Liverpool FC Signs PayPal as its New Official Digital Payments Partner

Hey Payments Fanatic!

PayPal has entered a global, multi-year partnership with Liverpool FC, becoming the club’s official digital payments partner.

This is PayPal’s first collaboration with a Premier League team and strengthens its position as a trusted player in global Payments.

The agreement will integrate PayPal across LFC’s digital platforms and checkout flows, making it the preferred digital payment method for fans. The company will also appear more prominently across e-commerce and All Red platforms.

The deal introduces PayPal+, the company’s new free loyalty program. Fans can earn points on matchday purchases and unlock Blue, Gold, and Black tiers, accessing rewards, boosted point values, and exclusive LFC benefits.

As part of the collaboration, LFC and PayPal will also support initiatives focused on women’s football and grassroots development.

I have often highlighted how sponsorships from FinTech companies and neobanks strengthen brand visibility and relevance. Partnerships like this one bring together two areas I follow closely: FinTech and sports.

Be well informed! More movement in Payments is always around the corner, and we’ll be back in your inbox tomorrow.

Cheers,

INSIGHTS

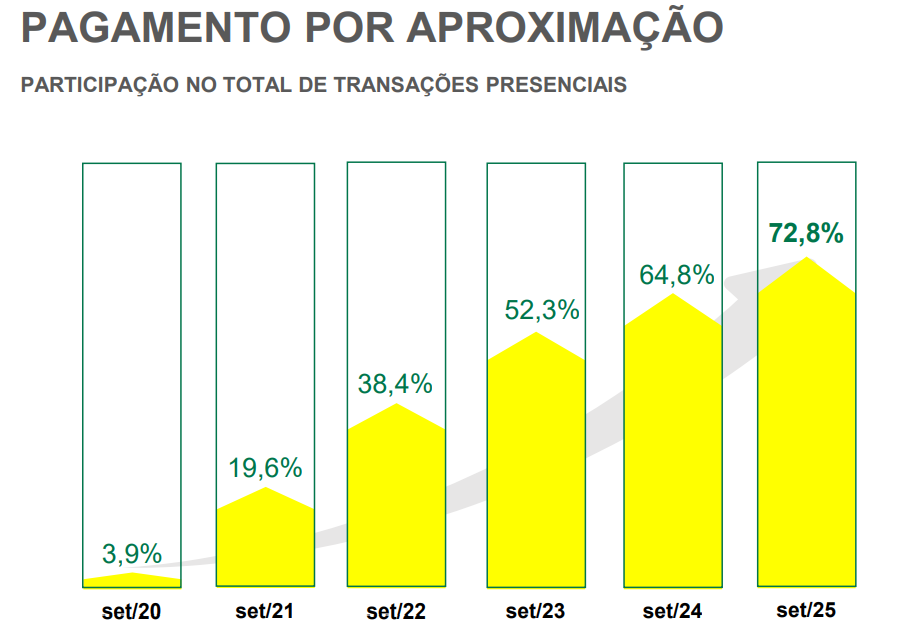

🇧🇷 Contactless payments account for 73% of card purchases in Brazil. In five years, the share of this payment method has increased from 3.9% to its current level and is expected to exceed 80% of in-person transactions by 2026 👇

NEWS

🌍Nuvei and European Payments Initiative launch Wero Payments for European eCommerce merchants. Wero enables instant account-to-account (A2A) payments through SEPA Instant Credit Transfer protocols, allowing consumers to pay securely and directly from their bank accounts in seconds.

🇬🇧 Liverpool FC welcomes PayPal as the Club's official digital payments partner. Through this collaboration, LFC and PayPal will collaborate on initiatives that elevate the profile of LFC Women and expand grassroots football programmes through LFC Foundation, helping to nurture the next generation of talent and grow the game at all levels.

🌍 Revolut integrates Polygon for payments, trading, and staking, processing $690m to date. Polygon enables Revolut users to move money across town or across borders with low fees, and seamlessly on- and off-ramp. Read more

🌍 Klarna is now available on Apple Pay in Denmark, Spain, and Sweden, with France to follow. Eligible customers can split purchases into three monthly installments, or pay up to 30 days later, always interest-free. Customers can also spread the cost of higher-value items over a longer period, with competitive interest rates starting from 0%.

