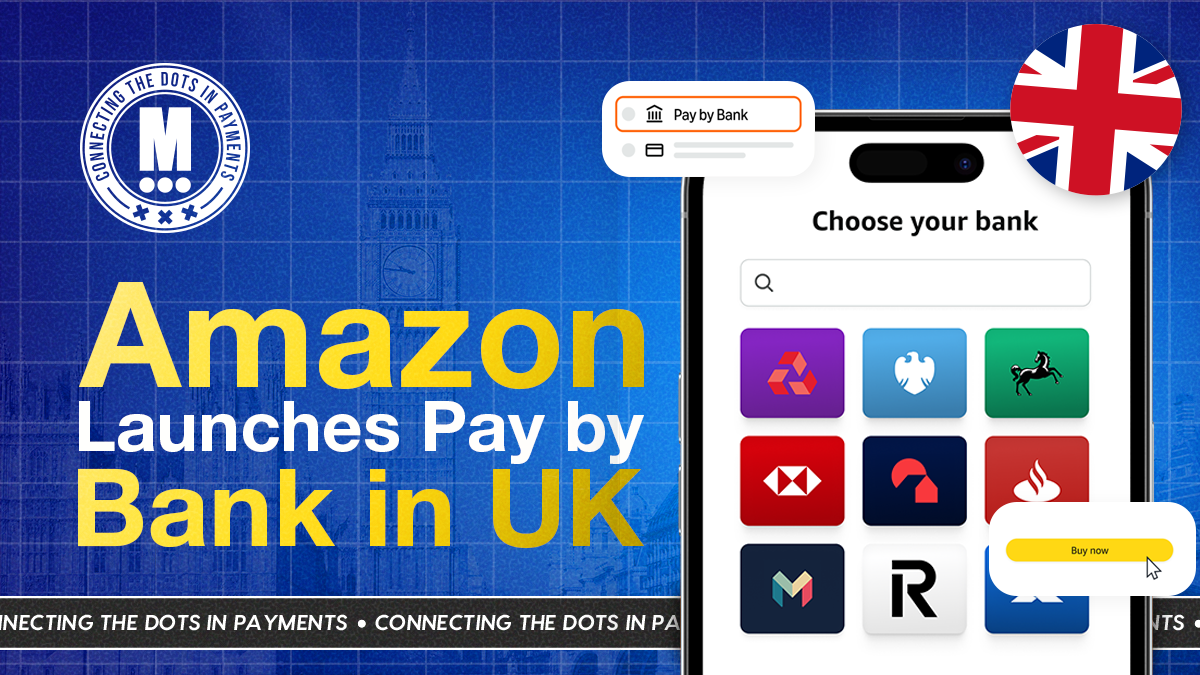

Amazon Launches Pay by Bank in the UK

Hey Payments Fanatic!

This one comes straight out of the UK, and it matters more than it looks at first glance.

Amazon has just rolled out Pay by Bank on amazon.co.uk, letting customers pay directly from their bank accounts instead of using cards.

No card details stored. No expiry dates. Authentication happens inside the customer’s own banking app, via biometrics or PIN.

What’s interesting here isn’t just convenience. It’s what this says about A2A payments finally moving into mainstream e-commerce.

Faster refunds (minutes, not days), permanent payment credentials, and alignment with the UK’s National Payments Vision all point in the same direction.

Large platforms are getting comfortable bypassing cards for certain flows, especially where trust, refunds, and repeat payments matter.

Jonathan Boumphrey, Amazon’s UK & Ireland Country Manager, framed it simply: faster refunds, easier setup, and another secure way to pay. But zoom out, and this looks like Amazon quietly validating bank-to-bank payments at scale.

Worth watching how quickly this expands beyond the UK, and where it shows up next in the checkout stack...

Curious what else is shifting across Payments today? Scroll down 👇 I'll be back tomorrow with more updates.

Cheers,

Q&A

📰 Building Trust in the World’s Toughest Payments Market: Checkout.com’s North American Playbook. Arthur Bedel and Zack Levine, Head of North America at Checkout.com, discuss Checkout.com’s rapid expansion in the highly competitive North American payments market, highlighting the importance of performance, reliability, and trust. The conversation explores the company’s customer-first strategy and new partnerships with major merchants. Read the full interview here

NEWS

🇪🇬 Bosta and Mastercard announce strategic collaboration. The collaboration delivers a comprehensive ecosystem designed to help businesses streamline operations and scale efficiently. Aditionally, Liv and Union Coop enter a strategic partnership to offer more value and rewards to UAE consumers. In collaboration with Mastercard, the companies will launch two co-branded credit cards that aim to enhance the shopping experience and reward everyday spenders in the UAE.

