Europe Sees Second iPhone Tap to Pay Expansion This Year

Hey Payments Fanatic!

Three years after launching in the U.S., and following steady expansion into Brazil, Asia, and key European markets, Apple’s Tap to Pay on iPhone is now rolling out across eight more countries in Europe, its second regional expansion this year. The service is newly available in Belgium, Croatia, Cyprus, Denmark, Greece, Iceland, Luxembourg, and Malta.

This brings the total to 29 countries where Tap to Pay is now live. It allows businesses to accept contactless payments, from physical cards, Apple Pay, and digital wallets, directly on an iPhone using only a supported iOS app. No extra hardware is needed.

The service works with all major networks: Visa, Mastercard, American Express, and Discover. Local card schemes are also supported, including Bancontact in Belgium via Axepta and Viva, and Dankort in Denmark through Nexi and Surfboard Payments.

Local and cross-border payment platforms continue to drive this expansion. Mollie, Adyen, Worldline, myPOS, and Revolut are key players across these markets, alongside SumUp, Stripe, and Viva. Their collaboration with Apple shows a clear shift toward flexible payment acceptance without the need for traditional infrastructure.

As Tap to Pay nears full coverage in the European Economic Area, just five countries remain: Estonia, Latvia, Lithuania, Norway, and Spain, one of the region’s largest economies.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Stay ahead in FinTech! Subscribe to my Daily FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

