Klarna Cited Again in Norway Over Credit Rules

Hey Payments Fanatic!

Klarna is back in the spotlight, this time in Norway. The country’s Consumer Council has reported the company to the Consumer Authority, claiming Klarna is not following the rules when offering credit.

The issue is not just what Klarna offers, but how it presents the cost of buying with credit. Norwegian law requires companies to clearly explain what customers are signing up for, including examples with interest rates. According to the Consumer Council, Klarna leaves this out of posters, online shops, and across its ads.

“We believe Klarna is not complying with the marketing regulations for credit,” said Guro Sollien Eriksrud from the Consumer Council. Klarna confirmed the complaint was received but did not share further details.

This is not the first warning. Last year, Norway’s Financial Supervisory Authority said Buy Now Pay Later services count as credit, which means companies like Klarna must run credit checks before allowing customers to delay payments.

The pressure is growing across borders. A few weeks ago, a Dutch court ruled against Klarna, saying it did not prove it avoided profit from late fees. The judge pointed to signs that Klarna may be acting like a lender, which would trigger stricter regulation.

For Klarna, the question now is whether its model can hold up under closer inspection or if it will need to adapt.

Enjoy more payments industry updates below👇 and I'll be back tomorrow!

Cheers,

Discover FinTech innovation across APAC. Stay informed with weekly updates—join now!

NEWS

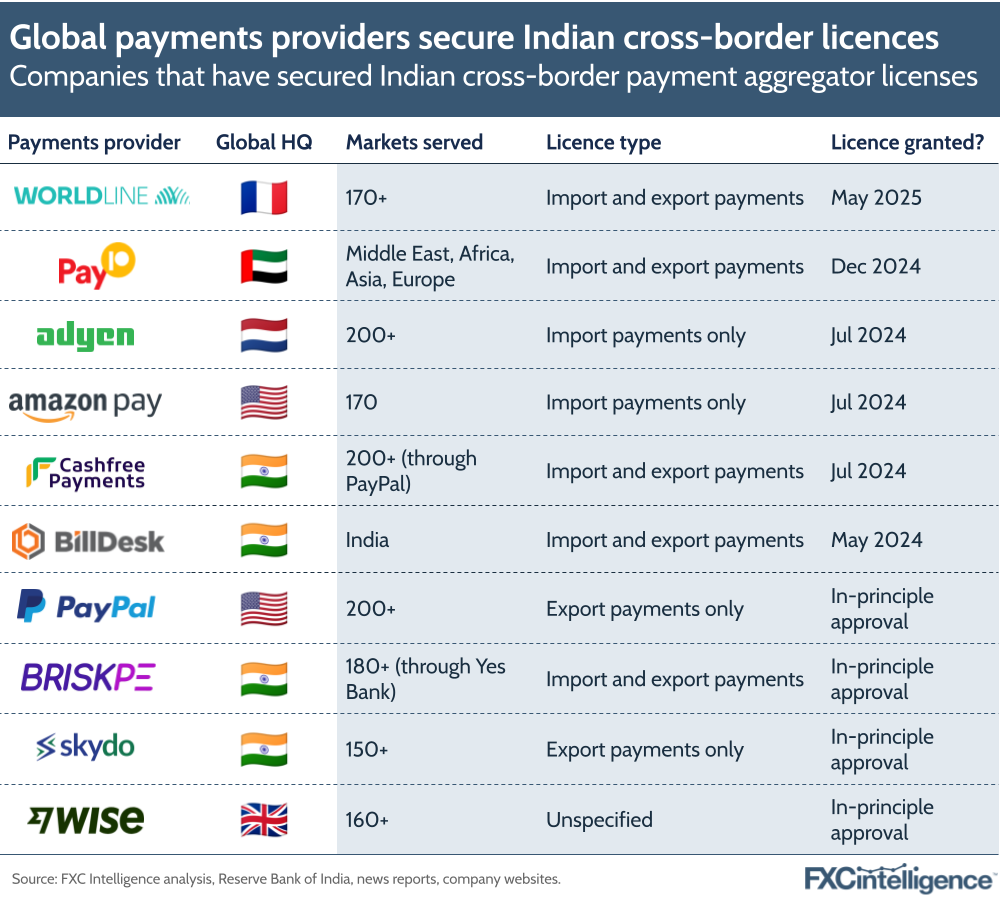

🇮🇳 PayPal and Worldline highlight growing India opportunity.

