Banked Snaps Up VibePay to Boost Global Open Banking Expansion

Hey Payments Fanatic!

Banked, a Pay by Bank platform, has acquired UK-based consumer payment app VibePay, accelerating its push into global open banking and real-time payments. This strategic move integrates VibePay’s AI-driven recommendation tools and advanced merchant analytics, enabling personalized rewards for users and actionable insights for merchants.

Since its 2019 launch, VibePay has successfully attracted Gen Z and Millennial users through instant peer-to-peer payments and tailored financial insights. Following the acquisition, VibePay founder Luke Massie and investor Steven Smith will join Banked’s board, pending FCA approval.

This marks Banked’s second major acquisition within a year, after purchasing Australia’s Waave, highlighting its aggressive expansion strategy. Initially focusing on the UK, the combined entity aims to leverage VibePay’s active user base to drive merchant adoption, with plans to extend the offering across Banked’s established markets in Europe, the US, and Australia.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

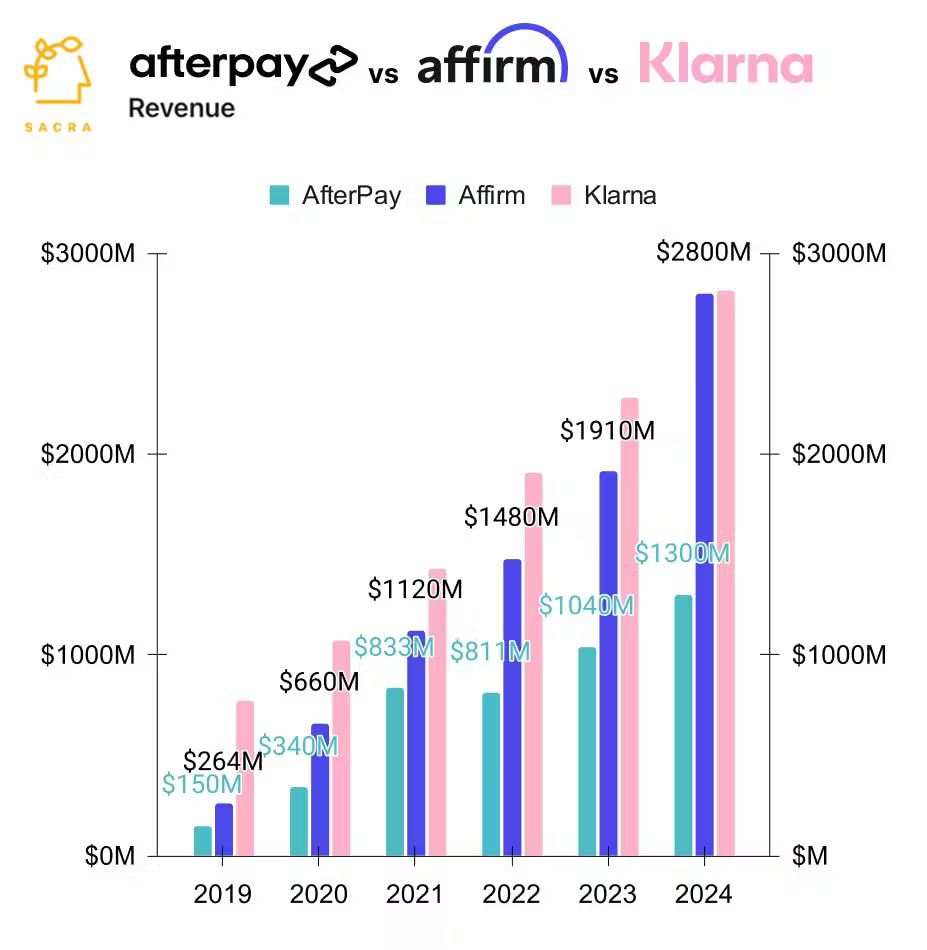

📊 Klarna has filed to go public, reporting $2.8B in 2024 revenue—a 24% YoY increase—and its first annual profit, as it targets a $10–$15B IPO valuation at 3.5–5x revenue.

Here is how they compare to it’s rivals Affirm and Afterpay👇

PAYMENTS NEWS

🇺🇸 U.S. Government to digitize all payments under Trump’s order. Starting September 30, 2025, all U.S. federal payments will go fully digital under a new executive order by President Trump. Phil Bruno of ACI Worldwide said, “The real story behind the White House’s Executive Order isn’t just that federal payments are going digital – it’s that Washington is taking a more proactive and assertive approach as a central player in how money moves across the entire economy.”

🇮🇪 Mollie enables Tap to Pay on iPhone for businesses in Ireland. This allows businesses of all sizes to use the Mollie app on iPhone to accept contactless payments without the need to purchase or manage additional hardware.

