Circle Joins Jack Ma’s Ant in Blockchain Deal

Hey Payments Fanatic!

Jack Ma-backed Ant Group is teaming up with Circle to bring its USDC stablecoin onto Ant’s blockchain platform to integrate regulated digital currencies into its payment and treasury systems.

Additionally, Ant International is expanding its reach, now exploring stablecoin licenses in several countries. The Chinese FinTech seems to be getting serious about stablecoins 👀

But there's more, scroll down to find out what happened 👇 I'll be back on Monday!

Cheers,

INSIGHTS

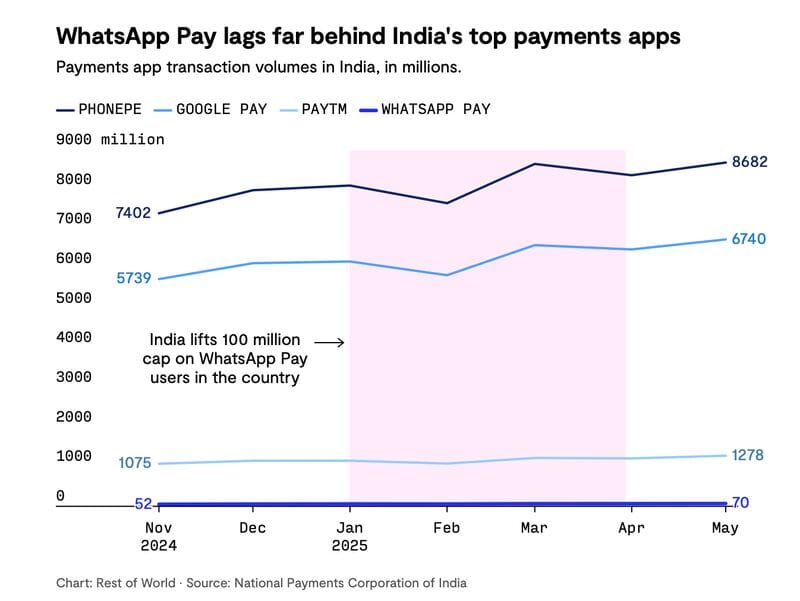

📊 Despite having 500 million users in India 🇮🇳, WhatsApp couldn’t crack the country’s $3 trillion FinTech market.

NEWS

🇸🇬 Ant International is exploring stablecoin license applications in multiple global jurisdictions, according to an executive’s statement on July 9. Kelvin Li, head of platform tech at Ant International, shared the plans during the Reuters Next Conference in Singapore. Sources say that the company is working with Circle Internet Group Inc. to adopt its stablecoin on the Chinese FinTech company’s blockchain platform.

🇬🇧 Global FinTech SumUp launched SumUp Terminal. Terminal empowers merchants to streamline their entire operation, from taking orders at the table to managing staff, inventory, and reporting. This design allows staff to leave the sales counter behind, taking orders and payments directly on the shop floor or right at the table.

🇺🇸 Stablecoin startup Agora raises $50 million Series A led by crypto VC giant Paradigm. With the new funding, which follows a $12 million seed round last year, Agora hopes to build up AUSD, its stablecoin, or a type of cryptocurrency that is pegged to an underlying asset such as the U.S. dollar.

🇳🇦 NPCI and the Namibian Central Bank enter a licensing agreement to develop a UPI-like instant payment system. The aim is to modernize Namibia’s financial infrastructure, enabling instant person-to-person and person-to-merchant transactions.

🇦🇺 Aussie FinTech Zepto launches PayTo Index, revealing real-time payments momentum. PayTo allows Australian businesses to collect payments instantly and securely from customers’ bank accounts, operating as a real-time alternative to traditional direct debits.

🇺🇸 Rain launches embedded earned wage access solution within Workday. This integration allows Workday customers to enable Rain directly within the Workday platform, eliminating the need for third-party implementations, system changes, or data handoffs.

🇫🇷 Worldline partners with commercetools to enhance payment solutions for e-commerce businesses. Customers can now access a diverse range of Worldline’s payment solutions, including local payment methods, multi-currency support, advanced fraud detection, and real-time transaction monitoring, all designed to ensure secure and efficient payment processing.

🇧🇭 Visa and Tarabut partner to unlock smarter credit decisions. Visa has partnered with Tarabut, a leading regulated financial technology platform specialized in embedded finance, open banking, and powering data-rich digital financial services, to introduce a bundle of innovative services for banks in KSA and Bahrain.

🇦🇺 Australia advances digital currency exploration with Project Acacia. The Reserve Bank of Australia will collaborate with three of the four major banks and other participants to pilot various digital currency use cases. These include stablecoins, bank deposit tokens, and a wholesale CBDC designed to facilitate credit and liquidity risk-free settlement.

🇺🇸 Truist merchant engages powers SMB growth in bank’s latest payments suite expansion. The platform is designed to help small and medium-sized businesses (SMBs) streamline operations, gain real-time insights, and scale with certainty. Keep reading

🇺🇸 Ria Money Transfer and Xe join forces with Google to collaborate on seamless, cross-border money transfers. The collaboration will improve access to payment services and enable more digital money transfer customers to benefit from Ria and Xe's industry-leading money transfer services.

🇮🇩 Jenius chooses Wise Platform to transform cross-border payments for millions of digitally-savvy Indonesians. Through this collaboration with Wise Platform, Jenius is further empowering users with a seamless process of sending money abroad in multiple currencies, including USD, EUR, GBP, SGD, AUD, and HKD, directly from the Jenius app to other banks, 24/7.

🇺🇸 Finix rolls out WooCommerce plugin to support merchants. Through this integration, Finix seeks to allow merchants operating across the US and Canada to accept payments, minimise operational complexities, and provide a consistent and optimal checkout experience.

🌍 Google Pay launches in Oman and Lebanon, Expanding Mobile Payments in MENA. The company said Google Pay allows people to pay and make secure purchases in stores (where contactless payments are accepted), in apps, and on the web.

🇺🇸 Apple, Visa, and Mastercard win dismissal of merchant antitrust lawsuit over payment fees. U.S. District Judge David Dugan in Illinois ruled that the merchants had not provided enough evidence to support their claim that Apple illegally declined to launch a competing payment network to rival Visa and Mastercard.

🇺🇸 Ramp introduces AI Agents to automate finance operations. Ramp agents are powered by Ramp Intelligence, the company's AI platform that automates expense reporting, data entry, contract review, and accounting accuracy. Read more

🇬🇧 Debenhams taps Mangopay for wallet payments. The collaboration aims to simplify multi-seller payouts, optimise operational processes, and create a scalable foundation for seamless multi-vendor commerce. Keep reading

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()