Cash App and Bizum Push Payment Boundaries

Hey Payments Fanatic!

7,000 km apart, two shifts opened new doors in payments. In the US, Cash App brought iPhone tap-to-pay to micro sellers’ pockets. In Spain, Bizum opens the door to teens for the first time. Different users, different aims, but both moves pushed the boundaries of who gets to pay, and how.

Over 1 million Cash App Business sellers in the US can now accept contactless payments directly on their iPhones, without needing extra hardware. Credit and debit cards, Apple Pay, and other digital wallets are all supported with this new feature.

“It’s a powerful way to ensure micro and nano sellers never miss a sale,” said Owen Jennings, Head of Business at Block.

Meanwhile, in Spain, instant payment app Bizum expanded access to a new audience. With parental approval, teens aged 12 to 17 can now send and receive money and shop online!

Keep reading for more on Cash App, Bizum, and the latest in payments 👇 See you tomorrow!

Cheers,

INSIGHTS

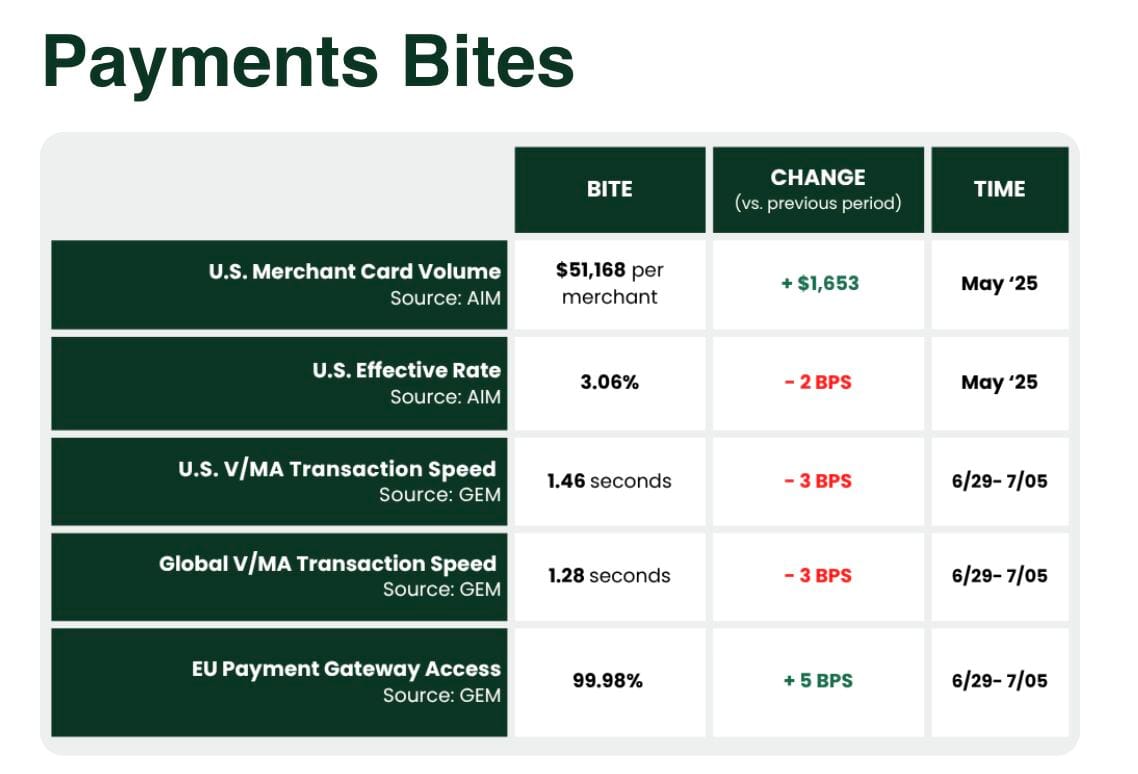

📊 Payments Bites by TSG

NEWS

🇺🇸 Cash App enables over a million sellers to accept contactless payments using only an iPhone. This new capability, powered by Square, is now available to millions of eligible Cash App Business sellers using their Cash App iOS app. Read more

🇪🇸 Bizum for minors. Bizum has launched a new feature that allows minors aged 12 to 17 to use its instant payment service under the supervision of a legal guardian. With parental approval and a compatible bank account, teens can send and receive money, make online purchases, and pay in person using only their mobile phone.

