Mollie’s Triple Launch: Czech, Slovenia, Hungary Go Live

Hey Payments Fanatic!

Mollie is in expansion mode, rolling out its payments platform across the Czech Republic, Slovenia, and Hungary in quick succession. With tailored onboarding, local support teams, and plug-and-play integrations already in place, the FinTech is betting big on growth in Central and Eastern Europe.

From Czech entrepreneurs to Slovenian ecommerce players and Hungarian businesses, Mollie’s pitch is clear: payments should power growth, not block it.

Scroll down to see how Mollie’s rapid rollout is shaking up legacy players, and what it signals for the future of payments in Europe. 👇

Cheers,

INSIGHTS

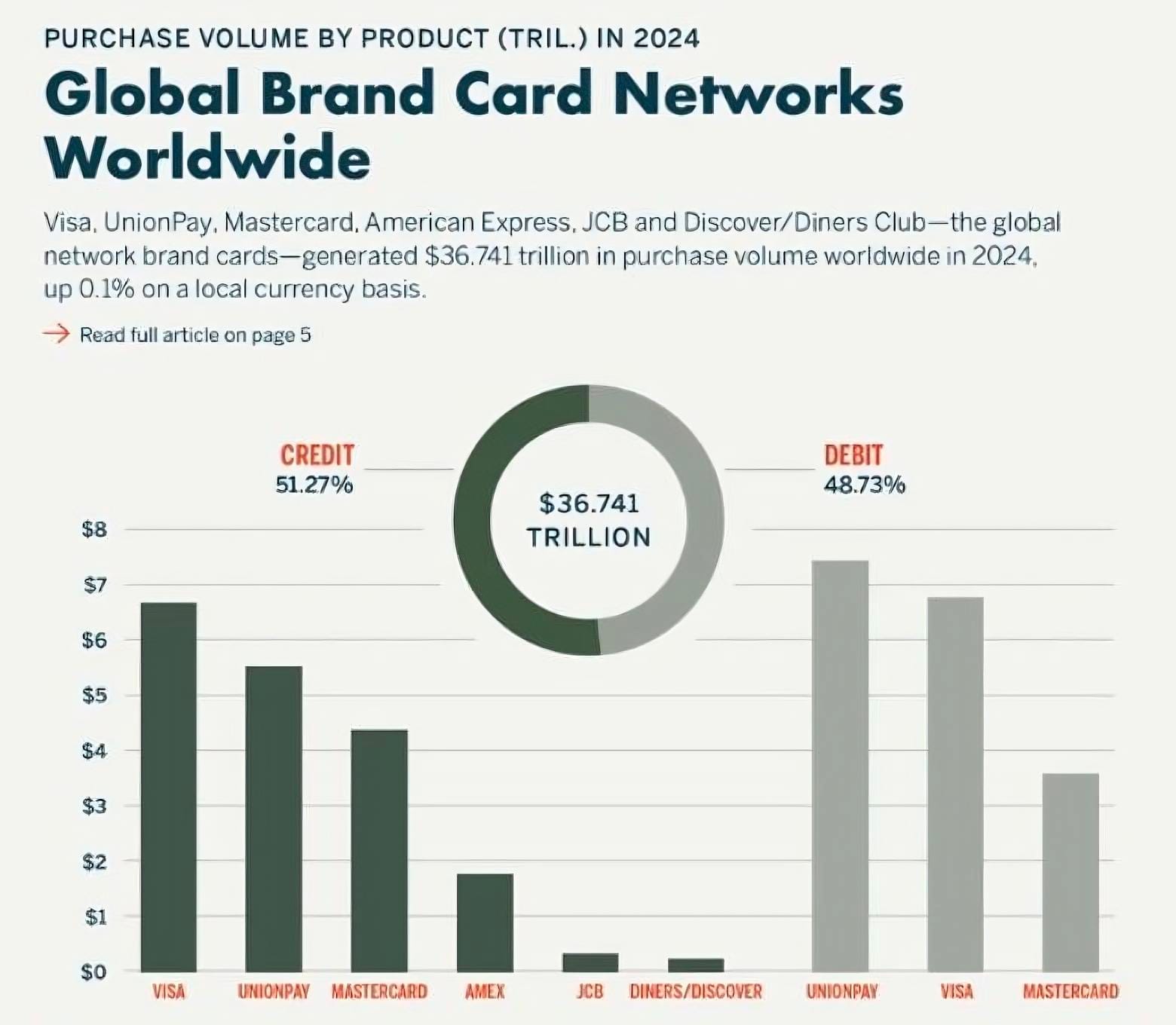

💵 Global card networks processed $𝟯𝟲.𝟳𝟰𝟭 𝗧𝗿𝗶𝗹𝗹𝗶𝗼𝗻 purchase volume in 2024 🤯

The global giants behind that number? Let's zoom in:👇

NEWS

🌍 Mollie lands in Czechia, Hungary, and Slovenia to bring their businesses the financial engine. This strategic move aims to provide local businesses with a powerful and reliable financial engine to support their growth. This expansion marks more than geographic growth; it reflects Mollie’s commitment to empowering the next generation of European businesses.

🇮🇱 IsraJets takes off with Airwallex to streamline global payments for private aviation services. Airwallex now enables IsraJets to accept passenger payments via multicurrency virtual IBANs in over 16 countries or credit cards, and to process vendor and employee payouts efficiently from a single platform.

🇬🇧 Solidgate x DRESSX: powering Web-2-App B2C expansion through payments. Through this partnership, DRESSX gains access to advanced payment solutions that support its B2C growth strategy. The partnership also enhances security with robust fraud prevention tools and adaptive 3DS, supports recurring revenue through a subscription engine and network tokenization.

🇮🇳 Wise opens global office in Hyderabad and plans major hiring. The company, which currently has 70 employees on its rolls in Hyderabad, plans to expand its workforce over the next few years. Additionally, UniCredit has selected Wise to handle FX payments in latest retail push. The partnership comes after the lender launched a review and found it had “shortcomings” in its mobile banking payments offerings.

🇺🇸 Mastercard says stablecoins still face hurdles to go mainstream. Mastercard’s CPO, Jorn Lambert, said stablecoins boast incredible technical potential, fast transactions, 24/7 uptime, low fees, programmability, and immutability. But those features alone don’t make them ready for everyday payments.

