Intuit Taps Affirm… and Unlocks $2 Trillion in Invoices

Hey Payments Fanatic!

Intuit has officially named Affirm its exclusive pay-over-time partner for QuickBooks.

The pitch is straightforward. SMBs struggle with cash flow. Intuit data shows 56% of businesses are owed money at any given time, with an average of $17,500 in unpaid invoices per company. This partnership aims to close that gap.

The numbers back the ambition. Over $2 trillion in invoices flow through the platform annually. Affirm gains access to massive volume. Merchants get paid upfront. Affirm takes the repayment risk...

Competition is real. Stripe. PayPal. Klarna. But QuickBooks holds the ledger. By embedding BNPL directly into the invoice, they aren't just offering a payment method; they are solving a liquidity crisis.

"By partnering with Affirm to bring native, pay-over-time functionality to QuickBooks, we are giving businesses a powerful new way to increase conversion and improve cash flow", said David Hahn, EVP, GM, Services Group, Intuit.

What else is quietly shifting across Payments today? Scroll down 👇 I'll be back tomorrow with more updates.

Cheers,

INSIGHTS

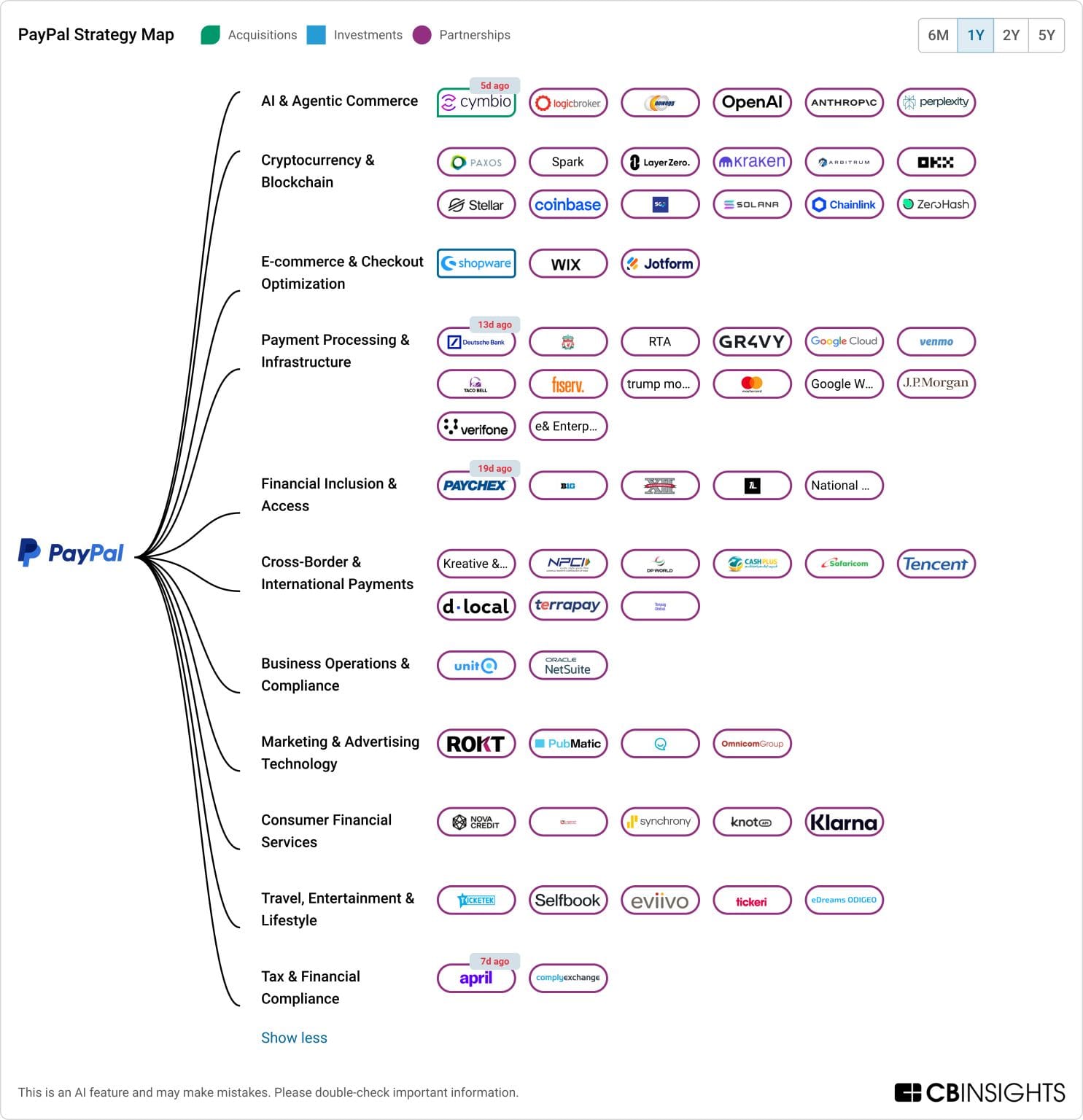

➡️ PayPal just broke a five-year acquisition drought.

