Klarna Partners with UATP to Tap into the $1 Trillion Air Travel industry

Hey Payment Fanatic,

Klarna partners with UATP to tap the $1 trillion air travel industry and this is what we know:

The collaboration enables airlines to provide Klarna’s versatile payment solutions, such as interest-free Buy Now Pay Later, giving customers more flexible ways to pay for travel products and services

The $1 trillion air travel industry presents a key growth opportunity for Klarna, as credit cards currently make up 70% of retail travel payments. This leads to high costs for airlines, who spend $20bn a year on payment processing, and massive interest payments for consumers.

Wherever Klarna is available on a travel site, consumer adoption is very high: the total value of travel booked through Klarna has increased by 50% in the past year.

For UATP, integrating Klarna further strengthens the payment network's support for BNPL options.

Offering a variety of BNPL choices helps UATP merchants tap into a global BNPL market estimated at $14.55 billion this year and is expected to grow at a CAGR of 26.50% to reach $60.47 billion by 2030.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

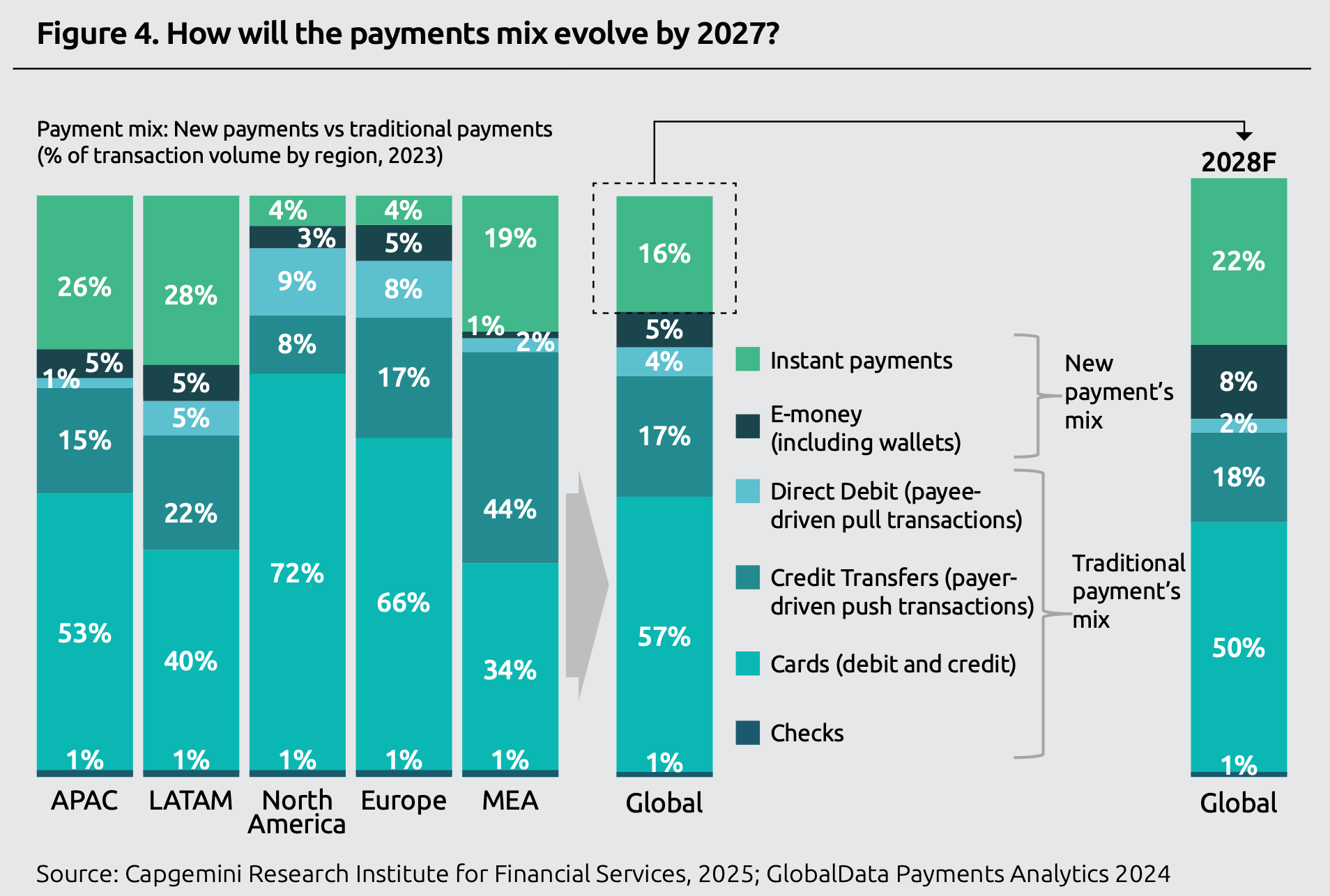

📊 Capgemini latest report predicts instant payments will account for 22% of all non-cash transaction volumes by 2028 globally 🤯

Non-cash transaction volumes rose to 1,411 billion in 2023 and are on track to reach 1,650 billion in 2024. Check out the complete report for more info

PAYMENTS NEWS

🇬🇧 Ecommpay launches Ecommpay for Good. The global payments platform has unveiled a new brand identity and inclusivity program, emphasizing accessibility, inclusivity, and sustainability. Its “Ecommpay for Good” initiative supports merchants in enhancing website accessibility, which can boost traffic by 23-24%.

🇫🇷 Factoryz selects Mangopay to power payments on its circular economy platform. The alliance between Factoryz and Mangopay enhances the Factoryz platform by integrating secure, seamless payments directly within the system. It also streamlines operations, improving overall efficiency.

🇺🇸 Stripe has a tough time keeping tabs on customers—and that’s a worry for some of its banks. Last year, Stripe learned its partnership with Wells Fargo was in jeopardy. Wells Fargo wanted to end its collaboration with Stripe, citing growing risks and regulatory scrutiny. Read the full piece

