Cashback Is Coming to Your Debit Card

Hey Payments Fanatic!

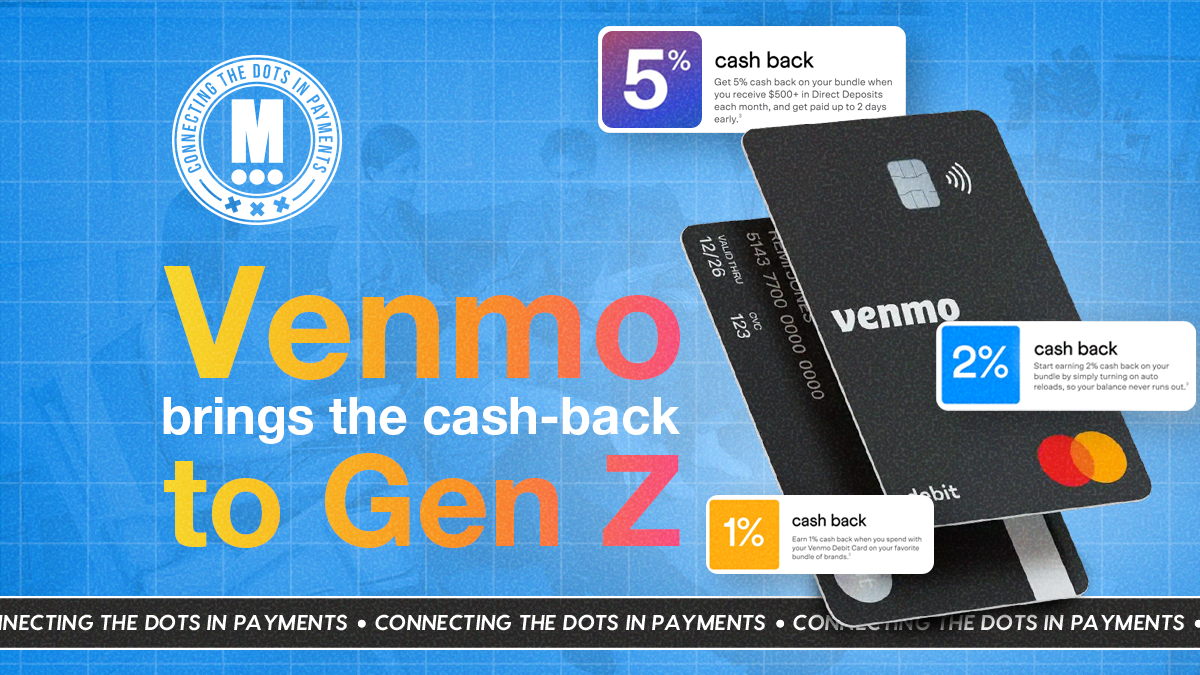

With the younger crowd in mind, Venmo launched a new rewards program for debit cards.

Named Venmo Stash, it tries to cater to Gen Z's spending behavior. According to research, they favor debit cards over other forms of payment.

In the new program, customers earn 1% cashback on their Venmo Debit Mastercard by spending their Venmo balance.

Rewards increase to 2% when customers turn on auto reloads to keep their balance replenished automatically.

And customers can earn 5% cash back when they receive Direct Deposits on Venmo each month.

The company said that in 2026, 'Stash' will expand and offer rewards when clients pay with Venmo at merchants within its nationwide network.

Stay tuned for more, because there’s always something new in the world of Payments.

Cheers,

NEWS

🇳🇱 Mollie has entered its next chapter with the launch of a unified business banking platform. The new offering aims to eliminate friction in money management by providing fast, intuitive tools that deliver real-time insights, automate administrative tasks, and scale alongside business growth, replacing outdated, costly financial systems with a smarter, more efficient solution.

🇨🇴 Colombia’s Bre-B Instant Payment System Transforms Transactions and Financial Inclusion. Bre-B is an instant payment system that enables transfers using simple “keys” like phone numbers or emails. It allows payments for services, transport, and salaries directly from mobile apps. ACI Worldwide noted that the system will let companies and freelancers send and receive payments instantly, improving efficiency and financial inclusion.

🇺🇸 Venmo introduces 'Venmo Stash' to reinvent rewards. Venmo Stash is an innovative rewards program designed to give customers more value that grows with every interaction. Unlike many traditional rewards programs, it is always on and flexible, evolving alongside customers as they engage across Venmo's expanding suite of products and services.

🇮🇳 RBI clears path for UPI wallet that lets children pay without bank accounts. The wallet will let customers scan any UPI QR code to pay, much like regular UPI users. This capability aligns closely with the UPI Circle initiative launched by NPCI, enabling youngsters to make UPI payments using their parents’ linked UPI accounts.

🇨🇳 Tencent launches TenPay Global Checkout, a new payment solution for Weixin Mini Program to enable merchants to accept local payments outside of China. Tencent said in a statement that with a single integration of TenPay, Weixin Mini Program overseas merchants can support multiple payment methods, including digital wallets, local real-time payment networks, and credit and debit cards.

