Ant International Brings Iris Recognition to Smart Glasses Payments

Hey Payments Fanatic!

Ant International has added iris authentication features to Alipay+ GlassPay, its AR glasses-embedded payment solution, through partnerships with smart glasses producers Xiaomi and Meizu.

Currently, Alipay+ GlassPay integrates multi-modal biometric verification measures. With the new feature, tested on AlipayHK, merchants and service providers can offer a more secure and immersive consumer experience via augmented reality.

The iris authentication feature compares over 260 biometric feature points to verify and protect the user's identity.

According to industry estimates, consumer adoption of smart glasses could grow almost sevenfold between 2024 and 2029, reaching 18.7 million units globally.

Now, let’s dive into today’s other top payments stories 👇

Cheers,

Get the Latest in Paytech! Join my new Telegram channel for daily updates on paytech trends and exclusive insights. Connect with industry enthusiasts and stay on top of innovation!

NEWS

🇪🇸 Bizum will report peer-to-peer transactions to the Bank of Spain for the next four years. The Bank of Spain announced the signing of a collaboration agreement with Bizum for the provision of aggregated data by sector and country on payment transactions carried out through this system, to use the global information provided by Bizum on economic transactions.

🇸🇬 Ant International launches iris authentication feature to Alipay+ GlassPay through partnerships with leading smart glasses producers. The enhanced solution improves consumer checkout experience and merchant payment success rate, and opens a new channel for personalised customer interaction.

🌏 Mastercard champions password-free and number-free checkout across the Asia Pacific by 2030 through tokenized, biometric payments. The company aims to achieve full adoption in Singapore, Malaysia, and Vietnam by 2027, enhancing security and convenience while reducing fraud and checkout friction.

🇺🇸 Rain acquires Uptop to integrate rewards into its full-stack platform for enterprise card and wallet programs. This will allow cardholders to automatically earn rewards on everyday purchases, while partners can sponsor bonus offers to boost engagement. Built on Avalanche’s on-chain infrastructure, Uptop enables fast, scalable, and seamless loyalty experiences with a user-friendly interface.

🇬🇧 PayPal re-launches in the UK after nearly two years. The digital payments platform said customers in the UK will have access to debit cards that can be used worldwide without any transaction fees, credit cards, and its PayPal+ loyalty programme.

🇦🇪 UAE conducts first government transaction using Digital Dirham. Officials said it represents the next phase of integrating the Digital Dirham into national financial operations, reinforcing the UAE’s leadership in advanced financial technologies. Keep reading

🇬🇧 Revolut offers fee-free fiat to stablecoin conversions. As part of the initiative, the company enables users to move their stablecoins across multiple blockchain networks, link their balance to their Visa and Mastercards for everyday spending, and protect withdrawals with biometrics.

🇺🇸 Nium joins Visa’s stablecoin settlement pilot, which allows selected partners to settle transactions with Visa using stablecoins across supported blockchains. The pilot introduces stablecoin settlement to Nium’s operations, enabling faster and more secure cross-border settlement.

🇦🇺 Paymentology partners with Constantinople to enter the Australian market. Through the partnership, Paymentology will handle card issuance and transaction processing across Mastercard and Visa, including Apple Pay and Google Pay tokenisation, with dedicated BINs for customisable card programmes.

🇺🇸 Visa Direct Stablecoin Payouts Pilot speeds up access to funds for creators & gig workers. The pilot enables businesses to send payouts directly to recipients’ stablecoin wallets via Visa Direct, allowing funds to be sent in fiat and received in USD-backed stablecoins like USDC.

🌏 Visa launches Scan to Pay to accelerate QR payments across Asia Pacific to enable millions of merchants to accept Visa payments through a wide range of digital wallets and payment apps. The initiative aims to make transactions simpler, more secure, and accessible for both consumers and businesses.

🇬🇧 SumUp raises R$850 million in FIDC for receivables financing. According to SumUp, the funds will be used to strengthen its receivables anticipation strategy for its clients, micro and small businesses. Keep reading

🇨🇳 HK introduces tokenized central bank money into record digital green bond sale. The integration of tokenized central bank money in this issuance lays the foundation for future integration with other forms of digital money, fostering interoperability and unlocking new synergies across different digital infrastructures,” said Eddie Yue Wai-man, Chief Executive of the Hong Kong Monetary Authority.

🇸🇬 Stablecoin payments take a leap in Singapore with a new bank partnership. Standard Chartered has partnered with DCS Card Centre to support DeCard, a new card designed for stablecoin payments in the real economy. This partnership aims to offer seamless stablecoin payments through DeCard, providing convenience to users in regulated environments.

