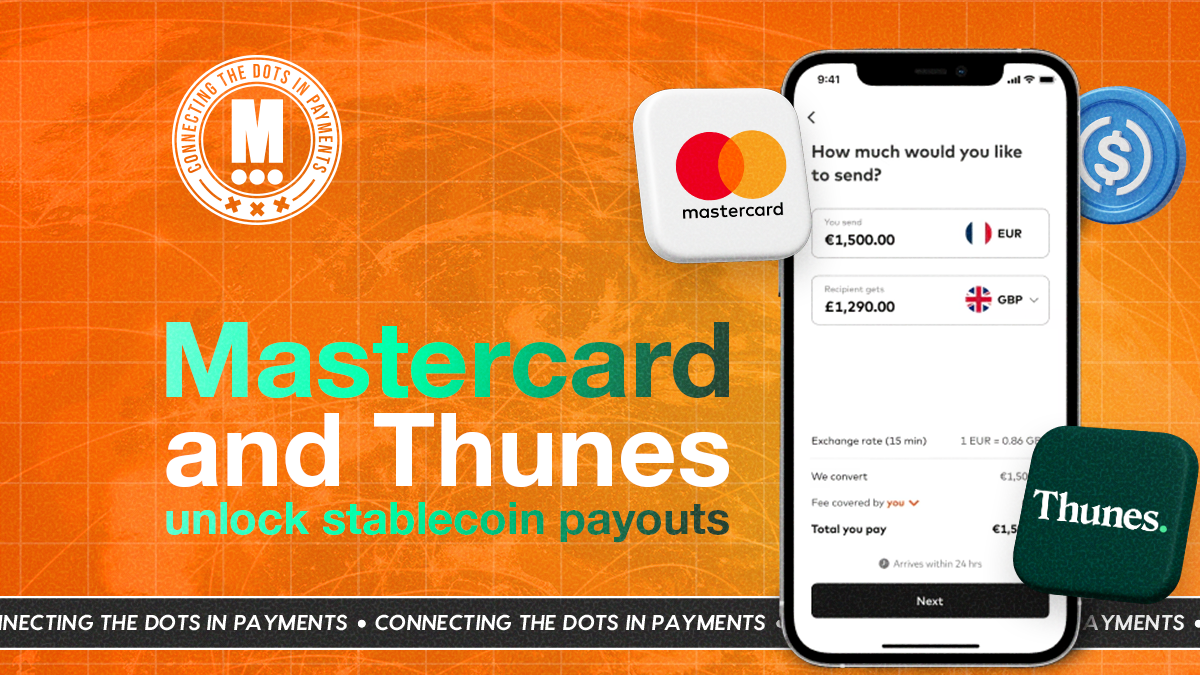

Mastercard and Thunes Bring Stablecoin Payouts to the Mainstream

Hey Payments Fanatic!

Big move today in the cross-border space. Mastercard and Thunes teamed up to bring stablecoin payouts to the mainstream: a major step in connecting traditional rails with digital wallets.

The collaboration enables near real-time transfers directly to stablecoin wallets via Mastercard Move and Thunes’ Direct Global Network, giving banks, PSPs, and end-users more flexibility, speed, and 24/7 access through regulated stablecoins.

This expands Mastercard Move’s reach, adding a brand-new payout endpoint alongside cards, bank accounts, and cash across 200+ markets. In many regions, stablecoins help reduce volatility and broaden financial inclusion.

Earlier this year, Thunes raised $150M to expand its U.S. network. Momentum that now strengthens the rails behind this new capability.

Stay tuned! The bridge between fiat and digital payments is getting sturdier by the day.

Cheers,

INSIGHTS

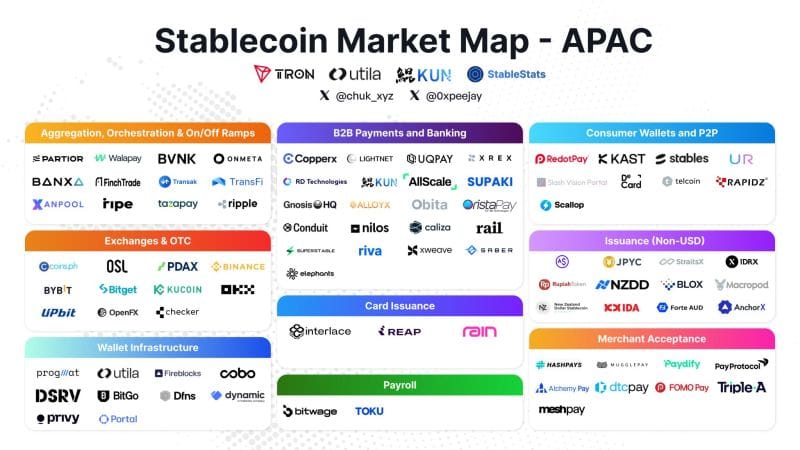

🌏 The APAC Stablecoin Payments Landscape👇

Any companies missing on this map?