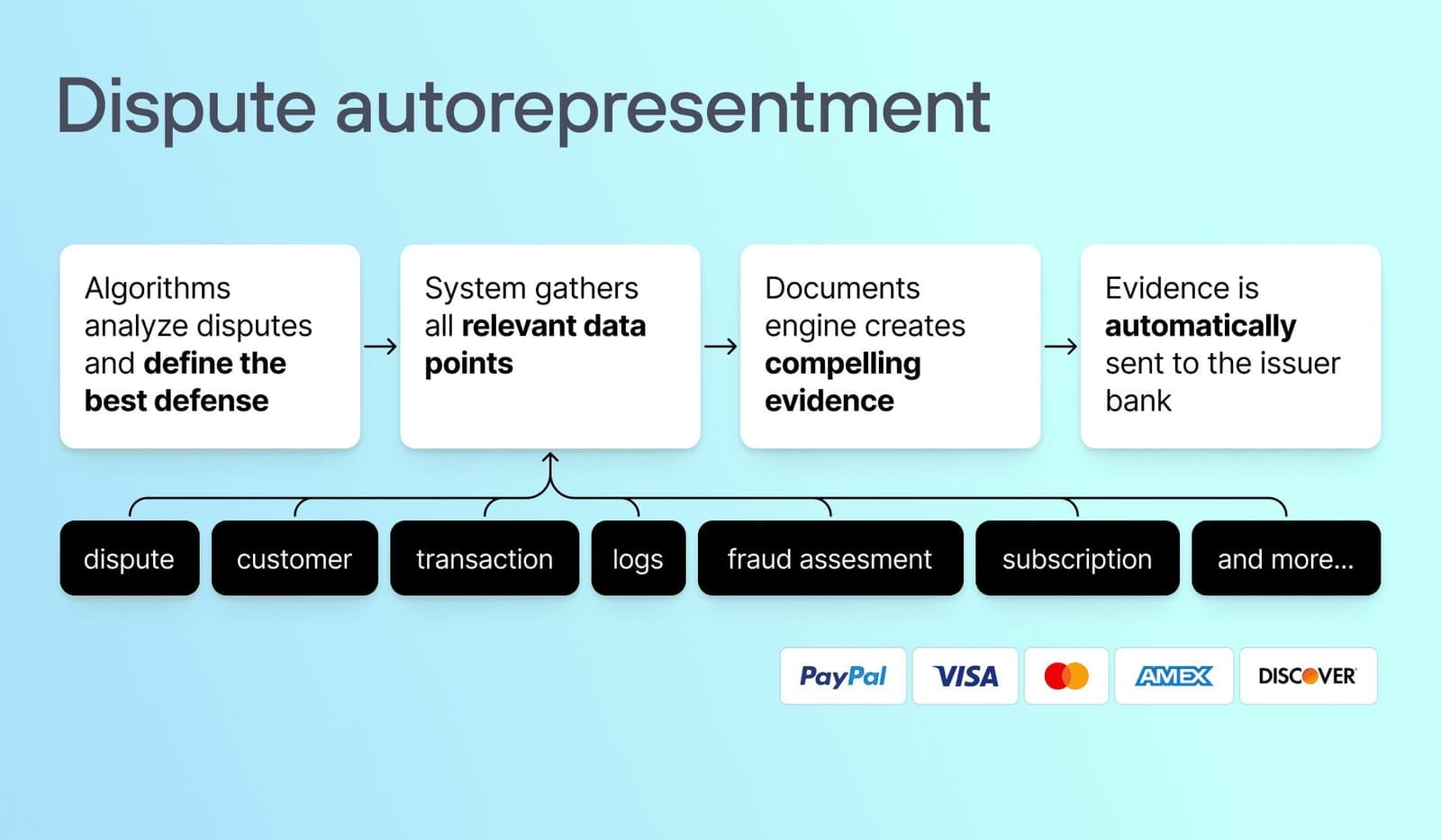

🇬🇧 Automated dispute representment: More revenue, less work, better win rates by Solidgate. It eliminates these challenges for PayPal and card chargebacks. Autorepresentment acts as an always-on dispute analyst and attorney, fighting disputes immediately, intelligently, and effectively. Read the full article

NEWS

🇬🇧 Solidgate partners with Tipalti to change the payment game for platforms and marketplaces. This collaboration brings Solidgate’s expertise in Pay-In infrastructure and Tipalti’s advanced Pay-Out and financial automation tools to create a seamless, end-to-end payment ecosystem.

🇬🇧 Ecommpay grows processing volume by 25% in 2024. Driven by a clear focus on financial inclusivity, the company has achieved a 19% YoY increase in transaction volume and an impressive 25% rise in processing volume. During the same period, merchants leveraging Ecommpay’s seamless global payments infrastructure experienced an 8% improvement in acceptance rates.

🇬🇧 ACI Worldwide redefines payments with ACI Connetic. ACI Connetic brings together account-to-account (A2A), card payments, and AI-driven fraud prevention on a unified cloud-native platform, making it simpler, faster, and more cost-effective for banks and financial institutions to modernize their payments infrastructures.

🌍 Visa names Antony Cahill CEO of its European operations. Mr. Cahill will replace Charlotte Hogg, who is leaving Visa after eight years to pursue a new external opportunity. Mr. Cahill will be based in London and is expected to transition to his new role in early June.

🇺🇸 Global Payments’ Worldpay offers stablecoin payouts using Circle. Infrastructure provider BVNK will enable the new stablecoin offering, and crypto firm Fireblocks’ integration services will help facilitate the connection to Worldpay. Worldpay’s payout platform currently supports 135 traditional currencies.

🇷🇴 Revolut Business and Danubius join forces to boost in-person payments in retail networks. The partnership aims to increase the flexibility of the merchants and retail networks by offering Revolut Reader to their customers across Romania. Keep reading

🇺🇸 CFPB to ditch open banking rule. The Financial Technology Association (FTA) has hit out at US regulators over plans to rescind open banking rules, calling the move a handout to Wall Street banks. Read more

🇳🇱 PayU rolls out MCP server to integrate AI assistants and payment systems. The company said early use cases include generating payment links, emailing invoices to customers, fetching payment status using invoice IDs, and checking transaction or refund statuses.

🇸🇦 PayTabs Group achieves FinTech dominance with its AI-powered payment platform. This transformative orchestration layer delivers unified control over the payment ecosystem through plug-and-play APIs and secure local hosting, ensuring unmatched efficiency, visibility, and compliance for the financial sector and other vital industries that drive the region’s economy.

🇺🇸 TransFi launches BizPay, a cross-border payment platform created to facilitate simpler transactions for businesses and individuals in over 100 countries. The platform is designed to improve sending and receiving money and managing payouts and pay-ins globally.

🇬🇧 JCB expands in-store card acceptance with PayXpert. This partnership ensures broader JCB Card acceptance, making it easier than ever for JCB Cardmembers to use their preferred payment method while traveling and spending in Europe and in the UK.

🌍 payabl. appoints Christia Evagorou as Deputy Group CEO. In her expanded role, she will work closely with Group CEO Ugne Buraciene and the Board to support the company’s continued growth across Europe and beyond. Christia brings over 15 years of experience in corporate governance, tax, and legal structuring.

