Mastercard x PayPal Join Forces to Bring Agentic AI Payments Mainstream

Hey Payments Fanatic!

Agent-driven commerce is no longer a concept. It’s happening as you read this.

Mastercard and PayPal have announced a strategic partnership to integrate Mastercard’s Agent Pay technology into PayPal’s digital wallet.

This means consumers will be able to complete purchases via AI-powered agents, with Mastercard providing the secure, tokenized payment infrastructure behind the scenes.

Let’s say you want to buy a new pair of running shoes. You ask your AI agent to find tailored options, and it picks a great deal from a merchant that accepts PayPal.

Your AI recognizes that you use PayPal and asks if you’d like to utilize it to check out. You verify your identity. The process is secure, thanks to Mastercard and PayPal’s authentication and tokenization systems.

The collaboration covers PayPal’s global merchant network and co-branded cards, aiming to build a shared infrastructure for agentic payments.

In the words of Mastercard’s Chief Digital Officer Pablo Fourez, this could represent “a paradigm shift bigger than the move to mobile.”

The first wave of agentic shopping experiences is expected to roll out during the 2025 holiday season 🎁. The question is: would you trust an AI agent to shop for you?

Enjoy the rest of today’s Payments headlines below 👇

Cheers,

INSIGHTS

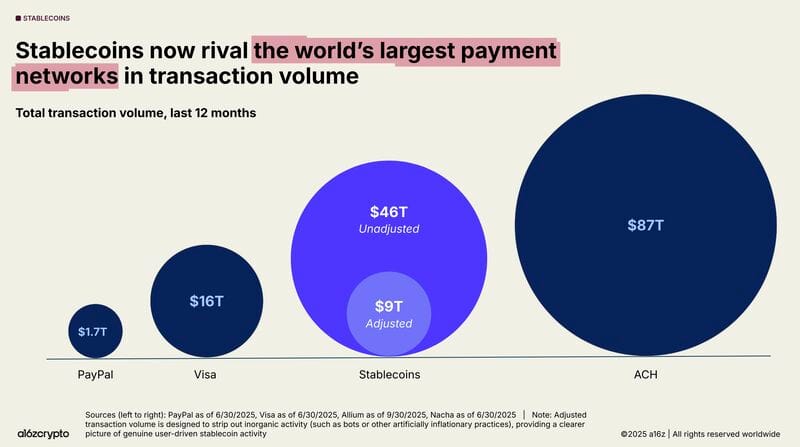

💰 Stablecoins are processing $46 trillion a year.

NEWS

🇩🇪 Unzer has achieved a key milestone in the rollout of Wero, completing the first successful transaction on its production system. As an EPI Company Principal Member, Unzer will enable thousands of merchants to accept secure, instant account-to-account payments, helping small and mid-sized businesses embrace digital commerce across Europe.

🇲🇭 BloFin partners with Checkout.com to power a next-generation fiat on-ramp experience. Users can now seamlessly purchase digital assets using Apple Pay, Google Pay, credit and debit cards, either directly or through mobile wallets, delivering greater flexibility and convenience in mobile-first markets.

🌎 Mastercard and PayPal join forces to accelerate secure global agentic commerce. Mastercard Agent Pay, the company’s agentic payments platform, will be integrated into PayPal’s wallet to allow AI agents to simply and securely complete transactions on behalf of PayPal users.

🇬🇧 Klarna introduces the Premium and Max program. The program delivers premium benefits like cashback, travel perks, and lifestyle rewards in a transparent, monthly plan, without the need to take on expensive credit. Premium and Max offer more than 10x their monthly value.

🇮🇹 Klarna signs an agreement with pagoPA for installment payments to public administrations, with the technological support of Worldpay. The agreement will enable users to utilize the payment system to make payments to public entities, including car taxes, fines, school fees, and healthcare charges.

🇺🇸 Coinbase x402 protocol logs 50,000 transactions, up 10,000%. Coinbase CEO Brian Armstrong posted on X that x402 is growing like crazy. The protocol allows AI agents and humans to transact in stablecoins directly over the internet without credit cards or traditional payment infrastructure.

🇺🇸 Chargebacks911 and its sister company, Fi911, launched their Unified Dispute Management System. UDMS eliminates the industry’s long-standing data silos, providing real-time transparency, agentic AI tools, self-service automation, and instant collaboration across the payments ecosystem that works to improve and safeguard dispute and transaction integrity.

🇰🇷 The Bank of Korea urges banks to lead won stablecoin issuance and include deposit tokens in reserves. The BOK stressed that a won stablecoin should be issued mainly by the banking sector. The rationale is that banks are already subject to strict capital, foreign exchange, and anti-money laundering regulations, which can minimize risks that may arise from the introduction of stablecoins.

🇨🇳 Ant Group files trademark for ‘AntCoin’ in Hong Kong amid digital asset push. According to filings with the Hong Kong Intellectual Property Department (HKIPD), the trademark application for “AntCoin” includes classifications covering digital currency, blockchain-based transaction systems, and virtual asset custody.

