India Just Launched Payments on ChatGPT

Hey Payments Fanatic!

India 🇮🇳 just did it again.

The country’s payments powerhouse — NPCI — just teamed up with Razorpay and OpenAI to launch a pilot that lets users shop directly inside ChatGPT, powered by UPI.

Yep, you can now chat your way to checkout.

Razorpay and OpenAI to launch a pilot that lets users shop directly inside ChatGPT

It’s the first real test of what the industry calls Agentic AI payments, where AI assistants don’t just find things for you, they actually buy them on your behalf (safely, securely, and under your control).

Bigbasket is the first e-commerce platform on board, with Axis Bank and Airtel Payments Bank handling the rails.

Razorpay CEO Harshil Mathur summed it up perfectly:

“We’re transforming AI assistants from simple discovery tools into full-fledged shopping agents.”

Also from India, a new report dropped with UPI stats that will blow your mind 🤯

Scroll down to check it out 👇

Enjoy your weekend, and I’ll be back in your inbox on Monday!

Cheers,

INSIGHTS

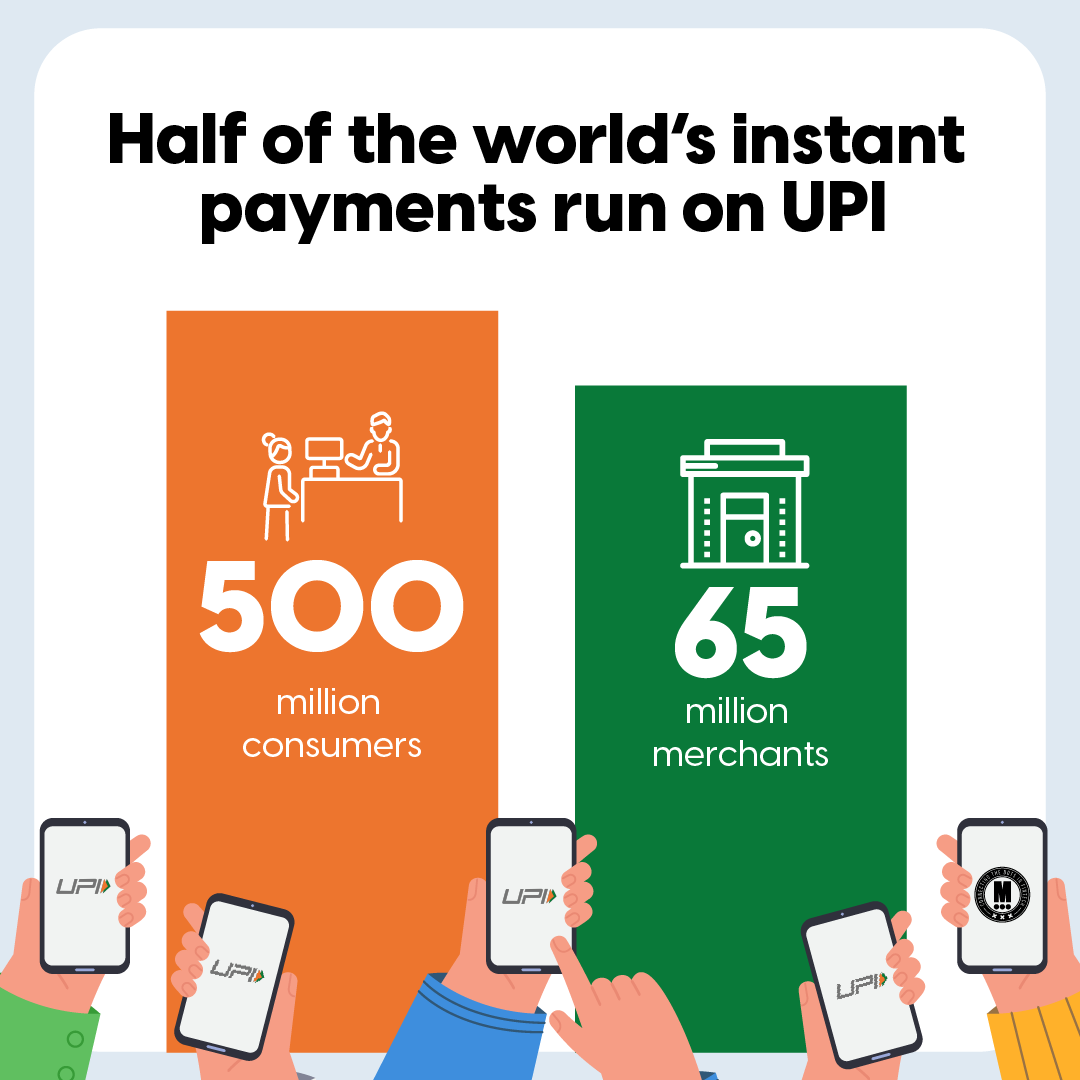

🇮🇳 India’s UPI is accounting for nearly 50 per cent of global real-time payment volumes 🤯

NEWS

🇵🇹 Elecctro and Getnet are leading the way in seamless EV charging in Portugal. Now, users can simply tap their bank card to pay at charging stations, no subscriptions, no apps, no long-term commitments required. Together, they're reshaping the EV charging landscape with a focus on simplicity, security, and scalability.

