineering, compliance, payment capabilities, and the overall user experience while strengthening its internal systems to support a rapidly growing subscriber base.

🇺🇸 Payroll startup Deel names former Intuit Exec Joe Kauffman as CFO for IPO goal. Kauffman previously served as the head of corporate development at New Oriental Education & Technology Group and as CFO of TAL Education Group, which he helped take public.

🇺🇸 US FinTech Navan’s founders net $25m each in IPO share sale. Navan, an American company with a large Israeli R&D center and about 3,400 employees worldwide, sold 30 million new shares, raising US$750 million, while existing shareholders sold 6.9 million shares for US$173 million.

🇮🇳 AtoB to acquire India’s LogiPe in global fleet FinTech expansion. The move aims to strengthen AtoB’s worldwide capabilities in delivering next-generation financial services for fleet owners and operators. Keep reading

🇮🇳 BNPL startup Snapmint raises $125 Mn led by General Atlantic. The proceeds will be used to expand its EMI-on-UPI offering and grow its merchant network. According to the company, the round will provide an exit to some of its early angel investors.

🇹🇱 SIBS reinforces its commitment to modernizing payments in Timor-Leste. SIBS's participation in this project included transaction processing, card production and personalization, the supply of ATM and POS terminals, and the implementation of a card management solution at this bank.

🇺🇸 Afriex and Visa bring real-time cross-border payments to 160+ markets. By integrating Visa Direct through Afriex’s financial institution partner, Afriex is making it faster and easier for individuals and businesses to send and receive funds across borders.

🇨🇳 Ant Chairman Eric Jing Xiandong touts ‘tokenised money’ for settlement but remains mum on stablecoin plans. Ant has used tokenised bank deposits to achieve cross-bank real-time settlement this year through the Hong Kong government’s Project Ensemble, Jing said at the city’s largest FinTech conference.

🇧🇷 Banco Inter and Chainlink power real-time CBDC trade settlement between Brazil and Hong Kong. Chainlink has completed a blockchain-based pilot that enabled the central banks of Brazil and Hong Kong to settle a cross-border trade transaction in real time using digital currencies and smart contracts.

🇺🇸 T-Mobile taps Capital One to issue its first credit card, which will feature no annual fees and 2% in T-Mobile rewards on every purchase. The T-Mobile card will run on Visa Inc.’s payment network, according to a statement. T-Mobile customers will also get $5 off their bills each month when they use the credit card via autopay.

