Alchemy Pay Expands to Australia with PayID Integration and AUSTRAC Approval

Hey Payments Fanatic!

Alchemy Pay just took a major leap in Australia’s crypto payment scene. Fresh off securing regulatory approval from AUSTRAC as a registered Digital Currency Exchange Provider, the global ramp solution leader has now integrated PayID, a real-time interbank payment system widely used across the country.

This move allows Australians to instantly convert AUD to crypto with lower fees, faster transactions, and higher success rates. The integration simplifies user onboarding and unlocks new go-to-market opportunities for Australian crypto projects.

“Australia’s tough regulatory environment has long been a barrier for crypto payments,” says Alchemy Pay. “By becoming one of the first crypto ramp providers registered with AUSTRAC, we’re breaking that barrier.”

Alchemy Pay is filling a much-needed gap in the Australian market, offering secure, compliant, localized crypto onramps where few others can. For local crypto projects, it opens new doors to scale and onboard users in one of the world’s most regulated markets.

Beyond Australia, Alchemy Pay’s global footprint spans Europe (SEPA, Skrill, BLIK), Southeast Asia (GrabPay, GCash, Thai QR), and more, delivering localized payment rails for crypto access across 170+ countries.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Stay ahead in FinTech! Subscribe to my Daily FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

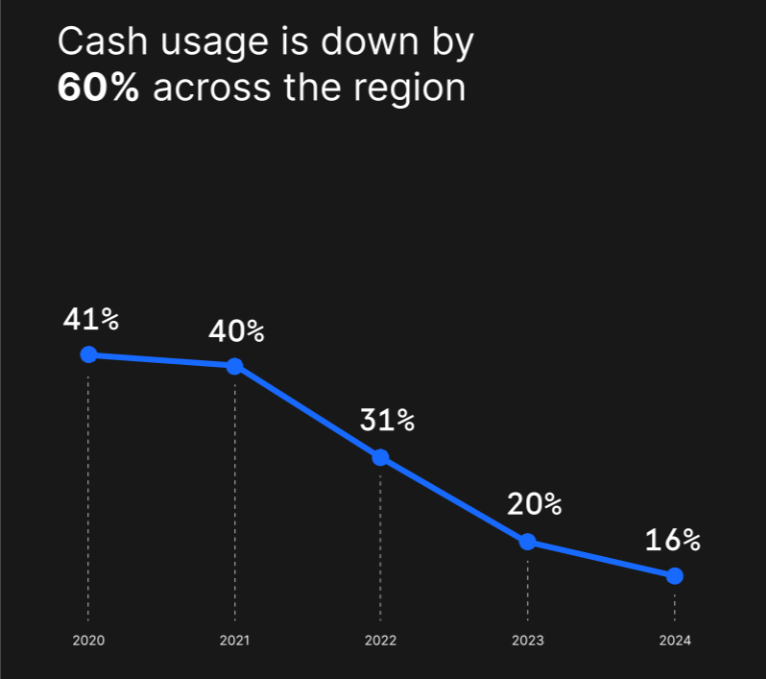

🌍 The state of digital commerce in MENA 2025 by Checkout.com. This exclusive report examines the evolving patterns and behaviors shaping the growth of digital commerce across the MENA region. Download the full report

🇶🇦 POS and e-commerce transactions hit $3.18bln in April. Qatar Central Bank revealed that the value of e-commerce transactions amounted to QR3.54bn, with a total volume of 8.95 million transactions. Meanwhile, point of sale transactions recorded a total value of approximately QR8.05bn, with a transaction volume of 40.1m.

NEWS

🇬🇧 Ecommpay’s Moshe Winegarten comments on How New BNPL Regulations Will Influence Consumer Confidence and E-Commerce Checkout Performance.

He stated that the introduction of these regulations will establish a consistent standard across the industry, ultimately boosting consumer confidence. However, he also noted that e-commerce merchants should assess the potential impact of the new requirements, especially the obligation for financial services providers to conduct affordability checks on checkout performance.

Partnering with payment providers such as Ecommpay, which offer a variety of credit solutions, will be essential. For instance, solutions like Visa Instalments, where payments are taken directly from an existing Visa card without the need for credit checks, help eliminate extra steps in the checkout process, enabling faster transactions and higher approval rates.

🇲🇾 CIMB Bank taps ACI Worldwide for payments platform modernisation. The partnership involves deploying ACI’s ISO 20022-native platform to unify all account-to-account transactions, including real-time, ACH, RTGS, and cross-border payments, onto a single system. The platform will first be launched in Malaysia.

🇰🇷 Kakao Pay plans to acquire SSG Pay and Smile Pay for digital optimisation in Korea. If successful, it will strengthen Kakao Pay’s position in the Korean mobile payments market. Additionally, Kakao Pay would expand its merchant relationships in retail and online marketplaces, paving the way for new financial products.

