BNPL Meets UPI in India 🇮🇳 — Paytm Makes the First Move

Hey Payments Fanatic!

Paytm just dropped a big one 👀. Its parent, One 97 Communications, has teamed up with Suryoday Small Finance Bank to launch Paytm Postpaid on UPI — think “buy now, pay later” but for every UPI QR code in India.

Here’s how it works: spend today, pay next month. Users get up to 30 days of interest-free credit, whether it’s for a bill, a recharge, booking tickets, or tapping a UPI QR code at the corner store.

Merchants? They still get instant settlement.

For now, it’s invite-only (based on spending behavior), but the plan is to scale this nationwide.

India’s UPI is already the world’s largest real-time payments system. Now, with credit layered on top, it’s moving a step closer to blending daily payments with everyday lending.

Cheers,

INSIGHTS

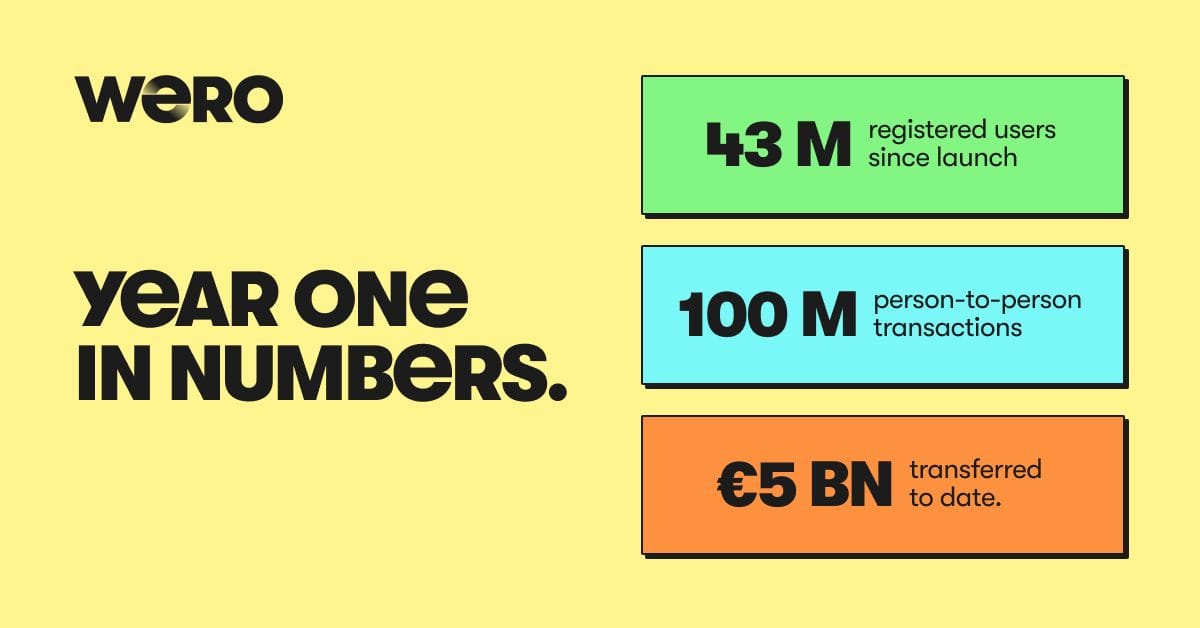

📈 Wero digital wallet has become a trusted everyday payment solution for over 44 million Europeans 🤯 EPI Company is preparing to launch Wero for e-commerce, starting in Germany later this year.

NEWS

🇧🇷 Getnet Appoints Caio Costa, Former PagBank, Visa, and Mastercard Executive, as VP of “Open Sales”. Getnet has announced the appointment of Caio Costa as its new Vice President of Open Sales. In this role, Costa will lead the company’s commercial strategy focused on acquiring clients through alternative sales channels.

🇬🇧 Enhancements to the Ecommpay subscription service help address failed recurring payments. With evolutionary network tokenization and card updates happening automatically in real-time, Ecommpay Subscriptions delivers flexible, intelligent, and globally accessible billing through easy-to-use APIs, dashboard tools, and hosted checkout.

🇺🇸 Creating successful strategies for payment resilience. The Finextra webinar, in partnership with ACI Worldwide, explored how financial institutions can build effective multi-cloud and hybrid cloud strategies to boost payments resilience amid growing regulatory, operational, and geopolitical pressures. Join this webinar

🇺🇸 Real-time security for real-time fraud in payments with Damon Madden, regional solution consultant and fraud expert at ACI Worldwide, and Yvonne Elford, Sales Executive at ACI Worldwide, dispel some myths, discuss the future of payment innovation, and unpack the latest trends in payment fraud.

🇮🇳 Paytm launches postpaid, a credit line on UPI, in partnership with Suryoday Small Finance Bank, offering ‘spend now, pay next month’ convenience. With Paytm Postpaid, consumers can now make payments using a credit line on UPI across all merchant touchpoints. This includes scanning any UPI QR code, shopping online, or paying for recharges, bill payments, and bookings on our app.

🇺🇸 Affirm partners with ServiceTitan to bring smart, flexible payment options to the trades. Through this partnership, ServiceTitan customers will offer approved consumers the ability to split home repair bills into budget-friendly biweekly or monthly payments.

🇺🇸 Affirm live for in-store purchases with Apple Pay on iPhone. This payment option offers even more flexibility and choice for Apple Pay customers, and is available with Apple Pay in the U.S. Continue reading

🇮🇳 Introducing Apple Pay on Razorpay: a new era of frictionless global payments. This milestone enables Indian businesses selling globally to offer their international customers one of the world’s most trusted, loved, and seamless payment methods, directly through Razorpay’s checkout.

