Klarna Launches an Open Standard for Agentic Commerce… Here's Why It Matters

Hey Payments Fanatics!

Klarna just launched its Agentic Product Protocol, an open standard designed to make products readable and usable by AI agents.

Think scale first. Over 100M products. Around 400M live prices. All structured and standardized across 12 markets.

As AI becomes the new shopping interface, this protocol gives agents something they’ve been missing. A clean, live product layer that they can actually reason on.

David Sykes, Chief Commercial Officer of Klarna, says it best: "Before agents can buy, they need to know what exists. Klarna’s Agentic Product Protocol defines a common language for how AI systems and merchants exchange product data."

Merchants plug in once and show up everywhere. No reformatting. No ads. No intermediaries. Just products, prices, and availability in real time. This quietly positions Klarna deeper in the commerce stack, well beyond payments.

What really caught my eye is that Klarna made this an open standard from day one. No walled garden. That choice says a lot about how seriously they’re taking agent-driven commerce.

Curious to stay ahead of today’s Payments shifts? Scroll down and catch the highlights. I’ll be back in your inbox tomorrow. 👇

Cheers,

INSIGHTS

🇺🇸 The Stripe Mafia has raised more than $110 billion in total funding 🤯

And the alumni list behind that number is even crazier:

NEWS

🇬🇧 Ecommpay presents Festive Payment Mixers, a playful, limited-edition eBook that reimagines 12 classic holiday cocktails through the world of payments. Each drink pairs festive flavours with core payments concepts, offering a light-hearted way to reflect on the systems behind secure transactions and smooth customer experiences.

➡️ Payments modernisation: How PSPs and acquirers are accelerating global merchant growth. The Finextra webinar, in association with ACI Worldwide, explores how payment service providers, acquirers, and FinTechs can drive global merchant growth through payments modernisation, focusing on integrated, flexible, and scalable payment strategies. Join this webinar

🇺🇸 Klarna launches Agentic Product Protocol. The protocol enables AI systems to find, compare, and recommend real products with current pricing and availability, while allowing merchants to connect once via a hosted API and reach multiple AI platforms without reformatting feeds.

🇮🇳 Paytm infuses Rs 2,250 crore into payments arm amid investor churn. The capital infusion strengthens PPSL at a time when Paytm has seen notable reshuffling among its institutional shareholders. Continue reading

🇨🇳 Alipay and Rokid open smart glasses ‘look-and-pay’ to developers, allowing them to integrate hands-free transactions into apps via the Model Context Protocol for the Rokid Spatial Joy 25 competition, accelerating immersive payments by enabling interaction with Alipay QR codes and tap-to-pay terminals on AR glasses, building on Ant International's push for AI payments, including iris authentication.

🇦🇪 Visa expands global travel program with Dubai launch, offering curated experiences for cardholders. The program is designed to give Visa cardholders access to exclusive benefits, premium offers, and unique opportunities, showcasing the very best of Dubai’s hospitality, culture, and lifestyle.

🇺🇸 Visa unveils new global stablecoins advisory practice. The new value-added service offering by Visa Consulting & Analytics (VCA) provides actionable insights and recommendations to guide banks, fintechs, merchants, and businesses of all sizes on market fit, strategy, and implementation.

🌎 Volt taps BVNK to add stablecoin acceptance to its checkout. The offering targets digital-native businesses with high transaction volumes, reflecting the growing demand from crypto-native consumers to spend directly from self-custody wallets.

🇬🇧 Currensea strengthens open banking expertise with ex-Ecospend hires. Currensea announces the appointments of James Hickman as Commercial Director and George Head as Head of Business Development. They bring deep commercial expertise and a strong track record of developing and scaling successful applications built around Open Banking.

🇺🇸 MassPay integrates Visa Direct for global B2B instant payout solutions, to enable faster payouts to cards, bank accounts, and digital wallets through MassPay's proprietary orchestration platform. Read more

🇺🇸 MassPay names co-founder Ran Grushkowsky as new CEO. Grushkowsky brings 20 years of experience to the role and has helped build and scale a number of businesses, having sold his first company at age 16. Read more

🇩🇰 Customers in Denmark can now access ViaBill’s Pay Later installment plans with Apple Pay. With Viabill Pay Later, eligible customers can split purchases into predictable monthly installments with clear pricing and a full overview of the payment schedule before they confirm their purchase.

