Hala Goes Live on Samsung Wallet… While a Fraud Shock Ripples Through West Africa

Hey Payments Fanatic!

Hala is now integrated with Samsung Wallet.

And every transaction stays visible in real time inside the Hala app.

That means Hala Business Card users can tap and pay directly from their phone or smartwatch, locally and worldwide, while spending straight from their Hala account.

It’s a clean move... Contactless at the edge.

Full visibility in the back office. Another example of wallets quietly becoming the default interface for business spend.

A Very Different Signal from Africa

CinetPay, backed by Flutterwave, is under pressure after a fraud incident left a partner out of pocket by roughly $1.1M.

According to documents, the loss followed a cyber fraud attack that hit CinetPay’s systems across Côte d’Ivoire, Togo, and Burkina Faso, creating a liquidity crunch that is still unresolved months later.

For its partner D-Pay, the impact has been severe. Customer settlements had to be covered from working capital just to keep operations running.

What else is quietly shifting across Payments today? Scroll down 👇 Stay tuned, I'll be back tomorrow with more stories from the industry worldwide.

Cheers,

INSIGHTS

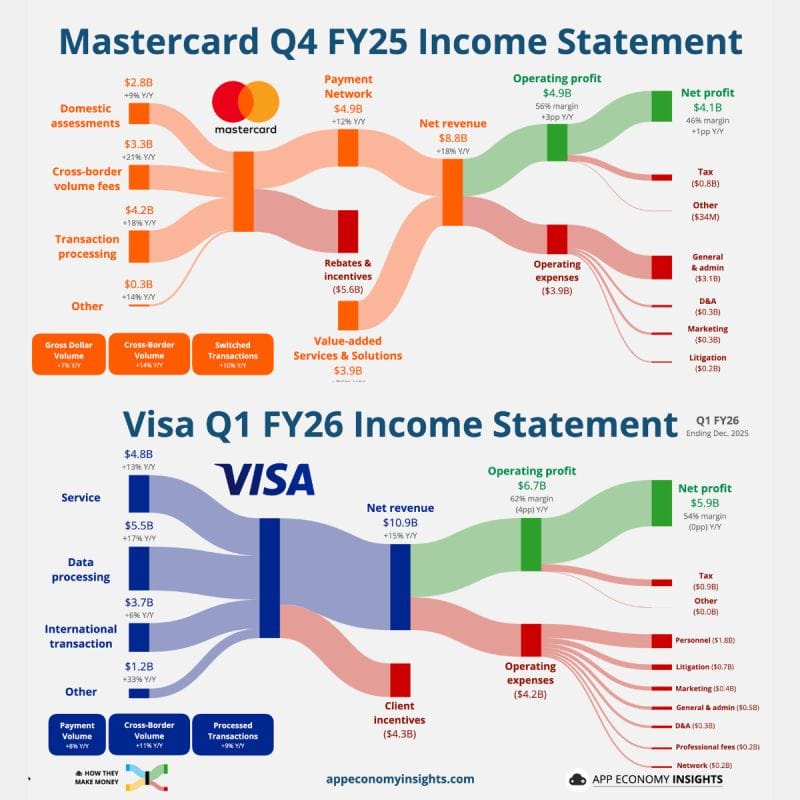

📈 Mastercard 🆚 Visa

A Comparison of Key Metrics in the Latest Income Statements👇

NEWS

🇸🇦 Hala Payment Solutions is now integrated with Samsung Wallet. Customers can now add their HALA card to Samsung Wallet and enjoy seamless, secure payments directly from their Samsung device. Learn more

🇨🇮 Flutterwave-backed CinetPay owes its partner USD 1.1m lost to a fraud incident. CinetPay is facing intensifying scrutiny as a new million-dollar dispute with a business partner emerges, compounding existing investigations into the company over alleged money-laundering and fraud in Senegal.

🌍 Bancomat, Bizum, EPI, SIBS, and Vipps MobilePay sign MoU to accelerate the rollout of sovereign, pan-European payment solutions. The cooperation brings together solutions that currently serve approximately 130 million users, creating immediate value for both consumers and merchants operating across borders.

🇺🇸 QuickBooks Payments to integrate Affirm’s flexible payment options. Affirm will be offered as a payment method to QuickBooks Online customers in the U.S. The addition of Affirm will strengthen the platform’s end-to-end financial management capabilities, enabling businesses to get paid up front while offering their customers the option of paying over time, the release said.

🇦🇪 NymCard enables stablecoin settlement with Visa in the GCC. By leveraging this alternative model, issuers can significantly lower operational costs, reduce collateral and prefunding requirements, and create a foundation for simpler multi-currency settlement in the future.

🇱🇺 Ripple receives a full EU electronic money institution license in Luxembourg. "Europe has always been a strategic priority for us, and this authorization allows us to scale our mission of providing robust, compliant blockchain infrastructure to clients across the EU," said Cassie Craddock, Managing Director, UK & Europe at Ripple.

🌎 Visa advances stablecoin settlements using the Ethereum network. Integrating a public blockchain into its settlement workflow signals that large financial institutions are increasingly viewing blockchain systems as mature and reliable enough for real-world financial operations.