NEWS

🇧🇷 Stablecoin is used as an alternative for tourists to dodge IOF abroad. According to Rafael Goulart, Head of the Pomelo Card FinTech in Brazil, "It is increasingly common to use these digital currencies as exchange protection. The user buys a stablecoin, preserves value, and, at the time of consumption, converts them into foreign currency more efficiently, often avoiding the high rates of traditional exchange."

🇸🇬 Mastercard and Thunes bring stablecoin payouts to the mainstream. Through this strategic collaboration, Mastercard Move will facilitate near real-time payouts to stablecoin wallets via Thunes’ Direct Global Network, harnessing the speed, liquidity, and 24/7 availability of regulated stablecoins.

🇸🇬 Thunes launches Account Top Up and Withdrawal solutions for digital asset platforms. The solutions aim to connect seamlessly with traditional finance and scale globally. It gives leading exchanges, infrastructure providers, networks, and issuers the ability to enable instant, compliant on and off-ramps for their end-users in their local payment methods and currencies.

🇺🇸 Cash App introduces new banking, bitcoin, commerce, and peer-to-peer features, along with an early look at upcoming AI and automation capabilities. Cash App has rolled out 11 product updates and made more than 150 improvements to meet the way that millions of people earn, manage, and share money.

🇬🇧 Zilch raises over $175 million to accelerate growth. The funds will be invested in driving greater brand visibility through increased above-the-line (ATL) marketing spend, further product development and platform enhancement, and the exploration of strategic M&A opportunities.

🇳🇴 Klarna expands its collaboration with Nordic Swish rivals, Vipps and Mobilepay, by becoming a payment option in their apps. Stores that already accept payments via Norwegian Vipps or Danish Mobilepay will automatically receive support for Klarna payments.

🌍 BLIK has introduced a pilot program to integrate BLIK with other European mobile payment systems. The program allows users to receive mobile money transfers in euros from European partner systems. The pilot phase will include several partner payment systems, starting with Portugal’s MB WAY and later including Spain’s Bizum, Italy’s Bancomat, and Scandinavia’s Vipps.

🇮🇳 PhonePe partners with OpenAI to integrate AI features. The alliance aims to expand the reach of advanced AI technology to a broad user base in India. The company stated that new use cases for AI are expected to emerge as adoption of these services grows across the country.

🇺🇸 PPRO maps LATAM payments for U.S. merchants. Therese Hudak, VP of Commercial for the Americas at PPRO, explained that LATAM is a $633 billion market with rapid e-commerce expansion, driven by both rising consumer demand and the increasing volume of U.S. exports into the region.

🇳🇱 Finom has introduced outgoing iDEAL payments for its Dutch customers, allowing businesses in the Netherlands to make fast, secure payments directly from their Finom accounts. Users can now complete iDEAL transactions by scanning a QR code in the Finom app or selecting Finom at checkout.

🇲🇽 PayPal Payments Mexico is authorized to operate as an Electronic Payment Funds Institution. With this authorization, PayPal is allowed to issue electronic payment funds, open electronic accounts for users, enable transfers between users, and provide cards or other payment methods linked to a user’s electronic balance.

🌍 Viber Pay partners with Paynetics to scale across 7 markets, working toward its super app strategy. By integrating Paynetics’ infrastructure, Viber can offer financial-grade security and cross-border operability without altering the app’s core user experience.

🇧🇷 Spreedly expands access to Brazil's $378 billion e-commerce market via Pix Automático and NuPay in partnership with EBANX. Through its partnership with EBANX, it enables merchants to sell products and services to Brazilian customers using credit and debit cards, Pix for single transactions, MercadoPago for e-wallets, and Boleto Bancário for cash-based methods.

🇬🇧 Paysafe incurs a net loss of $87.7M in Q3 2025, compared to $13.0 million in the prior year period, mainly due to a charge to income tax expense of $81.2 million related to the recognition of an additional valuation allowance against the company’s U.S. deferred tax assets due to the enactment of the One Big Beautiful Bill Act in July 2025.

🇦🇪 NEO PAY partners with Biz2X-AI platform to launch embedded SME financing in the UAE. The partnership will create a marketplace for lenders and borrowers, enabling real-time credit decisioning, tailored financing, and accelerated loan disbursement, all directly embedded within NEO PAY’s platform.

🇧🇷 Enfuce enters Latin America with Swile benefits card partnership. The partnership brings digital employee benefits to Brazil's largely paper-based voucher market. The card operates physical retail locations and online environments, and provides real-time balance tracking and transaction history.

🇬🇧 Sui Network introduces a native stablecoin for payments and DeFi with Bridge. USDsui aims to power e-commerce, gaming, and AI-driven transactions with enhanced stability and broader Stripe integration on the Sui blockchain. It is engineered to be GENIUS-ready, enabling seamless compatibility with advanced features.

🇧🇷 C6 Bank users can now make multiple Pix payments with the help of AI. The customer needs to provide the amounts and payment method keys, confirming the data afterward. It is also possible to share this information via an image. According to the bank, the new feature is already available for individuals and businesses.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()