🇺🇸 Big Banks enter the stablecoin era by taking Zelle International. Zelle said the initiative would help users move money across borders, and that the service would be available to customers of any bank that is part of the Zelle network. The move could help big bank owners of payment products head off competition from cryptocurrencies.

🇺🇸 Stablecoin Payments surge 70% Post-GENIUS Act. More than $10 billion flowed through stablecoins in August for goods, services, and transfers, according to a recent report from blockchain data provider Artemis Analytics. Keep reading

🇬🇧 ClearBank announces plans to join Circle’s payments network to power faster, more connected finance. This collaboration will focus on expanding access to USDC and EURC, Circle’s MiCA-compliant, fully reserved stablecoins, through Circle Mint in Europe.

🇯🇵 World's first yen-pegged stablecoin JPYC debuts in Japan. The company aims to issue 10 trillion yen ($66 billion) worth of JPYC over three years and have the digital assets used widely overseas. Continue reading

🇺🇸 Worldpay launches AI-powered service to increase payment approvals. The service uses AI to leverage insights from billions of global transactions processed by Worldpay and makes real-time decisions on when to apply 3DS to authenticate the transaction or directly authorize the payment based on risk, issuer preference, and other factors.

🇺🇸 Western Union CEO unveils stablecoin plans for treasury, customer payments. CEO Devin McGranahan announced that Western Union is testing stablecoin-enabled solutions in treasury operations, focusing on leveraging blockchain settlement rails to reduce reliance on legacy correspondent banking systems while shortening settlement windows and improving capital efficiency.

🇲🇽 tapi launches tapipay to boost SME digital payments in Mexico. tapipay automates up to 80% of the collections process, reducing operational costs and enhancing efficiency. Businesses can issue invoices via email or WhatsApp, send automatic reminders, and accept payments through multiple methods.

🌎 MAJORITY launches stablecoin transfers to millions across Latin America with Privy. With Privy, MAJORITY can create and manage on-chain wallets directly within its app experience, while users enjoy the benefits of stablecoin speed and transparency, without any crypto complexity.

🇳🇬 Nigerian FinTech Raenest raises US$11M in Series A. The FinTech plans to deepen its presence in Kenya, Nigeria, Ghana, Tanzania, and Uganda, focusing on the gig economy to outcompete the dozens of FinTech players in those markets. Read more

🇺🇸 Mastercard and Citi bring Citi Flex Pay Installments to more retailers at checkout. Through the integration with Mastercard Installments Payments Services, Citi cardmembers can choose to pay over time directly at checkout, whether shopping with their Citi credit card online, in-app, or through a digital wallet with participating partners.

🇨🇴 Cobre and TerraPay partner to provide businesses globally with seamless cross-border payments. This collaboration enables companies to send and receive payments seamlessly across borders, with faster settlement times, lower operational complexity, and a fully compliant infrastructure.

🇺🇸 Binance.US partners with AptPay to expand fiat access nationwide. This integration will enable Binance.US customers to fund and withdraw U.S. dollars instantly and securely, leveraging real-time and same-day payment networks alongside traditional ACH.

