BC Fines PayPal R$5 Million for Pix Rule Violations

Hey Payments Fanatic!

PayPal was fined R$5.3 million by the Brazilian Central Bank for failing to meet deadlines and requirements during the rollout of Pix in 2020.

In its statement, the company said the migration required moving from a closed system to an open platform, which created operational challenges.

The Central Bank did not accept the explanation and upheld the fine through its Financial System Organization and Resolution department.

PayPal exited Pix in 2023 and now handles payments in Brazil only through cards, boletos, and account balance. The company said the matter had been settled two years ago and reaffirmed its transparent relationship with the regulator.

The fine is linked to the early phase of Pix, when participants were required to meet strict compliance and integration standards. Regulators concluded that PayPal did not meet those obligations.

Stay tuned for more movement in Payments, and I'll be back in your inbox tomorrow.

Cheers,

INSIGHTS

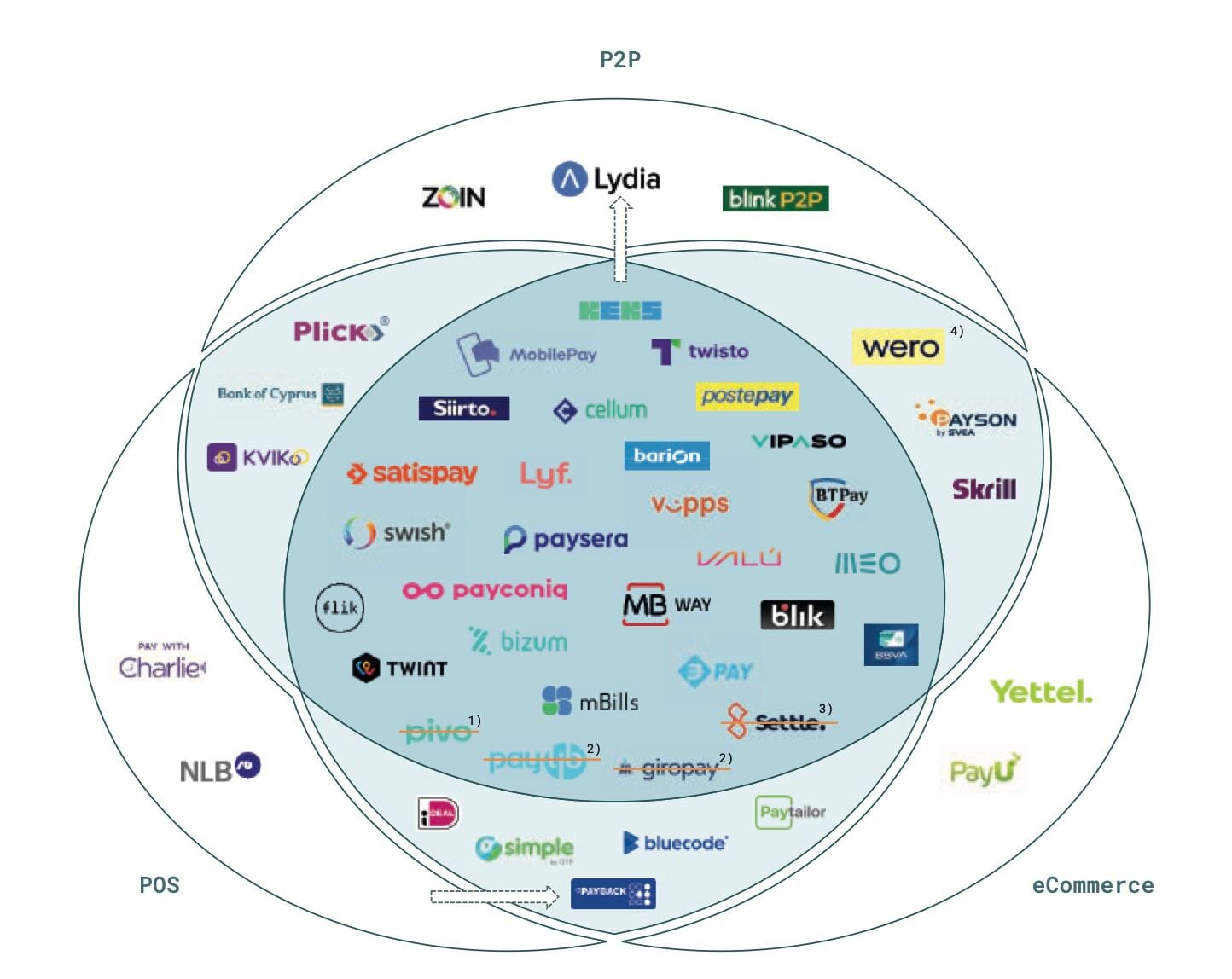

🌍 Europe’s local payment systems are gaining ground, and EPI Company’s Wero is helping reshape the landscape as domestic mobile solutions begin to outpace cards👇

