Google Deepens Pix Integration with Lens & Chrome

Hey Payments Fanatic!

Google isn’t letting any chance slip by when it comes to growing alongside Brazil’s most used payment method, Pix, which, in case you missed it, just set a new record last Friday: 276.7 million transactions in a single day, surpassing the previous high of 252.1 million from last year.

Now, only a few months after rolling out Tap-to-Pay with Pix, Google is taking the next step. Two new features, Pix on Chrome and Pix on Google Lens, are being introduced to bring Pix even closer to the way people already shop. Both are now available via Google Pay in Brazil, extending the experience of instant payments across digital and physical environments.

“Pix offers strong value to users, so we moved early to integrate it into Google Pay,” said Natacha Litvinov, Head of Payments Partnerships for Latin America at Google. The update highlights just how deeply Pix is woven into Brazil’s economic fabric, not just for e-commerce, but for daily transactions of all kinds.

With Google Lens, users can scan a Pix QR code using their camera or even a screenshot, and complete the payment using biometric authentication. In Chrome, the checkout process stays on the page: users simply copy the Pix code, select the linked account, review the details, and authorize the payment.

Enjoy more payments industry updates below👇 and I'll be back tomorrow!

Cheers,

NEWS

🇬🇧 Failed FinTech Zing lost $87m before HSBC axed it. The 2024 pre-tax loss for Zing’s holding company, incorporated as MP Payments, reflected a $88.4m impairment charge on its investments in subsidiaries. Zing reported an accumulated impairment loss of $131.7m since its establishment in July 2022.

🇺🇸 Payment Company Stripe to acquire crypto wallet provider Privy. The Privy news follows Stripe’s $1.1 billion acquisition of Bridge, a deal which accelerated an already growing wave of enthusiasm surrounding stablecoin. Continue reading

🇪🇸 Banco Santander launches Bizum payments in Spain to other countries. According to the bank, customers will be able to receive money "by simply selecting a contact from their address book and with the same level of security and trust that Bizum currently offers between Spanish bank accounts."

🇬🇧 Argentex shareholders approve acquisition by IFX Payments. The acquisition remains subject to receiving the regulatory approval from the FCA, DFSA, and Dutch Central Bank, the Court sanctioning the Scheme at the Court Sanction Hearing, and the delivery of a copy of the Scheme Court Order to the Registrar of Companies and the Scheme thereby becoming effective.

🇺🇸 PayPal USD (PYUSD) plans to use Stellar for new use cases. By potentially expanding to Stellar, PYUSD leverages the network's speed, low transaction costs, and ease of integration to enhance its utility for real-world payments, commerce, and micro-financing, offering an additional option to Ethereum and Solana.

🇺🇸 Fiserv CEO Mike Lyons embraces stablecoins. The payment processing giant is developing an infrastructure for its merchant customers to pay for goods and services with cryptocurrencies, the company’s CEO said in a presentation. Keep reading

🇮🇹 Klarna grows by 65% in Italy. Italian consumers are enthusiastically adopting flexible and interest-free payment formulas, both online and in physical stores. 5 million Italians are active on Klarna, equal to one in ten adults. It has also significantly strengthened its partner network in Italy, particularly in the technology sector.

🇮🇳 Uruguay-based dLocal partners with India's Juspay to strengthen cross-border payment capabilities. The partnership will strengthen the synergy between the two companies, offering customers access to dLocal's over 900 local and alternative payment methods (APMs) and the broad benefits of Juspay's payment ecosystem in fast-growing markets.

🇦🇺 Afterpay users are being asked to ditch BNPL services for mortgages and then offered credit cards. According to Afterpay, over 10% of 1,000 surveyed customers reported that a bank or mortgage broker requested they close their BNPL accounts during the home loan application process.

🇦🇺 Australian Payments Plus and G+D integrate least-cost routing. Together, they plan to develop eftops Click to Pay with integrated least-cost routing. Click to Pay is an online checkout experience that enables consumers to make fast, convenient, and secure purchases without manually entering card details.

🇺🇸 Corpay appoints Peter Walker as new CFO. Ron Clarke, Chairman and CEO of Corpay, expressed enthusiasm about Peter joining the company, stating that his blend of experience in both public and entrepreneurial CFO roles positions him to make an immediate impact.

🇨🇦 Calgary FinTech Finofo raises $3.3m to power global payments. The startup enables mid-market companies to streamline international payments and reduce foreign exchange losses. The funding was led by Watertower Ventures, with support from Motivate Venture Capital, SaaS Ventures, and Alberta-based early-stage investors.