🇸🇬 Airwallex Bucks The FinTech Winter: Inside the $6.2 billion bet on cross-border payments. Airwallex’s US$6.2 billion price tag now represents roughly 5.5 times its forecast US$1 billion run-rate revenue for 2025. That multiple looks steep beside public-market comps.

🇮🇩 Indonesia’s QR payment system to launch in Japan and China starting Aug 17. The rollout in Japan depends on technical preparations, including sandbox trials with Japan’s payment authority. In China, technical and operational agreements have been finalized.

🌏 India and UAE redefine cross-border payments with UPI integration. This partnership offers super-fast, highly secure, and seamless payment methods, redefining financial interconnectivity between the two regions and providing millions of expats with a quicker, more convenient way to make remittances and global transactions.

🇬🇧 BoomFi and Paytiko to provide crypto payment rails to merchants worldwide. Together, the companies aim to make it easier for merchants to offer customers flexible, fast, and secure crypto payment options alongside traditional payment methods.

🌍 dLocal powers Panda Remit's expansion into Africa with faster, reliable cross-border payment solutions. This collaboration reduces transaction costs, increases operational efficiency, and accelerates market expansion, ensuring reliable access to funds for those who rely on remittances.

🇦🇺 Zeller app launches mobile invoicing to tackle $115 bn debt to reduce late payments for Australian small and medium-sized businesses. The update introduces invoicing capabilities, allowing business owners to create, send, manage, and track invoices directly from their smartphones.

🇪🇬 Fawry joins forces with CTM360 to strengthen digital risk protection and safeguard customers from evolving cyber threats. Through this partnership, Fawry will gain real-time visibility into potential cyber risks, enabling the company to swiftly detect and respond to threats.

🇦🇪 JP Morgan-backed ISG and Bank of Baroda UAE launch Jaywan Cards in UAE. The introduction will significantly enhance merchant acceptance by offering lower costs and fees, improved transaction controls, and a fully digitised environment for payments and reporting.

🇦🇪 Careem Pay launches international money transfers to Jordan. The Careem app allows UAE residents to send money directly to bank accounts in Jordan quickly and at competitive rates. Careem Pay facilitates money transfers to some of the largest remittance corridors in the world.

🇨🇳 Visa launches Click to Pay in Hong Kong with ZA Bank, the first issuing bank in Asia Pacific. This enables cardholders to complete online transactions in seconds without the need for manual card entry. Keep reading

🇬🇧 Altery becomes Visa principal member. With its new principal partnership, Altery gains direct access to VISA’s global card network, giving it greater control over the processes and the flexibility to move faster when launching new features or responding to customer needs.