🇺🇸 Félix collaborates with Mastercard to accelerate U.S. to Latin America remittances. By integrating Mastercard’s global payment infrastructure with Félix’s technology platform, the collaboration will streamline the remittance process, reduce friction, and enhance trust across borders.

🇧🇷 Pix Parcelado promises inclusion in credit, but requires clear rules, experts argue. Regulation of this type of loan, planned by the Central Bank, will define the standards for offerings by financial institutions. Course corrections were necessary due to events that demanded urgent improvements from the regulator regarding the security requirements in the system's ecosystem.

🌎 dLocal joins Circle Payments Network to power stablecoin payouts. Powered by Circle, CPN connects financial institutions to enable real-time settlement of cross-border payments. With dLocal’s deep infrastructure integrated, CPN participants can seamlessly disburse funds in local currencies across key emerging markets.

🇺🇸 Paysecure and Approvely partner to strengthen U.S. payment processing and risk management. By integrating with Approvely, Paysecure gives its clients the flexibility to optimize acceptance, reduce costs, and expand into new markets with confidence.

🇺🇸 Plaid Introduces one-click payments. One click streamlines the open banking payment journey for Pay by Bank users through a cleaner, more accessible experience. One click automatically recalls their preferred bank and removes the selection pane entirely.

🌏 Hex Trust and Fireblocks partner to strengthen regulated digital asset custody offering in Asia and the Middle East. Institutions onboarding via Fireblocks gain a unified regulatory entry point, combining Fireblocks’ enterprise-grade infrastructure with Hex Trust’s regulated presence and custody services.

🇺🇸 Chargeflow raises $35 million to fight the surge in transaction denials. Chargeflow has built a merchant network of 15,000 clients, enabling the company to cross-reference data and provide deeper insights into customer behavior. Read more

🇳🇬 Mastercard and Zenith Bank launch essential debit card in Nigeria. The card is intended to serve the financial needs of underserved populations who have historically faced barriers to formal banking services. Zenith Bank aims to reach underserved market segments through simplified onboarding and lower issuance costs.

🇺🇸 Adyen US Executive Davi Strazza exits. The departing executive noted the company’s growth during the decade-plus that he’s been at Adyen, citing an increase in headcount from about 200 to 4,500 employees; a jump in annual processed volume to $1.3 trillion, from $30 billion; and a surge to $2 billion in annual net revenue, from $100 million.

