Cleo Tests Waters in Stablecoin Payments

Hey Payments Fanatic!

Cleo’s Founder and CEO Barney Hussey-Yeo confirmed the AI fintech is exploring stablecoins.

“We’re looking at how we can use stablecoins to help improve the banking system for our users,” told Sifted.

What does this mean? It may signal Cleo is preparing to move beyond budgeting tools and toward a broader role in financial services...

Scroll down to dive deeper into Cleo’s stablecoin plans and get your daily Payments fix 👇

Cheers,

INSIGHTS

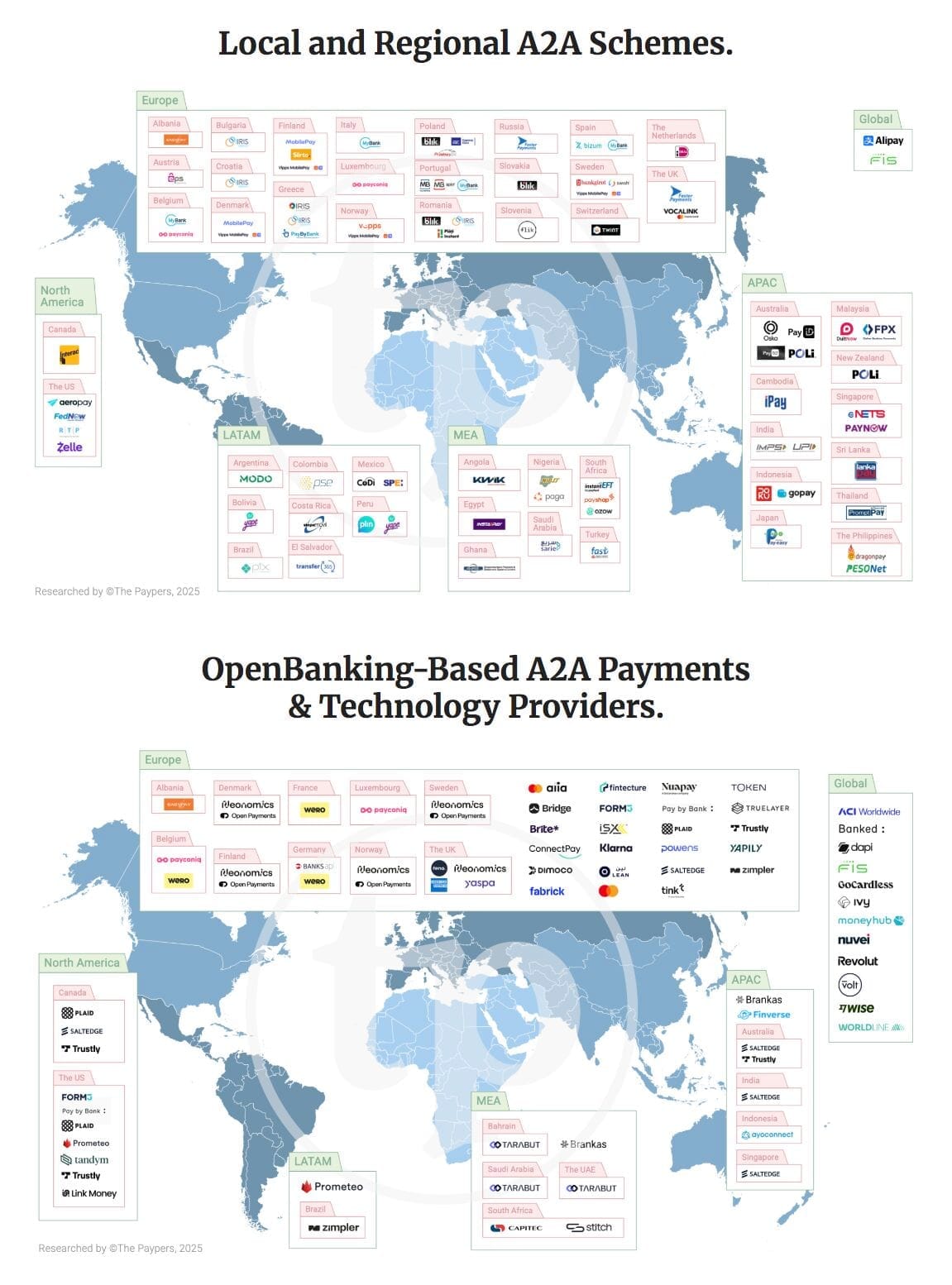

💰 Global Overview of the A2A Payments Ecosystem👇

Who's missing on this Market Map?

NEWS

🇬🇧 Solidgate partners with Salv to secure global payments. The collaboration aims to enhance the security, compliance, and monitoring of transactions processed through Solidgate’s Treasury product as the company scales its global payments infrastructure.