🇬🇧 Tradu chooses Salt Edge for PSD2 compliance and payment initiation across the UK and EU. The partnership with Salt Edge enables Tradu to address critical challenges in the financial sector, including regulatory compliance, fraud prevention, and user authentication, particularly in light of PSD2 regulations.

🇳🇱 Mambu launches latest product offering, Mambu Payments, extending composable banking beyond core. This means Mambu is poised to help financial institutions modernise core infrastructure and accelerate innovation across the entire banking stack, spanning lending, deposits, and payments.

🇱🇹 Genome partners with Sepagon to optimise the Open Banking market. Through this collaboration, Sepagon incorporates Genome’s secure incoming payment APIs and real-time webhook notifications to offer optimal and transparent C2B payments for businesses and their customers.

🇺🇸 Block’s bitcoin checkout goes live in Vegas, a significant step in making it ‘everyday money’. Block says the initiative is part of a broader strategy to offer small businesses more payment options and position bitcoin as the internet’s native currency.

🇮🇳 Worldline gets RBI nod to facilitate cross-border online transactions. According to a statement from its parent firm, Worldline India, this authorisation enables Worldline ePayments India to facilitate cross-border online transactions for the import and export of goods and services.

GOLDEN NUGGET

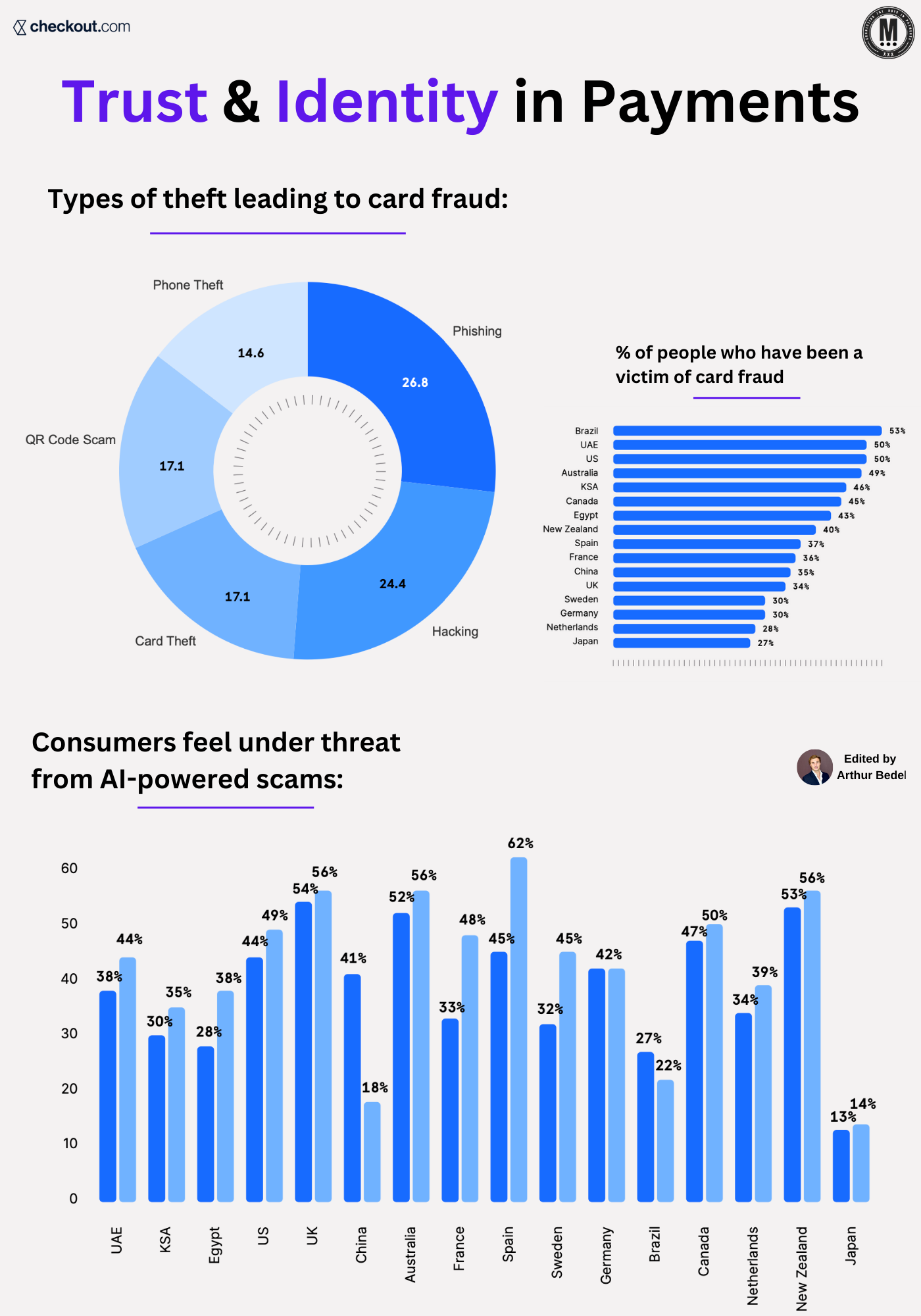

Welcome to 𝐓𝐡𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐀𝐜𝐚𝐝𝐞𝐦𝐲 by Checkout.com — Episode 15 👋 Created by Arthur Bedel

𝐓𝐫𝐮𝐬𝐭, 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 & 𝐀𝐈 — a new frontier in 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐅𝐫𝐚𝐮𝐝.

→ As digital commerce becomes the default, identity has become the primary attack vector. Consumers are demanding both seamless payment experiences and uncompromising security — and merchants are under pressure to deliver both.

1️⃣ 𝐓𝐫𝐮𝐬𝐭 & 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 in the Digital Economy

► In today’s payment ecosystem, identity is the trust layer. With 92% of consumers transacting online, verifying who’s behind the screen is the cornerstone of secure commerce.

