From Zero to 17M Transactions: The Bre–B Launch in Colombia Story

Hey, Payments Fanatic!

With over 32 million registered users and 17 million transactions in its first week, Bre–B, Colombia’s new Immediate Payment System, marks a turning point in how money moves across the country.

Developed by the Banco de la República in partnership with the private sector, Bre–B enables real-time transfers between different entities, 24/7, regardless of the user’s bank.

The system already counts 88.3 million registered keys, linked to 32.8 million users. This is a clear sign of the nation’s growing interest in this new tool.

Bre–B emerged from a dialogue between the central bank and key financial players, resulting in a hybrid model inspired by Brazil’s public PIX system and Colombia’s private Transfiya.

In just one week, it processed 17 million transactions worth COP $2.3 trillion, highlighting both its potential and the market’s appetite for faster and more secure digital payments.

The SPI supports person-to-person (P2P), merchant (P2B), business (B2B), and government (P2G/G2P) transactions.

International benchmarks prove the model’s promise. Brazil’s PIX, for instance, accounts for 89.4% of national transactions. Colombia’s challenge now is to drive similar adoption and reduce the use of cash.

Now get off to a great start to the week by reading more payment updates below, and I’ll be back tomorrow!

Cheers,

INSIGHTS

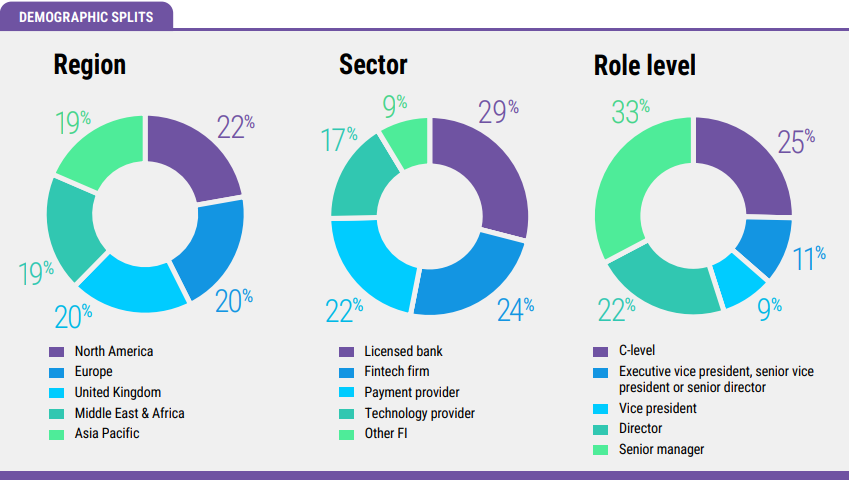

📊 The Payments 2030 Report by Finextra and ACI Worldwide provides a clear roadmap for financial institutions to future-proof their modernization strategies. Based on insights from 162 senior leaders across banks, FinTechs, and payment providers, it explores the shift to cloud and hybrid infrastructures, the rise of A2A and instant payments, and the impact of regulatory pressures on innovation. Download the report here

NEWS

🇺🇸 Airwallex plots bigger US presence. The payments platform will use its recent acquisition of U.S. startup OpenPay to build out a billing platform in the Americas. By integrating OpenPay, Airwallex said it will create the first truly global billing platform by merging a global FinTech infrastructure with billing and subscription management.

🇸🇦 HALA announced that Co-founder Maher Loubieh will transition from CEO of Hala Payments to Group Chief Executive Officer of HALA. In his expanded role, Loubieh will oversee Hala Financing, Hala Payments, and HALA’s venture initiatives, while leading the company’s inorganic and international expansion in preparation for its IPO journey.