🇺🇸 BlindPay raised $3.3M in a seed round to build a better global payment infrastructure with stablecoins, giving businesses the tools to move money across borders, stay compliant, and open virtual US accounts in minutes, all through one API built for developers.

🇴🇲 Mastercard Partners with Monak to cut costs in migrant remittances. By launching a new digital financial services platform, Mastercard and Monak plan to significantly reduce the cost and complexity traditionally associated with basic financial services, supporting broader efforts to drive financial inclusion.

🌎 Mercado Pago users grow and boost supply. The e-commerce ecosystem FinTech company reached nearly 68 million monthly active users by the end of the second quarter of 2025 in Brazil, Mexico, and Argentina, representing annual growth of 30 percent.

🇺🇸 Corpay and Circle collaborate to bring stablecoin payments to global FX and commercial card rails. They will work together to embed USDC across Corpay’s cross-border pay-in and pay-out rails, allowing companies to access blockchain’s 24/7 settlement and programmability.

🇺🇸 Corpay Cross‑Border uses blockchain technology to facilitate client FX conversions. Through Kinexys Digital Payments, Corpay Cross-Border can extend its trading hours for its global client base and provide speed of settlement not possible on traditional fiat FX rails without a significant lockup of liquidity.

🇦🇺 Treasury and Payments Platform Finmo enhances transaction security with the confirmation of payee rollout in Australia. CoP helps tackle rising fraud by verifying account details before funds are sent. It also helps prevent supplier fraud, misrouted payments, and delays in reconciliation, offering businesses greater confidence and control over every transaction.

🇸🇬 TransferMate receives in-principle approval from the Monetary Authority of Singapore to add payment services. TransferMate can now issue accounts, e-money, and local transfers after receiving in-principle approval from Singapore’s Monetary Authority (MAS).

🇮🇳 Razorpay partners with CRED and Visa for the CardSync payment solution to enable one-tap payments across online stores. CardSync automatically updates saved card details when users receive a new or replacement card, reducing payment failures and improving user experience.

🇧🇷 Bitget Wallet launches USD-based, zero-fee Mastercard crypto payment card in Brazil. Issued in partnership with infrastructure provider Immersve, the card allows users to spend crypto directly from their wallets at over 150 million merchants that accept Mastercard globally.

🇬🇧 AI FinTech Cleo eyes stablecoin push. Cleo is exploring a push into stablecoins as clearer regulatory frameworks in the digital asset space emerge. The stablecoin push would be a new frontier for Cleo, which is most known for its AI assistant, a characterful chatbot that encourages users to build better financial habits.

🇮🇳 Clear cuts 16% of workforce amid peak tax-filing season. The layoffs have affected several recently hired employees, including freshers who had joined just two months ago. The company is letting go of 20-25% of its workforce as part of a restructuring exercise.

🇵🇭 Telecom giant Globe's profit from GCash doubles as mobile payment arm eyes IPO. Globe’s share in the equity earnings rose to 3.8 billion pesos in the first half, up 78% from a year ago. It now makes up 26% of Globe’s pre-tax net income, more than double the 12% contribution it made a year ago, Globe said in a statement.

🇺🇸 Google Pay’s Ben Volk to join PayPal as GM Consumer. Volk will lead efforts to enhance the PayPal Consumer experience at a pivotal time, as the company focuses on building more connected and relevant user journeys. Continue reading

🇺🇸 Electronic Merchant Systems acquires omnichannel payments platform Paysley. Paysley will become a wholly owned subsidiary of the EMS corporation but will continue to operate as an independent brand, serving businesses directly and through agent, ISO, and ISV partnerships.

🇸🇨 Fusepay, a Seychelles-based FinTech, raises $350k pre-seed. The company aims to simplify cross-border payments across Africa and emerging markets. The funds will be used to enhance its platform, grow its team, and expand operations as it builds out its payment infrastructure.

🇺🇸 Taxbit Partners with Mural Pay to unlock stablecoin payments for customers. The partnership allows select Taxbit clients, which include digital asset exchanges, banks, FinTechs, and government entities, to invoice customers directly and accept desired stablecoins as payment.

🇬🇧 Visa to move its European HQ. Visa is reportedly moving its European headquarters. The payment giant is on the verge of agreeing a deal with Canary Wharf Group to move to London’s Docklands from its current premises in Paddington.

🇺🇸 PayPal is now a funding option for Kraken clients in the U.S. Customers can deposit USD and start trading in just a few taps, no wires, no wait, and no bank logins. Adding PayPal as a deposit method is part of Kraken´s mission to make crypto easier for everyone.