► 66% of consumers cite checkout experience as a leading indicator of trust, ahead of brand loyalty.

► Digital identity is now a visible driver of conversion and fraud prevention.

2️⃣ 𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐓𝐡𝐞𝐟𝐭 𝐅𝐮𝐞𝐥𝐢𝐧𝐠 𝐂𝐚𝐫𝐝 𝐅𝐫𝐚𝐮𝐝

→ 𝐏𝐡𝐢𝐬𝐡𝐢𝐧𝐠 (26.8%) — credential theft via deceptive communications

→ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 & P𝐫𝐨𝐜𝐞𝐬𝐬𝐨𝐫 𝐡𝐚𝐜𝐤𝐢𝐧𝐠 (24.4%) — breach of stored payment information

→ 𝐂𝐚𝐫𝐝 & 𝐐𝐑 𝐜𝐨𝐝𝐞 𝐭𝐡𝐞𝐟𝐭 (17.1%) — rising in mobile-first markets

→ 𝐏𝐡𝐨𝐧𝐞 𝐭𝐡𝐞𝐟𝐭 (14.6%) — especially in markets with mobile wallet dominance

📍 Brazil, UAE, and the US top the list of fraud exposure, driven by both digital sophistication and social engineering.

3️⃣ 𝐈𝐝𝐞𝐧𝐭𝐢𝐭𝐲 𝐅𝐫𝐚𝐮𝐝: Shifting Patterns & Demographics

→ Younger users are disproportionately targeted — 60% of Gen Zs have experienced identity-related fraud

→ Fraudsters increasingly leverage synthetic identities, combining real and fake data to bypass KYC

→ Adoption of biometric ID is growing — but so is biometric spoofing and deepfake abuse

4️⃣ 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐈𝐃 — The Infrastructure Layer of Payments

► ⅓ of under-45 consumers use biometrics to approve payments

► 43% want a digital identity wallet embedded into checkout experiences

► Digital ID enables persistent trust, one-click verification, and lower false declines

► Regions like MENA and APAC are leading the adoption curve

5️⃣ 𝐀𝐈 𝐢𝐧 𝐅𝐫𝐚𝐮𝐝: Promise & Peril

✅ AI enhances detection through behavioral biometrics, real-time scoring, and pattern recognition

❌ AI also enables fraud — powering advanced phishing, deepfake scams, and impersonation-as-a-service

𝐊𝐞𝐲 𝐅𝐚𝐜𝐭𝐬:

→ 60% of consumers express concern over AI’s role in fraud

→ 56% say they lack adequate knowledge on how to protect their identities

→ Estimated fraud losses in the U.S. could reach $40B by 2027 if AI threats go unaddressed

𝐊𝐞𝐲 𝐓𝐚𝐤𝐞𝐚𝐰𝐚𝐲𝐬:

✅ Digital identity is now a strategic asset

✅ Consumers demand trust at every touchpoint

✅ AI is both a tool and a threat — dual accountability is critical

✅ Identity, not credentials, is becoming the foundation of secure payments

Source: Checkout.com

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()