And this move says a lot about PayPal's Strategy👇

NEWS

🇬🇧 Checkout.com announces strategic partnership with Spotify to power efficient, scalable payments globally. The partnership will enable Checkout.com to provide global acquiring services for Spotify to deliver a smooth, secure, and reliable payments experience for its global audience of more than 700 million monthly active users and more than 280 million paying subscribers.

🇩🇪 Airwallex expands to Germany. Airwallex aims to differentiate itself by enabling faster international payments and local accounts across markets, with the goal of quickly attracting several thousand active customers in Germany. Keep reading

🇱🇺 Wero is now available at Banking Circle. The initiative is designed to simplify cross-border payments and scale adoption across Europe, aligning with Banking Circle’s role as a modern-infrastructure bank supporting payment service providers as new schemes and volumes emerge.

🇺🇸 Intuit partners with Affirm to provide a pay-over-time offering for QuickBooks Online. Through the partnership, many businesses will have the ability to offer Affirm’s flexible payment options to their customers, while enabling businesses to attract new customers, boost conversion rates, maximize sales, and improve cash flow.

🇨🇳 Visa Direct and UnionPay International will extend the global money movement network to billions of cards in the Chinese mainland. By connecting Visa Direct’s global money movement network to UPI’s MoneyExpress platform, Visa will provide a more seamless, secure, and transparent way for consumers and businesses worldwide to send money into Chinese Mainland, one of the world’s largest remittance destinations.

🌍 London FinTech Teya launches in Spain and Italy amid European expansion. According to Teya, the growing SME economies of Spain and Italy present a significant opportunity for FinTech to be a financial ally to small businesses. Teya’s expansion follows the launch of product innovations for its 75,000-strong European customer base.

🇺🇸 Merchant Rentals partners with FreedomPay to deliver flexible financing solutions for merchants. By collaborating with Merchant Rentals, FreedomPay can now offer merchants access to tailored leasing and financing options for POS technology, meeting growing demand for flexibility and affordability in the retail and hospitality sectors.

🇺🇸 Samsung Electronics plans to expand the scope of Samsung Wallet's global payment American Express cards. The existing Samsung Wallet has supported Mastercard and Visa payments overseas, and Amex card users can now use overseas payments through Samsung Wallet without a physical card.

🇬🇧 Clear Junction launches onChain stablecoin pay-in service. onChain Stablecoin Pay-In is designed for banks, electronic money institutions, and money service businesses. Through their own apps or online banking environments, clients can offer their customers stablecoin-based prefunding while maintaining a fiat-first operational experience.

🇦🇪 botim money expands global remittances through TerraPay’s Partnership. This partnership enables botim money users to send funds through direct bank transfers and instant mobile wallet payouts, supported by TerraPay’s global payments network.

🌎 alfred raises $15m in Series A funding. The company intends to use the funds to strengthen its technological, regulatory, and operational infrastructure across Latin America and extend its support to companies operating regional cross-border payments at scale.

🇵🇭 Coins.ph joins Circle payments network to enable Philippine Peso payouts. The move is designed to reduce the friction often associated with traditional international transfers, offering potentially lower fees and faster access to funds for recipients.

🇫🇷 Sumeria partners with Mistral AI. The company has launched a simplified bank transfer feature that uses Mistral AI’s latest OCR models to allow users to initiate payments directly from documents without manual data entry. Read more

🌎 Paysafe enables FuturePay’s Latin American expansion with a local payments suite. To support its Latin American market entry, FuturePay has integrated Paysafe’s SafetyPay solution to enable merchants to offer customers in the region bank transfers, online cash, and other local payment methods, including Pix for Brazil.

🇺🇸 Lydian enables crypto acceptance for Fiserv Clover merchants. The app will allow merchants to accept payments from more than 300 digital assets, including USDT, Bitcoin, and Ethereum, directly at the point of sale or online, while continuing to receive settlement in their local currency.

