Bank of England Eases Outlook on Stablecoins in New Proposal

Hey Payments Fanatic!

The Bank of England has published a consultation paper proposing that issuers of widely used stablecoins be allowed to invest up to 60% of the assets backing them in government debt.

A previous 2023 proposal had been criticized for requiring issuers to hold all of their assets in non-interest-bearing accounts at the central bank. The BoE has now suggested that 40% of those assets would need to be held with it.

The British central bank is sticking to its plan to cap the amount of stablecoins that individuals and businesses can hold, which sets it apart from European Union and U.S. regulators.

"We've listened carefully to feedback and amended our proposals for achieving this, including on how stablecoin issuers interact with the Bank of England," said Sarah Breeden, the BoE’s Deputy Governor for Financial Stability.

The consultation runs until February 10, 2026.

Now let’s dive into the rest of today’s Payments headlines. 👇

Cheers,

INSIGHTS

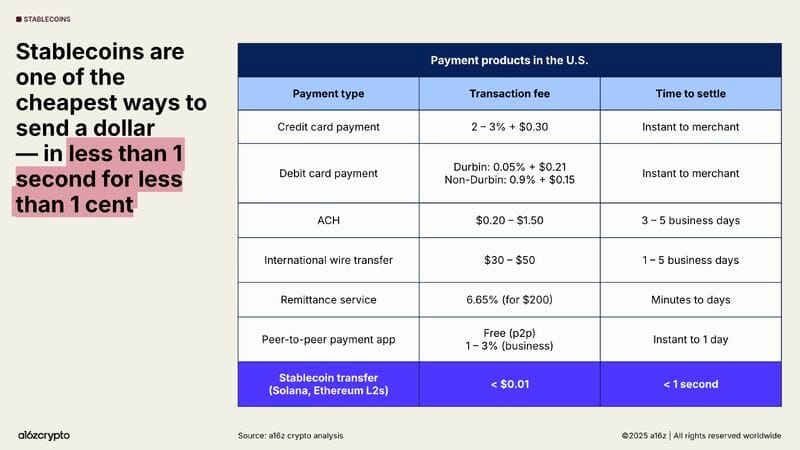

📈 Stablecoins are quietly eating global payments.

📈 How FinTech is accelerating the global money movement. According to ACI Worldwide, global RTP transactions reached 266.2 billion in 2023, up 42% year-over-year, underscoring the massive demand for speed and efficiency. Real-time payments are now setting the new standard for businesses and consumers worldwide.

NEWS

🇦🇷 Agentic Payments: the new trend in digital shopping with AI by Pomelo. In this article, Pomelo describes how agentic payments work, how artificial intelligence is involved in their development, some application examples, and how to prepare to incorporate them into your business.

🇺🇸 ACI Worldwide Thomas Warsop, CEO and President, rangs the Nasdaq stock market closing bell. The company provides real-time, intelligent payments orchestration software that enables banks, billers, and merchants to grow and modernize their payment systems securely and efficiently.

🇬🇧 Bank of England launches consultation on regulating systemic stablecoins. Such stablecoins are a new type of digital money designed to maintain a stable value and could be used for retail payments and wholesale settlement in the future. Keep reading

🇺🇸 FIS launches Innovative Asset Servicing Management Suite. The suite combines the traditionally separate critical functions of corporate actions processing to revolutionize asset servicing, creating a seamless experience that helps capital investment work more efficiently and underscores FIS's commitment to unlocking financial technology for the world.

🇮🇹 Italy's banks back digital euro, want costs spread over time. Italian banks support the European Central Bank's digital euro project, but want investments required by them to implement it to be staggered over time because the costs are high, a top official of the Italian Banking Association said.

🇨🇦 PayPal brings a no-fee buy now pay later offering to Canada. PayPal is promoting its Pay in 4 installment option, offering consumers a way to split purchases into predictable payments without late fees, sign-up costs, or hidden charges. Covered by PayPal’s Purchase Protection, the service ensures secure and worry-free online shopping.