🇺🇸 MoneyGram reinvents cross-border finance with next-generation App. Consumers who were once constrained by fragmented systems and local currencies will now be empowered to leverage stablecoins to access a fast and modern way to move and hold money across borders.

🇸🇦 MoneyGram and Enjaz partner to expand cross-border payments in Saudi Arabia. Through this collaboration, Enjaz will integrate MoneyGram’s global payments network infrastructure into its nationwide retail and digital channels, including the Enjaz Pay App, enabling millions of consumers to send money quickly and reliably. Additionally, MoneyGram and D360 Bank signed a strategic MoU at Money20/20 Middle East. The collaboration will focus on enhancing cross-border payment capabilities and delivering digital financial solutions to customers.

🇦🇪 Comera Pay secures Visa principal membership to launch multicurrency offerings in the UAE. The new membership is expected to enable Comera Pay to launch a multicurrency product, allowing consumers to transact locally and internationally, according to a statement.

🇺🇸 Zelle® hits new highs. Two billion in transactions and nearly $600 billion in payments in the first half of 2025. With over 125 average payments per second per day, Zelle captures the pulse of how Americans are navigating today's economy. Keep reading

🇺🇸 Stablecore raises $20M to bring stablecoins, tokenized deposits, and digital assets into banks and credit unions. The new funding allows Stablecore to grow its customer base within the 8,000+ regional and community banks and credit unions in the U.S. and hire additional talent to support them.

🇬🇧 Ex-OakNorth & Starling executive Ben Chisell appointed CEO at Paysend. Ronnie Millar said: “Ben’s strategic vision, product expertise, and deep understanding of both our business and the global payments ecosystem make him the ideal leader to take Paysend forward.”

🇨🇭 Swiss banks complete first binding blockchain payment. In a milestone for the Swiss financial sector, UBS, PostFinance, and Sygnum have successfully executed the first legally binding interbank payment using tokenized bank deposits on a public blockchain.

🇰🇪 PayU exits Kenya six years after launch and appoints Sonal Tejpal as the liquidator. The decision to shut down was filed under Kenya’s Insolvency Act and published in a local newspaper. As liquidator, Tejpal is now responsible for winding up the company’s affairs and settling any outstanding liabilities.

🇺🇸 Klarna CEO eyes $1 billion wealth revamp after US listing. Flat Capital AB proposed acquiring Double Sunday AB, which owns 6.5% of Klarna and is currently wholly owned by Sebastian Siemiatkowski, in a deal that values Double Sunday at 9.5 billion Swedish kronor.

GOLDEN NUGGET

🚨 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐈𝐧 𝐌𝐨𝐭𝐢𝐨𝐧 — Cost Optimization by DEUNA 👇 Created by Arthur Bedel 💳 ♻️

𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐈𝐧 𝐌𝐨𝐭𝐢𝐨𝐧

In payments, cost efficiency is not just about lowering fees — it’s about orchestrating every transaction path to balance performance, cost, and security.

This use case shows how an 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 𝐋𝐚𝐲𝐞𝐫 transforms raw data into proactive strategies that minimize transaction costs while protecting acceptance and margins.

𝐓𝐡𝐞 𝐑𝐨𝐥𝐞 𝐨𝐟 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 𝐢𝐧 𝐂𝐨𝐬𝐭 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧

Agentic intelligence transforms payments into a reasoning system — one that continuously evaluates provider fees, cross-border rules, and acceptance probabilities in real time.

1️⃣ 𝐅𝐫𝐨𝐦 𝐃𝐚𝐭𝐚 𝐭𝐨 𝐀𝐜𝐭𝐢𝐨𝐧𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬

Every transaction detail — PSP, card scheme, geography, acquirer fees — is funneled into a unified intelligence layer for analysis.

→ Netflix and/or The Walt Disney Company consolidates global PSP and acquirer data to ensure local routing for subscription renewals, minimizing unnecessary cross-border costs.

2️⃣ 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐜𝐞 𝐟𝐨𝐫 𝐂𝐨𝐬𝐭 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲

ML models process historical performance and fee structures, dynamically recommending the lowest-cost routes without compromising approval rates.

→ Uber applies real-time routing to adjust acquirer selection per ride geography, reducing blended processing costs while keeping checkout frictionless.

3️⃣ 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐞𝐝 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫 𝐒𝐞𝐥𝐞𝐜𝐭𝐢𝐨𝐧

The system proactively selects the most cost-effective provider by evaluating:

→ Acquirer fees and interchange rates

→ FX costs and cross-border rules

→ Regional performance and uptime

→ Financing terms

→ Spotify leverages Adyen, Stripe and other providers interchange optimization to cut costs on recurring subscriptions while maintaining strong acceptance levels.

4️⃣ 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐞𝐝 𝐅𝐫𝐚𝐮𝐝 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐨𝐧

Cost savings are protected by embedding antifraud capabilities directly into optimization logic. Transactions are dynamically routed with fraud controls adapted to their risk profile.

→ Stripe merchants balance cost reduction with adaptive fraud checks — applying minimal friction to trusted customers while deploying stronger controls for higher-risk.

𝐓𝐡𝐞 𝐁𝐨𝐭𝐭𝐨𝐦 𝐋𝐢𝐧𝐞:

✅ Lower processing costs through optimal acquirer and PSP selection

✅ Higher approval rates by avoiding high-cost / low-performance routes

✅ Improved margins as compounded savings scale globally

✅ Secure and seamless customer experiences at checkout

For leading enterprises, the role of AI in payments now has shifted from solving isolated problems to orchestrating an ecosystem where cost control, growth, and trust are engineered by design. It embeds intelligence into every aspect of a business.

Source: DEUNA

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()