Brazil’s Banks Use GenAI to Bring Finance Into WhatsApp

Hey Payments Fanatic!

Another breakthrough from Brazil’s Pix ecosystem is here: GenAI for payments. Sending money in Brazil is now as easy as sending a message.

Brazilian banks like PicPay, Itaú, and Nubank are using generative AI to let users transfer money within WhatsApp.

It’s seamless, fast, and integrated into the chat experience that over 90% of Brazilians use daily. No need to open a banking app anymore. This tech leap takes Brazil’s Pix system even further.

In 2023 alone, 56 billion Pix transactions were completed. As a result, mobile banking adoption has soared to 90%, putting Brazil ahead of the US and UK.

Here’s what’s new: users can now simply send a message with the payment amount and a Pix key, or even a photo of a QR code. They’re momentarily redirected to authenticate, then see the confirmation right in the chat. It all feels like one smooth conversation.

Brazil is redefining what digital payments and mobile banking can look like for the rest of the world. How would you feel about paying through text? 🤳🏼

Scroll down for more of today’s payment updates I picked for you, and I'll be back in your inbox tomorrow!

Cheers,

INSIGHTS

🇬🇧 3S Money’s Take on Stablecoins. What a Paris metro ticket has to do with Stablecoins, or why a ‘fiat-crypto-fiat’ flow is wrong. Using a Paris metro analogy, 3S Money CEO Ivan Zhiznevsky compared fiat to an unnecessary paper ticket slowing progress. He calls for treating stablecoins like real currencies, empowering businesses and individuals to transact directly in digital assets for greater efficiency and flexibility.

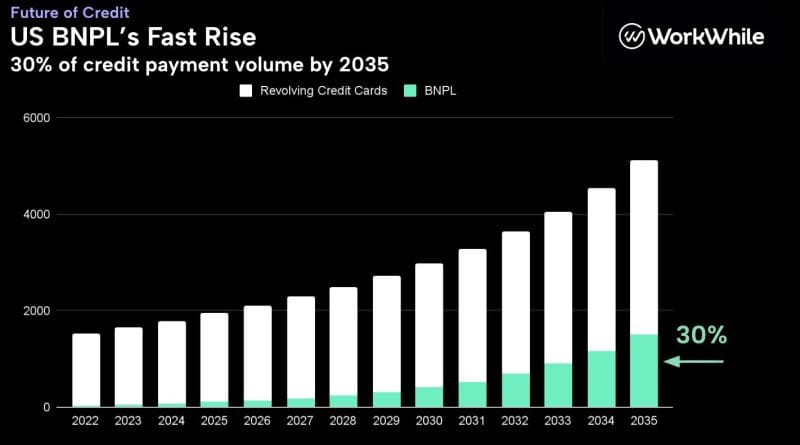

📈 BNPL will account for 30% of all credit-driven card purchases by 2035.

There are 148 credit card issuers in the US and ~ 6 BNPL "issuers"👇

NEWS

🌎 Getnet ranks among the world’s Top 10 Merchant Acquirers and #1 Latam acquirer. Getnet continues to empower millions of SMEs with secure, reliable payment and lending solutions, while supporting global businesses through a unified platform that connects every payment method across Latin America and Iberia.

🇺🇸 CellPoint Digital expands in Dallas to strengthen global reach and accelerate growth across the Americas. The company’s expanded presence in the U.S. provides a key base to meet surging demand for orchestration and optimisation solutions and to support its growing network of global clients, ensuring faster response times and deeper regional alignment.

🇬🇧 DashDevs to moderate stablecoin debate at Open Banking Expo 2025. Moderated by Denys Trush, Digital Finance Lead at DashDevs, the panel will feature senior industry leaders, including representatives from Standard Chartered and 11:FS, and will explore how stablecoins are reshaping digital payments and cross-border transactions.

🇧🇷 WhatsApp and Generative AI propel Brazil into the future of finance. PicPay, Itaú Unibanco, and Nubank are using GenAI to allow clients to transfer money in a chat with their official accounts, with no need to launch special payment apps, directly in WhatsApp, the messaging app used by more than 90% of Brazilians.