🇦🇺 Afterpay Ads integrates Square to unlock Australia’s complete shopping journey. The integration aims to unlock audience intelligence across industries and demographics. The result is an omnichannel advertising platform powered by payment data, predicting purchase intent through pre-transaction financial behaviours.

🇲🇽 Bitso seeks to connect digital currency to the payments infrastructure, relying on Nvio. The project aims to enable companies, FinTech firms, and international operators to make and receive local currency transfers through a regulated and technologically advanced structure.

🇩🇪 TransferMate connects with SAP. TransferMate acts as a non-bank payments provider with an integration to SAP Multi-Bank Connectivity. The partnership helps empower businesses using SAP solutions to execute cross-border payments effortlessly within their SAP Cloud ERP or SAP S/4HANA Cloud environments, eliminating the need for external payment platforms.

🇦🇪 Uzbekistan’s FinTech, OSON, ecosystem eyes the UAE market through DIFC licence. In the MENA region, OSON will focus on cross-border payments, regional wallet services, and collaborations with local banks and payment institutions, aligning with the region’s broader drive toward digital-economy transformation.

🇮🇳 Razorpay hires Google veteran Prabu Rambadran to lead engineering, AI innovation. His appointment comes as Razorpay accelerates its vision to build AI-first, globally adaptable platforms. These will power the future of digital payments and business banking across India and Southeast Asia, driving the company’s next wave of innovation and product diversification.

🇰🇪 Irish FinTech Umba hits profitability in Kenya and eyes next growth phase with stablecoin launch. Tiernan Kennedy, the company’s Chief Executive, said it is eying further success on the back of a move into stablecoins and the rollout of an AI bot. Umba is a digital financial services provider offering innovative banking solutions primarily by smartphone.

🇧🇷 PicPay announces a global account with the Visa brand and a partnership with AstroPay. Brazil’s PicPay has launched a Global Account in U.S. dollars and euros, enabling users to make international purchases and transfers directly from its app. Developed with AstroPay, the Visa-branded service offers competitive exchange rates, up to 4% annual returns.

🇺🇸 Paystand acquires Bitwage to make stablecoins enterprise-grade for global B2B finance. The deal positions Paystand to deliver enterprise‑grade stablecoin settlement and FX across its network, which has processed more than $20 billion in payment volume for 1,000+ enterprises and more than one million businesses worldwide.

🇬🇧 Monzo makes changes to buy now, pay later for millions of customers. The digital bank is simplifying the use of its service by allowing customers to select the "pay later" option at checkout and extend their repayment period to six or twelve months, albeit with interest.

🇯🇵 Japan approves major stablecoin project backed by top banks. Banks will start issuing payment stablecoins pegged to the yen, designed to streamline business-to-business transactions and improve overall productivity in Japan’s financial ecosystem. According to the FSA, the project will include user-protection measures and full transparency around the systems used.

🇺🇸 Arx Research raises $6.1 million seed round to launch ‘Burner Terminal’ stablecoin and fiat point-of-sale device. The terminal accepts stablecoins and both contactless and chip-and-PIN cards, with EMV certification for security, compliance, and compatibility with existing payment systems.

🇺🇸 Fortis appoints Brent Coles as CFO and Sharat Shankar as CROO to drive the next growth phase in payments technology. The strategic hires position Fortis to accelerate its embedded payments capabilities and deepen relationships across its software platform and enterprise resource planning (ERP) partner network.

🇳🇱 Bird boosts its stake to 5.39% as CM.com rejects €165.8M ‘unsolicited’ takeover bid. CM. com’s board dismissed the proposal, saying it undervalued the company and didn’t align with its long-term growth plans, while Bird’s growing stake signals continued interest and potential for renewed takeover attempts.