🇺🇸 Mastercard debuts experience-focused world legend card. The Mastercard Collection is available across the company’s World, World Elite, and newly created World Legend Mastercard cards, offering rewards on things like dining, entertainment, and travel.

🇺🇸 OpenAI to take cut of ChatGPT shopping sales in hunt for revenues. The San Francisco-based company currently displays products on the platform with an option to click through links to online retailers. It also announced a partnership with payments group Shopify in April.

🇦🇪 QIIB and Visa launch Biometric Click to Pay. Users can employ a unique identifier, such as their email address or phone number, to swiftly complete transactions with participating merchants. Integrated with Visa’s Payment Passkey Service, this solution leverages biometric authentication, eliminating the need for manually entering card details or one-time passcodes.

🇬🇧 Bank of England readying the new retail payment infrastructure plan. This new model, the central bank’s Payments Vision Delivery Committee said in a news release, “embeds public and private sector collaboration, utilizing the right expertise in the right functions to drive transformation.”

🇩🇪 Vivid Money and Adyen launch payouts on speed. Adyen processes have been integrated into the Vivid Money interface, allowing customers, upon acceptance of Adyen's terms and conditions, to withdraw revenue from payments directly to their account.

🇺🇸 ZBD secures EU EMI license and announces partnership with ClearBank to merge digital assets with traditional finance. ClearBank will provide ZBD with operational accounts for business expenses and safeguarding accounts for holding client funds. This enables ZBD EU users to fund a EUR balance in their virtual account.

🌍 PayPal appoints Maria Teresa Minotti as a new Vice President and General Manager of Southern Europe. Throughout her career at the company, she has held various roles of increasing responsibility, distinguishing herself for her ability to explore new market segments and develop advanced digital solutions.

🇬🇧 Akoni founder Panos Savvas joins Kani Payments as CTO. The company says Savvas will focus on "platform scalability, real-time analytics and data quality", with the new CTO adding that he will work on "scaling what already works, embedding more deeply into client workflows and setting new standards".

🇺🇸 PayPal Blockchain Lead José Fernández da Ponte Joins Stellar. Fernández da Ponte said the move was more about choosing to work at the infrastructure layer, ensuring applications like stablecoins can run at scale. The foundation also said it appointed Jason Karsh, a former Block and Blockchain.com executive, as CMO.

🇺🇸 FinTech giant FIS lays off 133 people at Seattle-area office. A new filing with the Washington state Employment Security Department revealed the job cuts, which begin Sept.15. “FIS is evolving our embedded finance strategy to prioritize delivery of embedded finance capabilities to banks,” a company spokesperson said.

🇺🇸 Jamie Dimon says JPMorgan Chase will get involved in stablecoins as the FinTech threat looms. Last month, JPMorgan announced it will launch a more limited version of a stablecoin that only works for JPMorgan clients; a true stablecoin would presumably be more universally accepted.

🇦🇪 Telr and Peko ink a strategic partnership agreement to launch Telr Incepta, an all-in-one platform designed to help in setting up businesses in the UAE and empower SMBs with advanced tools that transform the way businesses manage their finances and operations.

🇫🇷 Worldline introduces AI-powered routing to boost payment authorisation rates. Following successful pilots, the solution has delivered increased authorisation rates by more than 2% in addition to the 3% improvement achieved with its rule-based routing.

