🇨🇴 Colombia Launches Its Own Pix-Style Instant Payments System: BRE-B

Hey Payments Fanatic!

A big milestone for Colombia 🇨🇴 today as the Banco de la República officially launched BRE-B, the country’s new interoperable instant payments system.

It connects banks and digital wallets across Colombia, allowing people and businesses to send and receive money instantly, securely, and around the clock.

More than 3.2 million Colombians have already registered 8.2 million “payment keys”, linking their phone number, ID, or email to their accounts. With BRE-B, transferring money between institutions becomes as simple as sending a text message.

Colombia Launches BRE-B

This is Colombia’s answer to Pix in Brazil and UPI in India, and it could be a turning point for digital payments adoption across the country.

Cheers,

INSIGHTS

🇸🇦 Saudi Arabia’s Cross-Border Payments Market Map.

Any missing in this overview?👇

NEWS

🇵🇹 Elecctro and Getnet are leading the way in seamless EV charging in Portugal. Now, users can simply tap their bank card to pay at charging stations, no subscriptions, no apps, no long-term commitments required. Together, they're reshaping the EV charging landscape with a focus on simplicity, security, and scalability.

🇸🇦 HALA FinTech’s strategic growth and recent funding milestone. Rima Najjar is hosting Maher Loubieh, Co-Founder of HALA FinTech, for an insightful conversation on the company's evolution, growth trajectory, and plans following its recent $157 million funding round, led by TPG and Sanabil Investments, a subsidiary of Saudi Arabia’s Public Investment Fund (PIF).

🇨🇴 BRE-B officially began operating on Monday, October 6. The new BRE-B system will allow people and businesses to send and receive money quickly, securely, and interoperably all year round. This system is designed so that both individuals and companies can send money digitally, regardless of the bank or digital wallet.

🇺🇸 PayPal introduces 5% cash back on buy now pay later purchases this holiday season. With PayPal's BNPL offering, shoppers can split purchases into convenient payments and earn cash back, thus making their money go further during the holidays. PayPal is also introducing Pay Monthly3 in-store in the U.S., providing customers with more choice and flexibility to pay over time wherever they shop.

🇺🇸 PayPal’s PYUSD Stablecoin reaches $1 billion market cap through Spark partnership. PYUSD is now the ninth-largest stablecoin by market cap, with over 100% growth in the past year. Spark provides stablecoin infrastructure backed by an $8 billion reserve, enabling users to supply and borrow PYUSD.

🇧🇷 Pix Installment Rules to be released at the end of October, says Central Bank. The set of rules to be announced by the authority will define the operating model for Pix Parcelado, updating financial institutions and users on the new instant payment method. Keep reading

🇵🇭 Western Union introduces its first digital remittance app in the Philippines. The new app lets Filipino users request money from overseas senders and initiate transfers abroad. Through the app, customers can access Western Union’s international financial network of billions of bank accounts, millions of digital wallets, and thousands of retail outlets.

🇵🇹 Revolut reaches an agreement with SIBS and officially joins MB Way. Revolut joined the MB Way network and began allowing instant transfers through the app, like other Portuguese banks. The British financial institution officially signed an agreement with SIBS to launch Multibanco. Additionally, Revolut hopes the Brazilian community in Portugal will help its growth in Brazil. "We believe we have created a base, which is demonstrated by the waiting list in Mexico of more than 200,000 people," Ignacio Zunzunegui, Director of Growth for Southern Europe, said.

🇷🇴 Revolut launches a new service in Romania. It has officially introduced the Beneficiary Name Display Service (BND), a function that allows verification of the recipient's name when initiating a payment to an IBAN account. Continue Reading

🇮🇳 Razorpay unveils India’s First RBI-compliant biometric authentication for payments with YES BANK. Businesses, banks, and consumers are embracing online transactions more than ever, but with growth comes complexity. Despite the convenience of card payments, nearly 35% of transactions fail due to OTP delays, incorrect entries, or redirection issues.

🇳🇬 Zest payments paid CBN ₦2.7 million over the delayed 2023 audited financial report. The sanction, disclosed in Stanbic IBTC Holdings’ half-year report, came alongside other regulatory penalties within the group, highlighting growing compliance strain.

