Adyen Vets Power New Rounds in European Startups

Hey Payments Fanatic!

In a Fintech world obsessed with youthful disruption, two seasoned ex-Adyens are back in the startup game, and investors are betting big on their next acts.

Arnout Schuijff, co-founder of $60B Dutch payments giant Adyen, just raised €30M (~$34M) for his new venture, Tebi, an all-in-one platform helping hospitality SMBs manage payments, reservations, and operations. Backed by Alphabet’s CapitalG and Index Ventures, Tebi has processed nine figures in annual payments and is eyeing U.K. expansion, with AI at its core. Arnout Schuijff, energized by the product's technical roots, shared: “I got so inspired by the coding and the opportunity to contribute something to society.”

Meanwhile, Thijn Lamers, Adyen’s former EVP of Global Sales, has joined stablecoin startup Noah as co-founder and president, fueling a $22M seed round led by LocalGlobe, with backing from Palantir’s Joe Lonsdale and former Adyen CTO Alexander Matthey. Noah lets users convert between 50 currencies and transfer money between 70 countries in real-time, already processing over $1B in volume. “Everything is credibility,” Thijn Lamers emphasized, leveraging his deep network to build trust in a crowded, regulation-heavy sector.

What connects these two? Both are Fintech veterans leveraging deep domain expertise and networks to tackle real-world business payment friction, whether that’s local bars reconciling VAT or global teams escaping costly, slow bank transfers.

Their message is clear: Experience still scales. Capital agrees.

Enjoy more payments industry updates below👇 and I'll be back tomorrow!

Cheers,

Discover FinTech innovation across APAC. Stay informed with weekly updates—join now!

NEWS

🇧🇷 Mastercard Brazil expands in open finance and B2B card solutions. Mastercard, partnering with Lina Open X, will have exclusive rights to distribute Lina’s open finance services within the payments segment. Mastercard Brazil president Marcelo Tangioni said that although data sharing in open finance has matured, payments remain a largely untapped area.

🇨🇳 XTransfer partners with BNP Paribas to simplify Eurozone-China trade payments. The partnership will enable Chinese clients of XTransfer to collect payments in Euros more efficiently by making use of BNP Paribas’ network across Europe.

🌍 Deutsche Bank and Ant International announce strategic partnership to provide integrated cross-border payment solutions to global merchants. The bank will collaborate with Ant International’s Embedded Finance unit on a series of global treasury management and cross-border payment innovations.

🇦🇺 Afterpay and Zip Pay changes for millions of Australians. Stricter government regulation of delayed payment services may hurt users’ credit scores. Providers will be required to hold a credit license and comply with credit laws regulated by the Australian Securities and Investments Commission.

🇦🇺 Visa and Chainlink complete CBDC and a stablecoin swap between Hong Kong and Australia. This enabled an Australian investor to exchange an AUD-backed stablecoin for e-HKD and use the digital Hong Kong dollar to purchase a tokenized money market fund offered by asset managers in Hong Kong.

🇺🇸 Payments FinTech Navro acquires first US licence. The Delaware license means that Navro can now operate under full regulatory governance in the state, providing US firms access to its payments curation platform. Read more

🇳🇱 Plumery partners with Salt Edge to power smarter banking journeys. Through the partnership, Plumery has integrated Salt Edge’s open banking gateway, enhancing its digital banking experience platform with real-time access to account aggregation and payment initiation capabilities across thousands of banks worldwide.

🌍 Conferma expands virtual card services with JPMorgan Payments. This expansion offers European-based businesses the opportunity to issue and manage virtual cards effortlessly, unlocking multi-currency capabilities and providing greater flexibility to streamline payments across the region.

🇰🇷 South Korea’s ruling party unveils plan to allow stablecoins. South Korea’s new President is moving quickly to deliver on his campaign pledge to allow local companies to issue stablecoins, giving a further boost to one of the world’s most active digital-asset markets.

🇧🇷 Afinz acquires D3 Pagamentos and expands its offering for small and medium businesses. Afinz said that the operation represents a milestone and consolidates a new business front, “Afinz Empresas”. With this move, it sees that there is an opportunity in the market and intends to reach 500 thousand customers by 2030.

