Affirm Card GMV +115% as It Teams Up With Costco

Hey Payments Fanatic!

Affirm closed its fiscal third quarter with numbers that show a business stretching across more corners of consumer spending. The company’s Gross Merchandise Value (GMV) climbed 36% YoY to $8.6 billion, with 1.8 million new consumers transacting on the platform. Its Affirm Card stood out, GMV surged 115%, reaching $807 million with 2 million active cardholders.

While revenue matched GMV growth at 36%, totaling $783 million, the market reacted cautiously. Shares slipped 8% as the company’s guidance pointed to a slight deceleration ahead, with expected Q4 revenue landing between $815 – $845 million. Max Levchin, Affirm’s CEO, addressed the balance between risk and resilience: “Strategically, we believe we have all the tools necessary to manage our business effectively in any macroeconomic environment.”

Beyond the quarterly figures, Affirm announced a new partnership with Costco. Approved customers shopping online will be able to select Affirm’s monthly payment plans at checkout. Levchin called the collaboration a privilege, noting Costco’s “unwavering commitment to customer experience and transparency.”

The platform now counts 21.9 million active users, with merchant partnerships growing 20% to 358,000. Recent months also brought agreements across sectors such as travel and fashion, broadening the ways consumers access pay-over-time options amid shifting spending habits.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

SPONSORED CONTENT

The true cost of paying a $50K independent contractor.

Download the guide to uncover:

Why a $50,000 contractor can cost you much more — and how hidden fees, FX markups, and taxes quietly eat into your budget.

How taxes, compliance rules, and worker classification risks can turn a simple contractor deal into a legal and financial nightmare.

Country-by-country breakdowns showing where contractors lose up to 50% of their income — and where they take home almost everything.

The best and worst countries to hire contractors — based on real take-home pay, compliance complexity, and total cost.

INSIGHTS

🇲🇽 Mexico experiences accelerated adoption of digital payments. The use of digital wallets has quadrupled in the past decade, increasing from 6% of e-commerce transaction value in 2014 to 28% in 2024. This trend is expected to continue, with digital wallets projected to account for 37% of online transactions by 2030.