🇬🇧 Amazon has introduced Pay by Bank in the UK, allowing customers to pay directly from their bank accounts without using cards. The move signals growing mainstream adoption of account-to-account payments, offering biometric approval through banking apps, faster refunds, and upcoming support for Prime subscriptions.

🇺🇸 Stripe valuation set to hit $140 billion in new tender offer. The company, one of the most closely watched potential candidates for an initial public offering, has set up frequent tenders since 2024 as a way to let employees sell shares without going public. The latest deal is a sign that Stripe may continue to delay an IPO.

🇺🇸 Circle supports Fed plan to integrate stablecoins into core payment systems. The proposal would allow eligible non-bank financial institutions, including stablecoin issuers, to access Fed payment infrastructure without becoming fully chartered banks.

🇦🇪 Zand and Ripple are in a strategic partnership to power the digital economy with stablecoin and blockchain innovations. The partnership will see Zand and Ripple work together to explore initiatives, including enabling support for RLUSD within Zand’s regulated digital asset custody and issuance of AEDZ on the XRP Ledger (XRPL).

🇨🇴 Digital lending FinTech Addi accelerates its growth in Colombia and reaches 2.7 million customers, adding 33,000 partner businesses. It also reported US$3.6 billion in pre-approved loans and a presence in 1,034 municipalities, equivalent to 94% of the national territory, placing it among the platforms with the widest coverage within the FinTech ecosystem.

🇦🇪 FinTech Alaan launches new product SuperPay to enable supplier payment transfers globally. With SuperPay, Alaan now combines card payments, invoice automation, approvals, accounting, and international transfers in a single workflow - a major step in the company’s expansion into a complete finance-operations platform for the region.

🇩🇪 Lidl in Germany now allows paying via SEPA bank transfer, circumventing American VISA/MasterCard. Lidl shoppers can now complete purchases by paying directly via SEPA bank transfer through the Lidl Plus app, effectively avoiding reliance on major U.S.-based card networks.

🇦🇺 Para announces REST API. The software enables FinTechs and consumer applications with existing userbases to integrate the security, speed, and utility of blockchain wallets without changing the app’s UI or asking users to onboard to new systems. This launch accelerates the convergence of traditional FinTech and crypto by treating blockchain as background infrastructure.

🇩🇰 Unzer expands Danish footprint with in-store POS launch in partnership with Verifone for SME merchants. The expansion is designed to bridge the gap between digital and physical storefronts, providing the 30,000 Danish merchants already using Unzer’s backend with a hardware solution to match their online capabilities.

🇫🇷 Ingenico launches next-generation AXIUM payment device family and Ingenico 360 unified cloud platform. The new portfolio provides a modern foundation that accelerates innovation, streamlines estate management, and supports the rapid rollout of new services worldwide.

🇧🇷 Avenia raises US$17.3M to expand in Latin America and the US. With the funds, Avenia intends to expand its operations in Brazil, including the launch of new products such as performance solutions and cards. The strategy also envisions expansion into other Latin American countries and the North American market.

🇺🇸 Deel partners with MoonPay to enable stablecoin salary payouts for global workers. Together, MoonPay and Deel will further enhance stablecoin salary payouts for workers and expand these capabilities to employees around the world, offering a faster and more flexible way to get paid.

🇺🇸 NBA and American Express announce multiyear partnership extension. American Express and the NBA will launch a connected member program with NBA ID, the NBA's free membership program that provides fans access to a variety of benefits, including exclusive offers from NBA partners, ticket promotions, and members-only voting campaigns.

🇺🇸 Visa goes on-chain with Ethereum stablecoin settlements. By moving payments on-chain, Visa allows 24/7 transactions for institutional clients. This bypasses the delays that often happen with banks. In fact, Visa’s on-chain analytics show that the system has already processed over $3.5 billion in annualized volume.

🇺🇸 accesso® and Adyen expand strategic partnership to enhance platform payments capabilities at global scale. Together, accesso and Adyen's partnership is designed to deliver the scale and reliability required for complex, high-volume environments spanning multiple regions and sales channels.

🇨🇦 Uber now accepts WeChat Pay in Canada. The integration is specifically aimed at visitors and residents who rely on the WeChat mini app to book rides. By adding WeChat Pay to its local acquiring network, Uber is removing the need for users to have a traditional credit card or a local data plan to get around.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()