🇧🇷 Brazilian Central Bank regulates the use of virtual assets and creates a new type of institution. The set of rules seeks to balance incentives for innovation and security in cryptocurrency transactions. The rules will come into effect on February 2nd, 2026. Companies will now be authorized by the Central Bank, subject to the entire supervisory process.

GOLDEN NUGGET

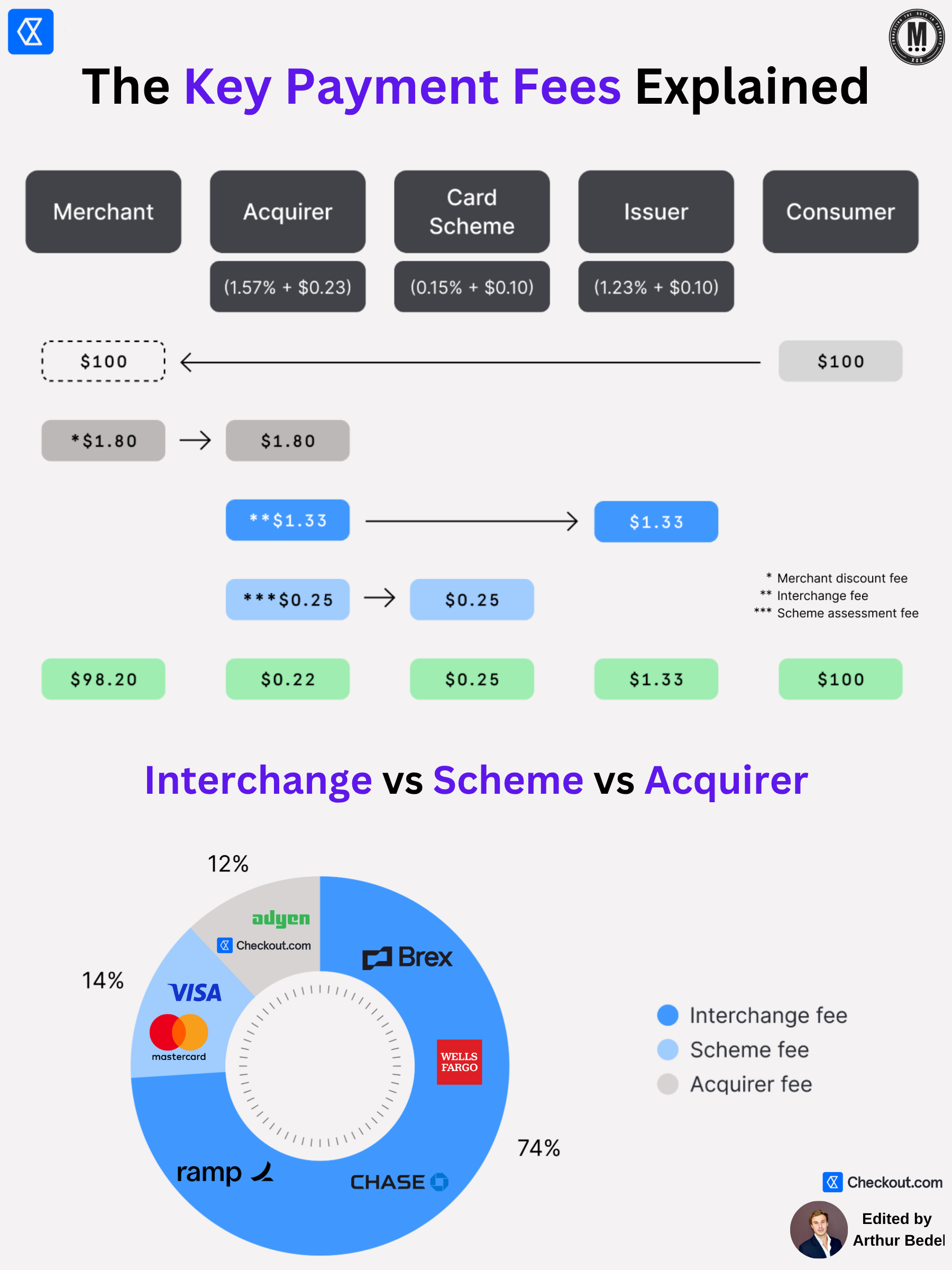

𝟒-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥 & 𝐊𝐞𝐲 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐅𝐞𝐞𝐬 𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝 by Checkout.com👇Created by Arthur Bedel 💳 ♻️