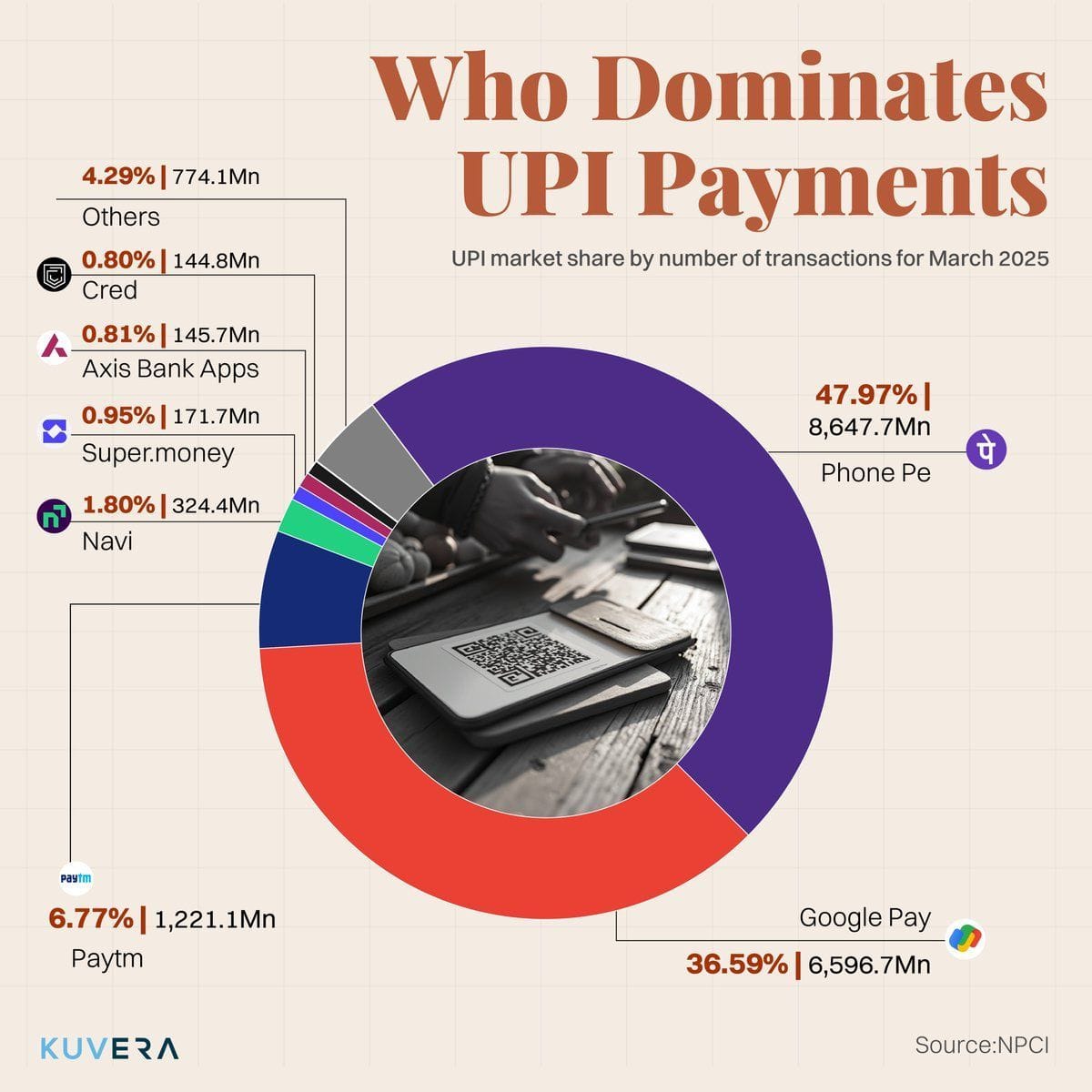

🇮🇳 Who dominates UPI Payments in India?

PAYMENTS NEWS

🇺🇸 ACI Worldwide, Inc. reports financial results for the March 31, 2025, quarter. ACI ended Q1 2025 with $230 million in cash on hand and a debt balance of $853 million, representing a net debt leverage ratio of 1.2x adjusted EBITDA. Year to date, the company has repurchased 1 million shares for approximately $52 million in capital.

🇺🇸 Apple tries to delay a ruling that bars it from taking a cut on external app payments. A U.S. court ruled in favor of Epic Games in a long-running case against Apple, after the Judge found that Apple did not comply with an order that was handed down in 2021.

🇦🇪 NymCard launches open finance services under the CBUAE open finance regulation. With this milestone, NymCard becomes one of the first entities in the UAE to embed regulated payment functionality within a broader financial infrastructure through one modular platform.

🇨🇦 Nuvei enables near-instant payouts via Mastercard in Canada. The service enables funds to be transferred directly to eligible cards, bypassing the need for traditional bank transfers or cheques. Businesses can access this capability through their current integration with the company’s platform.

🇺🇸 Paysafe and Fiserv strengthen partnership to drive SMB growth with enhanced capital access, fraud protection, and new digital wallet solution. This wallet will enable businesses to receive faster settlements and access a full range of banking services, while enhancing the customer experience.

🇺🇸 Stripe partners with Verifone. The partnership aims to deploy durable in-person payments through Verifone’s payment devices, expanding the company’s reach to businesses seeking enterprise-grade equipment and global payment capabilities.

🌍 PalmPay expands into four African markets after Nigerian success. The move comes on the back of strong growth in its home market of Nigeria, where the platform processed over 15 million daily transactions in the first quarter of 2025. Continue reading

🇬🇧 Major change to customers of 30 UK banks after new Post Office deal. Millions of bank customers can access their money at Post Office branches. The five-year deal secures the role of postmasters up and down the country in providing banking services to their communities.

🇮🇩 Korea is set to introduce a QR code payment service in Indonesia. This initiative aims to promote advanced digital financial services in Asia and operates under the guidance of the Bank of Korea (BOK). Read more

🇺🇸 Corpay strengthens its push into accounts payable for smaller businesses. Corpay will invest approximately $500 million for a 33% equity stake in AvidXchange. The $2.2 billion transaction is expected to close in Q4 2025, subject to shareholder and regulatory approval.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()