Deutsche Bank Rolls Out Wero Across Europe… and This Is a Clear Push for Payment Sovereignty

Hey Payments Fanatics!

Deutsche Bank just switched on the full Wero experience for its clients, with Postbank customers now fully live for both P2P transfers and e-commerce payments across Europe.

This means real-time money transfers to friends and family and the ability to pay online, all through the Wero app. No IBANs. No cards. Just account-to-account Payments.

Wero is operated by the European Payments Initiative and backed by 16 major European banks. The ambition is obvious: a unified, sovereign digital wallet built in Europe, for Europe.

P2P is live. E-commerce is rolling. POS, subscriptions, BNPL and loyalty features are already lined up next.

The app links directly to a Deutsche Bank or Postbank account. No top-ups. No friction. Payments feel as simple as sending a message.

This is one of the clearest signals yet that Europe is serious about owning its payment rails end to end.

Curious to stay ahead of today’s Payments stories? Scroll down and catch the highlights. Tomorrow I'll be back in your inbox with all the latest news! 👇

Cheers,

INSIGHTS

🇧🇷 Around 158 million Brazilians use Pix. That's about three-quarters of the total national population 🤯

NEWS

🌍 Deutsche Bank and Postbank launch Wero for simpler and sovereign digital payments in Europe. Clients of both banks have been able to send and receive money in real time to family and friends across Europe with Wero, as well as pay in participating online shops.

🌍 Ottu collaborates with Mastercard to empower global and regional enterprises to scale effortlessly across the GCC with local payment methods. The partnership brings together Mastercard Merchant Cloud with Ottu’s regional expertise to simplify and scale local payment methods for businesses. Additionally, Mastercard and LoanPro announce partnership to launch Loan on Card, a solution designed to enable lenders to deliver loans to approved consumer and small business borrowers through virtual and physical card-based experiences.

🇮🇳 Google deepens consumer credit push in India with UPI-linked card. Google entered India’s growing co-branded credit card market with the launch of Flex by Google Pay, partnering with private lender Axis Bank to expand access to credit in the country’s UPI-driven payments ecosystem.

🇮🇳 Amazon Pay lets users pay via fingerprint or face scan on UPI. Amazon Pay has launched UPI biometric authentication in India, allowing users to approve payments using fingerprint or face scan without entering a PIN. The feature works for transactions up to ₹5,000 and is currently available on Android devices.

🇳🇱 Vox AI partners with Adyen to bring payments to drive-thru order terminals. Powered by Adyen, Vox AI Pay enables card payments at drive-thru order terminals, directly from the speaker post. Continue reading

🇺🇸 Fireblocks and Zepz join forces to scale stablecoin remittance adoption for WorldRemit and Sendwave. The partnership aims to help scale stablecoin-powered remittances to consumers at scale. Serving more than 9 million users across 130 countries, WorldRemit and Sendwave will use Fireblocks to enable near-instant, lower-cost cross-border payments.

🇺🇸 MoonPay, Exodus, and M0 launch USD-backed stablecoin for consumer payments. According to a press release, the stablecoin will be fully reserved with U.S. dollar deposits and issued by MoonPay using M0’s open infrastructure. It will integrate into Exodus Pay, a new self-custodial payments experience inside the Exodus platform.

🇳🇬 Flutterwave’s Agboola: ‘We’re not in the IPO race’. Flutterwave founder Olugbenga “GB” Agboola said the African payments company is not rushing toward an IPO, instead prioritising profitability, regulatory compliance, and the development of cross-border payment tools for SMEs as FinTech markets stabilise.

🇧🇷 PicPay announced the launch of PicPay Delivery, a new feature created from a direct integration with Rappi. With the partnership, PicPay users can order meals and grocery items without leaving the digital bank's app. Keep reading

🇺🇸 Affirm CEO Max Levchin details a no-fee lending model. He said the BNPL provider’s strategy is built on aligning with consumers by not charging late fees, relying instead on strong underwriting and transparent, fixed-term lending to reduce borrower risk.

🇺🇸 FDIC launches plan on bank applications to issue stablecoins. The plan spells out how certain lenders can apply in order to get the regulator’s nod. Acting Chair Travis Hill said in a statement that the “tailored” process would allow the FDIC to evaluate the safety and soundness of an applicant’s proposed activities.

