Big Launch: Checkout.com Lands in Canada

Hey Payments Fanatic!

Checkout.com just launched direct acquiring in Canada. The strategic step comes as North America becomes its fastest-growing region, with 80% YoY revenue growth in the U.S. alone.

Direct acquiring in Canada gives customers more control over transaction data, enhanced authorization rates, and the performance edge in payments.

With over 27M online shoppers existing in Canada, it is a key market for Checkout.com who is betting big on global scale.

To lead the charge, Zack Levine steps in as Head of Revenue for North America, overseeing teams across the U.S., Canada, and also extending to Israel.

Look deeper 👇 to find the digital spending patterns of Canadians and why Checkout.com decided to expand there.

Plenty more news lined up below.

Cheers,

INSIGHTS

🇮🇳 India now makes faster payments than any other country, courtesy of UPI. India leads in faster payments due to the rapid growth of UPI. UPI processes over 18 billion transactions monthly, dominating electronic retail payments. Interoperable systems like UPI foster digital payment adoption and reduce reliance on cash, as evidenced by decreased ATM withdrawals.

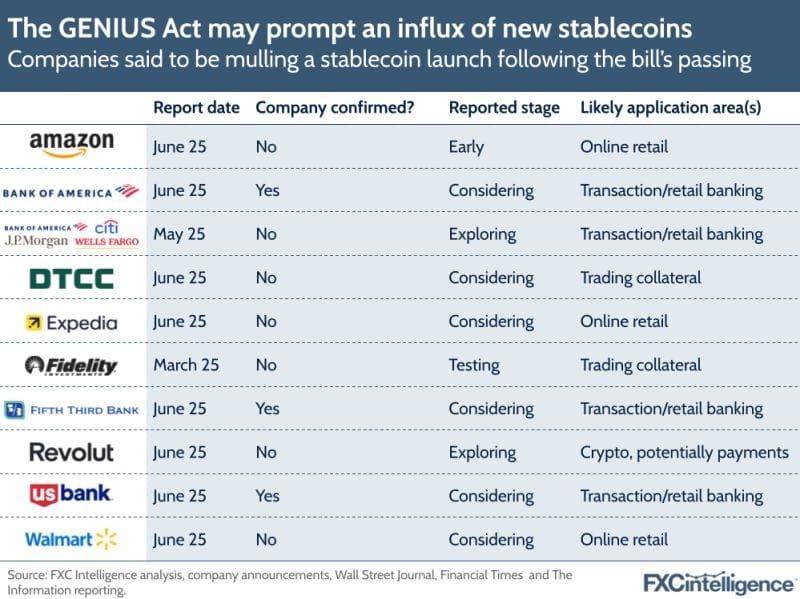

➤ How could the GENIUS Act impact the payments industry?

NEWS

🇨🇦 Checkout.com accelerates North America growth with Canadian launch and leadership refresh. To further drive this growth, it appointed Zack Levine as its Head of Revenue for North America. Direct acquiring in Canada offers customers more control over their transaction data, enhanced authorization rates, and greater payment performance.

🇬🇧 Ecommpay wins Special Judges Award at Financial Services Forum 2025 Awards for Innovation and Transformation. “Ecommpay is on a mission to deliver inclusive and innovative solutions to merchants and FinTechs, and this latest Award underlines our commitment to innovation,” said Max Ryzhov, Chief Product Officer at Ecommpay.

🇨🇴 LatAm FinTech Cobre to support real-time interbank B2B payments in Colombia. This functionality will allow companies to use payment keys to receive instant and interoperable transfers without altering their existing accounting flows or payment systems, eliminating operational friction and making it easier to adopt this new financial infrastructure.

🇨🇳 Coins.ph and HashKey Exchange launch PH-HK remittance corridor. The collaboration allows near-instant transfers between Philippine Pesos and Hong Kong Dollars, reducing friction for remittances and digital asset flows. Continue reading

🇯🇴 Valu receives regulatory nod to launch BNPL services in Jordan. Valu’s advanced BNPL platform offers flexible installment plans for everyday purchases. For merchants and businesses, the BNPL solutions provide an opportunity to expand sales, attract new customers, and build loyalty through seamless integration.