GOLDEN NUGGET

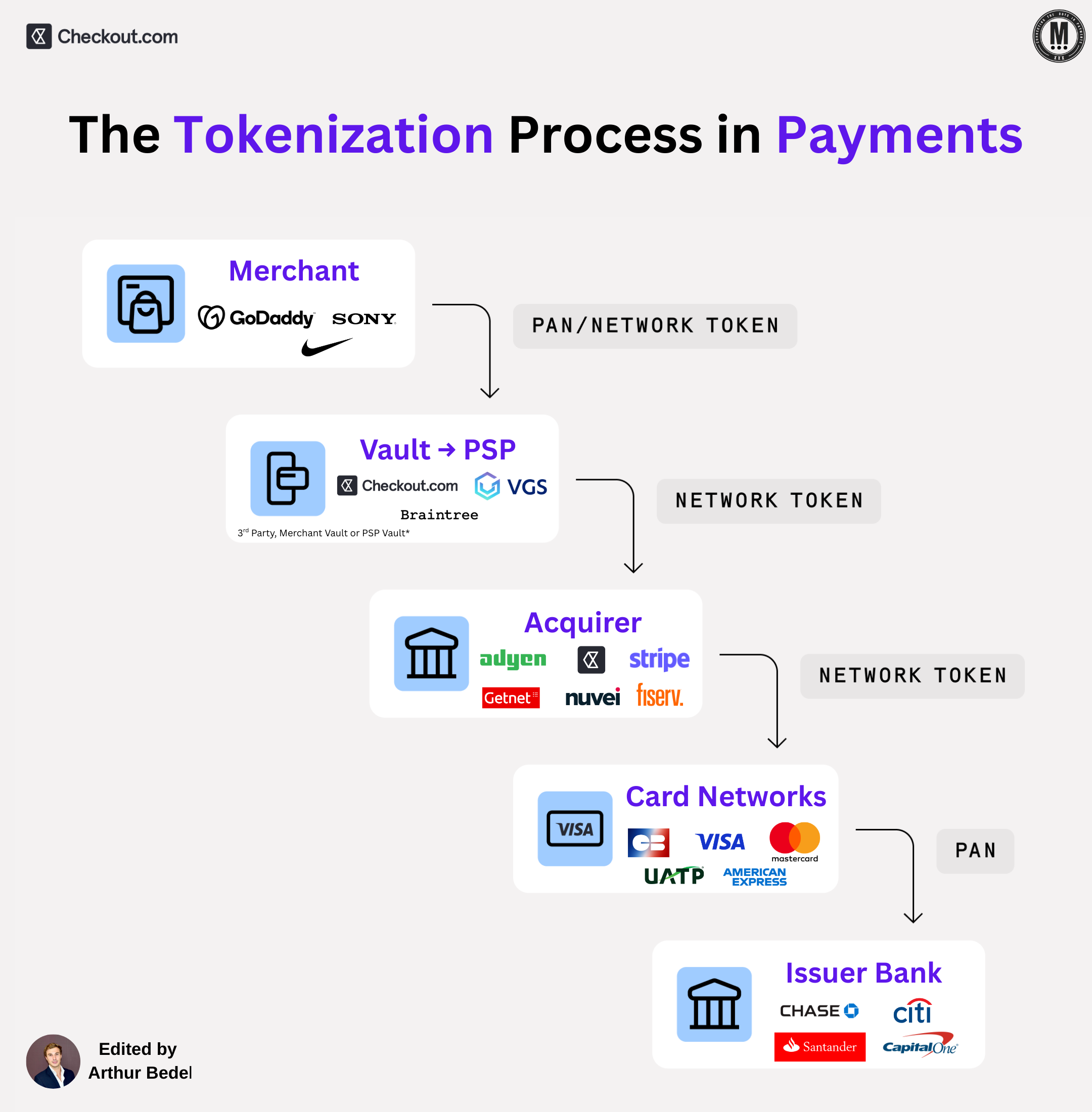

What is "𝐓𝐡𝐞 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬"? by Checkout.com 👇Created by Arthur Bedel 💳 ♻️

► 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 is the process of replacing sensitive card data (like PANs) with a non-sensitive equivalent known as a 𝐭𝐨𝐤𝐞𝐧. This ensures that actual card details are never exposed or stored during or after a transaction.

► The Goal → reduce fraud, simplify PCI compliance, and power secure, scalable commerce.

𝐓𝐡𝐞 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬 — Step by Step

1️⃣ Merchant (GoDaddy, Nike, Sony)

► Captures the customer’s Primary Account Number (PAN) through their website or app.

2️⃣ Vault / PSP (VGS, Checkout.com, Braintree)

► The PAN is sent to a token vault (merchant, third-party, or PSP-owned), where it’s replaced with a network token or PCI token.

3️⃣ Acquirer (Checkout.com, Adyen, Stripe, Nuvei, Getnet)

► Receives the tokenized transaction, which now contains a network-issued token rather than the actual PAN.

4️⃣ Card Network (Visa, Mastercard, American Express, GIE Cartes Bancaires)

► The token is translated back into the actual PAN so the transaction can be routed to the cardholder’s issuer.

5️⃣ Issuer Bank (Citi, Chase, Capital One)

► Validates the original card, checks for fraud, and approves or declines the transaction.

𝐓𝐡𝐞 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐭 𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

🔹 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬

→ Issued by card networks (Visa, Mastercard)

→ Enhances approval rates by keeping credentials fresh (via account updater)

→ Replaces PANs at the scheme level

→ Example: Visa Token Service, Mastercard MDES

→ Provided by Network directly or 3rd Parties (Vault, PSPs etc…) - Checkout.com, VGS

🔹 𝐏𝐂𝐈 𝐓𝐨𝐤𝐞𝐧𝐬 (Merchant Tokens)

→ Issued by a token vault provider (VGS, Checkout.com)

→ Designed to remove PCI scope from merchants

→ PAN is encrypted & stored in a secure vault; merchants only handle tokens

🔹 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭 𝐓𝐨𝐤𝐞𝐧𝐬

→ Managed by wallets like ApplePay, Google Pay, Samsung Pay

→ Device-specific tokens issued for in-app or contactless payments

→ Never exposes the actual card number to the merchant

𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬 — Real-World Applications

✅ 𝐎𝐧𝐞-𝐂𝐥𝐢𝐜𝐤 𝐂𝐡𝐞𝐜𝐤𝐨𝐮𝐭 — Amazon & Shopify store network tokens to enable fast, secure repeat purchases

✅ 𝐒𝐮𝐛𝐬𝐜𝐫𝐢𝐩𝐭𝐢𝐨𝐧𝐬 — Netflix and Spotify use PCI tokens to safely charge recurring payments

✅ 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 — ApplePay leverage device-based tokenization for in-store tap payments

✅ 𝐂𝐫𝐨𝐬𝐬-𝐏𝐒𝐏 𝐑𝐨𝐮𝐭𝐢𝐧𝐠 — VGS and 3rd party vaults, create merchant token vaults transmit the token to route transactions across multiple acquirers

Source: Checkout.com x Connecting the dots in Payments

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()