🇺🇸 Noah and Fin.com launch fiat-to-stablecoin virtual accounts. The partnership sees Fin.com customers able to receive bank transfers in EUR and USD through local virtual accounts issued and regulated by Noah. Funds arriving in these accounts are automatically converted into stablecoins inside the Fin.com apps.

🇺🇸 Square and Thrive expand partnership to simplify multi-channel inventory management for retailers. The new integration enables retailers to create and edit products within Square and have those updates automatically reflected on Shopify.

🌎 dLocal accelerates global payments across emerging markets with Convera. With this partnership, dLocal and Convera will streamline and scale their local payout capabilities in key emerging markets, starting with Colombia and expanding across Africa, Asia, and Latin America.

🇦🇺 Mint Payments partners with Zip Co to deliver flexible payment options for travel merchants. The collaboration allows travel agencies, tour operators, and other tourism businesses using Mint’s platform to offer Zip at checkout, giving customers the ability to spread payments over time while merchants continue to receive funds upfront.

GOLDEN NUGGET

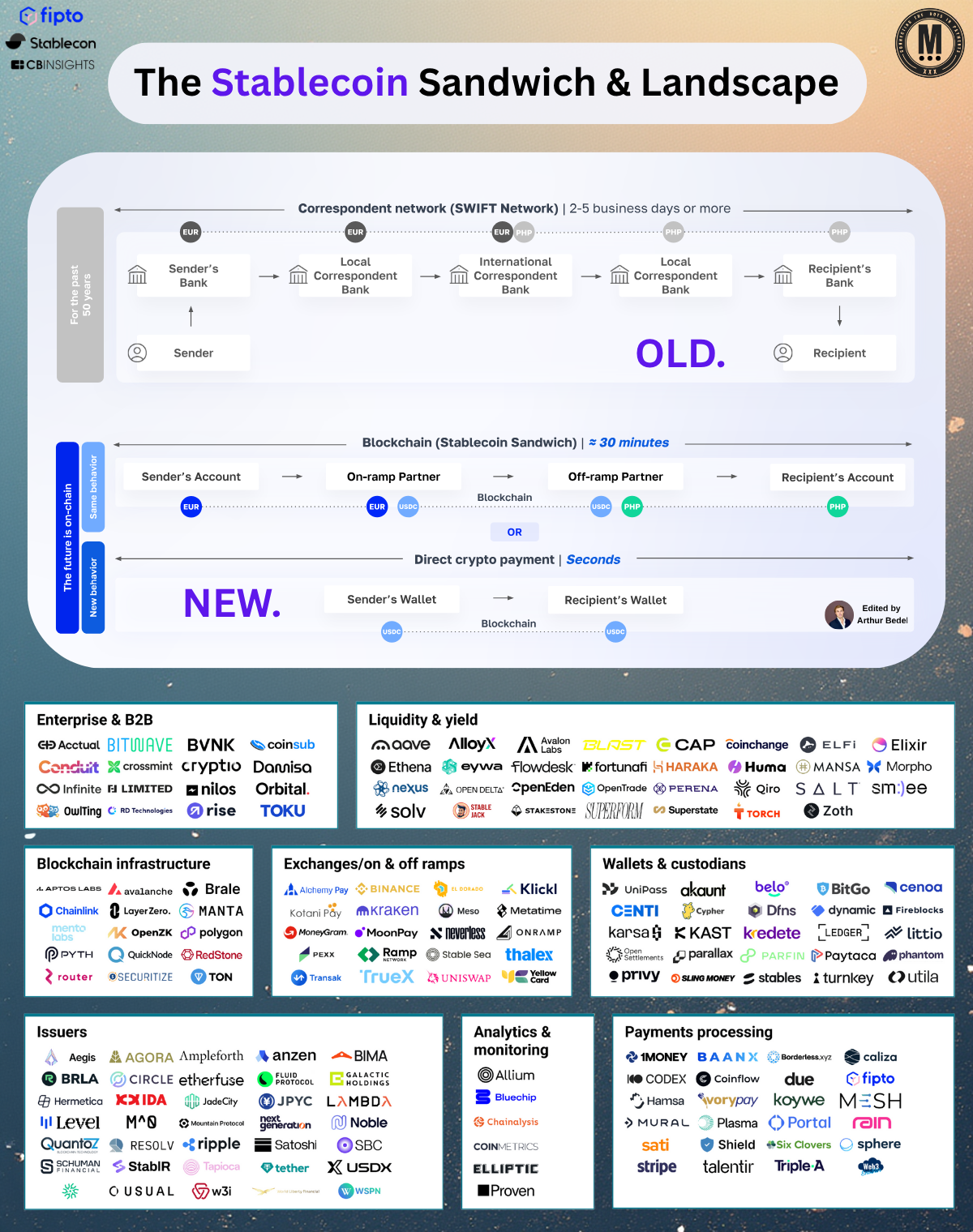

𝐓𝐡𝐞 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐒𝐚𝐧𝐝𝐰𝐢𝐜𝐡 — the next chapter of Cross-Border Payments 👇Created by Arthur Bedel 💳 ♻️

For decades, international payments have moved through a network of correspondent banks. Each transaction passed through multiple intermediaries — from local to international correspondents and back again — taking days and incurring fees at every step. This system worked, but it was slow, expensive, and opaque.

A new model is emerging — 𝐓𝐡𝐞 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐒𝐚𝐧𝐝𝐰𝐢𝐜𝐡 — where #blockchain replaces those intermediary layers to enable direct, near-instant settlement.

Here’s how it works:

→ The sender initiates a transfer in fiat (for example, euros).

→ An on-ramp partner converts those euros into a stablecoin such as USDC.

→ The stablecoin moves across the blockchain, serving as the settlement medium.

→ An off-ramp partner converts the stablecoin into local currency (such as pesos or reais).