► Interchange fees are a critical part of card payments, representing the fee paid by the acquiring bank to the issuing bank for processing a transaction. They are set by card schemes (Visa, Mastercard, etc.) and vary based on factors like card type, transaction method, and region.

Merchants indirectly pay interchange fees as part of their total Merchant Discount Rate (#MDR), which includes:

✔ Interchange Fees → Paid to the issuing bank (Chase, Wells Fargo).

✔ Card Scheme Fees → Paid to the card networks (Visa, Mastercard).

✔ Acquirer Fees → Paid to the acquiring bank or PSP (Checkout.com, Adyen).

𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬 𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝:

► $100 transaction

1️⃣ The customer pays $100.

2️⃣ The acquirer (Checkout.com, Adyen) deducts fees before settling the funds with the merchant. #MDR 1.57% + $0.23 → $1.80 goes to the Acquirer to be distributed across all parties.

3️⃣ Interchange fees (paid to the issuing bank, Chase, Wells Fargo) are deducted:

1.23% + $0.10 → $1.33 goes to the Issuer (deducted from $1,80)

4️⃣ Card scheme fees (paid to Visa, Mastercard, etc.) are deducted:

0.15% + $0.10 → $0.25 goes to the card scheme (deducted from $1,80)

5️⃣ The merchant receives the remaining amount: $98.20.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐭𝐡𝐞 𝟒-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥 & 𝐡𝐨𝐰 𝐝𝐨𝐞𝐬 𝐢𝐭 𝐢𝐦𝐩𝐚𝐜𝐭 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬?

The 4-party model is the foundation of card payments, involving the Cardholder and:

1️⃣ Merchant

2️⃣ Acquirer (Merchant’s Bank)

3️⃣ Issuer (Cardholder’s Bank)

4️⃣ Scheme (Card Network)

𝐖𝐡𝐚𝐭 𝐀𝐟𝐟𝐞𝐜𝐭𝐬 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬?

► Card Network — Visa, Mastercard, American Express have different rates

► Card Type — Debit, credit, premium, commercial cards have varying fees.

► Transaction Type: Card Present or Card Not Present

► Merchant Category Code (MCC) — Different Industry Types

► Geography — Fees vary by region due to regulation (EU has capped interchange fees)

𝐇𝐨𝐰 𝐝𝐨 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬 𝐏𝐚𝐲 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐅𝐞𝐞𝐬?

► 𝐈𝐧𝐭𝐞𝐫𝐜𝐡𝐚𝐧𝐠𝐞 𝐏𝐥𝐮𝐬 (IC+) → A transparent pricing structure, where merchants pay, here is an concrete example for $100:

👉 Interchange fee (Chase) → $1.33

👉 Scheme fee (Visa, Mastercard) → $0.25

👉 Acquirer fee (Checkout.com, Adyen) → $0.22

👉 Total Fees for Merchant: $1.80

👉 Merchant receives: $98.20

► 𝐁𝐥𝐞𝐧𝐝𝐞𝐝 𝐏𝐫𝐢𝐜𝐢𝐧𝐠 → A simpler, fixed-rate model where the merchant pays one flat percentage per transaction, covering everything: ~ 2.6% + $0.15

While easier to manage, blended pricing can be more expensive than Interchange Plus, as it bundles all costs into a higher flat rate.

🚨 Note: The numbers vary from region to region - U.S. vs EU vs etc..

Source: Checkout.com

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()