🌍 Paypercut lands €2 million pre-seed. Paypercut's BNPL Aggregator connects several underwriters in one place. Merchants integrate once, then either allow shoppers to choose their preferred BNPL provider at checkout or let an internal algorithm route the transaction.

🇮🇳 FinTech firm PayU India raises Rs 302 crore from Prosus arm. “This fundraise is to fuel the growth of our credit business, which is expected to break even by September,” a PayU India spokesperson told Inc42. “It also reflects Prosus’ confidence in our growth trajectory and our path to profitability.”

🇺🇸 ICBA Payments and Visa renew partnership supporting community bank payments. Together are deepening their efforts to equip local financial institutions with the modern payment tools and support they need to grow and better serve the needs of their customers.

GOLDEN NUGGET

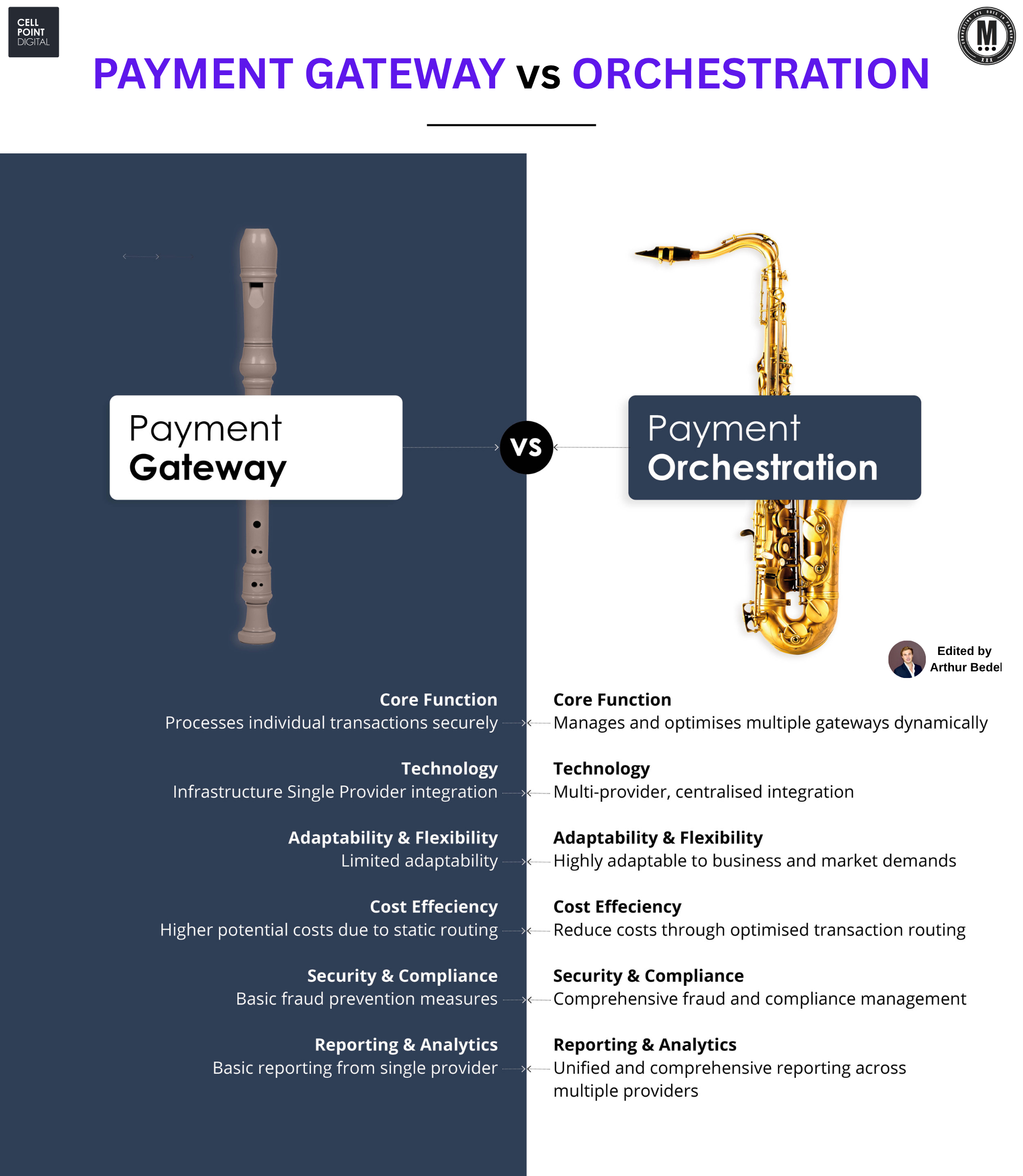

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 𝐯𝐬. 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 — by CellPoint Digital 👇 Created by Arthur Bedel 💳 ♻️

As digital commerce scales across channels, geographies, and payment methods — the limitations of traditional gateways are more visible than ever.

Merchants need more than a pass-through.

They need intelligence, control, and real-time flexibility.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲?

► A Payment Gateway is a front-end technology that securely transmits payment data from a merchant’s checkout to a single PSP or acquirer.

► It’s static — a one-to-one pipeline that lacks routing flexibility, optimization, or centralized analytics.

→ Authorize.net, Braintree, Cybersource, Checkout.com

𝐇𝐨𝐰 𝐃𝐨𝐞𝐬 𝐚 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 𝐖𝐨𝐫𝐤?

1️⃣ A customer initiates a transaction on the checkout page.

2️⃣ The gateway encrypts and forwards the payment data to the connected PSP.

3️⃣ The PSP sends it to the card network → issuer → approval or decline.

4️⃣ The result returns to the merchant for capture and settlement.

