Corpay and TPG to Acquire AvidXchange for $2.2B

Hey Payments Fanatic!

Corpay and TPG have agreed to acquire AvidXchange for $2.2 billion, valuing shares at $10 and taking the company private. AvidXchange, known for its accounts payable automation software, serves over 8,500 middle-market businesses and has supported corporate payment processing for 25 years.

In FinTech, this deal highlights a growing trend of payment firms and private equity partnering to streamline services that support middle-market business operations.

Launched in 2000, Corpay offers business payment and expense management solutions, including AP automation, commercial cards, and cross-border payments. Last month, Mastercard invested $300 million for a 3% stake in Corpay’s cross-border unit.

TPG, a global alternative asset manager with $246 billion in assets, invests across sectors like technology and healthcare, with a focus on long-term value creation.

“Over the last 25 years, AvidXchange has established itself as a leader in AP automation and payment software by building a differentiated platform primed for growth,” said CEO Michael Praeger.

TPG will take the majority stake, with Corpay holding a minority interest. Together, they aim to scale AvidXchange’s payment solutions and enhance corporate workflows—a shift for the businesses that depend on it daily.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

📊 UPI QR codes have recorded the fastest growth in digital payments infrastructure in the financial year 2024-25, with a 91.5 per cent jump over the previous financial year to 𝟲𝟱𝟳.𝟵 𝗺𝗶𝗹𝗹𝗶𝗼𝗻

PAYMENTS NEWS

🇧🇷 RS2 and ACI Worldwide call for advanced technology to reduce payment disputes in Brazil. These disputes can be costly and time-consuming for all parties, from merchants and payment processors to banks and card networks. Credit cards, the most popular payment method, are also the most frequently exploited by bad actors.

🌎 Exploring the expanding landscape of payment processing solutions. The Payment Processing Solutions market is highly competitive, featuring several notable companies that significantly shape the industry landscape, like ACI Worldwide.

🇺🇸 External billing is now live on App Store, and it’s a big deal for app monetization by Solidgate. A U.S. District Judge ruled that Apple must allow external payment options in App Store apps for U.S. users. In this article, find out what this change means in practice.

🇩🇪 GreenBanana unveils BNPL platform for retailers. The bnplx.io platform is designed to support small, medium-sized businesses and international enterprise retailers. It uses machine learning to route transactions in real-time to the best-suited BNPL providers across more than 25 countries.

🇬🇧 Revolut will roll out Bitcoin Lightning Payments for users in the U.K. and select European countries through Lightspark. The integration aims to reduce transaction fees and payment processing time by using Lightspark's infrastructure for global payments.

🇱🇹 MyTU secures Visa and Mastercard acquiring licences. This milestone will enable myTU to process card payments directly through its own acquiring infrastructure, across e-commerce platforms, retail stores, and POS terminals.

🇺🇸 Stripe allows iOS developers to dodge Apple’s commission. Developers can now accept payments with the processing platform Stripe, outside any app, without Apple Store commission fees. A guide showed developers how to accept transactions outside an app using Stripe Checkout.

🇺🇸 Samsung introduces a new tap-to-transfer feature for Samsung Wallet. The new feature will make peer-to-peer (P2P) payments faster and more convenient in the U.S. It is designed to simplify the process of paying, eliminating the hassle often associated with shared expenses.

🇺🇸 CFPB reveals plans to rescind BNPL regulation. That rule stated certain BNPL products would be regulated within the same parameters as credit cards under the federal Truth in Lending Act. Continue reading

🇬🇭 Ghanaian FinTech company Zeepay secures $18m debt funding to accelerate expansion. The new funding will provide crucial float financing support, ensuring Zeepay can manage liquidity demands associated with real-time mobile money transactions and international remittances.

🇺🇸 BigCommerce taps Klarna as global preferred partner for flexible payment solutions. The partnership furthers BigCommerce and Klarna’s mutual mission to help brands and retailers optimize their checkouts and conversion rates by offering payment flexibility and making large purchases more accessible to consumers.