🌍 Scalapay connects with PPRO. The partnership enables merchants and payment service providers (PSPs) to offer Scalapay through PPRO’s platform, providing faster and simpler access to BNPL in France, Belgium, Spain, Portugal, and Italy.

🇺🇸 Klarna backs Google’s Universal Commerce Protocol to enable agentic commerce across platforms. UCP enables consumers to shop seamlessly in AI conversations while giving agents, merchant systems, and payment providers a standardized way to interact across multiple AI platforms.

🇪🇬 CBE launches contactless “Soft POS” service, turning smartphones into payment terminals. The service enables merchants to convert their smart devices into electronic payment acceptance points, supporting transactions with various contactless cards.

🇧🇷 Pix will now be tracked across all banks to prevent fraud. According to the Central Bank, MED 2.0 allows tracking the flow of funds and sharing information with the financial institutions involved. This allows you to freeze funds in intermediary accounts and return the money within 11 days of filing a dispute.

🇬🇧 Former Griffin CCO Adam Moulson takes helm at Visa Direct UK and Ireland. Taking to LinkedIn to announce his appointment, Moulson says he will be "leading the growth of the business" and working to "shape the future of money movement in our region".

🇬🇧 Incard closes £10M Series A to expand its financial platform. Incard plans to focus on geographic expansion, continue investing in its app store, automation, and AI capabilities, and grow its engineering, compliance, and product development teams.

🇭🇰 Wonder raises USD 12 million venture debt from HSBC Innovation Banking to drive growth and expansion. The capital will help Wonder to scale its operations exponentially while continuing to innovate its full-stack omni-channel payments platform, serving a broad spectrum of industries.

🇬🇧 BOE is working on direct retail payments from banks and sidestepping cards. The Bank of England is working on a payment system that allows consumers to pay retailers out of their bank accounts without using cards, a move that could lower costs for retailers and consumers.