🇺🇸 US payment processor Merchant Industry acquired by Lovell Minnick Partners. While financial terms remain undisclosed, the transaction structure allows Merchant Industry's founders to retain a "substantial minority equity stake in the go-forward business", according to an LMP statement.

🌍 dLocal and XanderPay partner to streamline cross-border hotel payments. The collaboration aims to make international payouts faster and more cost-efficient for hotels and online travel agencies (OTAs) operating in multiple markets. The partnership combines dLocal’s payment network with XanderPay’s hotel-focused payment system to centralise and automate bank transfer payouts.

🇮🇳 PayGlocal enables Indian merchants to accept Apple Pay for global payments. Merchants using PayGlocal can now accept payments from over 180 countries without needing to manage complex local banking arrangements or additional compliance processes.

🇺🇸 PayDo introduces US IBAN via SWIFT. This new feature allows businesses and professionals to receive US dollar payments directly, without delays from intermediary bank checks. At the same time, PayDo has extended its currency support to more than 60 national and regional currencies.

🇬🇧 Ex-ClearBank executive Yasemin Swanson as a COO at OpenPayd. Swanson will be responsible for scaling OpenPayd’s operational infrastructure as it expands globally and secures additional regulatory milestones. Read more

🇺🇸 FinTech Decacorn Ramp acquires Jolt AI to help its engineers build faster. While a relatively small acquisition, the deal is significant in that it represents the role artificial intelligence is playing in many of the fastest-growing venture-backed startups, even those that aren’t strictly AI companies.

