ACI Worldwide Strengthens ACI Connetic With MongoDB and Synadia

Hey Payments Fanatic!

ACI Worldwide is entering new strategic partnerships with MongoDB and Synadia Communications to strengthen its cloud-native payments platform, ACI Connetic.

Launched last month, ACI Connetic combines A2A payments, card processing, and AI-driven fraud prevention in one platform, helping banks modernize their payment systems more efficiently.

The collaboration builds on ACI’s existing technology alliances with Microsoft, Red Hat, and IBM. By including now MongoDB’s NoSQL database and Synadia’s NATS messaging technology, ACI aims to enhance the platform’s resilience and adaptability in handling real-time financial transactions.

This technology stack is designed to support banks as they navigate growing operational demands, regulatory complexity, and the shift toward scalable, cloud-native architectures.

“ACI Connetic has been designed not only to help banks to future-proof their payments infrastructure but also to support the increasing non-functional requirements of modern payments,” said Scotty Perkins, head of product for banking and intermediaries at ACI Worldwide.

Get your daily dose of global payments news below 👇 I’ll be back with more tomorrow.

Cheers,

INSIGHTS

🇪🇸 The 2025 payments landscape in Spain and Portugal by Getnet. The adoption rates of real-time payments illustrate that the message is clear: consumers want real-time payments. Success will depend on merchants’ having the right technology to meet the needs of consumers without compromising on customer experience.

🇪🇺 The top 45 Merchant acquirers in Europe processed 141.05 billion Mastercard & Visa transactions in 2024

NEWS

🇬🇧 Ecommpay wins at Retail Systems Awards 2025. Ecommpay Payouts via Hosted Payment Page won the Payments Innovation category. It facilitates payments for member communities, delivering a swift time-to-market solution to overcome the traditional requirements of payout functionality.

🇧🇷 AstroPay partners with Pomelo to regionalise its card solution. Through this partnership, Pomelo’s technology supports AstroPay’s regional expansion with speed and efficiency, ensuring agility, compliance with local regulations, and strong operational performance.

🇺🇸 Mastercard expands stablecoin push with Paxos, Fiserv and PayPal integrations. The initiatives are the latest examples of global banks and payment firms racing to embrace stablecoins, a type of digital currency with prices anchored to an external asset such as fiat currencies, into their offerings.

🇺🇸 Chainlink and Mastercard partner to enable over 3 billion cardholders to purchase crypto directly on-chain. This removes long-standing barriers that have kept mainstream users from accessing the on-chain economy. Keep reading

🇲🇽 Belvo and Ualá join forces to facilitate access to credit through employment data. This will allow Ualá to make immediate decisions without relying on information from credit reporting agencies. Read more

🇲🇽 Unlimit to add card issuance to the Mexican financial portfolio. The company will now be able to work together with co-brand partners, whether a bank, retailer, or FinTech, and provide them with a financial infrastructure enabling them to easily launch payment products across Latin America.

🇺🇸 PayPal has announced the appointment of Tahira Adatia as Senior Director of Business Operations and Strategy within its Global Risk Management leadership team. In her new role, she will contribute to advancing PayPal’s mission of maintaining customer safety and trust.

🇺🇸 Nium promotes Dharminder Singh from Lead Engineer to CTO. In his new position, Singh will oversee Nium’s global engineering team. His responsibilities include scaling the company’s platforms and driving product innovation to support its growth in cross-border payments.

🇨🇳 China may test yuan stablecoins in Hong Kong. China’s central bank is exploring the idea of using Hong Kong as a testing ground for yuan-linked stablecoins to improve cross-border digital payments, according to a Morgan Stanley report, as part of its push to internationalise the yuan despite ongoing economic headwinds.

🇺🇸 Remitly launches International Business Payments from the U.S. Remitly developed a service that maintains the company’s trusted user experience while offering dedicated business support, without the cost or complexity of traditional enterprise solutions.

🇬🇧 dLocal unlocked trapped funds and accelerated payouts with BVNK. The company turned to BVNK to explore stablecoins as a solution for unlocking trapped liquidity. The result was a faster, more flexible settlement process that has since become a blueprint for how to operate in markets with liquidity challenges.

🇩🇪 Silverflow partners with Deutsche Bank for a European payments platform. The collaboration enabled the bank to minimise integration time as compared to legacy deployments, thus onboarding clients faster. This initiative demonstrated how modern payment infrastructure transforms banking operations.

🇰🇪 Pesalink and FinTech Alliance sign MoU to accelerate inclusive digital payments. The MoU is expected to foster joint initiatives that will reduce friction in FinTech-bank integrations, accelerate the adoption of instant account-to-account payments, and support a more inclusive, interoperable payments ecosystem.

🇿🇦 Peach Payments rolls out enterprise POS terminal with alternative payment methods. The Digit Pro is programmable with bespoke apps, and a library of plug-and-play apps is available. This allows merchants that have online and physical stores to have one payment partner and, therefore, only one integration process, which saves time and money.