🇸🇬 Whalet joins forces with TerraPay to empower SMEs with seamless global payouts. This collaboration is designed to empower Whalet's core customers-cross-border sellers from the Asia-Pacific region-by simplifying international financial transactions and boosting payment efficiency.

🇦🇺 Nexxtap teams up with Samsung to launch Tap to Phone payments. Through this move, Nexxtap and Samsung seek to improve the payment experience with simplified, embedded tap-to-pay functionality, with the two companies planning to eliminate the need for legacy terminals.

🇺🇸 Affirm boasts 2 million debit cards. The number of such cards the buy now, pay later provider has now made available is an increase of about 600,000 cards since January. Card users can use the Affirm card like a debit card, or they can use it to access the company’s buy now, pay later services.

🇨🇦 European FinTech Paynt acquires Canada-based E-xact transactions to accelerate North American Expansion. The acquisition of E-xact, which processes over CAD 3.5 billion annually across more than 50 million transactions, will add a new operational hub in Vancouver, Canada.

🇺🇸 Worldpay and Visa team to help merchants combat fraud, to enhance that company’s 3D Secure solution. This tool helps merchants reduce fraud while easing consumer friction and boosting authorizations. Read more

🇺🇸 Papaya Global and Deltek-Replicon partner to deliver a comprehensive global workforce payments and compliance solution. The partnership provides multinational enterprise clients across industries with compliant time and attendance in 85 countries, seamlessly connecting data and enhancing transparency and visibility of the full workforce management process.

🇬🇧 Yuno selects London as European headquarters to power global expansion. The announcement marks a significant milestone in Yuno’s international expansion and reinforces the company’s commitment to serving its growing base of global merchants and partners from the heart of Europe’s FinTech capital.

