Checkout.com Doubles Down on Europe with New Revenue Lead

Hey Payments Fanatic!

Momentum in Europe isn’t slowing down for Checkout.com.

The company just appointed Ashley Paulus as VP, Head of Revenue for the UK and EEA, putting her in charge of growth across two of its priority regions.

Timing matters here. In 2025, Checkout.com reported 78% year-on-year volume growth in the UK and nearly 60% across the EEA.

Paulus has been with Checkout.com for more than six years, working closely with enterprise merchants. Now she steps into a broader role, leading commercial strategy across Europe as the company deepens partnerships with brands like Spotify, Freenow, and Vinted.

From my perspective, this is about sharpening focus. Europe remains one of the most competitive Payments markets in the world. Directly acquiring licenses in the UK and France.

Meanwhile, Mastercard Expands Its Regulatory Footprint in Syria 🇸🇾

In parallel, Mastercard is deepening cooperation with the Central Bank of Syria.

Following a memorandum of understanding signed in September 2025, the two have launched structured knowledge-sharing exchanges and technical workshops aimed at strengthening regulatory capacity and modernizing financial infrastructure.

Mastercard’s global experts will work with policymakers and regulators on compliance frameworks, international standards, and emerging payment trends.

Two very different headlines today. One about enterprise growth in Europe. The other is about rebuilding financial capacity in a complex market.

Both show how Payments keeps expanding, in very different ways. What else is shifting across the ecosystem? Keep scrolling 👇

Cheers,

INSIGHTS

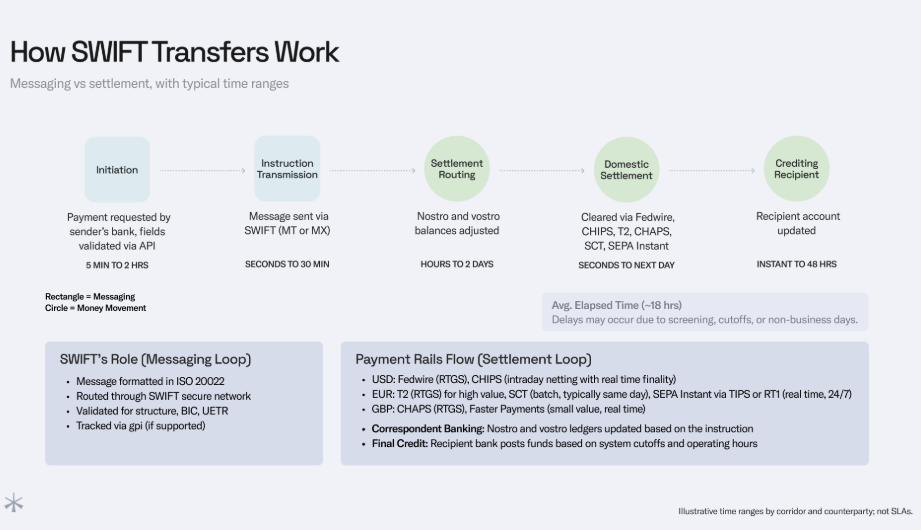

➡️ Stablecoins vs SWIFT: Routing Value by Logic, Not Legacy by Noah. Stablecoins bridge traditional finance and programmable payments, enabling faster, cheaper transfers than legacy rails. Bank cross-border payments still rely on BIC/SWIFT codes for secure messaging, but SWIFT only sends instructions; it does not move money. Read the full article here

NEWS

🇬🇧 Checkout.com appoints Ashley Paulus to head up growth for the UK and Europe, reinforcing the company’s continued investment across the region. In her new role, Paulus will lead Checkout. com’s revenue and growth strategy across the UK and the European Economic Area (EEA).

🇸🇾 Mastercard and the Central Bank of Syria launch knowledge-sharing exchanges under a strategic collaboration framework. Under the program, Mastercard’s global subject matter experts will deliver tailored technical sessions and knowledge transfer aligned with the Central Bank of Syria’s policy priorities.

🇺🇸 Stripe taps Base for AI agent x402 payment protocol. Stripe has launched a new payment system designed for artificial intelligence agents, allowing them to pay for digital services automatically using cryptocurrency. Through this system, AI agents can quickly and easily make small payments using USD Coin USDC stablecoins.

🇺🇸 Circle is bringing native USDC and its Cross-Chain Transfer Protocol (CCTP) to EDGE Chain, following an investment from Circle Ventures into edgeX, the team behind the network. The integration will give the ecosystem access to regulated USDC liquidity and secure cross-chain transfers, enabling new use cases for institutions, developers, and market participants.