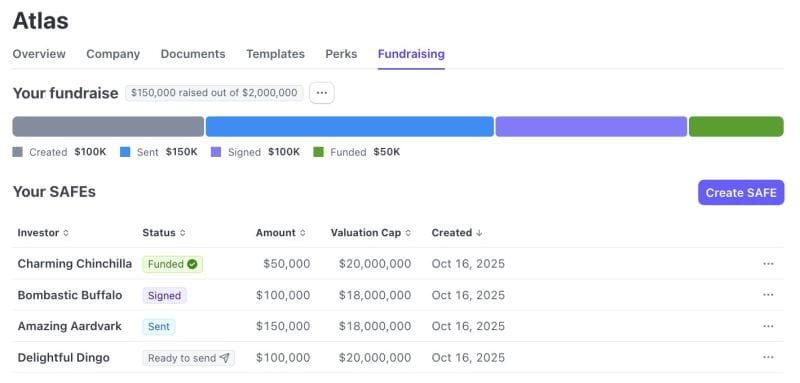

🇺🇸 Startup founders can now manage SAFEs end-to-end within Stripe Atlas, thanks to a new feature that enables sending, signing, and tracking documents in just a few clicks

🇨🇴 Bre-B debuts strongly. With more than 32 million registered users and 17 million transactions in its first week, the Bre-B Instant Payment System marks a turning point in the way money is transferred in Colombia. This system allows for real-time money transfers between different entities, 24/7, regardless of the user´s bank.

🇨🇴 dLocal enables instant transfers via Colombia’s Bre-B platform. This marks a significant milestone in the country’s financial modernisation journey, enabling seamless, always-on digital payments that connect banks, wallets and consumers across the nation.

🇦🇺 Afterpay impacted by major outage in Australia. The outage began around 2 pm on Monday and affected services across Australia, New Zealand, Canada, and the United States. According to its website, every part of the platform was impacted. The issue was resolved shortly after 4 pm, though investigations are ongoing.

🇦🇪 Tamara secures Central Bank of the UAE approval. Yamen Fakhreddine, CEO of Tamara UAE, stated that this milestone fundamentally strengthens the company’s entire operation and acts as a catalyst for its ambitious future in the region. He emphasized that the path is now clear for Tamara to achieve its mission of empowering people to own their dreams.

🇦🇪 UAE FinTech giant Qashio acquires Sanad Cash to fast-track Saudi expansion. The acquisition brings together Qashio’s advanced spend management technology with Sanad Cash’s established local expertise, creating a fully localised and compliant platform for Saudi businesses. The integration will enable clients in the Kingdom to issue locally regulated corporate cards and manage expenses seamlessly.

🇸🇬 Alipay+ expands digital services as SGQR payments surge. Singapore ranked first for tourism spending growth in 2025 amongst global travel hotspots. In line with this, cross-border payment acceptance for Alipay+ now includes more than 100 markets, and is expanding its partner ecosystem to 40, representing 1.8 billion users.

🇬🇧 Tink and SplitWise extend European partnership. Building on strong momentum in the UK, the expansion means users in France, Germany and Austria can now send money to friends and family instantly and securely, directly within the Splitwise app using Pay by Bank, powered by Tink.

🇳🇬 Flutterwave invites FG to invest $75M in $250M initial public offer on NGX. Analysts said Flutterwave’s IPO could mark a defining moment for Nigeria’s capital market, opening the door for more tech-driven enterprises to list locally and attract broader public investment. The proposal was part of Flutterwave’s strategic effort to secure sovereign endorsement.

🇦🇪 MoneyHash and Tabby collaborate to simplify flexible payments. This collaboration offers merchants seamless access to flexible Tabby payments across the UAE and KSA through MoneyHash’s unified API. Businesses can activate Tabby’s buy now pay later service, reducing time-to-market and elevating the checkout experience.

🇨🇦 Mesh and Peoples Trust bring AI-powered corporate expense management to Canada. By combining Peoples’ expertise in payments infrastructure and compliance with Mesh’s customer-first approach, the collaboration offers Canadian enterprises a secure, scalable platform for managing corporate payments: from travel booking to reconciliation and reimbursement.

🇰🇪 CBK strips PayU Kenya of payment licence. PayU Kenya Limited has been stripped of its operating licence by the Central Bank of Kenya, days after the company entered liquidation, drawing a close to the Prosus-owned payment firm’s attempt to break into Kenya’s e-commerce gateway market.

🇬🇧 Worldpay’s global payments deal cleared by UK antitrust watchdog. Worldpay’s $24.3 billion deal with Global Payments Inc. to create a payment processing behemoth avoided a deeper investigation as the UK watchdog found the deal will not weaken competition in the UK.

