Colombia’s Bre-B Reaches 8 Million Users in 3 Weeks

Hey Payments Fanatic!

FinTech is not coming to Colombia, it's already there: In just three weeks, Bre-B has crossed 20 million registered payment keys!

The payments platform is now connected to +8 million users, that's 15% of the country’s population.

As Ana María Prieto of Banco de la República puts it, “Bre-B is the system of transfers that unites an entire country.”

Rest assured, I’ll be keeping an eye on Bre-B’s next moves 😉

Read more below and keep scrolling for your daily dose of Payments 👇

Cheers,

INSIGHTS

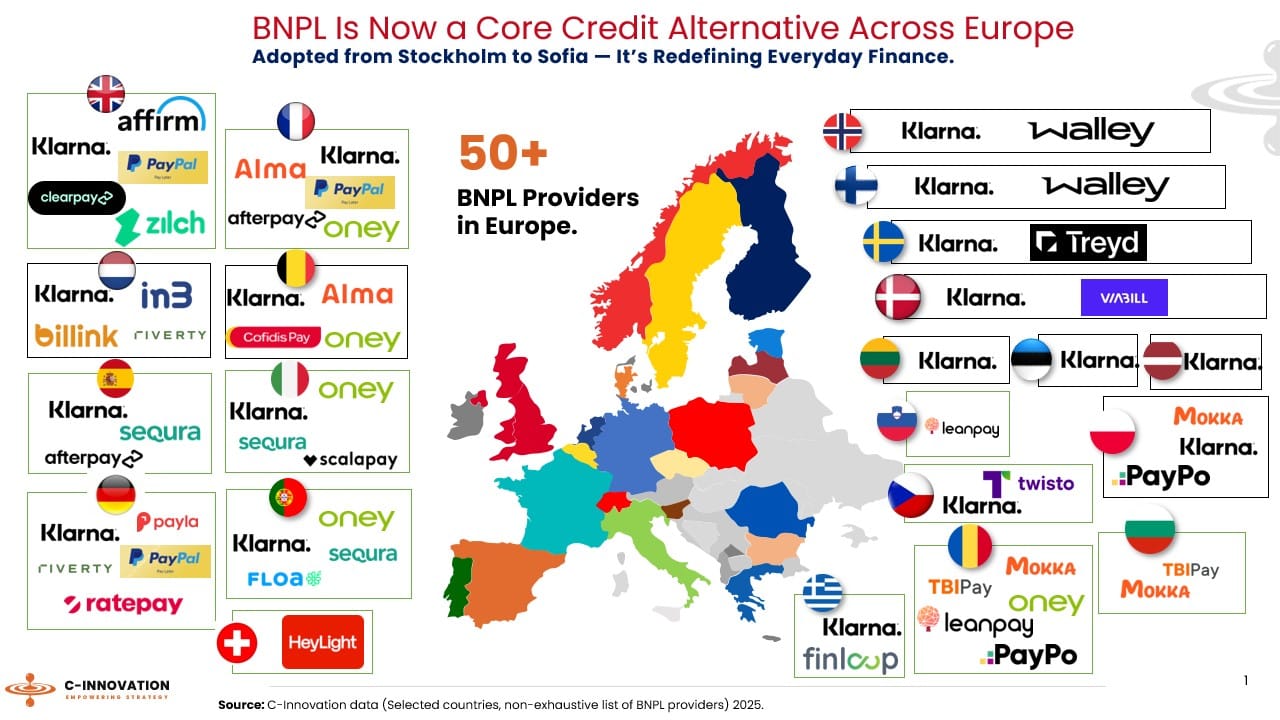

🌍 Buy Now Pay Later (BNPL) European Market Map 2025

Who’s missing in this overview?

NEWS

🇿🇦 ACI Worldwide’s advanced payment solutions enable real-time payments without risk. Outlining trends in global payments and new risks inherent in instant payments, ACI Worldwide experts noted that technologies such as cloud native payment hubs, advanced data analytics, and AI are making it safer for banks and financial institutions to embrace modernisation.