🇨🇦 TerraPay partners with Paramount Commerce in Canada. Through this collaboration, TerraPay’s global network of money transfer operators can now facilitate seamless, real-time payments to recipients and is expected to expand beyond remittances, with future phases targeting payments in sectors such as payroll, travel, and digital content.

🇼🇸 ANZ launches instant payments. ANZ customers in Samoa can now send and receive instant payments following the bank’s integration with the Samoa Automated Transfer System (SATS). Keep reading

🌍 RS2 collaborates with Visa to deliver end‑to‑end global payment processing solution. This powerful combination will enable banks, FinTechs, and merchants around the world to access a streamlined, scalable, and secure payment platform.

🇧🇩 Google Pay is now in Bangladesh. Customers can add all their City Bank-issued Mastercard or Visa cards (both physical and virtual cards) to Google Wallet to make contactless payments with Google Pay. Continue reading

🇬🇧 Wirex to launch Dedicated Appchain with Tanssi, aiming to power over $20 billion in crypto transactions. This move accelerates compliant, low-cost crypto payments globally, dramatically simplifies operations, and enhances Wirex’s autonomy, Ethereum-grade security, and interoperability with DeFi, stablecoins, and tokenised assets.

🇱🇧 Bank Audi and Neo Digital Bank introduce Google Pay services in Lebanon. Customers can now add their Mastercard issued by Bank Audi or Neo to Google Wallet and use it for contactless payments at points of sale, as well as for online or in-app purchases both within Lebanon and abroad.

🇲🇽 EBANX enables APLAZO's BNPL payments for global e-commerce in Mexico. This collaboration enables international online merchants to offer their customers in Mexico accessible financing options tailored to their needs. Read more

🇬🇧 MuchBetter secures Mastercard Principal Licence for expansion into the UK and Israel. This strategic milestone empowers MuchBetter to accelerate its growth across both markets, broaden its Cards-as-a-Service (CaaS) proposition, and onboard new partners with greater autonomy, speed, and regulatory efficiency.