🇸🇬 MAS grants MPI a license to Banking Circle. With the new license, BC Payments Singapore is now fully licensed to facilitate frictionless, scalable, and compliant cross-border payment flows for banks, FinTechs, and global payment providers in Singapore.

🌍 Michael Batuev joins WeFi to supercharge global payments roll-out. In his new role, Michael Batuev will lead the development of WeFi’s payments and infrastructure across all regions, starting from Europe and the Asia-Pacific, focusing on product strategy, partnerships, financial services, and scalable usage of DeFi frameworks.

🇵🇭 GoTyme Bank announces plans for Google Pay, Apple Pay integration, and full crypto rollout. The bank stated that these integrations aim to provide users with more convenient and secure payment options for both online and in-store transactions. Keep reading

🇨🇦 Wise brings cross-border payments to Wealthsimple customers. The partnership aims to streamline international transfers for its users as demand for inexpensive and fast cross-border payments grows in Canada. Wise Platform will power the new service by connecting its infrastructure and payments network.

🇺🇸 E6 and Fireblocks partner to unify traditional and digital payments infrastructure. The initiative aims to enable banks, FinTechs, and corporations to issue, fund, and process both fiat and digital assets seamlessly within one integrated ecosystem.

🇺🇸 Reseda Group acquires Tandem Finance App to extend expense-sharing solution to modern families. The acquisition marks a key step toward Reseda Group and MSUFCU's goal of creating an end-to-end family banking ecosystem, one that helps credit union members graduate from individual accounts to joint accounts.