🇬🇧 PayPal-backed UK FinTech kicks off legal battle over unpaid fees. A spokesperson for Modulr said: “Modulr has initiated winding-up proceedings against a former client, Paymob Technology. “This action follows Paymob’s failure to meet payment obligations and is a standard step in our commercial debt recovery process.”

🌎 Tether reaches 500m verified users as stablecoin market nears $316b. Tether's user base is 82% larger than Circle's, though its market cap lead is only 58%, indicating smaller average holdings. USDT averages $364 per user compared to USDC's $852, reflecting Tether's stronger retail presence versus institutional focus.

🇬🇧 Paymentology launches PayCredit. PayCredit integrates card issuing and credit ledger management to help issuers cut complexity, accelerate time to market, and create new revenue streams. The solution integrates card issuing with credit ledger management to reduce complexity and accelerate time to market.

🇫🇷 Edenred and Visa announce a strategic partnership to accelerate innovation across benefits and engagement, mobility, and B2B payment solutions. This collaboration strengthens Edenred's platform through the certification of its in-house issuing and processing infrastructure with Visa Europe.

🇸🇬 StraitsX raises US$10 million from UQPAY to fuel Asia stablecoin expansion. The new funding will enable StraitsX to expand its stablecoin-to-fiat capabilities, broaden cross-border use cases, and grow its network of enterprises and institutions. The company said it aims to advance programmable, real-time settlement solutions.

🇺🇸 Commerce introduces BigCommerce Payments powered by PayPal. Through this optional co-branded integration, merchants will gain access to advanced payment capabilities, simplified account management, and buy now, pay later (BNPL) via PayPal’s Pay Later offering, all seamlessly managed within the BigCommerce Control Panel.

🇮🇳 UPI transactions hit Rs 94,000 crore daily in October; festive spending, GST cuts drive record surge. With more than a week left in the month, UPI is on course to record its highest-ever monthly performance. The digital payments platform, which handles nearly 85% of India’s online transactions, continues to cement its position as the backbone of the country’s FinTech ecosystem.

🇮🇳 Zoho set to launch consumer payments app ‘Zoho Pay’. “Zoho Pay is designed to offer a smooth, secure, and integrated payment experience. It will be available both as a standalone app and within Arattai, enabling users to make transactions without leaving their chat interface,” Sivaramakrishnan Iswaran, CEO of Zoho Payments Tech, said.

🇪🇬 Egyptian FinTech, Money Fellows, now has over 8 million users and processed $1.4 billion. In a statement, the Egypt-based FinTech explained that the latest feat is a testament to its effort to digitalise the traditional money circle. The company is known for its unique model of onboarding rotational savings and making it safe and user-friendly for individuals.

🇺🇸 Capital One and Discover synergies power growth and lift card performance. Capital One’s third-quarter earnings results showed improving card performance, growth in purchase volumes on those cards, and synergies from the Discover acquisition that closed earlier in the year.

🇺🇸 Mastercard welcomes Jill Kramer as Chief Marketing and Communications Officer; Raja Rajamannar transitions to a senior fellow role. CEO Michael Miebach praised Raja for his transformative impact on the company and the marketing industry. She also highlights Kramer's global perspective, B2B marketing expertise, and visionary leadership as essential for Mastercard’s next chapter of growth and innovation.

🇬🇧 Allica Bank snaps up UK embedded finance startup Kriya. Allica, which offers lending, business banking, and savings services to SMEs with over 10 employees, said the all-share deal for Kriya strengthens its lending offering and represented a “strong strategic fit”.

🇺🇸 Tesser raises $4.5m seed round to bring instant cross-border payments to banks and PSPs. Tesser's stablecoin payment platform can help financial institutions reduce the time it takes to deliver cross-border payments to hours, with a 95% cost reduction compared to industry standards.