🇬🇧 Income at UK FinTech Wise jumps as payment volumes soar. The FinTech booked an underlying income of £350m for the financial year. This was a 13% increase from the previous year. Cross-border volumes soared 28% to £39.1bn, up from £30.6bn.

🇺🇸 Visa joins Global Dollar Network Stablecoin Consortium. The company will become the first traditional finance player to join the consortium that shares out yield to participants that create connectivity and liquidity. USDG members include Paxos, Robinhood, Kraken, Galaxy Digital, Anchorage Digital, Bullish, and Nuvei.

🇺🇸 Klarna scales in-store offering with Clover, expanding to local stores and service providers. With initial plans to enable over 100,000 merchant locations, in this strategic partnership, shoppers will be able to choose Klarna for payments on Clover devices for in-store purchases.

🇮🇳 India targets 300 million new users for UPI payments platform. Users can scan merchant QR codes to make payments ranging from small amounts to up to 500,000 rupees ($5,817) from their bank accounts without paying transaction fees. Read more

🇬🇧 Cashflows fueled 475% turnover growth for Get Found in 18 months. Nearly 70% of online shoppers abandon their carts due to complex or untrustworthy payment processes. Recognising this issue, Get Found partnered with Cashflows to provide its clients with a payment solution that speeds up transactions, allowing for a hassle-free checkout experience.

🇧🇷 Pix advances over cards and should reach 58% of e-commerce transactions in 5 years. Currently, it represents 41% of online purchases and 32% of point-of-sale transactions. This growth is attributed to its low cost for merchants, high user adoption, and upcoming features like Pix Automatico.

🌏 PayPal and TerraPay partner to expand access to cross-border payments across Middle East and Africa. This partnership aims to drive economic growth by making cross-border transactions faster, easier to use, and more accessible by connecting banks, mobile wallets, and financial institutions.

🇵🇹 Revolut launches new payment terminal for Portuguese companies. The Revolut Terminal offers fast, reliable service with Wi-Fi and SIM connectivity, long battery life, and support for major cards and mobile wallets. It also includes Revolut Pay, to pay directly through the Revolut app and earn loyalty points for discounts or rewards.

🌍 Sumsub chooses Volt’s Open Banking capabilities to power its verification offering. Through the new partnership, Sumsub will use Volt’s payment initiation services and AIS Open Banking capabilities across Europe to improve its onboarding and identity verification offerings.

🇦🇪 Al Etihad Payments inks co-badging deals with Visa, Mastercard, UnionPay & Discover. These collaborations are set to strengthen Jaywan, the UAE’s Domestic Card Scheme, by enabling seamless international transactions while reinforcing a robust domestic payment ecosystem.

🇺🇸 Pipe acquires Glean.ai to add spend management to a suite of embedded financial solutions. With this acquisition, Pipe becomes the first embedded finance company to bring together embedded capital and spend management for small businesses via its partners.