🇦🇺 New payment platform QwikPay launches in Australia. QwikPay is promising to eliminate the friction, fees, and outdated infrastructure that have long held back innovation in the way Australian consumers pay and businesses get paid. Read more

🇪🇺 MoonPay adds single-click crypto payments for Revolut users in the UK and EU. By allowing Revolut users to confirm crypto purchases with biometric ID or a passcode, it eliminates some of the common friction points faced by crypto buyers, particularly the card declines and identity verification delays.

🌍 OKX integrates PayPal to enable users to fund and purchase crypto across Europe. Users can fund their OKX accounts using a variety of funding sources made available by PayPal, including PayPal balance, linked bank accounts, debit cards, and credit cards.

🇧🇷 Bradesco launches Pix via voice command on WhatsApp. The feature, which allows transactions of up to R$300 per transaction, is already being tested with 1,000 selected customers. According to the bank, the next step is to integrate the tool with the institution's other digital channels.

🇬🇧 Lloyds Banking Group is in talks to buy digital wallet provider Curve. Britain's biggest high street bank is in talks to buy Curve, the digital wallet provider, amid growing regulatory pressure on Apple to open its payment services to rivals. Read more

🇺🇸 Remittix announces XRP-Compatible On-Ramp Solution as part of cross-border payment expansion. Users can trade Ripple's native cryptocurrency directly to fiat currencies in its cross-chain wallet. This innovation puts Remittix on the same level as digital payment giants but with a quick, hassle-free doorway to real-world transactions.

🇬🇧 Bank of England Governor warns banks not to issue stablecoins. The Governor of the Bank of England, Andrew Bailey, would prefer that banks stick to tokenized deposits, in part because they are blockchain equivalents of conventional deposits. These support bank lending activities.

🇺🇸 Zelle's payment network grows beyond its big bank owners. Zelle added more community banks to its ranks over the last six months than it did in the prior year, feeding the peer-to-peer payment network's need to reach a wide range of financial institutions.

🇦🇺 SuperAPI and Payroo partner with Monoova. Monoova and SuperAPI’s offering will ensure that the employee gets paid correctly the first time by pre-validating worker and member details, as well as fulfilling the PayDay Super requirements for every employer from July 1st, 2026.

🇹🇼 Taiwanese digital wallet JKOPay hit by asset seizure fallout. JKOPay, a major digital payment platform in Taiwan, is facing operational uncertainty after several businesses cut ties with the service. Read more

🇸🇬 Almond FinTech expands its transfer network in APAC through Ample Transfers partnership to optimize its internal treasury and settlement operations for transfers from Singapore to Indonesia. Keep reading

🇨🇭 Worldline Turmoil Hands Swiss bourse a $300 million headache. The exchange is facing a third writedown in as many years following the recent collapse in Worldline's share price as a result of fraud allegations. SIX is reviewing potential actions for the shareholding, including carrying out a test to determine if further impairment is required.

GOLDEN NUGGET

🚨 Part 3: 𝐓𝐡𝐞 𝐀𝐠𝐞 𝐨𝐟 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 → 𝐞𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐅𝐫𝐨𝐦 𝐍𝐨𝐰 𝐎𝐧 by DEUNA👇 Created by Arthur Bedel 💳 ♻️

After decades of evolution — from single PSP setups (2000s) to multi-PSP orchestration (2010s)—the next paradigm is not infrastructure, but intelligence.

𝐖𝐞’𝐯𝐞 𝐞𝐧𝐭𝐞𝐫𝐞𝐝 𝐚 𝐧𝐞𝐰 𝐩𝐡𝐚𝐬𝐞:

→ Where fragmented data becomes structured.

→ Where static AI becomes context-aware.