🇨🇱 Chilean FinTech Fintoc receives authorization to issue payment cards with funding. The Financial Market Commission (CMF) authorized the existence of Fintoc Pagos SA, through Fintoc Payments. The organization seeks to simplify the way companies receive, manage, and move money.

🇧🇷 UnblockPay, which makes global payments with stablecoins, completes seed round. By connecting local payment systems with crypto infrastructure, UnblockPay enables international transactions between stablecoins and fiat currencies. In practical terms, in a remittance from Brazil to the US, reais are converted into stablecoins, which then become dollars on the other end.

🇷🇺 Russia embraces crypto for cross-border transactions. The country’s Ministry of Finance and the Central Bank have agreed to legalize the use of cryptocurrencies for payments in foreign trade, a landmark move that could transform how Russia conducts international business.

🇺🇸 Kraken CEO, David Ripley, claps back at the American Bankers Association over claims against stablecoin yields. Ripley argued that customers should have the right to decide how and where they store their digital value. He claimed that banks profit from customer assets without offering fair returns or financial inclusion.

GOLDEN NUGGET

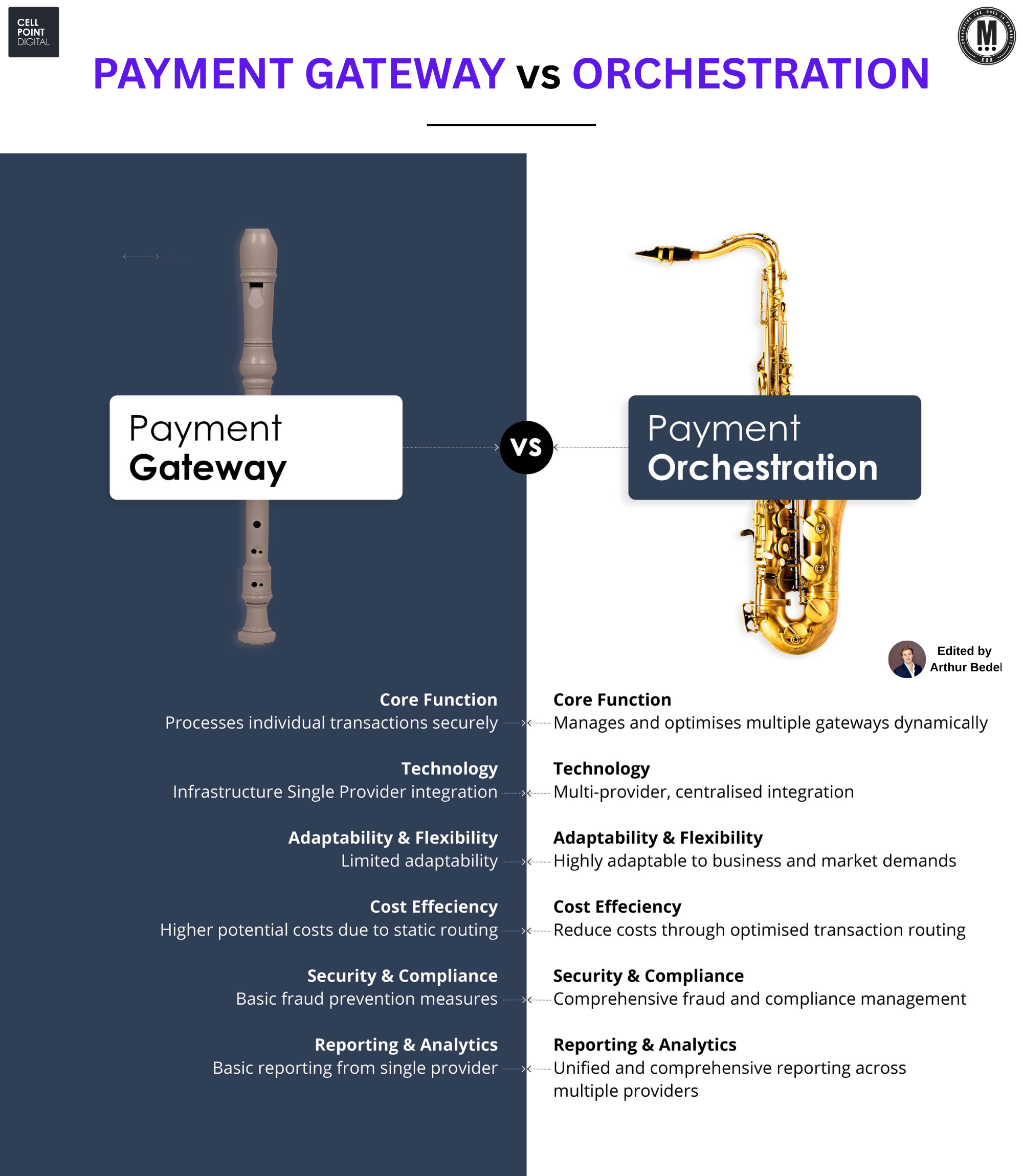

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 𝐯𝐬. 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 — by CellPoint Digital 👇 Created by Arthur Bedel 💳 ♻️

As digital commerce scales across channels, geographies, and payment methods — the limitations of traditional gateways are more visible than ever.

Merchants need more than a pass-through.

They need intelligence, control, and real-time flexibility.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲?

► A Payment Gateway is a front-end technology that securely transmits payment data from a merchant’s checkout to a single PSP or acquirer.

► It’s static — a one-to-one pipeline that lacks routing flexibility, optimization, or centralized analytics.

→ Authorize.net, Braintree, Cybersource, Checkout.com, Nuvei

𝐇𝐨𝐰 𝐃𝐨𝐞𝐬 𝐚 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 𝐖𝐨𝐫𝐤?

1️⃣ A customer initiates a transaction on the checkout page.