🇯🇵 Largest Japanese banks to use SWIFT-linked stablecoin system for cross-border payments. MUFG, SMBC and Mizuho plan to use a stablecoin-based system to facilitate cross-border payments in the future. The initiative, Project Pax, replaces correspondent banks with blockchain technology, linking it to SWIFT to allow users to initiate payments conventionally using regular banking rails.

🇺🇸 Zelis launches solution for Out-of-Network Health Bill Payments. Health Bill Assist is designed to improve plan members’ healthcare financial literacy, spot and resolve billing discrepancies, and use Zelis’ team of expert negotiators to settle bills with providers when appropriate, according to a press release.

🇬🇧 Wise joins AbbeyCross ABX Platform to bring greater connectivity to global FX payments. By joining the ABX Platform, Wise Platform will give AbbeyCross users access to faster, transparent and low-cost FX payments rates, including emerging markets rates, as well as a more convenient settlement experience.

🇩🇪 Primer appoints ex-Amazon, Microsoft leader Alex Mallet as its Chief Technology Officer. This strategic appointment demonstrates the company’s commitment to developing robust and cutting-edge infrastructure for its global customer base.

🇬🇧 DNA Payments launches Apple Pay Express Checkout for Ecommerce. This will enable merchants to offer Apple Pay at checkout or via the Express option through the Safari browser, ensuring consumers a swift and seamless buying experience. Link here

🇺🇸 Nium has announced two new executive appointments to strengthen its leadership team. Andre Mancl joins as Chief Financial Officer, overseeing all financial strategies for the company, while Philip Doyle joins as Chief Compliance Officer, leading Nium's global risk and compliance programs. More here

🇺🇸 Adyen announced Intelligent Payment Routing for US debit payments. This new feature ensures that enterprise businesses processing US debit transactions do not need to choose between cost, acceptance, or speed. Read on

🇬🇧 Form3 successfully completes a $60m series C extension, with new investment from British Patient Capital and existing shareholders. This funding will enable Form3 to develop new products and services to help support exponential growth in key markets such as the UK, Europe and the US.

🇬🇧 Liberis to extend Small Business financing to 10 European countries through myPOS partnership. This will enable myPOS to offer revenue-based financing in 10 European countries starting with the UK, providing small businesses with the money they need to fund new projects, address business challenges, and expand at their own pace.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()