GOLDEN NUGGET

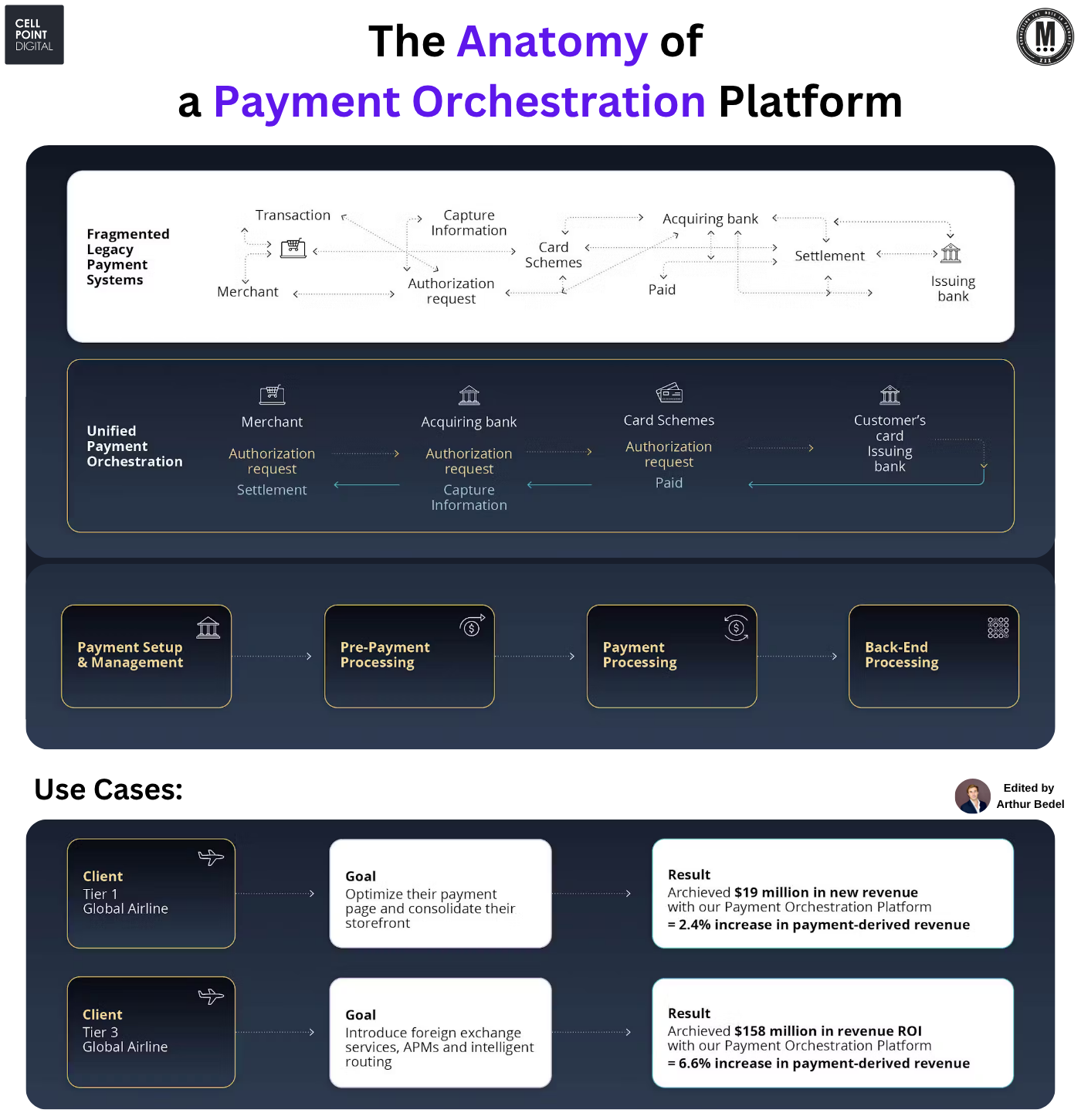

🚨 𝐓𝐡𝐞 𝐀𝐧𝐚𝐭𝐨𝐦𝐲 𝐨𝐟 𝐚 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 — by CellPoint Digital 👇 Created by Arthur Bedel 💳 ♻️

Behind every online payment lies a complex web of banks, card schemes, and processors. For global merchants, managing this manually is a recipe for friction, failed transactions, and lost revenue.

That’s where Payment Orchestration Platforms (POPs) step in — unifying fragmented payment systems into one streamlined layer.

𝐍𝐨𝐭𝐞: Orchestrators are great platforms to innovate with, A/B test and have access to innovation quickly. New markets, new payment flows & channels, they are a great first option to try out new things without over-committing to a single PSP. Once you have selected a primary partner, having direct integrations is definitely a best practice to enable redundancy and build relationships directly with your key partners.

𝐖𝐡𝐚𝐭 𝐈𝐬 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧?

A Payment Orchestration Platform integrates all players in the payment chain — from merchants and acquirers to card schemes and issuers — into a single, coordinated flow. Instead of juggling multiple providers and integrations, merchants gain one control center to:

► Route transactions intelligently

► Optimize authorization success

► Add new payment methods quickly

► Automate back-end reconciliation

𝐓𝐡𝐞 𝐂𝐨𝐫𝐞 𝐒𝐭𝐞𝐩𝐬 𝐢𝐧 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧:

1️⃣ Payment Setup & Management – onboarding acquirers, wallets, and APMs.

2️⃣ Pre-Payment Processing – fraud checks, FX, and routing logic.

3️⃣ Payment Processing – real-time transaction execution across schemes.

4️⃣ Back-End Processing – reconciliation, settlement, and reporting.

𝐑𝐞𝐚𝐥 𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬 - the results speak for themselves:

✈️ A Tier-1 global airline consolidated its storefront and boosted revenue by $19M (+2.4%).

✈️ Another Tier-3 airline leveraged FX, APMs, and routing to unlock $158M ROI (+6.6%).

Payment orchestration isn’t just a technical upgrade — it’s a strategic lever for growth, turning payments from a cost center into a revenue driver.

Source: CellPoint Digital

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()