🇺🇸 Sezzle lawsuit accuses Shopify of stifling BNPL options. Sezzle said in a news release that it is seeking an injunction to block Canada-based Shopify from continuing this alleged conduct, with the suit asking for treble damages, or damages three times the amount awarded by a jury.

🇬🇧 BR-DGE partners with AstroPay to scale APM coverage. AstroPay got integrated with BR-DGE’s platform, making it available as an APM for the latter’s merchant customers across several sectors, including ecommerce, travel, gaming, and digital goods.

GOLDEN NUGGET

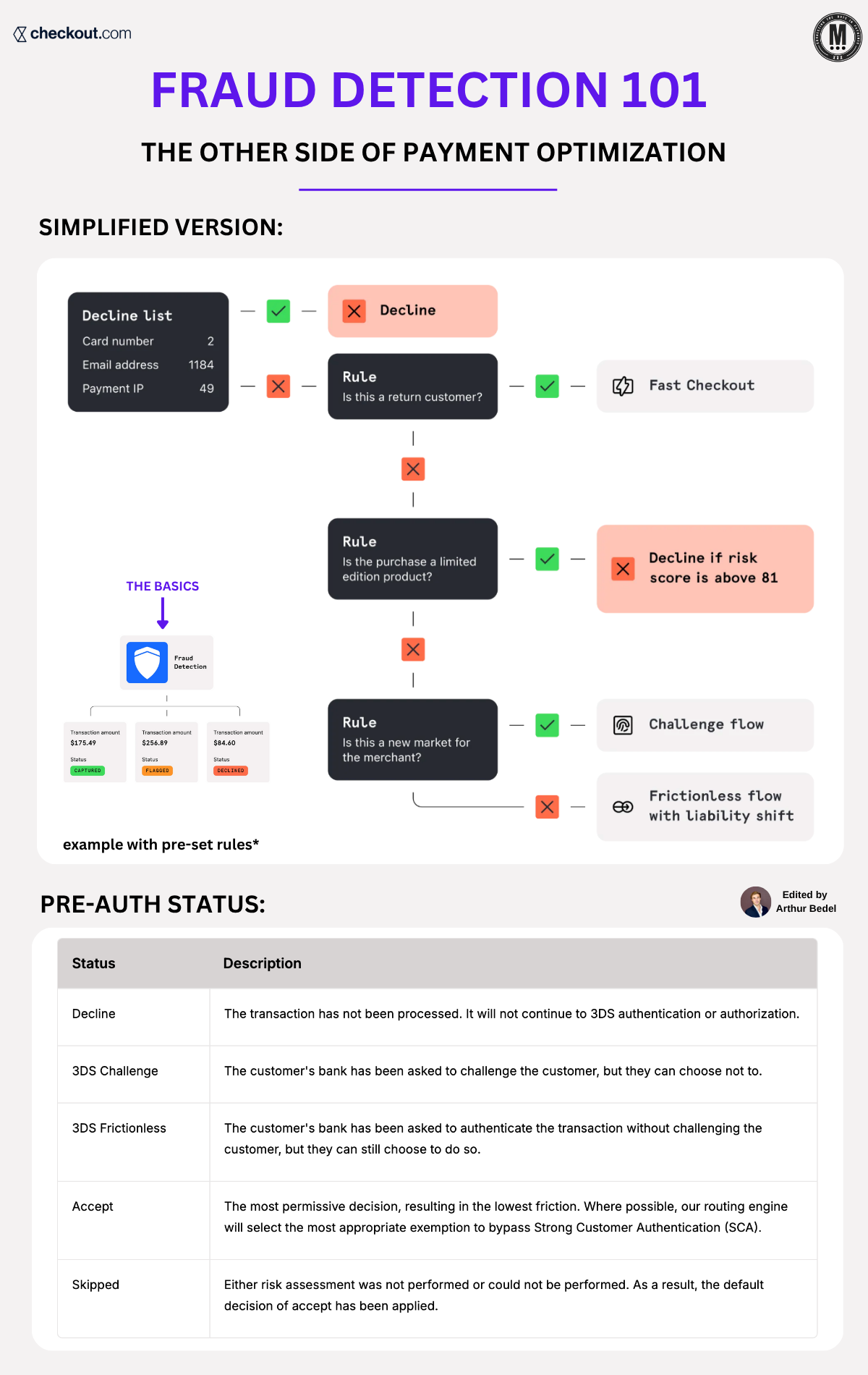

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 17 👋 Created by Arthur Bedel 💳 ♻️