GOLDEN NUGGET

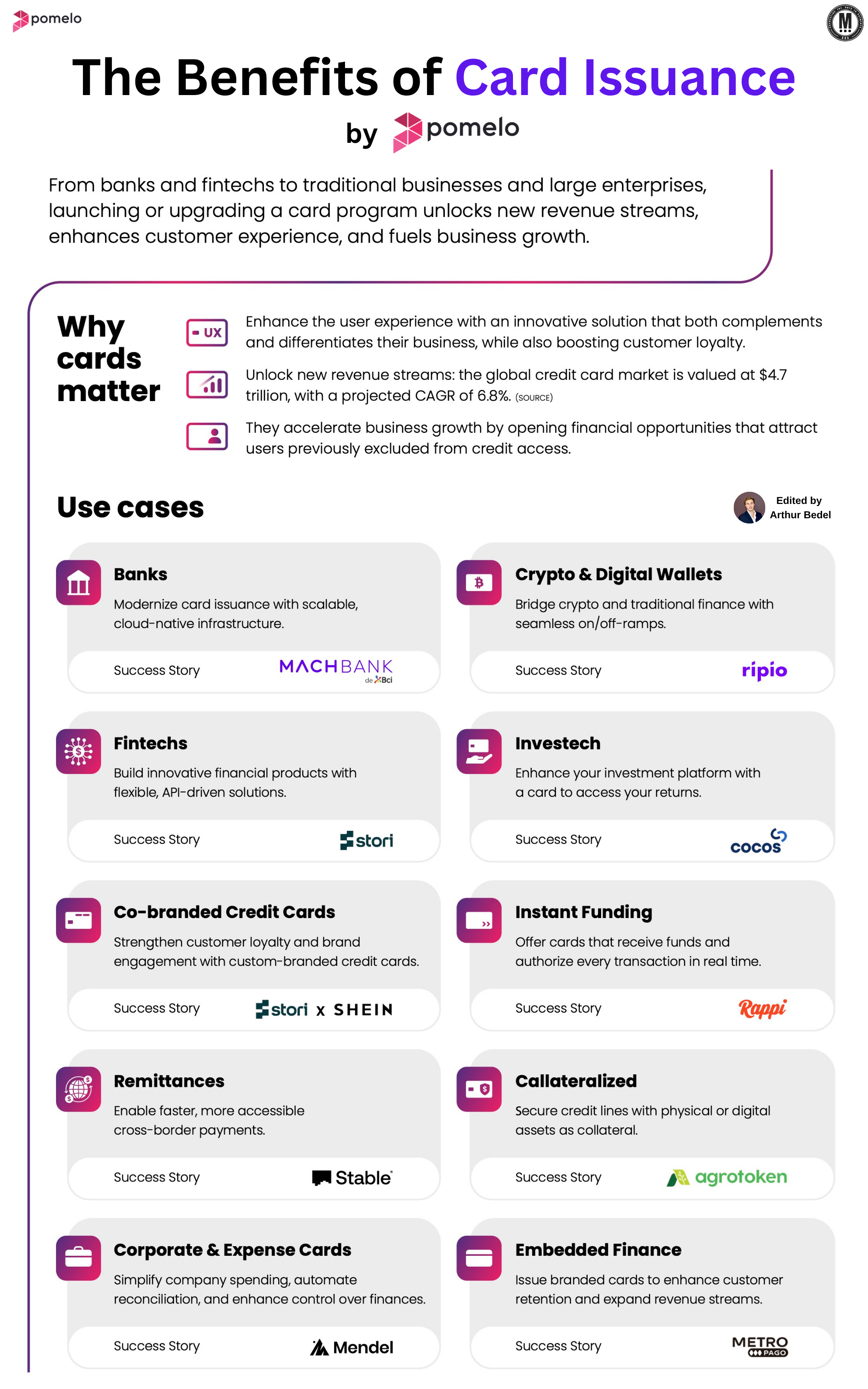

𝐂𝐚𝐫𝐝 𝐈𝐬𝐬𝐮𝐚𝐧𝐜𝐞 — The Benefits & Use Cases by Pomelo👇 Created by Arthur Bedel 💳 ♻️

From banks and FinTechs to global platforms and super apps, card issuance has become a powerful lever to unlock new revenue streams, drive user engagement, and enhance product differentiation.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐚𝐫𝐝 𝐈𝐬𝐬𝐮𝐚𝐧𝐜𝐞?

► Card issuance is the process of creating and managing branded payment cards—physical or virtual—that are linked to a customer’s account.

► These cards can be debit, credit, prepaid, or secured, and are issued via partnerships between brands, card networks (Visa, Mastercard), processors, and BIN sponsors.

𝐇𝐨𝐰 𝐢𝐭 𝐖𝐨𝐫𝐤𝐬:

► An issuer configures the card product with network and processor partners.

► Cards are provisioned—instantly or traditionally—and linked to user accounts.

► APIs and orchestration tools enable real-time funding, transaction routing, and lifecycle management.

𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬 — Where Card Issuance Delivers Value 💳

𝐁𝐚𝐧𝐤𝐬

Modernize card issuance with scalable, cloud-native infrastructure.

→ MACHBANK

𝐅𝐢𝐧𝐓𝐞𝐜𝐡𝐬

Build innovative financial products with flexible, API-driven solutions.

→ Stori

𝐂𝐫𝐲𝐩𝐭𝐨 & 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬

Bridge crypto and traditional finance with seamless on/off-ramps.

→ Ripio

𝐈𝐧𝐯𝐞𝐬𝐓𝐞𝐜𝐡

Enhance your investment platform with a card to access your returns.

→ Cocos

𝐂𝐨-𝐛𝐫𝐚𝐧𝐝𝐞𝐝 𝐂𝐫𝐞𝐝𝐢𝐭 𝐂𝐚𝐫𝐝𝐬

Strengthen customer loyalty and brand engagement with custom-branded credit cards.

→ Stori x SHEIN

𝐈𝐧𝐬𝐭𝐚𝐧𝐭 𝐅𝐮𝐧𝐝𝐢𝐧𝐠

Offer cards that receive funds and authorize every transaction in real time.

→ Rappi

𝐑𝐞𝐦𝐢𝐭𝐭𝐚𝐧𝐜𝐞𝐬

Enable faster, more accessible cross-border payments.

→ Stable Money

𝐂𝐨𝐥𝐥𝐚𝐭𝐞𝐫𝐚𝐥𝐢𝐳𝐞𝐝

Secure credit lines with physical or digital assets as collateral.

→ Agrotoken

𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 & 𝐄𝐱𝐩𝐞𝐧𝐬𝐞 𝐂𝐚𝐫𝐝𝐬

Simplify company spending, automate reconciliation, and enhance control over finances.

→ Mendel

𝐄𝐦𝐛𝐞𝐝𝐝𝐞𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐞

Issue branded cards to enhance customer retention and expand revenue streams.

→ MetroPago

𝐓𝐡𝐞 𝐒𝐭𝐫𝐚𝐭𝐞𝐠𝐢𝐜 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 of 𝐂𝐚𝐫𝐝 𝐈𝐬𝐬𝐮𝐚𝐧𝐜𝐞

✔ Improve user retention and product stickiness with branded payment experiences

✔ Create new monetization channels through interchange and value-added services

✔ Expand access to credit and payments across underserved segments

✔ Differentiate core offerings in a crowded financial services landscape

Card issuance is no longer just a financial product—it’s an infrastructure layer powering the next wave of embedded finance.

Source: Pomelo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()