Bre-B Reaches 11.6M While Rollout Faces Delay

Hey Payments Fanatic!

Last Friday, I shared news from Colombia with Félix Pago, making its way into the country. Today, I’m back with another update from there, this time about Bre-B.

It’s been just a month and a half since the launch and already reached 11.6 million users, that’s about 22% of Colombia’s population. Amazing, right?

But not everything is moving as fast as expected. The rollout was planned for September, but Credibanco’s president, Felipe Acevedo, revealed it will now happen on October 9.

As he put it, the team is still working with the Central Bank on “an articulated and organized schedule of the proper tests for the functioning of the different layers of the nodes, with the entity’s infrastructure.”

To be continued...

👇 Scroll down for the rest of today’s payments headlines and enjoy your week.

Cheers,

INSIGHTS

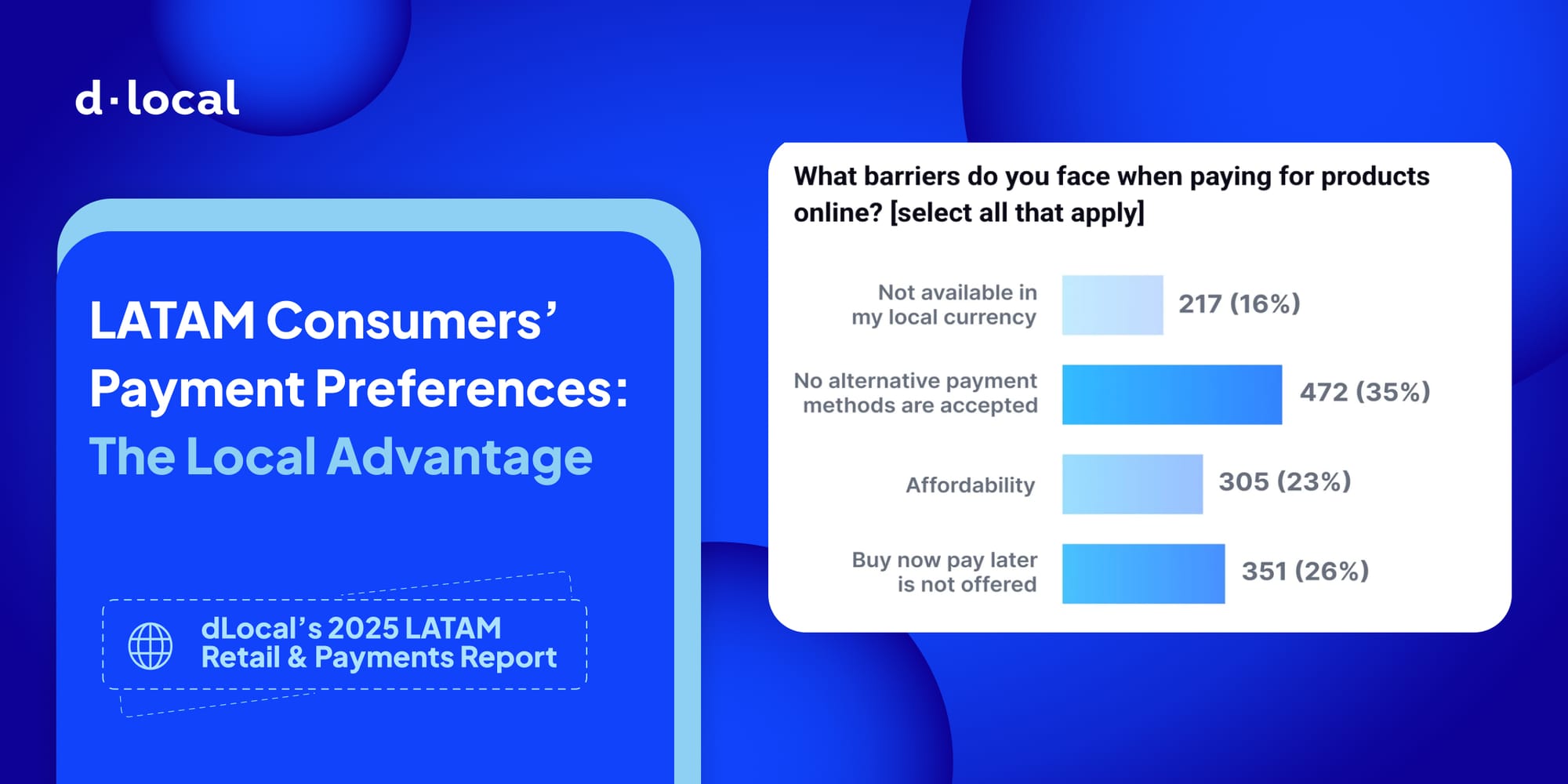

🌎 Unlock the power of LATAM retail: essential consumer insights from the dLocal Payments Survey. The report provides a first look into these crucial consumer attitudes, from payment preferences and brand perceptions to the influence of tariffs.

NEWS

🇸🇬 Airwallex wins hat-trick at 2025 Asia FinTech Awards, winning three top honors: Banking Tech of the Year, Best Employer of the Year, and Director of the Year for Arnold Chan, General Manager, Asia Pacific, highlighting both its technological leadership and workplace excellence.

🇧🇷 How ACI Worldwide is using AI to redefine fraud prevention in banking with Cleber Martins. In an interview with BM&C Business, he highlights how ACI is leveraging AI to enhance banking fraud prevention, discusses the company’s financial performance and global expansion, and outlines key strategic projects shaping its future. Watch the full interview here

🇨🇴 Bre-B, "the Colombian Pix," has once again delayed its operational start date. The new launch date was updated to October 9, as they are still working with the Central Bank on an articulated and organized schedule of the proper testing of the operation of the different layers of the nodes, with the entity's infrastructure.

🇵🇪 Western Union allows customers to carry out international operations and exchange dollars through WhatsApp Business in Peru. Through this tool, users will be able to send money to more than 200 countries and territories, as well as buy or sell dollars, all from the comfort of their cell phone.

🇪🇸 Caixabank enables Apple Pay installment payments in Spain. Users can select their eligible credit card and then tap Pay Later to view their available installment plans. They can then select the installment plan of their choice, ranging from two to 12 months, depending on their card conditions, and complete the checkout process through Apple Pay.

🇨🇳 Ant Group quarterly profit falls 60% to $663 million. The decrease was mainly attributable to "investments in new growth initiatives and technologies, and the decrease in fair value of certain investments". Read more

🌏 Ant International completes real-time FX blockchain settlement in Asia through Kinexys by J.P. Morgan. The solution provides businesses with uninterrupted access to liquidity across selected global currencies, including USD, EUR, and GBP, enabling them to conduct transactions outside of designated market hours and beyond the limitations of traditional market cutoff times.

🇨🇦 Corpay Cross-Border partners with SKsoft to power seamless global payments. This collaboration embeds Corpay’s payment automation and global treasury capabilities directly into the SKsoft environment, enabling clients to process and manage their cross-border payments through a single, unified solution, enhancing operational efficiency, visibility, and control.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()