Monzo Enables Flex Users to Make monthly Payments with Apple Pay

Monzo Bank is the first UK bank to enable its Flex customers to choose monthly payment options when making online purchases with Apple Pay.

Customers using iOS 18 and iPadOS 18 can now choose to pay in full or spread the cost over multiple months directly at the point of purchase with Apple Pay. This feature is available for online and in-app purchases on iPhone and iPad.

This allows customers to see the monthly payments, understand total cost including any interest, and choose how they’d like to repay before completing their purchase.

Kunal Malani, General Manager at Monzo, said:

“Our customers love using their Flex credit card with Apple Pay and we’re thrilled to be the first bank to bring this feature to Apple Pay users in the UK. Now our customers are able to choose their monthly payments — right at checkout with Apple Pay when using their Monzo Flex credit card. This brings an even more convenient experience for our customers when shopping online.”

This new feature gives Monzo Flex customers greater flexibility and control over their spending, enhancing the convenience of using Apple Pay for online and in-app purchases.

Do you think this new feature will make Monzo the go-to choice for Apple Pay users in the UK? Tell me more in the comments.

Cheers,

Stay Updated on the Go. Join my new Telegram channel for daily updates and real-time breaking news. Stay informed and connect with industry enthusiasts —subscribe now!

INSIGHTS

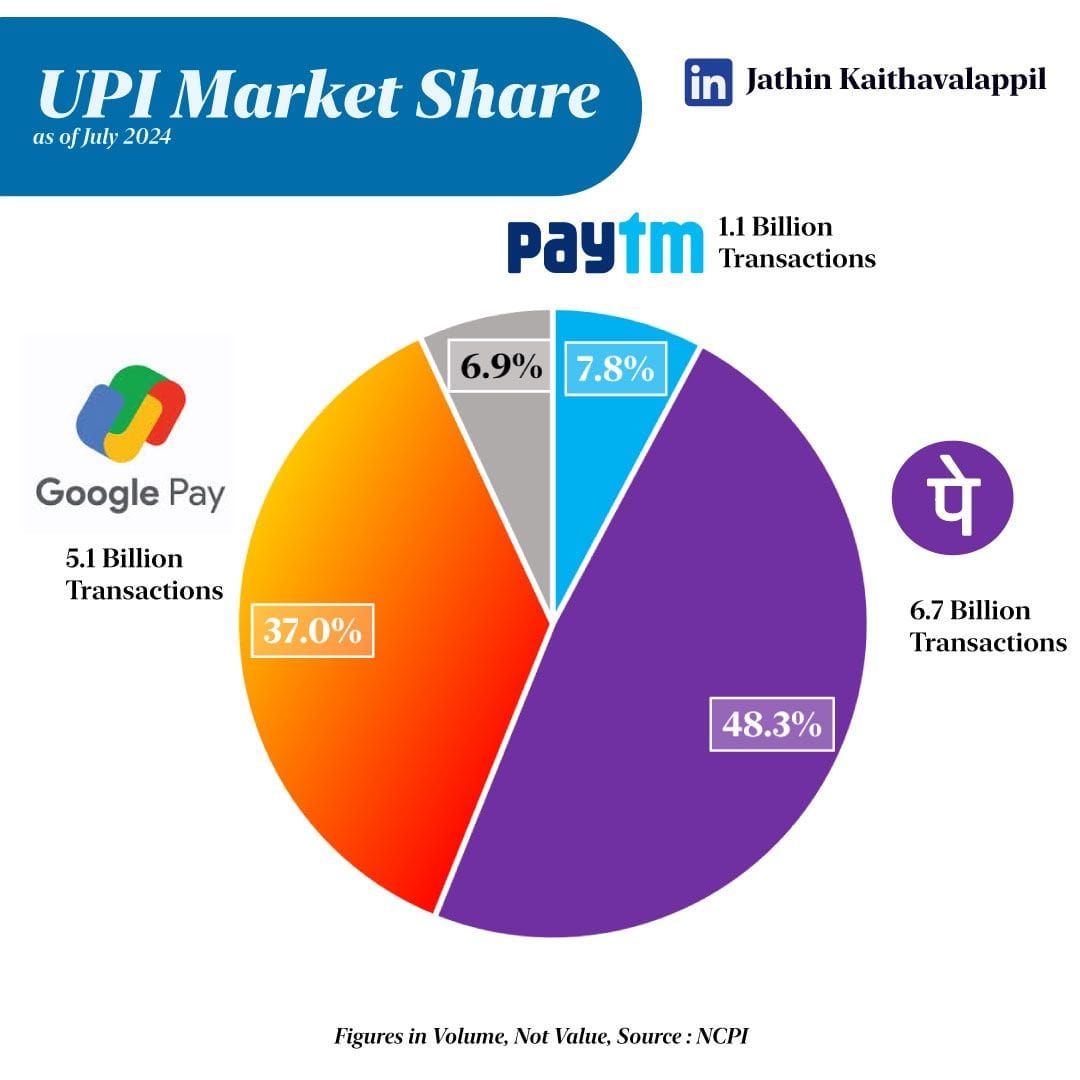

🇮🇳 UPI market share in India by Jathin Kaithavalappil.

PAYMENTS NEWS

🇱🇺 Ex-Meta Payments Director becomes new Mangopay CEO. Sergi Herrero, confirmed as Mangopay’s new CEO, is dedicated to continuing the platform’s upward trajectory. He succeeds Romain Mazeries, who stepped down after six years as CEO but will remain on the board to work with other members.

🇬🇧 Ecommpay shortlisted in Open Banking Expo Awards. The inclusive global payments platform, has been shortlisted in the prestigious Open Banking Expo Awards, in the Best Industry Partnership category.

Winners will be announced at the Awards ceremony on 15th October 2024 after Day One of the UK & Europe Expo at the Business Design Centre, London.

The payments provider has been focused on delivering the benefits of open banking to the online merchant marketplace in an accessible and cost-effective way, improving sales conversion and volumes.