🇨🇴 $5.1 million will enter the financial system over the next three years. For ACI Worldwide, with technological support for the Bre-B system, more players will join. ACI Worldwide will help facilitate real-time electronic payments. The 50-year-old company manages infrastructure in several countries on five continents.

🌍 How Solidgate supports Tickets to make travel more accessible. Partnering with Solidgate helped Tickets open new revenue streams and overcome limitations in their traditional European-based setup, allowing them to expand confidently into previously underserved regions.

🇬🇧 Ecommpay shortlisted for three Women in Tech Employer Awards. CCO Willem Wellinghoff and CMO Miranda McLean have been shortlisted for advocacy awards in the Women in Tech category, while the company’s accessibility-focused website and payments platform overhaul is a finalist for Best Initiative of the Year.

🌍 Klarna expands programmatic retargeting across Europe. In collaboration with Criteo, Klarna is enabling more brands to tap into its high-intent shopper audience, helping reconnect with customers at key decision-making points across multiple channels.

🇸🇪 BNPL FinTech Klarna reports a decline in delinquency rates as consumer health improves. The FinTech announced a continued improvement in repayment performance among its extensive consumer base of 100 million. Globally, its delinquency rate on BNPL loans fell to 0.88% for Q2 2025, a 15 bps improvement from 1.03% in Q2 2024.

🇺🇸 Mastercard backs open banking. Its CEO, Michael Miebach, expects the open banking trend to keep gaining ground and seems to prefer that over banks charging for consumer data. The card network chief gave his view on the recent controversial practice of banks charging for consumer data after an analyst asked about it during the company’s second-quarter earnings call.

🇨🇳 Payment connect goes live: How a single switch is re-wiring Mainland–Hong Kong payments. In practical terms, anyone with a mobile number on either side of the boundary can now push money across it, in renminbi or Hong Kong dollars, 24 hours a day, for the price of a milk-tea upgrade.

🇦🇺 Banking Circle completes acquisition of Australian settlements limited to revolutionise payments in Australia. This strategic acquisition unites ASL’s established ADI licence and deep domestic banking, payments, and settlement experience with Banking Circle’s world-class cross-border payments and infrastructure capabilities.

🇬🇧 FinTech group Intelligent Lending launches Binq app for UK SMEs. Founder and CEO Jamie Stewart stated, “Binq was established within Intelligent Lending, a group of FinTech companies that includes CredAbility, Ocean, and TotallyMoney. This structure allows the company to leverage the scale, experience, and expertise of the wider group while maintaining a lean and agile approach.”

🇮🇳 Mobikwik Q1 loss widens to $4.8m on lower revenue. The India-based FinTech company saw its revenue from operations fall 20.7% year-on-year to Rs 271.36 crore (US$31.1 million), while total income dropped 18.6% to 281.61 crore rupees (US$32.2 million).

🇬🇧 Circle bolsters stablecoin adoption with UK support, hyperliquid integration, and Aptos wallet expansion. These developments underscore Circle’s mission to enhance global financial accessibility, interoperability, and efficiency through USDC and its suite of developer tools.

🇦🇪 ADIB latest GCC bank to launch Visa's real-time cross-border money transfer. The 'Remit!' service from ADIB allows its customers to send money to more than 11 billion cards, digital wallets, and accounts worldwide. The Visa instant fund transfer option will help banks in the UAE and the Gulf expand on gaining a bigger slice of the remittance market, too.

🇬🇧 PingPong gets on board with ClearBank. Through this collaboration, PingPong will leverage ClearBank’s local agency banking solution to enhance its UK offering with virtual business accounts, GBP collections, and Confirmation of Payee (CoP) functionality.

🇨🇴 Bre-B's instant payment system reaches more than 20 million users. The Bank of the Republic reported that more than 20 million keys have been registered, which are linked to nearly 11 million means of payment and more than eight million clients of the financial system.

🇨🇴 Kamin, the first platform to modernize instant payments for businesses, was born with Bre-B. With the new Colombian paytech, companies will now benefit from access to instant payment rails in Colombia and the region. The platform includes real-time collection and disbursement to bank accounts or digital wallets.