🇳🇱 Adyen launches 'Personalize' to tailor checkout experiences in real-time. Personalize allows businesses to adjust their checkout pages in real-time based on individual shopper preferences, making it easier for customers to pay while reducing processing costs for the merchant.

🇺🇸 Zelle says payments sent last year surged 20% to $1.2 trillion. Zelle has been seeking to build out its operations, saying last year that it would expand internationally. The company has also boosted its work with small businesses, with nearly 30% of all the money sent on Zelle last year moving to or from those companies.

🇬🇧 Volt integrates stablecoin acceptance into its real-time payments network, bridging crypto and fiat worlds. This development, which helps bring digital currencies firmly into the world of online payments, will unlock faster settlements for merchants and facilitate access to truly borderless commerce.

🇬🇧 New protections for BNPL users confirmed by the FCA. New protections aimed at people using buy now pay later (BNPL) credit products have been confirmed by UK financial regulators. BNPL will be subject to the Consumer Duty, which will regulate it in line with other loan products.

🇦🇪 E& money opens a new era in financial access following the Finance Company license. Under this new phase, e& money will progressively introduce a range of fit-for-purpose lending solutions, rolled out in stages. These will include buy-now-pay-later offerings, early wage access, credit cards, and other solutions.

🇺🇸 Fiserv looks to AI and BNPL to spur its recovery. The FinTech vendor is increasingly investing in artificial intelligence, including tools to support agentic AI for small and mid-sized businesses, as part of its strategy to remain competitive with banks and merchants while controlling costs.

🇺🇸 Levl secures $7m seed funding to revolutionize stablecoin payment infrastructure in emerging markets. Levl plans to allocate the new capital toward aggressive hiring and geographic expansion. The company specifically targets Latin America and Africa as primary growth markets.

🇸🇦 Shahbandr partners with Tabby to bring flexible, interest-free payments to Saudi E-Commerce. Under this partnership, businesses on Shahbandr can offer Tabby’s flexible payment options, enhancing the shopping experience and increasing conversion by allowing customers to split purchases into interest-free payments.