🇺🇸 Payment platform Lava raises $5.8M to build digital wallets for the ‘agent-native economy’. A new startup, Lava Payments, aims to take on payment giants by building a solution for the modern web where AI agents now handle transactions for their customers.

🇺🇸 Ex-Apple Engineer unveils privacy-focused crypto Visa Card. The Payy Visa card hides stablecoin transactions using clever cryptographic proofs and a custom-built ledger, avoiding the situation where non-custodial card spending can be looked up and traced on public blockchains. A Co-founder of the team that built the Payy card thinks it’s irresponsible, unethical, and even borderline illegal.

GOLDEN NUGGET

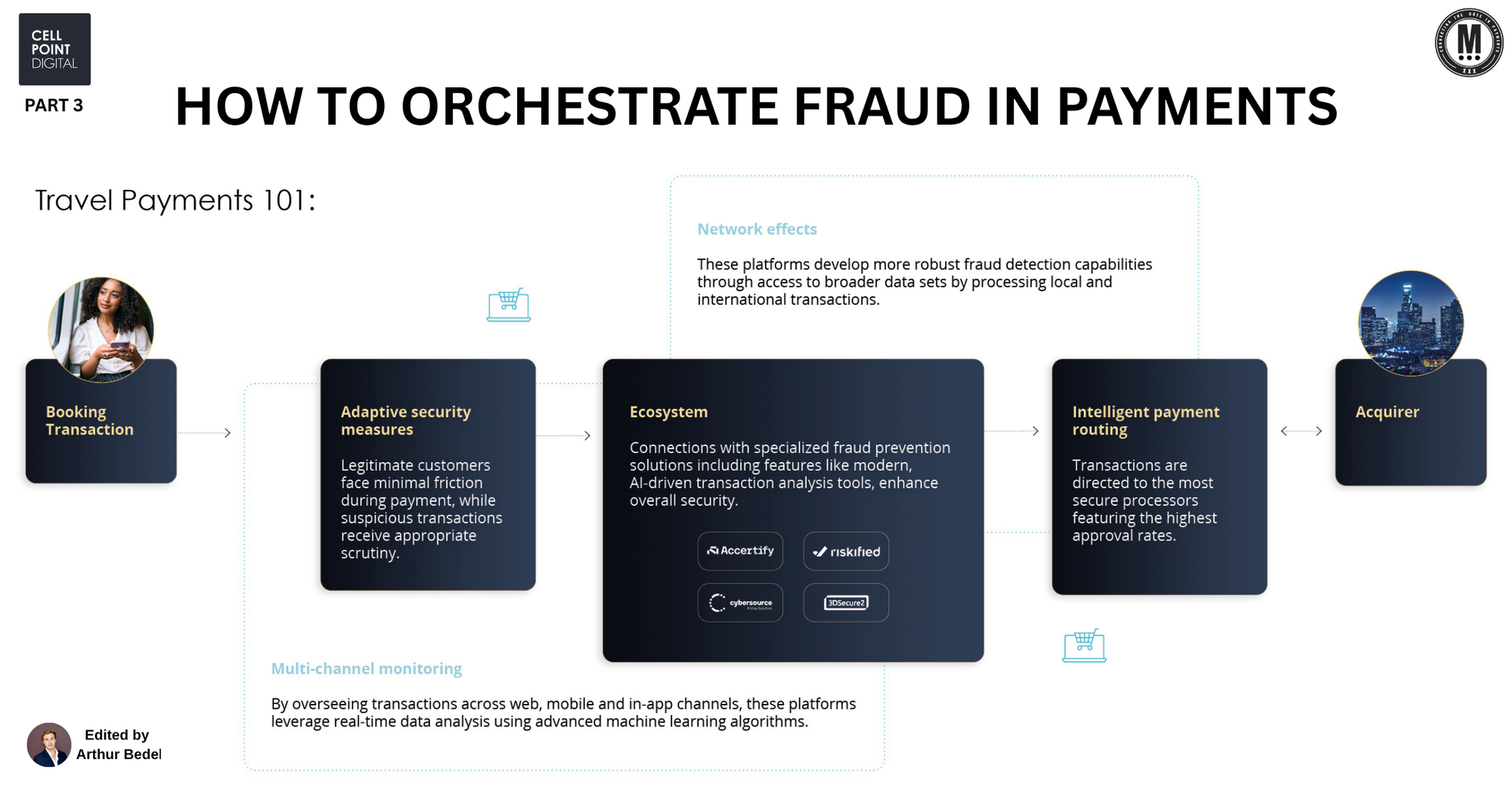

🚨 Part 3: 𝐇𝐨𝐰 𝐭𝐨 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐞 𝐅𝐫𝐚𝐮𝐝 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 by CellPoint Digital 👇 Created by Arthur Bedel 💳 ♻️