NEWS

🇧🇷 The Central Bank of Brazil fined PayPal R$5 million for failing to comply with specific rules of the national instant payment system, Pix. The fine was imposed because PayPal did not meet the regulatory requirements for participation in the Pix ecosystem.

🇩🇰 Danish startup FlatPay joins the club of European FinTech unicorns to track. Flatpay’s own valuation has grown at a similarly fast pace. Now valued at €1.5 billion ($1.75 billion), the Danish startup reached unicorn status in only three years. However, while CEO and co-founder Sander Janca-Jensen is proud of this accomplishment, he has his sights set on another metric: annual recurring revenue.

🇨🇱 Monnet Payments strengthens its presence in Chile after acquiring ETpay. With this move, the company expects to reach 70 million transactions in Chile and process USD 5 billion by the end of 2025. The acquisition adds 90 to 100 new Chilean clients and around 20 global clients from Mexico to Monnet’s portfolio.

🌏 Visa leans into AI-enabled payments and stablecoins to stay ahead of the game in Asia. Visa introduced AI-enabled payments that let consumers use AI agents to shop and complete secure, tokenized transactions. Additionally, a stablecoin settlement pilot is allowing select partners to make payments using stablecoins across supported blockchains.

🇧🇷 Pix celebrated its fifth anniversary as the country’s main payment method. According to the Central Bank, Pix transactions reached BRL 28 trillion through October. Originally designed for instant transfers between individuals, Pix has grown to include features like Pix cobrança and Pix automático, and is now used by 170 million adults and over 20 million companies.

🇬🇧 Revolut expands travel footprint by launching a new payments partnership with online travel platform Booking.com. Expanding Revolut’s innovative travel offering for customers, millions of Booking. com customers can now pay via Revolut Pay, Revolut’s streamlined one-click checkout solution, and benefit from a range of currencies.

🇸🇬 UBS has entered a strategic partnership with Ant International. UBS Digital Cash will support Ant International’s global treasury operations with blockchain-based payments, enabling greater efficiency, transparency, and security. Meanwhile, UBS applies this expertise to enhance cross-border payment solutions for its clients.

🇬🇧 LemFi rolls out savings accounts for UK immigrants. LemFi is moving to expand beyond remittances with new UK savings accounts offering 3.92% interest rates, targeting immigrants who face barriers accessing traditional financial services despite strong financial backgrounds.

🇮🇳 PayU secures RBI approval to run online, offline & global payments. The approval covers both inward and outward cross-border flows, positioning PayU to deliver a unified, compliant, and seamless suite of payment acceptance, settlement, and international transaction capabilities to merchants across all touchpoints.

🌍 PayPal and KKR renew agreement for European pay-later receivables. New agreement enables KKR to purchase up to €65 billion of eligible current and future PayPal buy now, pay later loans originated in Europe through March 2028. PayPal will continue to remain responsible for all customer-facing activities, including underwriting and servicing, associated with its European BNPL products.

🇦🇪 SIB launches digital payments and card tokenization platform, SIB Pay. One of the key features of SIB Pay is card tokenization, which replaces a user’s debit or credit card information with a randomly-generated token usable only with specific merchants.

🌍JP Morgan builds a unified payments backbone for digital and FinTech platforms worldwide. APAC’s payments landscape is shaped by fast-evolving digital adoption and significant market diversity. JP Morgan’s architectural response has been to redesign its infrastructure around interoperability. Additionally, J.P. Morgan is to cut 33 jobs as its Luxembourg payments unit shuts. The US banking group has decided to cease operations of J.P. Morgan Mobility Payments Solutions. It cited the company’s “performance and profitability” as reasons for the closure.

🇺🇸 Finzly brings agentic AI to back-end payments processing. The payments FinTech's agents, built on AWS cloud infrastructure, are designed to assist banks and credit unions with some of the manual steps involved in back-end payments processing and operations.