→ The recipient receives funds in their local account, often in under 30 minutes.

→ This hybrid flow combines the compliance and familiarity of traditional finance with the efficiency, transparency, and programmability of blockchain technology.

The scale of this transformation is already visible. 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐭𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬 𝐧𝐨𝐰 𝐞𝐱𝐜𝐞𝐞𝐝 $7 𝐭𝐫𝐢𝐥𝐥𝐢𝐨𝐧 𝐚𝐧𝐧𝐮𝐚𝐥𝐥𝐲, surpassing Visa’s global network volume. Stablecoins are becoming a fundamental layer for liquidity management, B2B settlement, and cross-border treasury flows.

An entire ecosystem is forming around this shift:

→ 𝐄𝐧𝐭𝐞𝐫𝐩𝐫𝐢𝐬𝐞 & 𝐁2𝐁: BVNK, Bitwave, and Contact are helping global merchants manage stablecoin liquidity, compliance, and treasury operations.

→ 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞: Polygon Labs, Aptos Labs, and Chainlink Labs are building the rails that connect traditional payment networks with blockchain-based settlement.

→ 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 & 𝐂𝐮𝐬𝐭𝐨𝐝𝐢𝐚𝐧𝐬: Dfns and BitGo offer programmable, secure wallet solutions designed for enterprises managing large digital asset volumes.

→ 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐏𝐫𝐨𝐜𝐞𝐬𝐬𝐨𝐫𝐬: Mural Pay, Fipto and Noah are integrating stablecoin rails into existing payment stacks, bridging traditional and digital commerce.

→ An exciting one, Breeze is reimagining the 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐨𝐟 𝐑𝐞𝐜𝐨𝐫𝐝 (MoR) model with programmable, blockchain-enabled settlements that occur instantly.

𝐖𝐡𝐚𝐭’𝐬 𝐡𝐚𝐩𝐩𝐞𝐧𝐢𝐧𝐠 𝐢𝐬 𝐧𝐨𝐭 𝐚 𝐫𝐞𝐩𝐥𝐚𝐜𝐞𝐦𝐞𝐧𝐭 𝐨𝐟 𝐭𝐡𝐞 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐬𝐲𝐬𝐭𝐞𝐦, 𝐛𝐮𝐭 𝐚𝐧 𝐮𝐩𝐠𝐫𝐚𝐝𝐞. Traditional bank accounts are evolving into wallets. Money movement is becoming programmable. Settlement is shifting from days to seconds.

The Stablecoin Sandwich represents a new layer of global financial infrastructure — one that merges the reliability of banks with the speed and transparency of blockchain.

Source: Fipto, CB Insights, Dawn Capital

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()