In travel, fraud prevention can no longer be an isolated system. It must be embedded, adaptive, and orchestrated into every transaction

𝐓𝐡𝐞 𝐬𝐜𝐚𝐥𝐞 𝐢𝐬 𝐚𝐥𝐚𝐫𝐦𝐢𝐧𝐠:

→ Global ecommerce payment fraud reached $41B in 2022

→ Projected to hit $91B by 2028

Merchants are expected to lose $343B to online payment fraud between 2023–2027 (Juniper Research)

𝐓𝐡𝐞 𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐅𝐫𝐚𝐮𝐝 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

► 𝐂𝐚𝐫𝐝-𝐍𝐨𝐭-𝐏𝐫𝐞𝐬𝐞𝐧𝐭 (𝐂𝐍𝐏) 𝐅𝐫𝐚𝐮𝐝 — Fraudulent use of stolen card details in online or phone bookings

► 𝐀𝐜𝐜𝐨𝐮𝐧𝐭 𝐓𝐚𝐤𝐞𝐨𝐯𝐞𝐫 (𝐀𝐓𝐎) — Criminals gaining access to customer accounts to make unauthorized bookings

► 𝐅𝐫𝐢𝐞𝐧𝐝𝐥𝐲 𝐅𝐫𝐚𝐮𝐝 — Legitimate customers claiming they didn’t authorize a transaction to dispute charges

► 𝐒𝐲𝐧𝐭𝐡𝐞𝐭𝐢𝐜 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐅𝐫𝐚𝐮𝐝 — Fraudsters creating fake identities using real and fabricated personal data

► 𝐑𝐞𝐟𝐮𝐧𝐝 𝐀𝐛𝐮𝐬𝐞 — Illegitimate refund claims to exploit hotel and airline refund policies

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐅𝐫𝐚𝐮𝐝 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧?

Fraud orchestration is the process of integrating multiple fraud prevention tools, security layers, and intelligent routing rules into one unified flow.

► 𝐀𝐝𝐚𝐩𝐭𝐢𝐯𝐞 𝐒𝐞𝐜𝐮𝐫𝐢𝐭𝐲 𝐌𝐞𝐚𝐬𝐮𝐫𝐞𝐬 — Minimal friction for legitimate customers, strong checks for suspicious ones

► 𝐌𝐮𝐥𝐭𝐢-𝐂𝐡𝐚𝐧𝐧𝐞𝐥 𝐌𝐨𝐧𝐢𝐭𝐨𝐫𝐢𝐧𝐠 — Web, mobile, and in-app transaction oversight

► 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐄𝐟𝐟𝐞𝐜𝐭𝐬 — Broader transaction data across geographies to improve fraud detection accuracy

► 𝐈𝐧𝐭𝐞𝐥𝐥𝐢𝐠𝐞𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐑𝐨𝐮𝐭𝐢𝐧𝐠 — Sending transactions to the most secure, highest-approval processors

𝐇𝐨𝐰 𝐈𝐭 𝐖𝐨𝐫𝐤𝐬

1️⃣ 𝐁𝐨𝐨𝐤𝐢𝐧𝐠 𝐈𝐧𝐢𝐭𝐢𝐚𝐭𝐢𝐨𝐧 — Customer begins a transaction online or in-app

2️⃣ 𝐀𝐝𝐚𝐩𝐭𝐢𝐯𝐞 𝐒𝐜𝐫𝐞𝐞𝐧𝐢𝐧𝐠 — Real-time fraud filters assess transaction risk

3️⃣ 𝐅𝐫𝐚𝐮𝐝 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝐂𝐡𝐞𝐜𝐤 — Tools like Accertify, Inc., Riskified, Cybersource, and 3-D Secure 2 verify authenticity

4️⃣ 𝐑𝐨𝐮𝐭𝐢𝐧𝐠 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧 — Safe transactions routed to the optimal PSP/acquirer; risky ones challenged or blocked

5️⃣ 𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 𝐒𝐮𝐛𝐦𝐢𝐬𝐬𝐢𝐨𝐧 — Approved transactions processed with embedded fraud checks

𝐑𝐞𝐚𝐥-𝐋𝐢𝐟𝐞 𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬 𝐢𝐧 𝐓𝐫𝐚𝐯𝐞𝐥

✔️ Air France — Integrates multiple fraud vendors into a single decisioning layer, cutting manual review rates and enabling faster bookings.

✔️ Expedia Group — Uses adaptive fraud rules to instantly approve trusted repeat customers while challenging high-risk first-time bookings.

✔️ Marriott International — Combines fraud checks with loyalty account protection to prevent unauthorized bookings and point redemptions.

Source: CellPoint Digital

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()