🇦🇺 Australian payments firm Vault becomes Mastercard Principal Issuer to boost innovation and security. This new collaboration unlocks faster innovation, greater agility, and enhanced security for its clients and cardholders alike. Keep reading

🇬🇧 Santander’s Ebury weighs stake sale after London IPO delay. Prospective investors have been discussing the possibility of acquiring a minority stake in the group. Discussions are at an early stage, and the structure of a potential deal hasn’t been finalized, with an IPO remaining an option at a later stage.

🇺🇸 First digital asset bank in the U.S. approved for Norfolk. Governor Jim Pillen said the move signals Nebraska’s intent to lead in digital payments innovation, declaring the state “open for business” to the digital asset industry. Continue reading

GOLDEN NUGGET

The 𝐏𝐫𝐚𝐜𝐭𝐢𝐜𝐚𝐥 𝐆𝐮𝐢𝐝𝐞 to integrating 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬 in 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 by DashDevs👇Created by Arthur Bedel 💳 ♻️

Stablecoins are becoming a cross-border settlement rail — faster, cheaper, and programmable in ways traditional payment networks are not... Plot twist, they are investing here too 😉

How do we actually integrate them into our product stack?

There are 3 primary paths, each shaped by the level of control, regulatory scope, and product maturity of an organization. Across all of them, 𝐬𝐞𝐜𝐮𝐫𝐞 𝐜𝐮𝐬𝐭𝐨𝐝𝐲 / 𝐰𝐚𝐥𝐥𝐞𝐭 𝐢𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 (e.g., Dfns) is the foundational layer that ensures assets can be held, moved, and managed safely.

1️⃣ 𝐎𝐧/𝐎𝐟𝐟-𝐑𝐚𝐦𝐩 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫𝐬 — BVNK, Bridge, Ramp Network, MoonPay

This is the most direct way to introduce stablecoins without redesigning internal payment systems.

A user pays with card, SEPA, or SWIFT, and the on-ramp provider converts that fiat into stablecoins, delivering funds into your wallet. Off-ramps reverse the process.

This path prioritizes speed to market and a familiar UX — ideal for companies testing stablecoin flows, enabling deposits/withdrawals...

𝐓𝐫𝐚𝐝𝐞𝐨𝐟𝐟: less visibility into settlement mechanics and pricing execution.

2️⃣ 𝐁𝐫𝐨𝐤𝐞𝐫𝐚𝐠𝐞 / 𝐄𝐱𝐜𝐡𝐚𝐧𝐠𝐞 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧 — Coinbase, Kraken, Binance

Larger platforms, FinTechs, and merchant processors often progress to direct integration with exchange APIs.

Your app requests quotes, executes trades, and manages stablecoin balances — then withdraws them on-chain into custody.

𝐓𝐡𝐢𝐬 𝐦𝐨𝐝𝐞𝐥 𝐢𝐦𝐩𝐫𝐨𝐯𝐞𝐬:

• Pricing efficiency

• Treasury management

• Control over when and how funds move

𝐁𝐮𝐭... it introduces operational + regulatory responsibility: you are closer to the transaction flow, and therefore compliance surfaces.

3️⃣ 𝐃𝐢𝐫𝐞𝐜𝐭 𝐎𝐧-𝐂𝐡𝐚𝐢𝐧 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧 — Tether.io, USDC, Ethereum, Solana, Base, Tron

This is where stablecoins shift from “a payment method” to an infrastructure layer.

Your application interacts directly with the stablecoin smart contract, moving value peer-to-peer or wallet-to-wallet without intermediaries.

𝐓𝐡𝐞 𝐦𝐨𝐝𝐞𝐥 𝐮𝐧𝐥𝐨𝐜𝐤𝐬:

• Near-zero cost settlement

• Global interoperability

• Programmable payment logic (e.g., conditional disbursements, automated B2B flows, supplier networks)

This is the blueprint behind programmable commerce, agent-driven transactions, and multi-rail merchant strategies. Custody here isn't an add-on, it's the foundation enabling enterprises to interact directly with blockchains safely (e.g. Dfns).

𝐓𝐡𝐞 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐏𝐫𝐨𝐠𝐫𝐞𝐬𝐬𝐢𝐨𝐧 → 1️⃣ → 2️⃣ → 3️⃣

Stablecoins move money the way the internet moves information. The companies preparing their infrastructure now will be the ones shaping the next chapter of payments.

Source: DashDevs

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()