→ It’s simple, but rigid — with no fallback, no smart routing...

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧?

► A Payment Orchestration Platform (POP) connects multiple PSPs, acquirers, and fraud tools through one API — offering control, intelligence, and efficiency at every step of the payment flow.

► It acts as a smart layer that routes, recovers, and reconciles payments across markets.

→ CellPoint Digital, ACI Worldwide, DEUNA, Yuno

𝐇𝐨𝐰 𝐃𝐨𝐞𝐬 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐖𝐨𝐫𝐤?

1️⃣ The merchant checkout triggers an API call to the orchestration layer

2️⃣ Business logic is applied — including tokenization, fraud checks...

3️⃣ The transaction is routed to the best-performing PSP based on success rates, costs, and geography

4️⃣ If declined, fallback routing can retry in real-time

5️⃣ Funds are captured, settled, and reconciled centrally

→ Orchestration gives merchants the tools to adapt, optimize, and scale.

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐆𝐚𝐭𝐞𝐰𝐚𝐲 𝐯𝐬. 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧: 𝐊𝐞𝐲 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐜𝐞𝐬

✔ 𝐑𝐨𝐮𝐭𝐢𝐧𝐠

→ Gateway: Static routing to a single PSP

→ Orchestration: Dynamic, rules-based routing across multiple providers

✔ 𝐅𝐥𝐞𝐱𝐢𝐛𝐢𝐥𝐢𝐭𝐲

→ Gateway: Fixed connection

→ Orchestration: Modular, market-adaptive stack

✔ 𝐂𝐨𝐬𝐭 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧

→ Gateway: Minimal

→ Orchestration: Built-in savings via routing & retry logic

✔ 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 & 𝐅𝐫𝐚𝐮𝐝

→ Gateway: Basic or dependent on PSP

→ Orchestration: Integrated tools like VGS (token vault) and Forter (fraud scoring)

✔ 𝐀𝐧𝐚𝐥𝐲𝐭𝐢𝐜𝐬

→ Gateway: PSP-specific reports

→ Orchestration: Unified, real-time performance dashboards

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧:

Payment Gateways brought us online.

Payment Orchestration takes us forward.

Source: CellPoint Digital

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()