🌎 Adyen and Fresha surpass $5.5 million in capital issued. The offering is now live in the US, UK, Australia, Canada, Netherlands, Finland, and Sweden, with over $5.5 million in loans issued to date. This launch strengthens Fresha's financial product ecosystem, enabling small and medium businesses across the platform to access working capital quickly and seamlessly to fund their growth.

🇺🇸 PayPal appoints Enrique Lores as Chief Executive Officer and David W. Dorman as Independent Board Chair. The appointment follows a detailed evaluation conducted by the Board of Directors on the current position of the company relative to its competition and the broader industry landscape.

🇰🇷 Upbit partner KBank files stablecoin wallet trademarks ahead of IPO. In its IPO registration statement, the bank said it plans to use proceeds from the offering to accelerate its digital asset business, among other initiatives. Continue reading

🇩🇴 Qik launches remittances to receive money from abroad. With this feature, the bank said that funds sent from abroad are credited in less than 30 minutes. This benefit applies to remittances from the United States and other countries whose remittance companies operate with Visa Direct.

🇿🇦 South Africa’s first institutional rand stablecoin, ZARU, launches. ZARU is designed to modernise payment and financial infrastructure, enabling both retail and institutional users to transact at the speed of the internet while bolstering the local financial system.

GOLDEN NUGGET

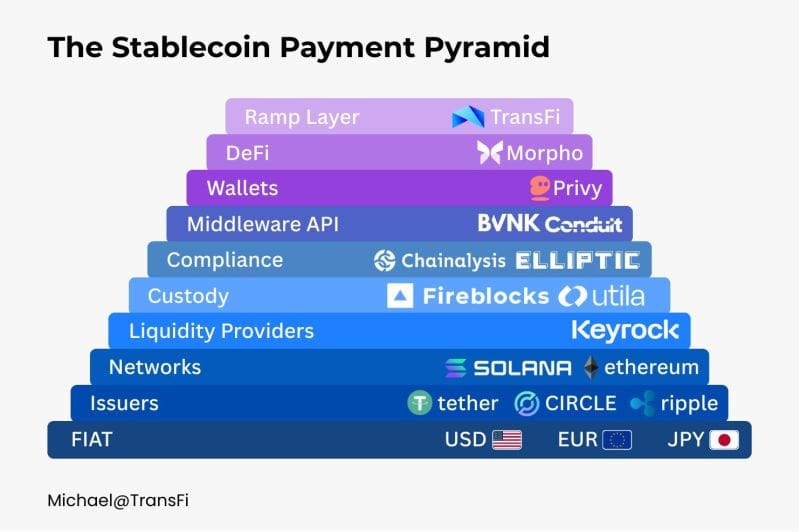

The 𝗦𝘁𝗮𝗯𝗹𝗲𝗰𝗼𝗶𝗻 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗣𝘆𝗿𝗮𝗺𝗶𝗱

Every real-world stablecoin payment runs through all of these layers:

► 𝗙𝗶𝗮𝘁 – USD, EUR, JPY. The credibility anchor.

► 𝗜𝘀𝘀𝘂𝗲𝗿𝘀 – minting fully-backed stablecoins (USDT, USDC, etc.).

► 𝗡𝗲𝘁𝘄𝗼𝗿𝗸𝘀 – Ethereum, Solana and others where settlement actually happens.

► 𝗟𝗶𝗾𝘂𝗶𝗱𝗶𝘁𝘆 𝗣𝗿𝗼𝘃𝗶𝗱𝗲𝗿𝘀 – FX, pricing, and conversion between rails and tokens.

► 𝗖𝘂𝘀𝘁𝗼𝗱𝘆 – securing assets, keys, governance, MPC.

► 𝗖𝗼𝗺𝗽𝗹𝗶𝗮𝗻𝗰𝗲 – transaction monitoring, sanctions, traceability.

► 𝗠𝗶𝗱𝗱𝗹𝗲𝘄𝗮𝗿𝗲 𝗔𝗣𝗜𝘀 – abstracting blockchain complexity into payments infra.

► 𝗪𝗮𝗹𝗹𝗲𝘁𝘀 – addresses, keys, and transaction UX for users and apps.

► 𝗗𝗲𝗙𝗶 – yield, lending, liquidity, capital efficiency.

► 𝗥𝗮𝗺𝗽 𝗟𝗮𝘆𝗲𝗿 – on/off-ramps that connect crypto back to local bank accounts.

My takeaway: adoption accelerates when the last mile disappears. Users don’t want “a stablecoin strategy”, they want payroll, payouts, and checkout that just works.

Source: Michael Ngo at TransFi

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()