🇺🇸 Samsung wants to launch a U.S. credit card and challenge Apple in consumer finance. South Korean tech giant and Barclays are in advanced talks to launch a credit card, with both seeking bigger inroads into Americans’ financial lives. Keep reading

🇳🇱 Adyen forecasts 20% annual net revenue growth after 2026. The figure is in range with analyst forecasts. The company’s shares rose as much as 3.3% in Amsterdam. Adyen sees “significant potential” to expand market share and is positioned to become “one of the largest players” in its industry.

🌎 Visa unveils 2025 Creator Report and introduces creator agent pilot with Karat to make the business side of creativity easier. Monetized: Visa 2025 Creator Report is a comprehensive study of the creator economy spanning five regions: the United States, Brazil, Australia, the United Kingdom, and the United Arab Emirates.

🇺🇸 Visa and Mastercard agree $38bn settlement over swipe fees. Under the proposed deal, the networks said they will reduce the combined average effective credit interchange rate by 10 basis points for five years and cap posted standard consumer credit rates at 1.25% through an eight‑year term following court approval.

🇺🇸 Visa reaches proposed settlement in payment card antitrust litigation. The settlement addresses claims from the injunctive relief class and is subject to court approval. The proposed settlement outlines several key terms for U.S. merchants accepting credit card payments.

🇺🇸 Coinbase and stablecoin startup BVNK call off $2 billion acquisition. Coinbase Global Inc. has decided not to proceed with its planned $2 billion acquisition of stablecoin infrastructure firm BVNK. The company stated that both parties mutually agreed to end discussions, while BVNK has not yet commented on the decision.

🇬🇧 PPRO launches Buy Now Pay Local solution to help merchants and PSPs access Europe’s booming BNPL market. New solution provides a single integration point to access a curated portfolio of high-growth, locally preferred Buy Now, Pay Later (BNPL) providers across Europe.

🇬🇧 Crypto leaders flag ‘deep concerns’ over Bank of England’s stablecoin rules. Sarah Breeden, Deputy Governor for Financial Stability at the Bank of England, said that the central bank’s “objective remains to support innovation and build trust in this emerging form of money”.

🇳🇵 Central Bank of Nepal approves LemFi partnership with Esewa for enhanced remittances. The partnership means Nepalese in North America and Europe can continue sending money low-cost, reliably, and at competitive exchange rates to Nepal and other countries across Africa, Asia, Latin America, and Europe.

🇧🇷 Pix transactions totaled R$15 trillion in the first half of the year, according to the Central Bank. In total, Brazilians made 72.5 billion payment transactions, which moved R$59.7 trillion between January and June. This number represents a 15.2% increase in the number of transactions. Additionally, the Central Bank will allow the preventive blocking of PIX key opening. The measure, scheduled to take effect in December, aims to offer more security to users and reduce the number of frauds in the instant payment system.

🇧🇷 Central Bank changes risk management rules in payment arrangements. In a statement, the BC stated that the regulation seeks to ensure the soundness, efficiency, and proper functioning of the Brazilian Payment System. The rules come into effect immediately, but the payment arrangement providers will have up to 180 days to adapt.

🇰🇪 Airtel Money launches cloud-native platform to transform mobile financial services across Africa. This strategic deployment marks the beginning of a continent-wide digital transformation program, designed to redefine how Airtel Money delivers financial services to its 49.8 million customers.

🇿🇦 FNB and Mastercard unite to advance Africa’s cross-border payments with the launch of Globba. The new solution, unveiled in Johannesburg, supports transfers to more than 120 countries, reaching destinations via bank accounts, mobile wallets, or cash pickup locations.

🇺🇸 Jack Dorsey’s 4 million+ Square merchants can now access Bitcoin payments. The launch provides access to instant settlement with no fees until 2027. The feature is accessible to traders from the Square dashboard to activate. Buys are executed on the Bitcoin blockchain, making transactions transparent and traceable.

🇬🇧 OpenPayd expands European payment capabilities with additional domestic virtual IBANs and payment rail. Building on its existing virtual IBAN offering, OpenPayd now provides clients with NL-issued virtual IBANs alongside its existing UK, FR, and MT options.

🇬🇧 Cashflows partners with Boodil to bring card payments to UK e-commerce merchants in time for the golden quarter. The new partnership addresses merchant requests for a full payment stack. Designed to streamline checkout processes, reduce cart abandonment, and boost conversion rates, the solution is rapid and low-friction.

🇵🇭 GoTyme Bank and Wise Platform team up to make international remittances seamless for millions of Filipinos. GoTyme integrated with Wise to enable fast and easy international payments over SWIFT. Customers can now receive money from over 11,000 banks worldwide in 23 major currencies with full pricing transparency and faster settlement times.

🇦🇺 Wisr announces $11 million equity capital raise. Wisr CEO Andrew Goodwin announced that the company’s latest capital raise marks a key milestone in its journey toward scale and profitability, highlighting strong backing from both existing and new institutional investors as a sign of confidence in Wisr’s strategy and long-term vision.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()