Amex Partners with Knot to Simplify Card-on-File Updates

Hey, Payments Fanatic!

American Express is teaming up with Knot to make adding card-on-file info easier for its customers at select merchants like Bloomingdale’s, Hilton, and Macy’s. This pilot program helps Amex Card Members seamlessly add their payment details for smoother future checkouts.

How does it work? Knot, a fintech specializing in card-on-file management, makes it easy to automatically update payment methods without any hassle. With Knot’s CardSwitcher™ tech and Amex’s proprietary systems, customers can securely add or update their cards with just a click—no manual entry required!

This partnership started with Amex Ventures’ investment in Knot back in 2023. Now, they’re bringing real-world solutions to life, making checkout experiences smoother for everyone.

Amex is all about helping customers simplify payments and driving value for merchants by boosting checkout efficiency. This partnership is a great example of how fintech collaborations can truly enhance the digital experience.

Cheers,

Stay Ahead in FinTech! Subscribe to my FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

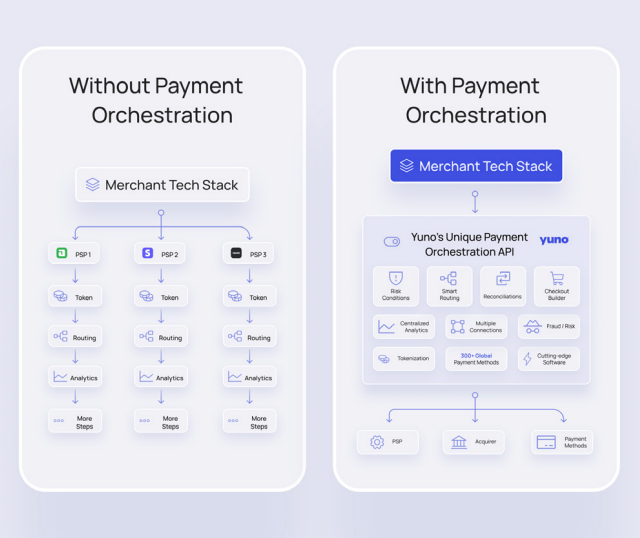

Read this great report by Carol L. Grunberg from Yuno to learn all about it:

PAYMENTS NEWS

🇺🇸 PayQuicker strengthens client and partner excellence with strategic appointment of Nathan England. He will be responsible for identifying and fostering strategic partnerships and providing industry-proven customer excellence support solutions to PayQuicker’s new and existing global client base.

🇺🇸 IRS clears final hurdle in $2B epayment tech award. The IRS now appears able to move forward with a $2 billion electronic payment system contract, now that the final protest has been withdrawn. ACI Payments and Link2Gov Corp. won the Epayment Card Services contract in August 2023, but it was quickly followed by protests from NIC Federal and Value Payment Systems.

🇬🇧 Mastercard has announced the launch of a new crypto debit card in Europe through a partnership with Mercuryo. This innovative card allows users to spend over 40 different cryptocurrencies directly from their self-custodial wallets at more than 100 million merchants across the continent.

🇬🇧 UTP’s tapeeno app enables Tap to Pay on iPhone for merchants in the UK to accept contactless payments. With Tap to Pay on iPhone at checkout, the merchant will simply prompt the customer to hold their contactless payment near the merchant’s iPhone, and the payment will be securely completed using NFC technology.

🇺🇸 JAGGAER Pay and Bottomline partner to bolster procure-to-pay offering. The partnership marks a transformative step in simplifying payment processes and leveraging them as a strategic advantage. Continue reading

🇺🇸 Trustly selects Newline™ by Fifth Third to drive innovation in U.S. payment capabilities. The first payment products on which the parties will collaborate are deposits and withdrawals via ACH and RTP. Newline’s API platform enables Trustly to transmit payments directly via Fifth Third Bank.

🇨🇦 Lithic expands into Canada. This marks Lithic’s first entry into a non-U.S. market and introduces powerful multicurrency processing capabilities that position Lithic to support the most ambitious and innovative card program use cases.

🇸🇦 Mastercard and barq collab to expand digital payment services in Saudi Arabia. The partnership is expected to deliver increased convenience, speed, and security, as well as advanced fraud prevention features, aligning with Saudi Arabia’s Vision 2030, which seeks to drive the digital transformation of the country’s financial services sector.

🇨🇦 Paystand expands its zero-fee B2B payments service to Canada. According to a press release, the expansion comes as Canadian businesses are increasingly choosing cash-based B2B transactions instead of credit, to reduce the risks of payment delays or non-payment.

🇨🇦 Shopify: Back on Track. Shopify’s Gross Payments Volume (GPV = GMV processed through Shopify Payments) was 61% of Gross Merchandise Volume (dollar value of orders facilitated) Vs. 58% in the prior year. Shopify’s Revenue grew +21% to $2.045 billion ($40 million beat), or +25% after adjusting for the sale of the logistic business.

🇸🇪 Qliro launches new checkout with SEK 1 million conversion guarantee for new enterprise merchants. As part of the launch, Qliro is offering a time-limited conversion guarantee to new merchants who process more than SEK 10 million per month, reflecting the company's strong belief in the new product.

🇭🇰 Aquanow to Power Crypto Payments for Hongkong Jet. This initiative underscores Hongkong Jet's commitment to delivering unparalleled business jet solutions tailored to meet the needs of its clientele. For Aquanow, this initiative represents a key opportunity to grow the crypto payments use case.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()