2️⃣ The gateway encrypts and forwards the payment data to the connected PSP.

3️⃣ The PSP sends it to the card network → issuer → approval or decline.

4️⃣ The result returns to the merchant for capture and settlement.

→ It’s simple, but rigid — with no fallback, no smart routing...

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧?

► A Payment Orchestration Platform (POP) connects multiple PSPs, acquirers, and fraud tools through one API — offering control, intelligence, and efficiency at every step of the payment flow.

► It acts as a smart layer that routes, recovers, and reconciles payments across markets.

→ CellPoint Digital, ACI Worldwide, DEUNA, Yuno

𝐇𝐨𝐰 𝐃𝐨𝐞𝐬 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐖𝐨𝐫𝐤?

1️⃣ The merchant checkout triggers an API call to the orchestration layer

2️⃣ Business logic is applied — including tokenization, fraud checks...

3️⃣ The transaction is routed to the best-performing PSP based on success rates, costs, and geography

4️⃣ If declined, fallback routing can retry in real-time

5️⃣ Funds are captured, settled, and reconciled centrally

→ Orchestration gives merchants the tools to adapt, optimize, and scale.

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 𝐯𝐬. 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧: 𝐊𝐞𝐲 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬

✔ 𝐑𝐨𝐮𝐭𝐢𝐧𝐠

→ Gateway: Static routing to a single PSP

→ Orchestration: Dynamic, rules-based routing across multiple providers

✔ 𝐅𝐥𝐞𝐱𝐢𝐛𝐢𝐥𝐢𝐭𝐲

→ Gateway: Fixed connection

→ Orchestration: Modular, market-adaptive stack

✔ 𝐂𝐨𝐬𝐭 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧

→ Gateway: Minimal

→ Orchestration: Built-in savings via routing & retry logic

✔ 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 & 𝐅𝐫𝐚𝐮𝐝

→ Gateway: Basic or dependent on PSP

→ Orchestration: Integrated tools like VGS (token vault) and Forter (fraud scoring)

✔ 𝐀𝐧𝐚𝐥𝐲𝐭𝐢𝐜𝐬

→ Gateway: PSP-specific reports

→ Orchestration: Unified, real-time performance dashboards

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧:

Payment Gateways brought us online.

Payment Orchestration takes us forward.

Source: CellPoint Digital

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()