🇪🇸 Bizum celebrates its 9th anniversary with 30 million users and is leading the transformation of digital payments in Spain and Europe. Since its launch in 2016, Bizum has experienced exponential growth, incorporating new uses and features to facilitate and improve the lives of the Spanish society.

🇧🇷 Pomelo expands its solutions in Brazil, enabling companies to issue postpaid credit cards through partnerships with Central Bank–licensed institutions. This new structure removes licensing barriers, enabling customers to charge interest, launch products more quickly, and compete in the credit market with greater flexibility and lower costs.

🇺🇸 Moving from payments coordination to payments orchestration by ACI Worldwide. Merchants need a modern, centralized payment platform to keep up with savvy shoppers demanding a frictionless experience with the latest alternative payment methods. Download the whitepaper here

🇩🇪 Sibos 2025: Tokenisation moves centre stage. At Sibos 2025 in Frankfurt, tokenisation dominated discussions as the future of global finance. ACI Worldwide’s Philip Bruno highlighted tokenisation’s potential to accelerate economic growth through faster money movement. Keep reading

🇬🇧 Innovation and Security at Ecommpay. At a recent fireside chat with Erica Stanford and Charles Kerrigan, Willem Wellinghoff highlighted the growing threat of AI-driven scams, deepfakes, and crypto-fuelled fraud networks. Ecommpay echoed this message, emphasizing that innovation and security must advance together.

🇺🇸 Citi Ventures invests in BVNK to power the next generation of financial infrastructure. Arvind Purushotham, Head of Citi Ventures, noted the growing interest in using stablecoins for settling on-chain and crypto asset transactions, highlighting BVNK’s enterprise-grade infrastructure and strong track record as key reasons for Citi’s investment.

🇺🇸 DEUNA appoints Chase Foster as Head of US, including GTM & Sales. He’ll lead DEUNA’s U.S. expansion, driving growth and awareness of Athia, its agentic intelligence system transforming payments through actionable data. His leadership marks a pivotal step as the company scales in the world’s most competitive commerce ecosystem.

🇮🇳 India rolls out pilot for e-commerce payments via ChatGPT. The pilot will evaluate how the service can be expanded across verticals and how UPI can be used to enable AI agents with payment credentials "to autonomously complete transactions on behalf of users in a safe, secure, and user-controlled manner," the companies said in a statement.

🇺🇸 Affirm extends its collaboration with Google as a supporter of Agent Payments Protocol (AP2). By contributing to AP2, Affirm is helping embed BNPL directly into the architecture of agentic commerce and shaping a payments ecosystem designed for accountability and trust.

🇯🇵 PayPay and Binance Japan form a strategic alliance to drive the future of digital finance. Together, the companies aim to make Web3 and digital assets more accessible to everyday users in the country. Initial integration will enable Binance Japan users to purchase crypto using PayPay Money and withdraw directly into PayPay Money.

🇩🇪 Vivid Money launches Card Terminals with 1-Second Payouts, which transfer payment revenue to business accounts in one second, ending multi-day settlement delays for small businesses. The launch extends Vivid Money's all-in-one platform from digital finance into in-person payments.

🇺🇸 PayPal unleashes the power of retail media for small businesses, enabling them to join the billion-dollar advertising boom. PayPal Ads Manager will help small businesses create billions of new advertising impressions for brands of all sizes by utilizing a fast-growing and highly profitable segment of digital advertising.

🇬🇧 G20's cross-border payments push set to miss 2027 target. Goals set in 2021 included cutting the global average cost of a retail payment to no more than 1% and for 75% of wholesale and retail payments to be credited within an hour of being made. Read more

🇧🇭 STC Pay intends to expand regionally and double its growth. In an exclusive interview, Metin Zavrak noted that this expansion marks a bigger push from the whole group. He affirmed that some other discussions are going on, as the team is actively working to scale business in neighboring countries and North Africa later on.

🇬🇧 LemFi introduces AI-powered 'send now, pay later' service. Send Now, Pay Later aims to address this critical pain point and provide vital service to customers who are new to the country and have a limited UK credit history. Keep reading

🇮🇳 Wise is to launch a travel card in India. In June, Wise received in-principle approval from the RBI to operate as a cross-border payment aggregator for export transactions. It also opened a full-stack hub in Hyderabad, its second in the APAC region.

🌍 Yapily supports Google to provide bank account verification services for business customers to power its bank account verification service for business customers across Europe, marking a major milestone in open banking’s expansion. Yapily continues to strengthen its position in the sector.

🇺🇸 Square offers Bitcoin payments for merchants as crypto adoption accelerates. Square launched a feature enabling local businesses to accept Bitcoin at the point of sale and hold the digital asset in an integrated wallet, helping advance Bitcoin’s use as a medium of exchange.

🇬🇧 PayCaptain and ClearBank partner to deliver real-time payroll payments and embedded savings accounts for employees at over 300 corporate clients, specialising in the hospitality and retail sectors. Long-term partnership delivers an easy, transparent approach for employees to build savings and enhance their financial resilience.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()