GOLDEN NUGGET

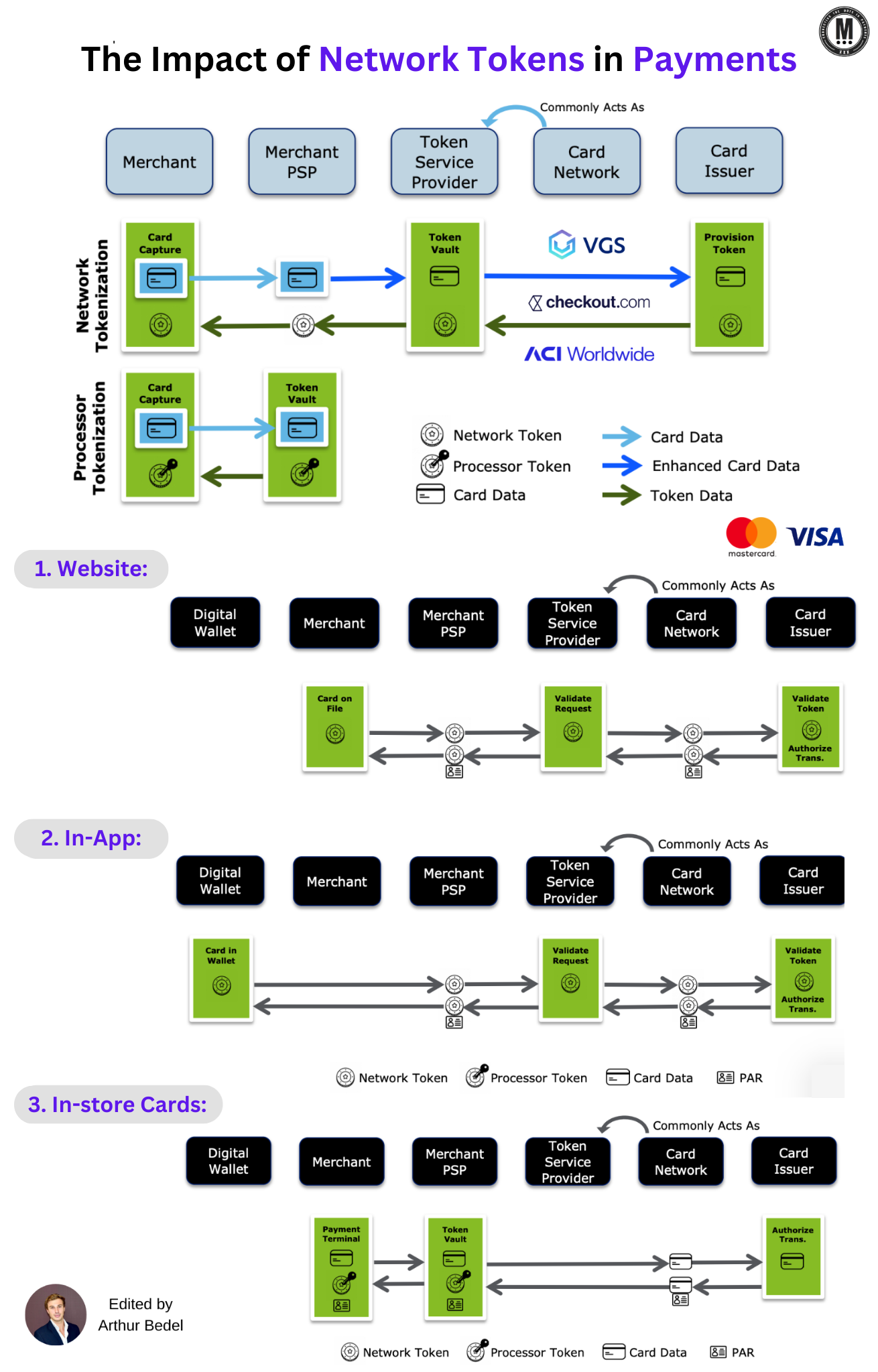

🚨 𝐓𝐡𝐞 𝐢𝐦𝐩𝐚𝐜𝐭 𝐨𝐟 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — Processor vs Network Tokens 👇Created by Arthur Bedel 💳 ♻️

𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 (𝐍𝐓) is an industry standard published by EMVCo. First introduced with the launch of ApplePay and the payment networks, NT is gaining traction in the Card on File and wallet markets.

𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐨𝐫 𝐯𝐬 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬:

🔸 Processor Tokenization (Checkout.com, Stripe, Getnet…) is a proprietary service offered by PSPs, Acquirers and Processors to minimize a merchant’s PCI scope. The generated token, a replacement for a Personal Account Number (hashtag#PAN), is restricted to the merchant and a single PSP environment.

🔸 Network Tokenization goes further by generating tokens in cooperation with the Card Issuer and Card Network (i.e. Visa & Mastercard and others, American Express, GIE Cartes Bancaires) to offer additional benefits to the merchant and protect the PAN throughout the value chain.

𝐓𝐡𝐞 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐟𝐨𝐫 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭𝐬:

→ 𝐂𝐨𝐬𝐭 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 - Merchants can optimize costs with Visa’s pricing changes. Security and compliance costs can be reduced since NT reduces the scope of PCI DSS.

→ 𝐑𝐞𝐝𝐮𝐜𝐞𝐝 𝐅𝐫𝐚𝐮𝐝 - Implementing NT offers a higher level of security for CNP transactions. The impact of any potential data breach is greatly reduced since the data is useless when stolen (i.e. 26% decline in Fraud rates).

→ 𝐈𝐦𝐩𝐫𝐨𝐯𝐞𝐝 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐑𝐚𝐭𝐞𝐬 - NT involves card issuers unlike PSP tokens. NT can be limited in scope and offer additional payments detail (i.e. 2.1% increase).

→ 𝐁𝐞𝐭𝐭𝐞𝐫 𝐂𝐗 - Card issuers can update NT in real time replacing the need for card members to update the information periodically (i.e. 35% of cardholders stop shopping after one decline).

𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 — 𝐚𝐧 𝐎𝐦𝐧𝐢𝐜𝐡𝐚𝐧𝐧𝐞𝐥 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐲:

👉 𝐖𝐞𝐛𝐬𝐢𝐭𝐞 - Token information is captured by the merchant and shared with the Token Service Provider (i.e. VGS) and Card Issuer to validate the token and authenticate the transaction. Card Issuer then shares PAR along with the token to complete the transaction.

👉 𝐈𝐧-𝐀𝐩𝐩 - Token information is shared from the digital wallet with the token service provider and card issuer to validate and authenticate the requests. Card Issuers authorize the transaction and share customer PAR information back to the merchant PSP along with the token.

👉 𝐈𝐧-𝐒𝐭𝐨𝐫𝐞 𝐂𝐚𝐫𝐝𝐬 - The Payment Terminal captures the card data and shares it with the card issuer to authorize the transaction. Card issuers authorize transactions and share with merchants the response and PAR, while the processor provides the Processor Token.

Source: Deloitte

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()