GOLDEN NUGGET

🚨 𝐓𝐡𝐞 𝐌𝐨𝐛𝐢𝐥𝐞 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐑𝐞𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐢𝐧 𝐋𝐀𝐓𝐀𝐌 — by Getnet 👇Created by Arthur Bedel 💳 ♻️

Mobile is reshaping how Latin America pays — and it’s doing so faster than almost anywhere else in the world.

→ Over 60% 𝐨𝐟 𝐋𝐚𝐭𝐢𝐧 𝐀𝐦𝐞𝐫𝐢𝐜𝐚𝐧𝐬 already 𝐮𝐬𝐞 𝐦𝐨𝐛𝐢𝐥𝐞 𝐰𝐚𝐥𝐥𝐞𝐭𝐬 𝐟𝐨𝐫 𝐞𝐯𝐞𝐫𝐲𝐝𝐚𝐲 𝐭𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬.

→ Brazil’s 𝐏𝐈𝐗 𝐩𝐫𝐨𝐜𝐞𝐬𝐬𝐞𝐝 64𝐁+ 𝐢𝐧𝐬𝐭𝐚𝐧𝐭 𝐭𝐫𝐚𝐧𝐬𝐚𝐜𝐭𝐢𝐨𝐧𝐬 𝐢𝐧 2024, with 87% of adults adopting it.

→ By 2025, 𝐋𝐀𝐓𝐀𝐌 𝐰𝐢𝐥𝐥 𝐡𝐚𝐯𝐞 424𝐌 𝐦𝐨𝐛𝐢𝐥𝐞 𝐢𝐧𝐭𝐞𝐫𝐧𝐞𝐭 𝐮𝐬𝐞𝐫𝐬, unlocking an unprecedented digital-first payments base.

𝐇𝐨𝐰 𝐈𝐭 𝐖𝐨𝐫𝐤𝐬 — 4 Growth Engines

🔸 𝐌𝐨𝐛𝐢𝐥𝐞 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — Apps like Mercado Pago, Nubank, and PicPay securely store cards and are overtaking cards in Argentina’s e-commerce market.

🔸 𝐖𝐞𝐚𝐫𝐚𝐛𝐥𝐞𝐬 — Smartwatches and NFC devices are still nascent but forecasted to surge in Brazil and Argentina in the next 5 years.

🔸 𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 — PIX is now a default in Brazil and spreading fast across Colombia and Argentina. Transactions settle in real time, 24/7.

🔸 𝐐𝐑 𝐂𝐨𝐝𝐞𝐬 — Nearly 30% of PIX payments start with QR scans; Mexico’s CoDi and Colombia are racing to scale similar infrastructures.

𝐑𝐞𝐠𝐢𝐨𝐧𝐚𝐥 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦:

🇧🇷 Brazil: PIX, Mercado Pago, Nubank, PicPay, PagBank, Santander Brasil

🇲🇽 Mexico: SPEI, Nubank, Mercado Pago, CoDi, Santander México

🇨🇱 Chile: Khipu, MACH, Mercado Pago, Santander

🇦🇷 Argentina: Ualá, MODO, Mercado Pago, Santander

🇺🇾 Uruguay: AstroPay, Prex, Toké, Mercado Pago, Santander

🌎 Leading PSPs shaping the rails:

→ DEUNA — building agentic commerce and orchestration infrastructure for LATAM merchants, focusing on checkout optimization, payment routing, and AI-driven insights.

→ dLocal & EBANX — enabling international merchants to reach LATAM consumers through a single API that simplifies FX, settlement, and tax.

→ Getnet & Santander — innovating in merchant acquiring local payment methods and financial services with deep banking integrations.

→ AstroPay — bridging global merchants and LATAM consumers through prepaid cards, wallets, and loyalty tools.

→ PPRO — providing global payment infrastructure by aggregating local methods and offering PSPs “payments as a service”.

𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬

→ Lower costs & faster settlement for merchants.

→ Financial inclusion for millions who never had access to cards.

→ Cross-border growth powered by multi-currency rails.

→ New digital opportunities — loyalty programs, embedded finance, and social commerce via Pay-by-Link.

The message is clear: in LATAM, mobile isn’t an alternative. Merchants that embed local rails and mobile-first methods will grow. Those that don’t risk being locked out of the fastest-growing payments revolution.

Source: Getnet

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()