🇮🇳 ICICI Bank will start charging payment platforms like Google Pay and PhonePe for UPI transactions. According to reports, ICICI Bank has informed PAs that those maintaining an escrow account with the bank will pay 2 basis points per transaction, capped at Rs. 6. For those without an escrow account at the bank, the fee will be 4 basis points, capped at Rs. 10 per transaction.

🇬🇧 Lao Mobile Money signs digital payments partnership with Visa. Lao Mobile Money and Visa will integrate Visa's payment system into the MmoneyX platform to provide secure and convenient options for multiple forms of transactions, such as scanning payments, paying for goods in stores, mobile phone top-ups, and digital financial services, among other things.

🇬🇧 Stratiphy selects Moneyhub to unlock seamless funding of personalised investment strategies. Stratiphy’s partnership with Moneyhub provides users with a secure and efficient payment experience, enhancing their ability to manage investments with confidence and ease.

GOLDEN NUGGET

🚨 𝐓𝐡𝐞 𝐑𝐢𝐬𝐞 𝐨𝐟 𝐄𝐦𝐛𝐞𝐝𝐝𝐞𝐝 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐢𝐧 𝐋𝐀𝐓𝐀𝐌 — 𝐛𝐲 Getnet 👇 Created by Arthur Bedel 💳 ♻️

As SMEs across Latin America push toward digitalization, one challenge remains constant: access to credit. Traditional lending models often fail to support the needs of micro, small, and medium-sized businesses. Embedded lending is closing that gap

𝐓𝐡𝐞 𝐋𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞

► In Latin America, over 90% of companies are SMEs — yet only a small fraction receive formal financing.

► Digital platforms are now embedding credit into their ecosystems, offering contextual, data-driven lending solutions with seamless user experiences.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐄𝐦𝐛𝐞𝐝𝐝𝐞𝐝 𝐋𝐞𝐧𝐝𝐢𝐧𝐠?

► Embedded lending allows businesses to offer credit directly within their own platforms — whether e-commerce, SaaS, acquirers, or marketplaces.

► Rather than redirecting to a traditional bank, credit is issued in real-time at the point of need — backed by alternative data and simplified KYC processes.

🔍 𝐓𝐫𝐚𝐝𝐢𝐭𝐢𝐨𝐧𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐯𝐬. 𝐌𝐨𝐝𝐞𝐫𝐧 𝐋𝐞𝐧𝐝𝐢𝐧𝐠

Traditional Lending:

→ Paper-heavy onboarding

→ Fixed approval logic

→ Long disbursement cycles

→ One-size-fits-all financing

⤵️

Modern Lending Models:

→ BNPL (Buy Now, Pay Later)

Short-term installment credit offered at the point of sale — often with zero interest — allowing SMEs to access necessary goods/services while smoothing cash flow

→ Invoice Factoring

SMEs sell their outstanding invoices to lenders for immediate cash — unlocking working capital without taking on new debt

→ Merchant Cash Advances

Financing based on a merchant’s projected credit card sales or daily revenue, typically repaid via a percentage of future transactions

→ Recurring Revenue Lending

Tailored for SaaS companies and subscription-based businesses, this model lends against predictable monthly recurring revenue (MRR)

→ API-Based Embedded Lending

Fully digital, contextual lending offered directly within a platform’s interface. Credit terms are calculated based on real-time behavioral and transactional data, and loans are issued instantly

These new models reflect a fundamental shift: from rigid credit products to embedded, data-driven financing that meets SMEs where they operate

📈 𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐢𝐧 𝐋𝐀𝐓𝐀𝐌

► Embedded lending is projected to grow 5x in Latin America over the next 3 years, as platforms integrate financing tools into their core offerings

► By embedding credit at checkout or payout, platforms like Getnet are enabling merchants to access capital tied to their revenue and transaction data

► This is not just fintech innovation — it’s ecosystem transformation, unlocking working capital for millions of businesses across the region

Embedded lending isn’t just a trend — it’s the next infrastructure layer for LATAM’s digital commerce economy

Source: Getnet

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()