🇬🇧 Clear Junction extends named virtual IBAN services to VASP‑licensed businesses. By offering this capability to European and UK-licensed crypto asset providers, it aims to strengthen the fiat infrastructure available to regulated crypto firms and help them overcome long-standing barriers to accessing reliable account services.

🇧🇭 EazyPay and Tamara announce strategic partnership to power seamless payment solutions across the GCC. EazyPay will serve as Tamara’s local acquirer and provide advanced payment gateway services, enabling secure, seamless, and efficient transaction processing across Tamara’s expanding network of merchants.

🇱🇹 myTU enables instant global payouts with Visa Direct and Mastercard cross‑border services. This integration empowers businesses and individuals to send real-time payouts, including salaries, insurance claims, refunds, and gig-economy payments to eligible cardholders, as well as directly to bank accounts in supported markets.

🇿🇦 Luno co-founder’s MoneyBadger raises $400,000 pre-seed. MoneyBadger plans to use the new capital to expand its merchant footprint through partnerships with Tier 1 payment providers, ecommerce platforms, and national QR code networks.

🇮🇳 PhonePe ropes in Meta's Shivnath Thukral as V-P for public policy. "Shivnath will be responsible for leading PhonePe's external engagement and discussions with policymakers and regulators," the company said in a statement, adding that he would work closely with the company’s founders, Sameer Nigam and Rahul Chari.

🇮🇳 Visa-backed PayMate has withheld, delayed salaries since April amid a cash crunch. The delays come amid delayed funding and as the company has ramped up investments in international markets following a Reserve Bank of India directive last year that destabilised its India business.

🇮🇳 FinTech majors are counting on co-branded cards in returns play. Google Pay is in discussions to build a co-branded credit card with Axis Bank. This marks a shift for Google, which has so far avoided regulated businesses in India and pulled back its FinTech bets globally.

🇬🇧 Corpay launches Corpay Complete platform in the UK. The move aims to help finance teams streamline operations and reduce cost and complexity, given that they are “under growing pressure to do more with less,” said the company. Continue reading

🇵🇹 Contactless payments using NFC technology are now available to the MB Way app. The entry into force of the European Union's Digital Markets Act forced the iPhone maker to open access to contactless payment technology to third-party apps, as MB Way has now announced.

🇺🇸 BVNK & Bitwave announce partnership to enable real-time stablecoin payments for enterprise finance. The integration will empower enterprise finance teams to send and receive stablecoin invoice payments with compliance, security, and speed.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()