Airwallex Accelerates with UAE & Saudi Approvals

Hey Payments Fanatic,

Airwallex just planted its flag in the Middle East, and it’s not just dipping a toe in.

The Aussie-born FinTech has secured in-principle approval from the Central Bank of the UAE for stored value and retail payment services, and also set up its first entity in Saudi Arabia under the Ministry of Investment.

Why it matters? With Vision 2030 (KSA) and Vision 2031 (UAE) pushing for digital-first economies, this is prime territory for Airwallex’s playbook of multi-currency accounts, global transfers, payment acceptance, and corporate cards.

To sweeten the local checkout, Airwallex even teamed up with Tabby (the BNPL leader in the region) to boost basket sizes and conversions for merchants.

Backed by a fresh $300m Series F and partnerships with Arsenal and McLaren Racing, Airwallex is going full throttle: 60+ licences worldwide and now building out offices and staff in the Gulf.

The goal? Becoming truly “default global” while staying hyper-local.

Have a great weekend, and I'll be back in your inbox on Monday!

Cheers,

INSIGHTS

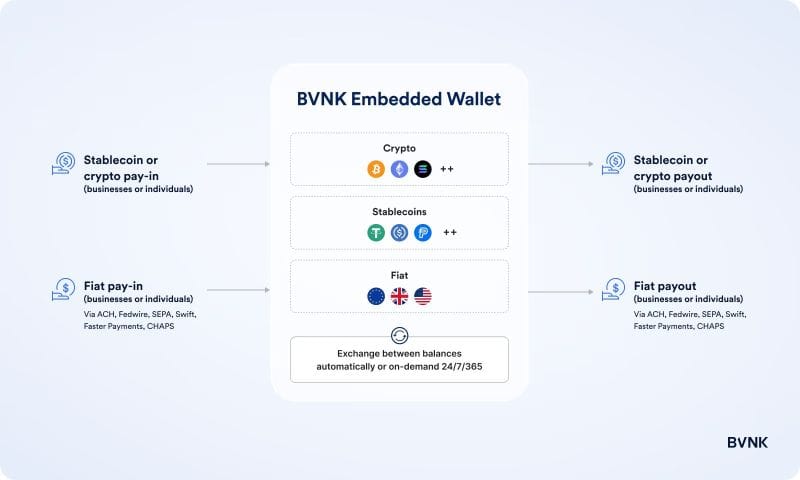

🪙 Are you looking for a beginner-friendly guide to embedded stablecoin wallets?

NEWS

🌍 Airwallex accelerates market entry in the Middle East as part of a broader global growth strategy across APAC, EMEA, and the Americas. In the UAE, it has secured In-Principle Approval for key payment licenses, enabling services like multi-currency accounts, global transfers, and corporate cards. Meanwhile, Airwallex has also established a new entity in Saudi Arabia, aligning with Vision 2030 and supporting the region’s digital economy.

🇺🇸 Klarna Card passes 1 million US sign-ups in 11 weeks. Launched in the US on July 4th, the Klarna Card has quickly resonated with consumers looking for more freedom in how they pay, whether paying instantly with debit or spreading the cost over time.

🇺🇸 Klarna chairman to CEO: We're 10 years behind Revolut. The warning came just after Klarna's IPO debut on the New York Stock Exchange, where shares jumped 30%. While the event featured celebrations, Michael Moritz’s sharp message underscored the challenge of catching up with Revolut.

🇮🇱 FinTech unicorn Tipalti raises $200 million in debt and surpasses $200 million ARR. The funds will help to accelerate its investment in artificial intelligence and international expansion. The deal comes shortly after Tipalti acquired Statement, a treasury automation startup built around native AI technology.

🇨🇳 RedotPay achieves Unicorn status with $47M strategic investment. The round saw new participation from Coinbase Ventures and a global technology entrepreneur, with increased commitments from Galaxy Ventures and Vertex Ventures.

🇺🇸 YC-backed Alguna emerges from stealth with $4M seed round. The funds from the seed round, which was supported by several undisclosed industry angels, will be used to expand the team in the US and UK, mostly focusing on the go-to-market teams and marketing.

🇺🇸 European banking alliance plans Euro stablecoin to challenge US market dominance. The project represents a coordinated effort by traditional European banks to enter the stablecoin market, potentially establishing a significant competitor to existing dollar-denominated digital currencies in cross-border payments and digital asset transactions.

🇬🇧 Payments firm Ebury to revive £2bn London float next year. Ebury, which handles cross-border payments for small businesses, is expected to seek a valuation of around £2bn, with Santander thought to be unlikely to proceed with an IPO if that figure is not attainable.

🇰🇷 Kakao Pay links Japan’s PayPay to offline payments in Korea. This enables Japanese PayPay users to make offline payments at more than 2 million merchants across the country. The online payments company said that PayPay’s network is now connected to Korean offline stores, allowing Japanese travelers to pay as they would at home.

🇦🇺 PayPal provides $1.5 billion in flexible loans to Aussie SMBs. The initiative enables eligible business customers to access funding swiftly, with loan amounts based primarily on their PayPal sales figures. Approved applicants generally receive funding within minutes, with a single fixed fee agreed at the time of application.

🇩🇰 Pleo launches Embedded Finance Solution, giving partners instant access to industry-leading spend and cash management for SMBs. With Pleo Embedded, partners can now offer their customers smart company cards, automated expenses, accounts payable, and a real-time cash management suite as a fully white-labeled or co-branded solution.

🇧🇷 EBANX enables Pix recurring payments for Hotmart, leading to a 32-point retention increase. Hotmart is now converting more than four times the number of recurring payments that previously failed with Pix into continued subscriptions. Continue reading

🇨🇭 Bivial AG rolls out Physical Visa Debit Cards. The physical Visa cards complement Bivial's robust suite of finance solutions, including Business Accounts, global bank transfers, direct debit collections, virtual IBANs, virtual corporate cards, alternative payment methods/wallets, and API-first banking infrastructure.

🇬🇧 TransferGo expands partnership with tell.money. The collaboration now includes both open banking API compliance and the implementation of the EU Verification of Payee (VoP), a process that helps confirm whether the name entered by a payer matches the account details provided, reducing fraud and misdirected payments.

🇲🇾 BNM fines Alipay Malaysia RM340,000 in wider compliance crackdown, for failing to update its sanctions database as required under the Financial Services Act 2013 and the AML/CTF and Targeted Financial Sanctions policy. This lapse disrupted the screening of customer accounts and delayed the freezing of funds linked to a listed entity.

🇬🇧 TrueLayer revenues up 63% in 2024 as it charts path to profitability. The highlights from TrueLayer’s FY2024 financial data showcase a year of exceptional growth and momentum towards achieving profitability. Its growth has been driven by increased adoption of its Pay by Bank solution across key sectors, particularly in e-commerce.

🇬🇧 Thredd powers OFX corporate card expansion across key global markets. Thredd provides the processing backbone, compliance expertise, and in-market support that enable OFX to deliver secure, scalable physical and virtual corporate card programmes with real-time spend controls, automated expense management, and multi-currency capabilities.

🇬🇧 Zilch appoints Amex veteran Boriana Tchobanova as COO. Bringing her two decades' worth of Fortune 100 experience, she will work with the team to deliver major initiatives that will support the organization’s growth, unlock new revenue opportunities, and improve efficiencies.

🇲🇾 Malaysia's MBSB launches international remittance service powered by Wise Platform. The partnership enables customers to transfer money internationally in real-time across more than 12 currencies, including USD, GBP, EUR, SGD, IDR, and AUD.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()