𝐅𝐫𝐚𝐮𝐝 𝐃𝐞𝐭𝐞𝐜𝐭𝐢𝐨𝐧 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — The Other Side of Optimization

As payments get faster and more seamless, fraudsters get smarter. Real-time risk scoring, advanced rule engines, and pre-auth checks now form a critical part of how merchants protect revenue.

Fraud prevention isn’t a blocker — it’s a performance layer that balances risk, user experience, and regulatory compliance.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐅𝐫𝐚𝐮𝐝 𝐃𝐞𝐭𝐞𝐜𝐭𝐢𝐨𝐧 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬?

It refers to the pre-authorization logic that identifies and blocks suspicious or high-risk transactions before they reach the issuer or card network.

Fraud detection works by leveraging:

→ Real-time risk scoring

→ Device fingerprinting

→ Behavioral analytics

→ Rule-based logic

→ Machine learning models

𝐇𝐨𝐰 𝐃𝐨𝐞𝐬 𝐅𝐫𝐚𝐮𝐝 𝐃𝐞𝐭𝐞𝐜𝐭𝐢𝐨𝐧 𝐖𝐨𝐫𝐤?

► Fraud detection engines operate at the pre-authorization stage using a layered approach that combines data signals, rule logic, and real-time scoring to assess risk. The process includes:

→ 𝐑𝐞𝐩𝐮𝐭𝐚𝐭𝐢𝐨𝐧 𝐒𝐜𝐫𝐞𝐞𝐧𝐢𝐧𝐠 — Validate card numbers, email addresses, and IP addresses against internal and external blocklists.

→ 𝐂𝐮𝐬𝐭𝐨𝐦𝐞𝐫 𝐏𝐫𝐨𝐟𝐢𝐥𝐢𝐧𝐠 — Analyze behavioral patterns to determine if the user is a known or returning customer.

→ 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐁𝐞𝐡𝐚𝐯𝐢𝐨𝐫 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 — Detect risky attributes like high-value orders or limited-edition items.

→ 𝐆𝐞𝐨𝐠𝐫𝐚𝐩𝐡𝐢𝐜 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 — Flag transactions from new or unusual markets.

→ 𝐑𝐢𝐬𝐤 𝐒𝐜𝐨𝐫𝐢𝐧𝐠 — Apply a dynamic risk score to guide next-step decisions (i.e. decline, challenge, or approve).

► Based on these evaluations, transactions are routed as:

→ Accepted — Cleared for authorization without added friction

→ 3DS Challenge — Requires active customer authentication

→ 3DS Frictionless — Seamless authentication through trusted data

→ Declined — Blocked due to elevated risk or violation of custom rules

𝐓𝐡𝐞 𝐒𝐭𝐚𝐠𝐞𝐬 𝐨𝐟 𝐅𝐫𝐚𝐮𝐝 𝐃𝐞𝐭𝐞𝐜𝐭𝐢𝐨𝐧:

1️⃣ Initial screening — Device, IP, BIN, and email verification

2️⃣ Risk scoring — Evaluate risk thresholds and merchant-set rules

3️⃣ 3DS decisioning — Trigger frictionless or challenge authentication

4️⃣ Final decision — Approve, decline, or challenge based on scoring

𝐅𝐫𝐚𝐮𝐝 𝐃𝐞𝐭𝐞𝐜𝐭𝐢𝐨𝐧 𝐱 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧

Fraud detection and payment optimization are not opposites — they're two sides of the same coin. Together, they ensure every payment is fast, safe, and authorized.

Source: Checkout.com x Connecting the dots in payments...

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()