🇮🇹 Tether’s bid to buy Italian soccer Club Juventus was rejected. Exor has unanimously rejected Tether’s all-cash offer to buy its 65.4% stake in Juventus, stating it has no intention of selling any shares despite Tether’s proposal to invest an additional $1 billion in the club.

GOLDEN NUGGET

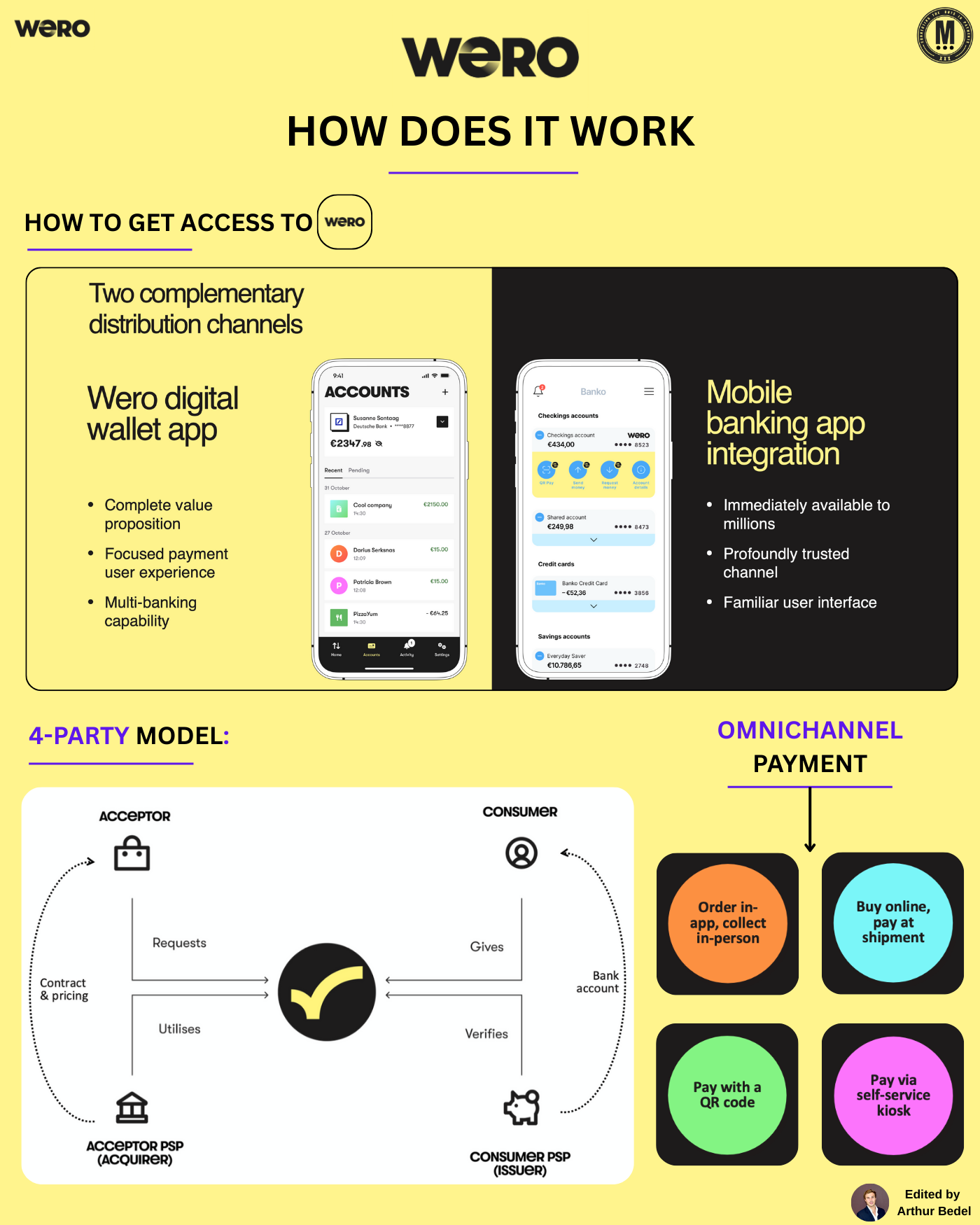

Welcome to 𝐓𝐡𝐞 𝐄𝐮𝐫𝐨𝐩𝐞𝐚𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐒𝐞𝐫𝐢𝐞𝐬 by 𝐖𝐞𝐫𝐨 🇪🇺 — Episode 2 👇 Created by Arthur Bedel 💳 ♻️