🇺🇸 Michael P. Lyons assumes leadership of Fiserv as Chief Executive Officer. Lyons assumed the position upon the confirmation of Frank Bisignano, Fiserv’s prior CEO, as Commissioner of the Social Security Administration. Lyons also joins the Fiserv Board of Directors.

🇺🇸 Global Payments bets big on $600M Synergy from Worldpay. The merger will combine Global’s strength in small and mid-sized businesses and vertical-specific solutions with Worldpay’s enterprise and eCommerce capabilities, creating a comprehensive commerce solutions platform that spans the full merchant spectrum.

🇬🇧 TrueLayer hits record-breaking milestone processing over $10 billion in payments in a single month. Its rapid growth is being driven by consumer demand for simple, instant payments and instant refunds, and by merchant demand for low-cost, secure payment methods that eliminate the possibility of card fraud.

🇫🇷 Edenred Payment Solutions supports Qileo in making corporate accounts more responsible in France. This allows companies to no longer choose between business and impact. They can manage their finances with peace of mind, save valuable time with pre-accounting features, and measure and reduce their carbon emissions through the tool’s recommendations.

🌍 Nordics and Estonia are rolling out offline card payment back-up in case the internet is cut. The plans come after the region has suffered several instances of unexplained damage to critical undersea infrastructure in recent years, and as Western intelligence services have accused Russia of committing various acts of sabotage.

🇬🇧 Ant International partners with Barclays on treasury management with an AI-powered FX model. By integrating the time series forecasting algorithms, the TST Model predicts patterns over time. Ant also created new pre-training and Supervised Fine-Tuning (SFT) frameworks to train the model and improve its predictions over time.

🇬🇧 Cardstream and Mastercard partner to advance open banking payments in the UK. The new solution expands payment choice for businesses and consumers, supporting single immediate payments (SIP) and preparing for commercial variable recurring payments as they are expectedly to roll out across Europe.