GOLDEN NUGGET

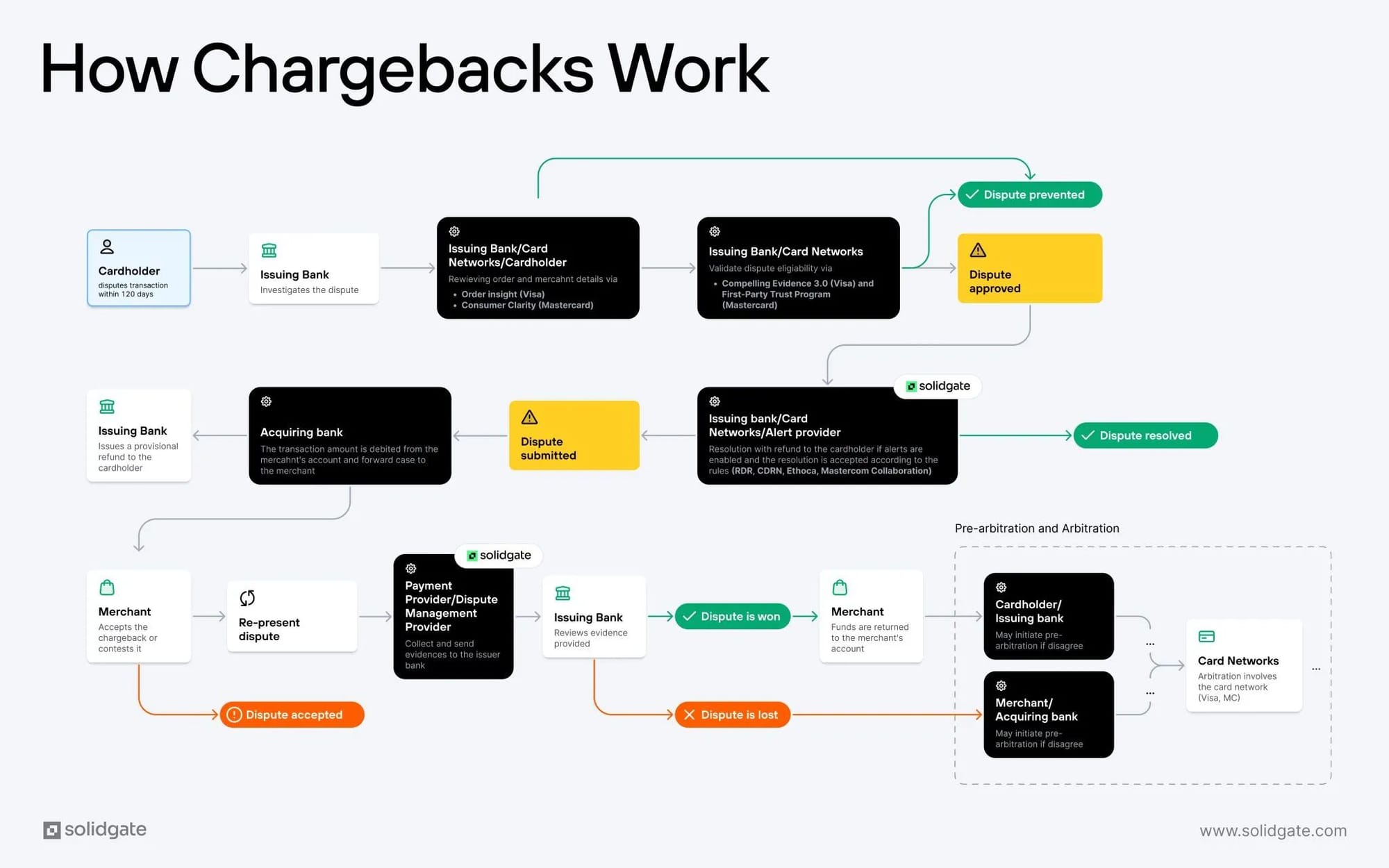

💳 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤𝐬 hurt more than profits, they can block your ability to get paid.

Here’s how Chargebacks work, and what you can do to stay ahead:

𝐊𝐞𝐲 𝐓𝐞𝐫𝐦𝐬 𝐓𝐨 𝐊𝐧𝐨𝐰

► 𝐃𝐢𝐬𝐩𝐮𝐭𝐞: When a cardholder questions a charge—may trigger a chargeback.

► 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤: Issuer reverses funds, often due to fraud or complaints.

👉 Visa says “dispute”; others use “chargeback.”

► 𝐏𝐫𝐞-𝐃𝐢𝐬𝐩𝐮𝐭𝐞 𝐀𝐥𝐞𝐫𝐭: Warns the merchant before chargeback, enabling early action.

► 𝐑𝐞-𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐦𝐞𝐧𝐭: Merchant submits evidence to contest a chargeback.

🔄 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰:

1️⃣ 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤 𝐈𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐨𝐧

A cardholder disputes a charge within 120 days. The main reasons include:

► Fraud

► Consumer disputes

► Processing errors

► Authorization issues

2️⃣ 𝐏𝐫𝐞-𝐃𝐢𝐬𝐩𝐮𝐭𝐞 𝐑𝐞𝐯𝐢𝐞𝐰

Before a formal chargeback, the issuer/cardholder may:

► Run fraud checks

► Review the transaction

► Check receipts or contact info

Goal: resolve early and avoid chargebacks.

3️⃣ 𝐏𝐫𝐞-𝐃𝐢𝐬𝐩𝐮𝐭𝐞 𝐀𝐥𝐞𝐫𝐭𝐬

If unresolved, alerts help merchants avoid escalation. To prevent formal chargebacks, merchants may:

► Use auto-rules

► Issue a quick refund

4️⃣ 𝐃𝐢𝐬𝐩𝐮𝐭𝐞 𝐒𝐮𝐛𝐦𝐢𝐬𝐬𝐢𝐨𝐧

If not resolved, the chargeback is filed.

Merchants (e.g., Amazon) get it via their acquirer, and the cardholder gets a provisional refund.

5️⃣ 𝐑𝐞-𝐩𝐫𝐞𝐬𝐞𝐧𝐭𝐦𝐞𝐧𝐭

Merchants can:

► Accept or challenge the chargeback.

⚙️ Platforms like Solidgate automate:

► Response strategy via rules/AI

► Evidence collection (e.g., delivery proof, receipts, emails, device ID)

► Submission and process management

The acquirer (e.g., Adyen) sends the response to the issuer.

6️⃣ 𝐈𝐬𝐬𝐮𝐞𝐫’𝐬 𝐑𝐞𝐯𝐢𝐞𝐰

The issuer (e.g., Barclays) reviews evidence:

► If valid, merchant keeps the money

► If not, chargeback is upheld

👉 Merchants always pay a fee.

7️⃣ 𝐏𝐫𝐞-𝐀𝐫𝐛𝐢𝐭𝐫𝐚𝐭𝐢𝐨𝐧 & 𝐀𝐫𝐛𝐢𝐭𝐫𝐚𝐭𝐢𝐨𝐧

𝐏𝐫𝐞-𝐀𝐫𝐛𝐢𝐭𝐫𝐚𝐭𝐢𝐨𝐧: If either side disputes the outcome, this step allows for further negotiation.

𝐀𝐫𝐛𝐢𝐭𝐫𝐚𝐭𝐢𝐨𝐧: If still unresolved, the dispute escalates to Visa/Mastercard, who make the final ruling.

🚨 𝐖𝐡𝐲 𝐇𝐢𝐠𝐡 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤 𝐑𝐚𝐭𝐢𝐨𝐬 𝐇𝐮𝐫𝐭 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬:

High chargeback rates can lead to lower conversion, financial penalties, higher processing fees, and enrollment in card network monitoring programs, potentially resulting in the loss of payment processing altogether.

Source: Solidgate

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()