→ Where teams stop reacting—and systems start reasoning.

𝐖𝐡𝐲 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐈𝐧𝐟𝐫𝐚 𝐀𝐥𝐨𝐧𝐞 𝐈𝐬𝐧’𝐭 𝐄𝐧𝐨𝐮𝐠𝐡

Despite orchestration, $300B+ is lost annually due to fraud, churn, routing errors, and ineffective personalization (McKinsey & Company, Visa, Forbes).

The root cause? → Lack of intelligent, actionable infrastructure.

3 persistent blockers remain:

1️⃣ 𝐅𝐫𝐚𝐠𝐦𝐞𝐧𝐭𝐞𝐝 𝐚𝐧𝐝 𝐈𝐧𝐜𝐨𝐧𝐬𝐢𝐬𝐭𝐞𝐧𝐭 𝐃𝐚𝐭𝐚

80% of time is spent cleaning spreadsheets—not analyzing outcomes.

Disconnected PSPs, fraud tools, and platforms lead to siloed, noisy data.

2️⃣ 𝐂𝐨𝐧𝐭𝐞𝐱𝐭-𝐥𝐞𝐬𝐬 𝐀𝐈 𝐃𝐨𝐞𝐬𝐧’𝐭 𝐃𝐞𝐥𝐢𝐯𝐞𝐫

Generic tools miss what matters.

90% of AI initiatives never operationalize because they lack real business context.

3️⃣ 𝐂𝐨𝐧𝐬𝐭𝐚𝐧𝐭 𝐅𝐢𝐫𝐞𝐟𝐢𝐠𝐡𝐭𝐢𝐧𝐠, 𝐍𝐨 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲

Teams chase incidents, reactively.

Only ~15% of effort goes into actual growth-driving strategy.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞?

A new reasoning layer that unifies your payments, commerce, and customer data — detecting high-impact opportunities & executing in real time.

It’s not about dashboards or alerts. It’s about intelligent systems that think, decide, and act — autonomously & aligned with your goals.

𝐓𝐡𝐫𝐞𝐞 𝐏𝐫𝐢𝐧𝐜𝐢𝐩𝐥𝐞𝐬 𝐨𝐟 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞

1️⃣ 𝐔𝐧𝐢𝐟𝐢𝐞𝐝, 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐭 𝐃𝐚𝐭𝐚 𝐋𝐚𝐲𝐞𝐫

→ Structure and standardize payments, orders, fraud, and behavior data

→ Extract identities, patterns, and lifecycles from your stack

2️⃣ 𝐀 𝐒𝐲𝐬𝐭𝐞𝐦 𝐟𝐨𝐫 𝐇𝐢𝐠𝐡-𝐈𝐦𝐩𝐚𝐜𝐭 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐲 𝐃𝐞𝐭𝐞𝐜𝐭𝐢𝐨𝐧

→ Context-aware agents continuously scan for blockers, friction, and revenue upside

→ Issues are flagged before they become losses

3️⃣ 𝐄𝐱𝐞𝐜𝐮𝐭𝐢𝐨𝐧, 𝐍𝐨𝐭 𝐉𝐮𝐬𝐭 𝐈𝐧𝐬𝐢𝐠𝐡𝐭

→ Automate checkout logic, provider switching, and retry routing

→ Simulate outcomes, trigger actions, and iterate in real time

𝐓𝐡𝐢𝐬 𝐢𝐬 𝐧𝐨𝐭 𝐣𝐮𝐬𝐭 𝐨𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧. 𝐈𝐭’𝐬 𝐚 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲 𝐞𝐧𝐠𝐢𝐧𝐞.

Agentic Payments Intelligence helps you move from post-mortem analysis…

to preemptive action.

❌ From fragmented reports…

✔️ to unified intelligence

❌ From lagging indicators…

✔️ to automated growth

Final Recap → The Evolution of Payments in One Framework

Summary of the last 25 years of transformation — and what defines the next era.

Source: DEUNA

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()