Inside the architecture powering Europe’s next-generation wallet → 𝐖𝐞𝐫𝐨

Built on SCT INST and governed by the EPI Company, Wero is designed to streamline digital payments across Europe — ensuring consistent user experiences, lower merchant costs, and strong regulatory alignment.

𝐇𝐨𝐰 𝐭𝐨 𝐀𝐜𝐜𝐞𝐬𝐬 𝐖𝐞𝐫𝐨

1️⃣ 𝐒𝐭𝐚𝐧𝐝𝐚𝐥𝐨𝐧𝐞 𝐖𝐞𝐫𝐨 𝐀𝐩𝐩

A full-featured mobile wallet available directly to consumers, offering:

• A clean, secure user interface built for real-time transactions

• Multi-banking across participating PSPs

• Full transparency into past payments, upcoming authorizations, and value-added services

2️⃣ 𝐌𝐨𝐛𝐢𝐥𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧

+80% of consumers in launch markets can find Wero in their trusted mobile banking apps, enabling:

• Immediate access via trusted banking environments

• Frictionless enrollment and usage without app switching

• A seamless transition from P2P usage to merchant payments

• i.e Paylib, Bancontact Payconiq Company

𝐓𝐡𝐞 𝟒-𝐏𝐚𝐫𝐭𝐲 𝐌𝐨𝐝𝐞𝐥 — 𝐁𝐮𝐢𝐥𝐭 𝐟𝐨𝐫 𝐒𝐜𝐚𝐥𝐞

Wero follows a classic four-party model, comprising:

→ 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫

→ 𝐂𝐨𝐧𝐬𝐮𝐦𝐞𝐫 𝐏𝐒𝐏 (Issuer)

→ 𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 (Acceptor)

→ 𝐀𝐜𝐜𝐞𝐩𝐭𝐨𝐫 𝐏𝐒𝐏 (Acquirer)

In this architecture:

• The consumer provides consent to pay the merchant for goods or services from their wallet, with strong customer authentication

• The issuing bank verifies and processes payment

• The acquiring bank receives funds in real time

• Transactions are settled via SCT Inst, with strong customer authentication for consent and traceability built in

This framework ensures that Wero can scale across multiple geographies, PSPs, and verticals — without compromising trust or operational clarity.

𝐎𝐦𝐧𝐢𝐜𝐡𝐚𝐧𝐧𝐞𝐥 𝐁𝐲 𝐃𝐞𝐬𝐢𝐠𝐧

Wero’s flexible consent model enables support for a broad range of use cases:

→ 𝐎𝐫𝐝𝐞𝐫 𝐢𝐧-𝐚𝐩𝐩, 𝐜𝐨𝐥𝐥𝐞𝐜𝐭 𝐢𝐧 𝐩𝐞𝐫𝐬𝐨𝐧 – Ideal for click-and-collect or QSR flows

→ 𝐁𝐮𝐲 𝐨𝐧𝐥𝐢𝐧𝐞, 𝐩𝐚𝐲 𝐚𝐭 𝐬𝐡𝐢𝐩𝐦𝐞𝐧𝐭 – Funds will be reserved, only captured by the merchant on dispatch

→ 𝐏𝐚𝐲 𝐯𝐢𝐚 𝐐𝐑 𝐜𝐨𝐝𝐞 – Enable cardless in-shop payments without hardware dependencies

→ 𝐏𝐚𝐲 𝐯𝐢𝐚 𝐬𝐞𝐥𝐟-𝐬𝐞𝐫𝐯𝐢𝐜𝐞 𝐤𝐢𝐨𝐬𝐤 – Power digital checkouts across retail, mobility, or ticketing

These omnichannel flows are not just supported or added-on — they’re native to Wero’s infrastructure.

Source: EPI Company

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()