🇧🇷 Visa launches new company in Brazil to enter PIX. The move is part of Visa's global strategy to transform itself into a financial transaction technology company, going beyond credit and debit cards. For e-commerce is the reduction of friction and the potential increase in conversion.

🇺🇸 Fasten partners with Visa's Fast Track Program to launch a rewards card. This card is designed to provide value to both consumers and dealerships by simplifying car payments and fostering loyalty in the automotive industry. Fasten is granted access to various resources, simplified onboarding, risk, and fraud management solutions.

🇺🇸 Apple, X, and Airbnb among growing number of Big Tech firms exploring crypto adoption. The interest from Big Tech comes as stablecoins have attracted millions in venture funding and lawmaker attention as Congress weighs two bills that would regulate the asset class.

🇮🇪 Fiserv to acquire AIB Merchant Services. Focus remains on delivering market-leading solutions to SMEs across Ireland and the broader European market. The transaction is subject to regulatory approvals and closing conditions and is expected to close in the third quarter.

🇫🇷 Lemonway acquires PayGreen’s Business. This acquisition enables Lemonway to extend its expertise to e-commerce sites, complementing its historically marketplace-focused offering and third-party account payment solutions. The team of 11 employees will now form Lemonway’s e-commerce department.

🇩🇪 Deutsche Bank explores stablecoins and tokenized deposits. The bank is also assessing the development of its own tokenized deposit solution for use in payments, intending to improve efficiency. Read more

🇺🇸 PopID closes equity financing. The additional capital will allow it to work with its partners to build critical infrastructure to support an open-loop, global biometric network that can connect point-of-sale solutions to any loyalty program, card payment method, FinTech wallet, BNPL platform, stablecoin product, or PBB scheme.

🇧🇸 Commonwealth Bank and Mastercard bring Apple Pay to customers in the Bahamas. Customers can use Apple Pay on iPhone, iPad, Apple Watch, and Mac to make faster and more convenient purchases in apps or on the web without having to create accounts, card details, or shipping and billing information.

🇺🇸 Former Stripe exec Will Larson named new Imprint CTO. In his new role, Larson will oversee Imprint's engineering team and technology strategy, focusing on enhancing the company's cloud-based credit card and banking platform. His responsibilities include implementing AI and machine learning capabilities across the organisation and its systems.

🇮🇳 IPO-bound PhonePe announces UPI payments on feature phones. This innovative feature-phone UPI app will provide essential capabilities such as peer-to-peer transfers and offline QR payments, specifically designed to cater to the often overlooked feature phone demographic.

🇰🇿 Kazakhstan’s National Bank rolls out crypto card for instant conversion to fiat. Kazakhstan’s crypto card is designed as a non-cash payment solution within the Astana International Financial Centre (AIFC). Users need a crypto wallet from a licensed digital asset service provider to use the card for everyday transactions.

🇺🇸 ThetaRay and Spayce team up to fight financial crime using cognitive AI. Spayce has integrated ThetaRay’s solution into its global payment infrastructure, optimising its financial crime detection capabilities. This solution analyzes large volumes of transaction data, identifying subtle suspicious activities and uncovering financial crime schemes with precision.

🌍 Tether backs Shiga Digital to boost blockchain finance across Africa. The partnership supports blockchain-based financial tools designed for businesses in emerging markets. This move signals Tether’s broader intention to enhance financial access through USDT in underserved regions.

🇺🇸 The Circle IPO leaves $1.72 billion on the table and is the seventh-largest underpricing in decades. If competition rises and times get tough, Circle and its shareholders may sorely miss the extra almost $1.7 billion that went to first-day gains for the underwriters’ clients and not into its coffers. That’s over ten times its profits from last year.

🇺🇸 Uber eyes stablecoins to cut global payment costs, CEO Dara Khosrowshahi says bitcoin is a 'proven commodity'. His comments come amid a broader push within the tech sector to evaluate the role of digital assets in everyday transactions, particularly those involving mobility and delivery Services.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()