GOLDEN NUGGET

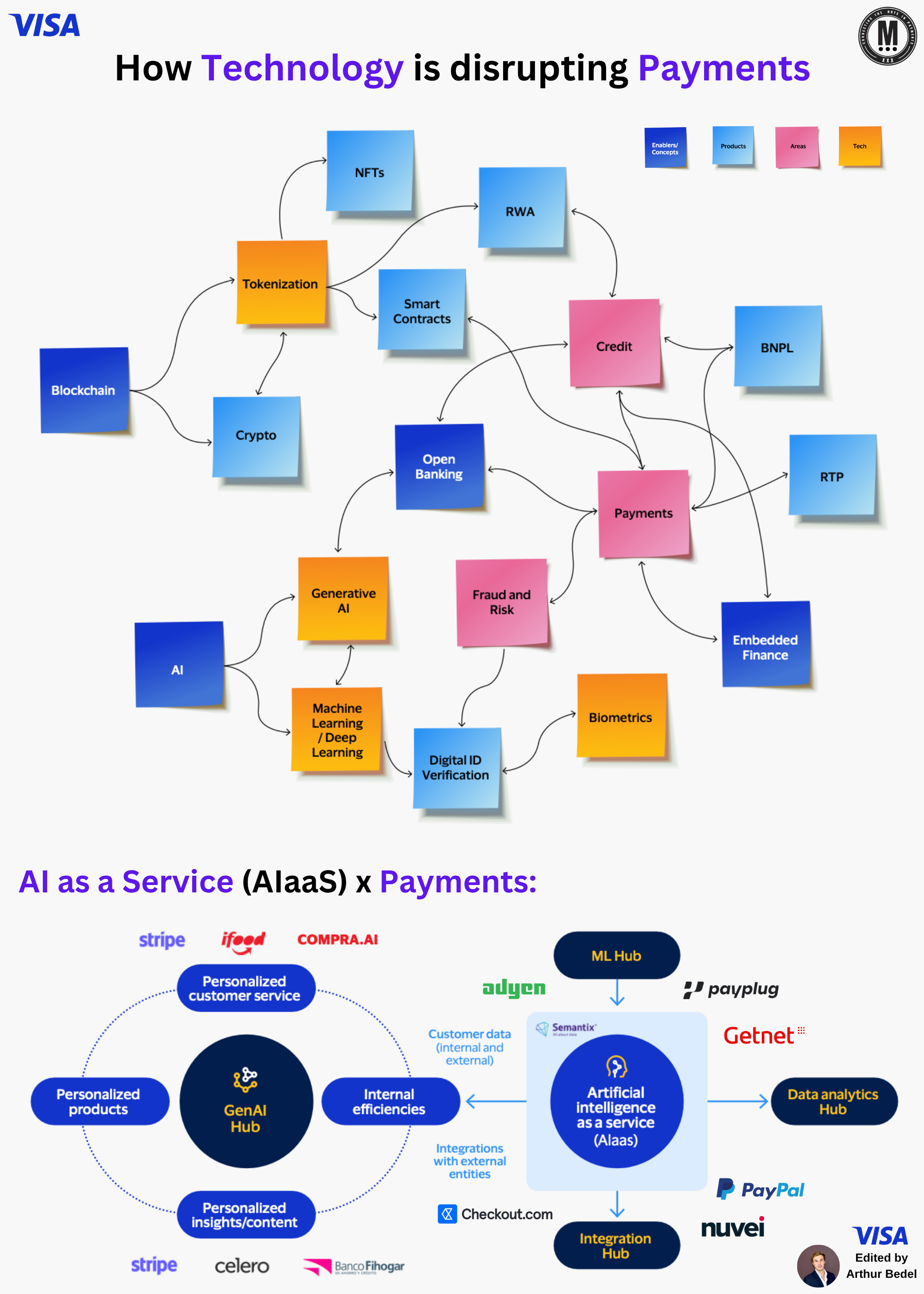

🚨 𝐇𝐨𝐰 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐲 𝐢𝐬 𝐃𝐢𝐬𝐫𝐮𝐩𝐭𝐢𝐧𝐠 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — the 2025 reality 👇 Created by Arthur Bedel 💳 ♻️

The question I most often get is → "𝐖𝐡𝐚𝐭'𝐬 𝐧𝐞𝐱𝐭 𝐢𝐧 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐫𝐭𝐡𝐮𝐫?" well, still don't have a crystal ball but here are some thoughts.

Payments feel instant at checkout. But underneath, AI, blockchain, and tokenization are rewriting the rules of how money moves — and who controls it.

1️⃣ 𝐀𝐈 𝐱 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

AI is moving from “supporting tool” to autonomous orchestrator.

→ Routing transactions through the right PSP in real time.

→ Dynamically adjusting fraud thresholds without human input.

→ Powering agentic checkout, where AI finalizes purchases on behalf of users.

Example: DEUNA is building an AI intelligence layer that predicts the best PSP and risk strategy per transaction, cutting fraud while lifting conversion.

2️⃣ 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 & 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬

Stablecoins are no longer experiments — they’re becoming core rails for settlement.

→ Corporates are shifting liquidity cross-border in seconds, not days.

→ Networks like Visa are already settling stablecoin payments on Solana.

Example: PayPal’s PYUSD is now integrated into Venmo, unlocking stablecoin utility for retail.

3️⃣ 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 & 𝐏𝐫𝐨𝐠𝐫𝐚𝐦𝐦𝐚𝐛𝐥𝐞 𝐅𝐢𝐧𝐚𝐧𝐜𝐞

Tokenization is becoming programmable — from network tokens to real-world assets.

→ Merchants reduce declines with adaptive tokens per device, merchant, or channel.

→ Banks fractionalize deposits and collateral into programmable tokens for 24/7 flows.

Example: J.P. Morgan’s Tokenized Collateral Network is enabling intraday repo trades in hours, not days.

4️⃣ 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞

AI agents don’t just recommend products — they negotiate, purchase, and retry payments.

→ Subscriptions renewed automatically.

→ Price optimization triggered by algorithms.

→ Checkouts executed invisibly in the background.

Example: Checkout.com is enabling agentic commerce flows, where AI agents leverage orchestration + network tokens to select optimal PSPs, maximize approvals, and reduce costs.

5️⃣ 𝐄𝐦𝐛𝐞𝐝𝐝𝐞𝐝 𝐓𝐫𝐮𝐬𝐭 (𝐈𝐃 + 𝐁𝐢𝐨𝐦𝐞𝐭𝐫𝐢𝐜𝐬)

As payments decentralize, trust must be embedded.

→ Digital ID + tokens are merging into the new passport of payments.

→ Biometrics authenticate while tokens protect data.

Example: VGS enables merchants to process payments without ever touching sensitive data — combining PCI vaulting, tokenization, and biometric flows with the networks to de-risk compliance at scale. This is directly linked to 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞.

A little 𝐏𝐫𝐨𝐯𝐨𝐜𝐚𝐭𝐢𝐯𝐞 𝐓𝐡𝐨𝐮𝐠𝐡𝐭:

The next payment won’t be a transaction. It will be an autonomous event — orchestrated by AI, settled on-chain, and trusted through embedded identity.

Thoughts?

Source: Visa

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()