GOLDEN NUGGET

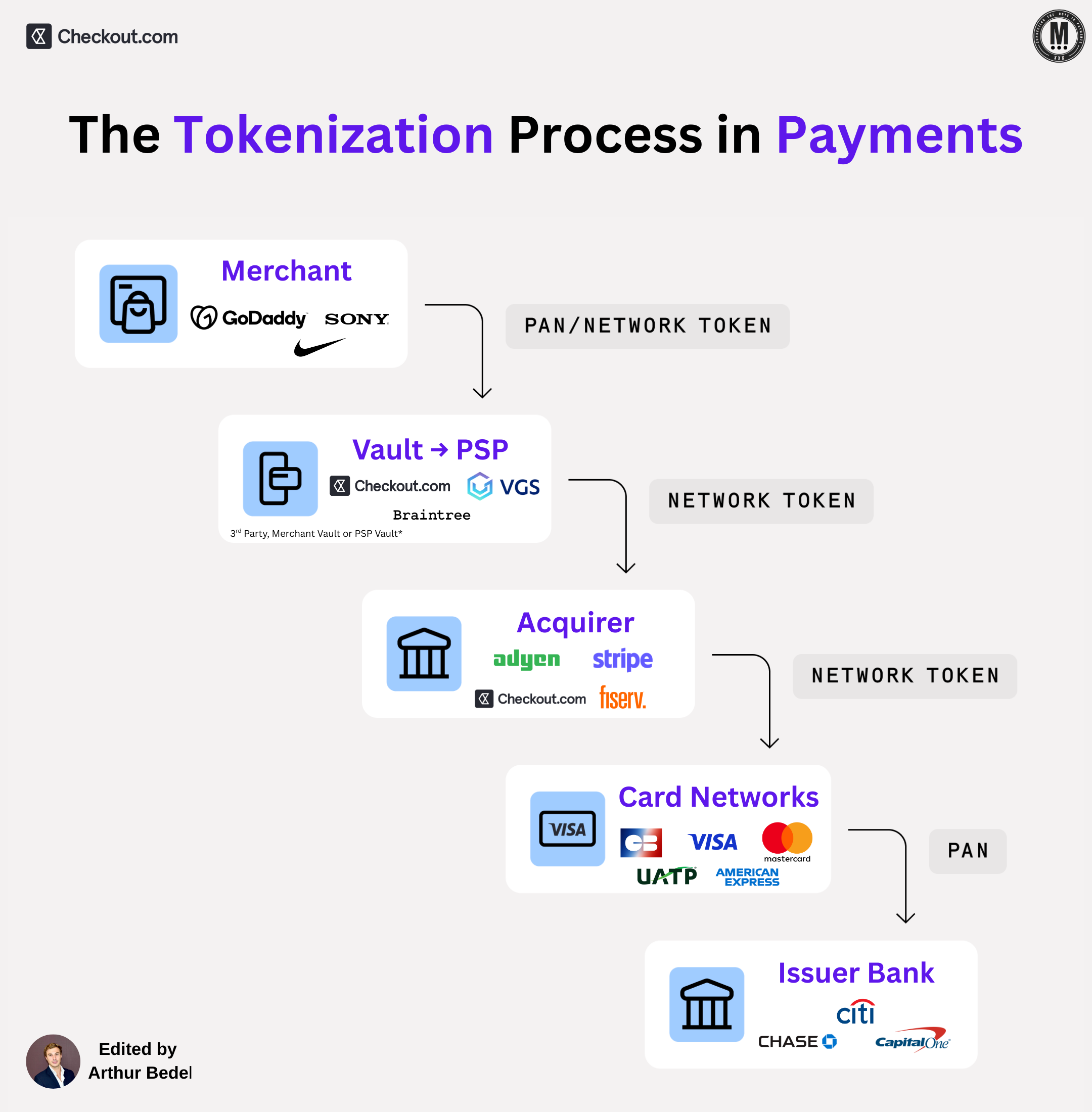

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 10 👋

What is "𝐓𝐡𝐞 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬"?

► 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 is the process of replacing sensitive card data (like PANs) with a non-sensitive equivalent known as a 𝐭𝐨𝐤𝐞𝐧. This ensures that actual card details are never exposed or stored during or after a transaction.

► The Goal → reduce fraud, simplify PCI compliance, and power secure, scalable commerce.

𝐓𝐡𝐞 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 — Step by Step

1️⃣ Merchant (GoDaddy, Nike, Sony)

► Captures the customer’s Primary Account Number (PAN) through their website or app.

2️⃣ Vault / PSP (VGS, Checkout.com, Braintree)

► The PAN is sent to a token vault (merchant, third-party, or PSP-owned), where it’s replaced with a network token or PCI token.

3️⃣ Acquirer (Checkout.com, Adyen, Stripe)

► Receives the tokenized transaction, which now contains a network-issued token rather than the actual PAN.

4️⃣ Card Network (Visa, Mastercard, American Express)

► The token is translated back into the actual PAN so the transaction can be routed to the cardholder’s issuer.

5️⃣ Issuer Bank (Citi, Chase, Capital One)

► Validates the original card, checks for fraud, and approves or declines the transaction.

𝐓𝐡𝐞 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐭 𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

🔹 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬

→ Issued by card networks (Visa, Mastercard)

→ Enhances approval rates by keeping credentials fresh (via account updater)

→ Replaces PANs at the scheme level

→ Example: Visa Token Service, Mastercard MDES

🔹 𝐏𝐂𝐈 𝐓𝐨𝐤𝐞𝐧𝐬 (Merchant Tokens)

→ Issued by a token vault provider (VGS, Checkout.com)

→ Designed to remove PCI scope from merchants

→ PAN is encrypted & stored in a secure vault; merchants only handle tokens

🔹 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭 𝐓𝐨𝐤𝐞𝐧𝐬

→ Managed by wallets like ApplePay, Google Pay, Samsung Pay

→ Device-specific tokens issued for in-app or contactless payments

→ Never exposes the actual card number to the merchant

𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬 — Real-World Applications

✅ 𝐎𝐧𝐞-𝐂𝐥𝐢𝐜𝐤 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 — Amazon & Shopify store network tokens to enable fast, secure repeat purchases

✅ 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧𝐬 — Netflix and Spotify use PCI tokens to safely charge recurring payments

✅ 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — ApplePay leverage device-based tokenization for in-store tap payments

✅ 𝐂𝐫𝐨𝐬𝐬-𝐏𝐒𝐏 𝐑𝐨𝐮𝐭𝐢𝐧𝐠 — VGS and 3rd party vaults, create merchant token vaults transmit the token to route transactions across multiple acquirers

Source: Checkout.com x Connecting the dots in payments...

I highly recommend following my partner Arthur Bedel 💳 ♻️ for more great content like this one👌

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()