GOLDEN NUGGET

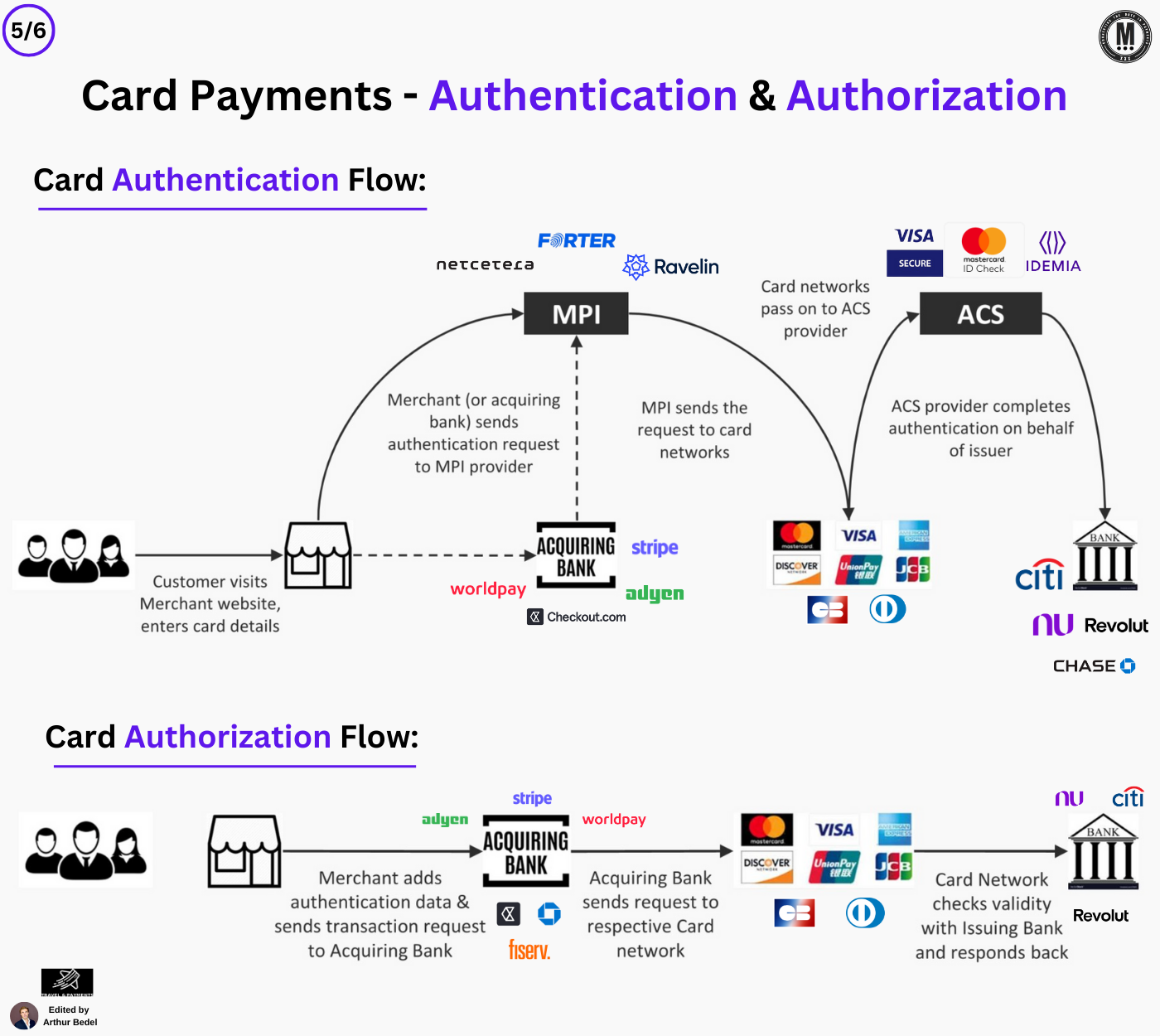

𝐓𝐡𝐞 𝐈𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐭𝐨 𝐂𝐚𝐫𝐝𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 by Travel & Payments 👇 Created by Arthur Bedel

𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 & 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 in 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬?

► Authentication is the process of verifying the identity of the cardholder before a payment is processed. It's a core pillar of card security and fraud prevention.

► It is typically handled through 3DS (3D Secure) protocols, connecting issuers, card networks, merchants, and specialized service providers.

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐀𝐮𝐭𝐡𝐞𝐧𝐭𝐢𝐜𝐚𝐭𝐢𝐨𝐧 𝐖𝐨𝐫𝐤?

1️⃣ A customer visits a merchant’s site (e.g., using VGS, DEUNA, Payplug, CellPoint Digital) and enters their card details.

2️⃣ The merchant or acquiring bank (Adyen, Checkout.com, Worldpay) sends an authentication request to an MPI provider (Merchant Plug-In).

3️⃣ Providers like Forter, G+D Netcetera, and Ravelin Technology process and forward the request to the card networks (Visa, Mastercard, Discover Financial Services, etc.).

4️⃣ The networks route the request to an ACS provider (Access Control Server), such as IDEMIA, which completes the authentication on behalf of the issuing bank (Citi, Revolut, Nubank, Chase).

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬?

► Authorization is the approval of the transaction by the issuer after authentication. It verifies whether the cardholder has sufficient funds and is not flagged for fraud.

► It happens in milliseconds—but is crucial to ensure the payment is legitimate and cleared to proceed.

𝐇𝐨𝐰 𝐝𝐨𝐞𝐬 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐨𝐫𝐤?

1️⃣ After authentication, the merchant (via Adyen, Stripe, or Worldpay) sends the transaction request with all data to the Acquiring Bank.

2️⃣ The Acquiring Bank (e.g., Fiserv) routes the request to the appropriate Card Network (Visa, Mastercard, GIE Cartes Bancaires, etc.).

3️⃣ The card network contacts the Issuing Bank (Citi, Nubank, Revolut) for final approval.

4️⃣ The Issuer checks the validity and funds, responds back via the network, and the transaction is either approved or declined.

𝐍𝐞𝐱𝐭 𝐔𝐩: 𝐂𝐥𝐞𝐚𝐫𝐚𝐧𝐜𝐞 & 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 + 𝐑𝐞𝐜𝐨𝐧𝐜𝐢𝐥𝐢𝐚𝐭𝐢𝐨𝐧 𝐢𝐧 𝐂𝐚𝐫𝐝 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

Source: Travel & Payments

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()