GOLDEN NUGGET

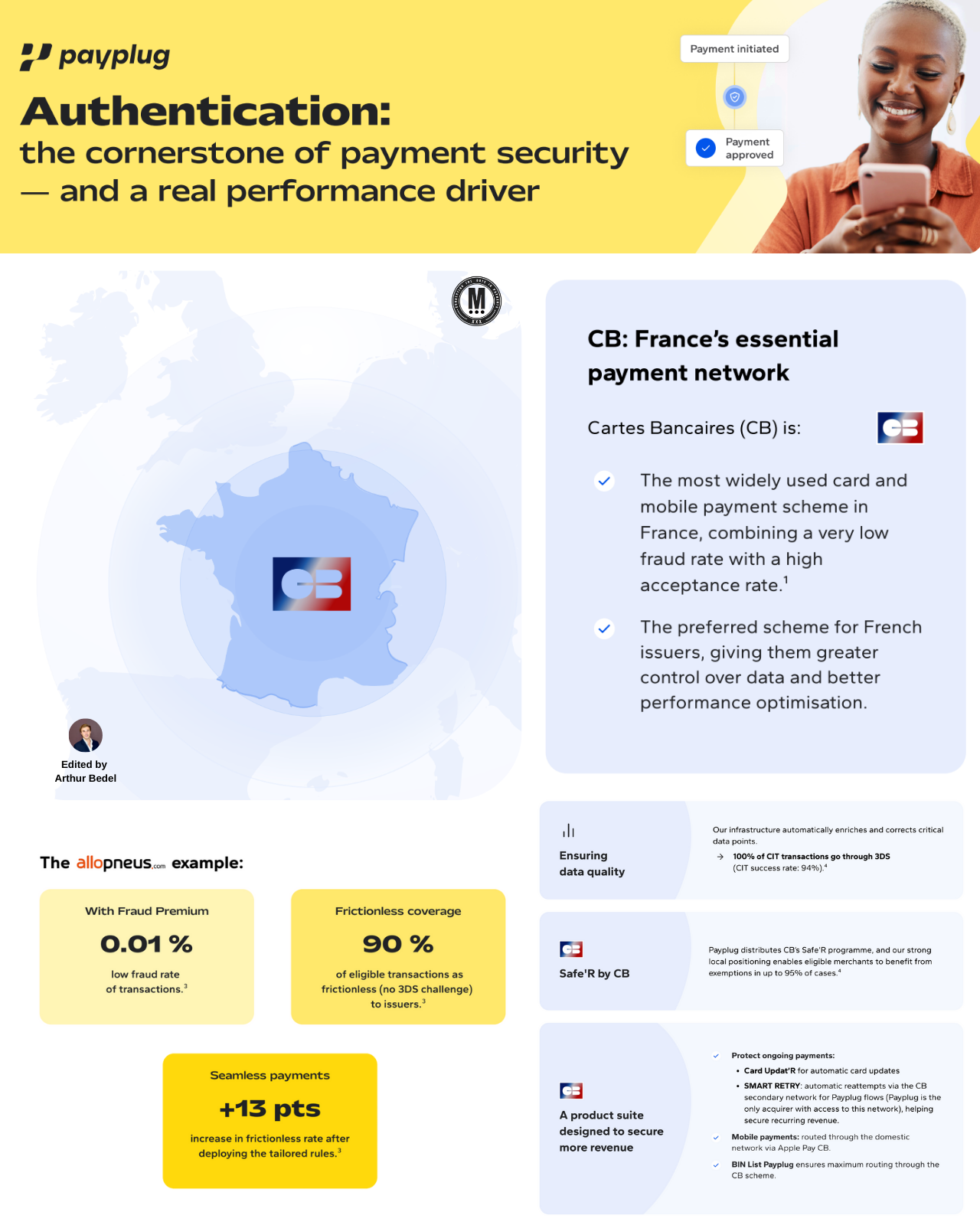

𝐋𝐨𝐜𝐚𝐥 𝐍𝐞𝐭𝐰𝐨𝐫𝐤𝐬 𝐚𝐫𝐞 𝐛𝐞𝐜𝐨𝐦𝐢𝐧𝐠 𝐚 𝐩𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲 — not just a payment rail👇 Created by Arthur Bedel 💳 ♻️

As authentication becomes stricter in Europe, payment performance now depends on how well a PSP understands local issuer behavior, data expectations, and domestic routing logic.

In France, GIE Cartes Bancaires (CB) is the perfect example of how a local network can materially improve fraud, routing, and acceptance outcomes.

The results speak for themselves: lower fraud, higher acceptance, and better control — simply by aligning with how French issuers prefer to authenticate and authorize.

Below is a clear breakdown of why local rails like CB give PSPs a measurable performance edge.

𝐓𝐡𝐞 𝐏𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 𝐋𝐚𝐲𝐞𝐫𝐬 — decoded

1️⃣ 𝐃𝐚𝐭𝐚 𝐐𝐮𝐚𝐥𝐢𝐭𝐲 & 𝐄𝐧𝐫𝐢𝐜𝐡𝐦𝐞𝐧𝐭

→ Local issuers are extremely sensitive to missing or inconsistent data.

→ PSPs like Payplug enrich and correct critical fields automatically, achieving 100% CIT routing through 3DS with a 94% success rate.

↳ Better data = fewer soft declines.

2️⃣ 𝐃𝐨𝐦𝐞𝐬𝐭𝐢𝐜 𝐈𝐬𝐬𝐮𝐞𝐫 𝐋𝐨𝐠𝐢𝐜 & 𝐄𝐱𝐞𝐦𝐩𝐭𝐢𝐨𝐧𝐬

→ Local networks give acquirers access to domestic intelligence that international rails can’t match.

→ Through 𝐂𝐁’𝐬 𝐒𝐚𝐟𝐞’𝐑 program, PSPs can obtain exemptions for up to 95% of eligible transactions, unlocking major gains.

3️⃣ 𝐋𝐨𝐜𝐚𝐥 𝐑𝐨𝐮𝐭𝐢𝐧𝐠 & 𝐀𝐜𝐜𝐞𝐩𝐭𝐚𝐧𝐜𝐞 𝐎𝐩𝐭𝐢𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧

→ French issuers consistently prefer CB routing.

→ PSPs that leverage this correctly — from standard e-commerce to Apple Pay CB — achieve stronger approval rates and fewer unnecessary challenges.

4️⃣ 𝐅𝐫𝐚𝐮𝐝 𝐂𝐨𝐧𝐭𝐫𝐨𝐥 𝐁𝐮𝐢𝐥𝐭 𝐟𝐨𝐫 𝐋𝐨𝐜𝐚𝐥 𝐑𝐢𝐬𝐤 𝐏𝐫𝐨𝐟𝐢𝐥𝐞𝐬

→ Domestic fraud patterns differ significantly from international ones.

→ Payplug’s model shows that aligning fraud scoring with issuer expectations can simultaneously lower fraud and raise acceptance.

5️⃣ 𝐑𝐞𝐯𝐞𝐧𝐮𝐞 𝐏𝐫𝐨𝐭𝐞𝐜𝐭𝐢𝐨𝐧 & 𝐒𝐦𝐚𝐫𝐭 𝐑𝐞𝐭𝐞𝐧𝐭𝐢𝐨𝐧 𝐓𝐨𝐨𝐥𝐬

Recurring payments benefit massively from domestic routing:

→ 𝐂𝐚𝐫𝐝 𝐔𝐩𝐝𝐚𝐭’𝐑 for automatic card refresh

→ 𝐒𝐌𝐀𝐑𝐓 𝐑𝐄𝐓𝐑𝐘 using CB’s secondary network for optimized retries

→ Mobile payments routed through domestic rails for consistency

↳ These tools keep revenue flowing — especially for subscription-heavy merchants.

𝐓𝐡𝐞 Allopneus.com 𝐬𝐭𝐨𝐫𝐲 — proof in the data

A merchant operating at scale saw dramatic improvements after deploying tailored rules aligned with CB:

• 0.01% fraud rate

• 90% frictionless coverage

• +13 pts frictionless rate after optimization

This is what happens when authentication, routing, and domestic intelligence work together.

Local networks are not optional. They are performance infrastructure — and PSPs that fully leverage them will deliver materially better outcomes.

Source: Payplug

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()