GOLDEN NUGGET

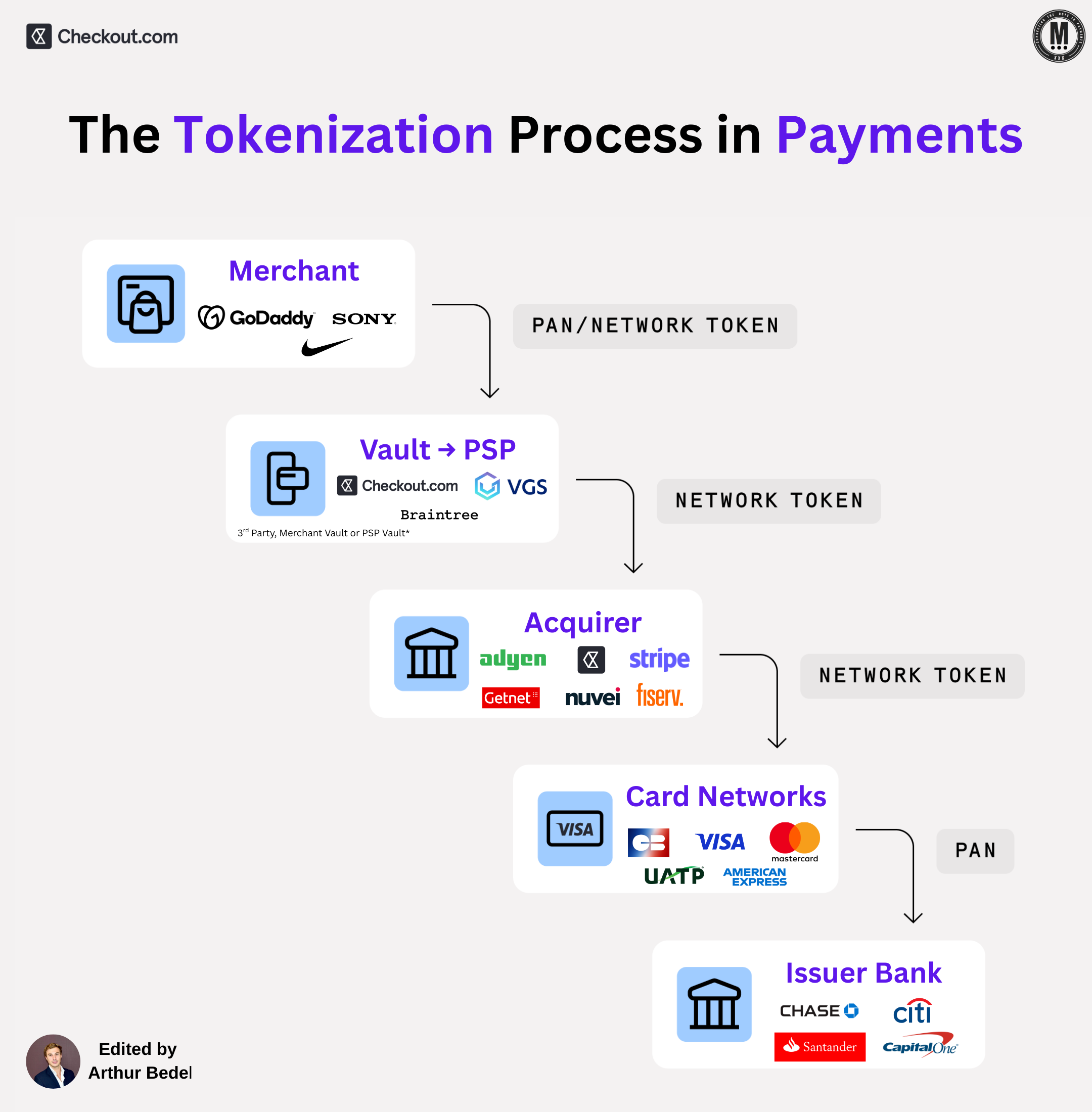

What is "𝐓𝐡𝐞 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬"? by Checkout.com👇Created by Arthur Bedel 💳 ♻️

► 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 is the process of replacing sensitive card data (like PANs) with a non-sensitive equivalent known as a 𝐭𝐨𝐤𝐞𝐧. This ensures that actual card details are never exposed or stored during or after a transaction.

► The Goal → reduce fraud, simplify PCI compliance, and power secure, scalable commerce.

𝐓𝐡𝐞 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 — Step by Step

1️⃣ Merchant (GoDaddy, Nike, Sony)

► Captures the customer’s Primary Account Number (PAN) through their website or app.

2️⃣ Vault / PSP (VGS, Checkout.com, Braintree)

► The PAN is sent to a token vault (merchant, third-party, or PSP-owned), where it’s replaced with a network token or PCI token.

3️⃣ Acquirer (Checkout.com, Adyen, Stripe, Nuvei, Getnet)

► Receives the tokenized transaction, which now contains a network-issued token rather than the actual PAN.

4️⃣ Card Network (Visa, Mastercard, American Express, GIE Cartes Bancaires, UATP)

► The token is translated back into the actual PAN so the transaction can be routed to the cardholder’s issuer.

5️⃣ Issuer Bank (Citi, Chase, Capital One)

► Validates the original card, checks for fraud, and approves or declines the transaction.

𝐓𝐡𝐞 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐭 𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

🔹 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬

→ Issued by card networks (Visa, Mastercard)

→ Enhances approval rates by keeping credentials fresh (via account updater)

→ Replaces PANs at the scheme level

→ Example: Visa Token Service, Mastercard MDES

→ Provided by Network directly or 3rd Parties (Vault, PSPs etc…) - Checkout.com, VGS

🔹 𝐏𝐂𝐈 𝐓𝐨𝐤𝐞𝐧𝐬 (Merchant Tokens)

→ Issued by a token vault provider (VGS, Checkout.com)

→ Designed to remove PCI scope from merchants

→ PAN is encrypted & stored in a secure vault; merchants only handle tokens

🔹 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭 𝐓𝐨𝐤𝐞𝐧𝐬

→ Managed by wallets like ApplePay, Google Pay, Samsung Pay

→ Device-specific tokens issued for in-app or contactless payments

→ Never exposes the actual card number to the merchant

𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬 — Real-World Applications

✅ 𝐎𝐧𝐞-𝐂𝐥𝐢𝐜𝐤 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 — Amazon & Shopify store network tokens to enable fast, secure repeat purchases

✅ 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧𝐬 — Netflix and Spotify use PCI tokens to safely charge recurring payments

✅ 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — ApplePay leverage device-based tokenization for in-store tap payments

✅ 𝐂𝐫𝐨𝐬𝐬-𝐏𝐒𝐏 𝐑𝐨𝐮𝐭𝐢𝐧𝐠 — VGS and 3rd party vaults, create merchant token vaults transmit the token to route transactions across multiple acquirers

Source: Checkout.com

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()