GOLDEN NUGGET

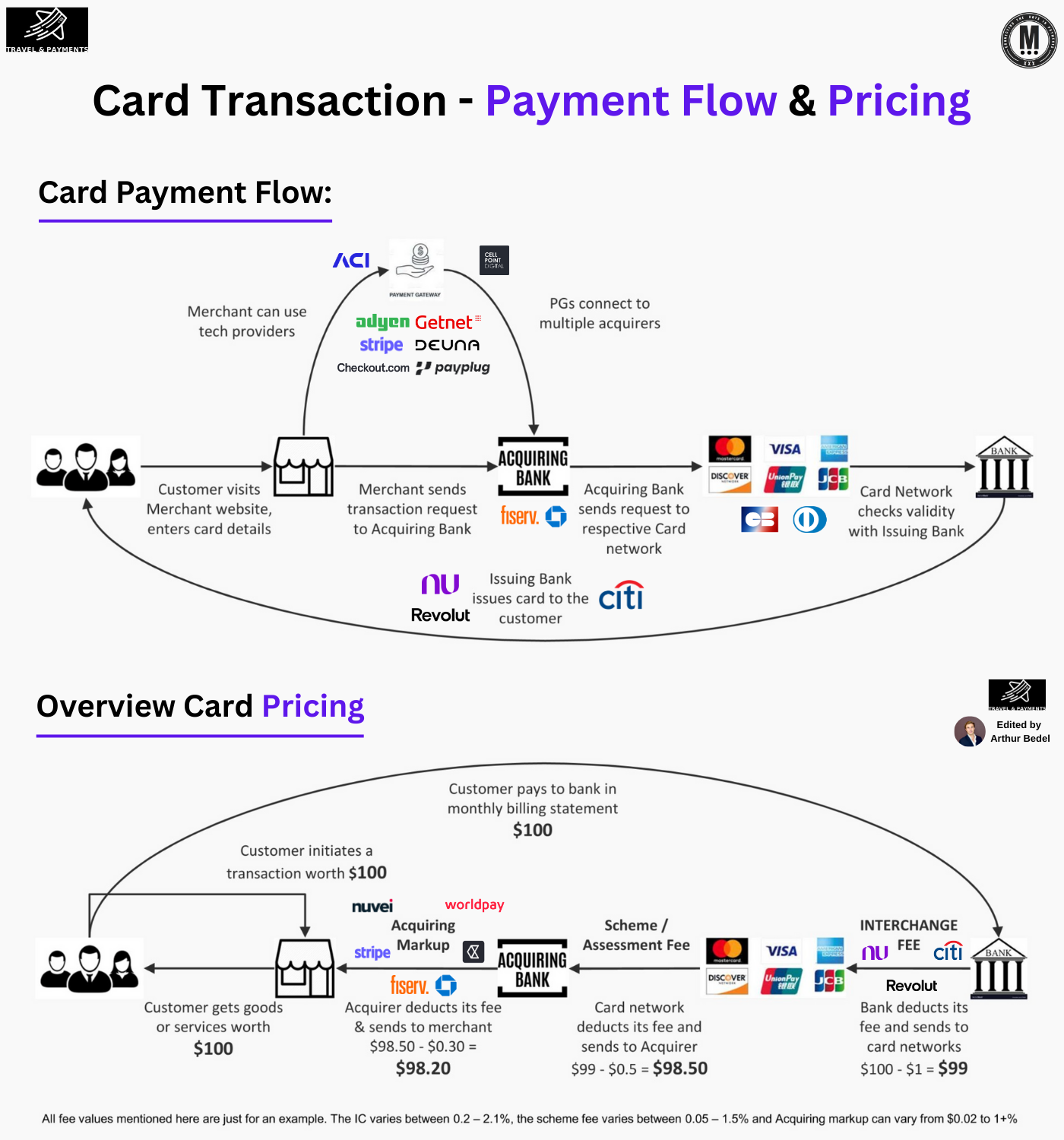

𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐅𝐥𝐨𝐰 & 𝐂𝐚𝐫𝐝 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 by Travel & Payments 👇 Created by Arthur Bedel 💳 ♻️

At the heart of every card payment is a variety of participants, from merchants to banks, gateway, PSPs and card networks. Understanding how these parties interact is key to grasping the complexity of payment processing.

𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 𝐢𝐧 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬:

► 𝐈𝐬𝐬𝐮𝐞𝐫 → Provides / Issues cards to customers (Revolut, Citi, Nubank)

► 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 → Processes merchant transactions, those include Acquiring Banks and PSPs with Acquiring licenses (Fiserv, Chase, Worldpay, Checkout.com, Payplug, Getnet)

► 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 → Connects Issuers, Acquirers and PSPs (Visa, Mastercard, GIE Cartes Bancaires)

► 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 → Connects merchants to acquirers, those include traditional gateways, orchestrators and PSPs - only listed traditional and orchestration in examples (ACI Worldwide, CellPoint Digital, DEUNA, Cybersource, Solidgate)

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐚 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐰𝐨𝐫𝐤?

1️⃣ 𝐒𝐭𝐞𝐩 𝟏: Customer visits a merchant’s website and enters their card details.

2️⃣ 𝐒𝐭𝐞𝐩 𝟐: Merchant sends the transaction request to an Acquiring Bank (Fiserv, Chase) via a Payment Gateway (ACI Worldwide, CellPoint Digital, DEUNA).

3️⃣ 𝐒𝐭𝐞𝐩 𝟑: The Acquirer forwards the request to the Card Network (Visa, Mastercard).

4️⃣ 𝐒𝐭𝐞𝐩 𝟒: The Card Network checks with the Issuing Bank to validate the transaction.

5️⃣ 𝐒𝐭𝐞𝐩 𝟓: If approved, the Issuer confirms the transaction, and funds are authorized.

𝐓𝐡𝐞 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 — 𝐓𝐡𝐞 𝐅𝐞𝐞𝐬 𝐁𝐫𝐨𝐤𝐞𝐧 𝐃𝐨𝐰𝐧 💳

1️⃣ 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐢𝐧𝐢𝐭𝐢𝐚𝐭𝐞𝐬 $𝟏𝟎𝟎 𝐩𝐮𝐫𝐜𝐡𝐚𝐬𝐞.

2️⃣ 𝐈𝐬𝐬𝐮𝐢𝐧𝐠 𝐁𝐚𝐧𝐤 (Revolut, Citi) deducts an 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞 ($1), sends $99 to Card Network.

3️⃣ 𝐂𝐚𝐫𝐝 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 (Visa, Mastercard) deducts 𝐒𝐜𝐡𝐞𝐦𝐞 𝐅𝐞𝐞 ($0.50), sends $98.50 to Acquirer.

4️⃣ 𝐀𝐜𝐪𝐮𝐢𝐫𝐢𝐧𝐠 𝐁𝐚𝐧𝐤 (Fiserv, Adyen, Nuvei) deducts 𝐌𝐚𝐫𝐤𝐮𝐩 (~$0.30), sends $98.20 to the Merchant.

Notes:

► Payment Gateways also may take a transaction fee.

► All fee values mentioned here are just for an example. The IC varies between 0.2 – 2.1%, the scheme fee varies between 0.05 – 1.5% and Acquiring markup can vary from $0.02 to 1+%

► This model is different in a 3-party model (i.e. American Express)

𝐒𝐢𝐦𝐩𝐥𝐢𝐟𝐢𝐞𝐝 𝐓𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧 𝐅𝐥𝐨𝐰 𝐄𝐱𝐚𝐦𝐩𝐥𝐞:

✔ $100 spent → Merchant receives $98.20.

✔ Total fees ($1.80) split between Issuer, Card Network, and Acquirer.

✔ Fees depend on card type, transaction type, and region.

Now you understand how card payments & the pricing behind it works!

Source: Travel & Payments

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()