GOLDEN NUGGET

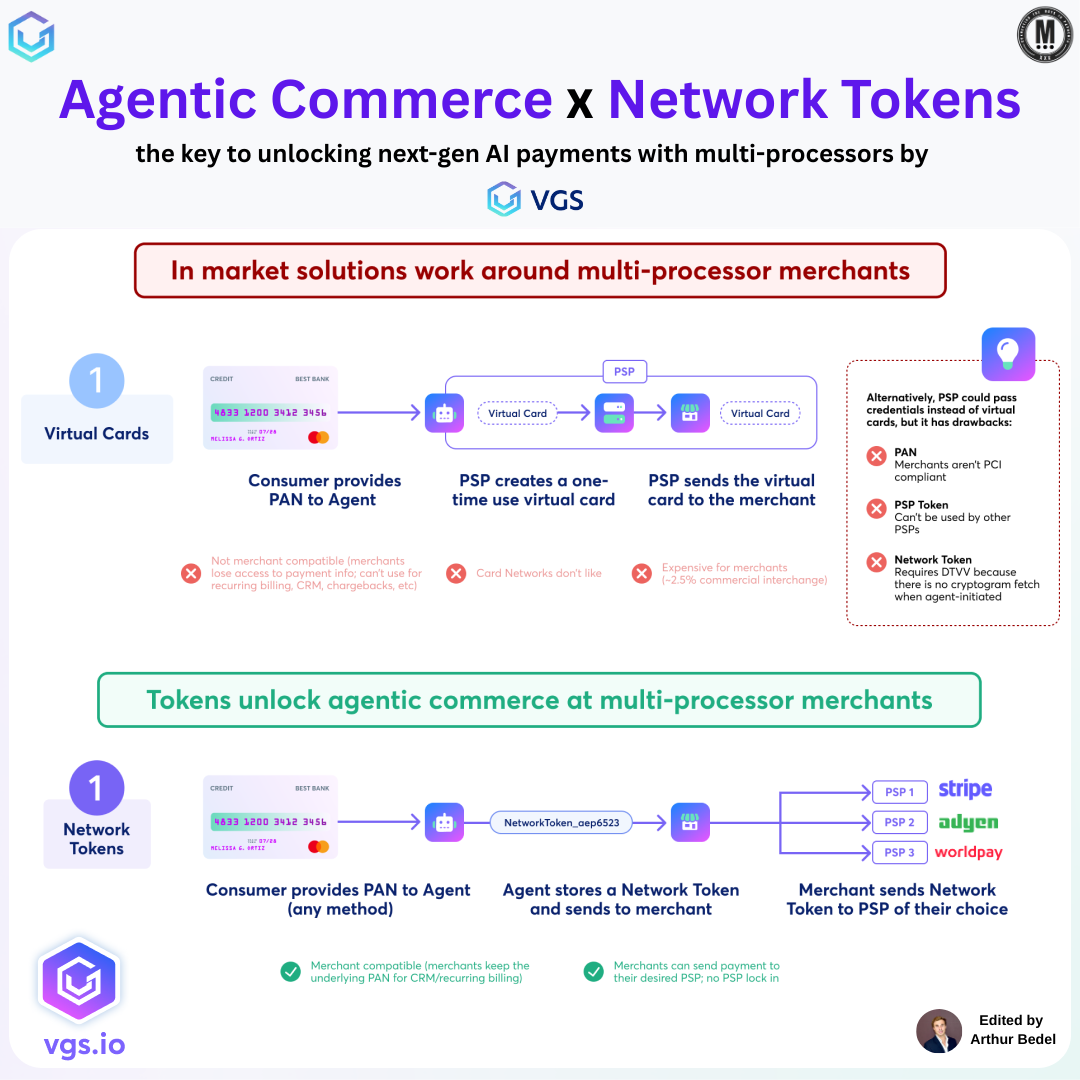

𝐓𝐡𝐞 𝐊𝐞𝐲 𝐭𝐨 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞? → 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 👇 Created by Arthur Bedel

The infrastructure for AI-native payments is being built right now.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞?

Agentic Commerce refers to a new paradigm in which autonomous AI agents— such as OpenAI (ChatGPT), Perplexity, Microsoft Copilot, Mistral AI, or Alexa— perform and complete transactions on behalf of users.

Unlike bots, which execute predefined actions, agents operate with contextual awareness, decision-making capabilities, enabling fully autonomous shopping, booking, and payments.

𝐁𝐨𝐭 𝐯𝐬. 𝐀𝐈 𝐀𝐠𝐞𝐧𝐭: A Structural Shift

🔹 Bots operate via scripted, rule-based interactions.

🔹 Agents are proactive, intelligent systems that learn user intent and make purchasing decisions independently — transforming the commerce experience from reactive to autonomous.

𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐛𝐥𝐞𝐦: Agents Need Card Data — But No One Wants to Store It

Enabling agent-led payments requires coordination between:

→ The AI agent

→ The merchant

→ The card network

→ The payment processor

But there’s a tension:

→ PCI compliance makes storing card data complex and risky.

→ Merchants need access to payment info for CRM, recurring billing, and refunds.

→ Payment tokens are often locked to one processor, limiting flexibility.

→ Virtual cards and PSP tokens are workarounds — but introduce cost & complexity.

🔴 𝐋𝐞𝐬𝐬-𝐓𝐡𝐚𝐧-𝐈𝐝𝐞𝐚𝐥: Virtual Cards

Many PSPs today issue one-time-use virtual cards to agents. The agent passes the virtual card to the merchant to complete a purchase.

But this approach has limitations:

• Incompatible with recurring billing or refunds

• Merchants lose access to payment credentials

• High cost (2–2.5% interchange)

• Not reusable across PSPs

• Card networks prefer fewer, reusable tokens

✅ 𝐀 𝐁𝐞𝐭𝐭𝐞𝐫 𝐀𝐩𝐩𝐫𝐨𝐚𝐜𝐡: Network Tokenization by VGS

→ The consumer provides their card info to the agent once.

→ The agent tokenizes the PAN using a network-issued token.

→ That token is then shared with the merchant.

→ The merchant can send the tokenized payment via any PSP (Stripe, Adyen, Worldpay, etc.).

Key Benefits:

✔ Merchant-compatible: Supports refunds, recurring billing, and CRM

✔ Processor-agnostic: No PSP lock-in; enables multi-processor routing

✔ Security & compliance: Card credentials remain protected

✔ Scalable for agent-led commerce: Tokens can be dynamically issued per agent, per use case

𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲:

To enable AI agents to transact securely, flexibly, and intelligently at scale, tokenization must evolve—from single-processor vaults to interoperable, network-native credentials.

Agentic Commerce won’t thrive on workaround infrastructure. It requires purpose-built, tokenized payment rails—and that’s exactly what VGS is helping build.

Source: VGS x Chuck Yu

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()