🇺🇸 Capchase partners with Stripe as their first B2B BNPL payment method for the US. The Capchase Pay experience is now available inside the Stripe payments infrastructure which makes it even easier for SaaS businesses to leverage this flexible payment method.

🇩🇪 PUMA partners with Payrails to transform online payments and improve the shopping experience for customers worldwide. The collaboration will enable shoppers to have a wider variety of payment options and receive a more seamless buying experience - regardless of their location or payment method.

🇺🇸 Affirm opens BNPL offering to Apple Pay Users. The recently announced integration allows Apple Pay users in the U.S. to pay for purchases via iPhone and iPad over time using Affirm, breaking down their payments into biweekly or monthly installments.

🇮🇳 Razorpay’s Harshil Mathur discusses their omnichannel payment evolution, future growth in offline payments, international expansion towards south east asia, and the potential of India’s FinTech ecosystem. Read the full piece here

🇬🇧 ID-Pal and CLOWD9 enter global strategic partnership to revolutionise payment processing. The partnership advances CLOWD9’s mission to revolutionize the payment industry by integrating advanced payment processing with AI-driven identity verification, setting new benchmarks for security and efficiency.

🇺🇸 Zūm Rails establishes U.S. headquarters in Miami in preparation for 50% of revenue originating stateside. Miami was selected due to its emergence as a destination for some of the country’s largest technology and finance corporations following the Silicon Valley exodus of tech talent in recent years.

🇧🇷 Banco de Brasília (BRB) has officially been authorized to operate as a payment initiator within open finance, becoming one of 36 institutions offering this service. This new role enables users to conduct Pix payment transactions outside the traditional financial institutions' environment, facilitating account management through various platforms.

🇺🇸 FinTech Cherry pitches bond tied to BNPL cosmetic surgery loans. The startup is collaborating with Barclays on a potential healthcare asset-backed deal, with investor meetings scheduled for the coming weeks. The proposed bond would be secured by consumer loans provided by Cherry for cosmetic surgery, dental, or medical aesthe.

GOLDEN NUGGET

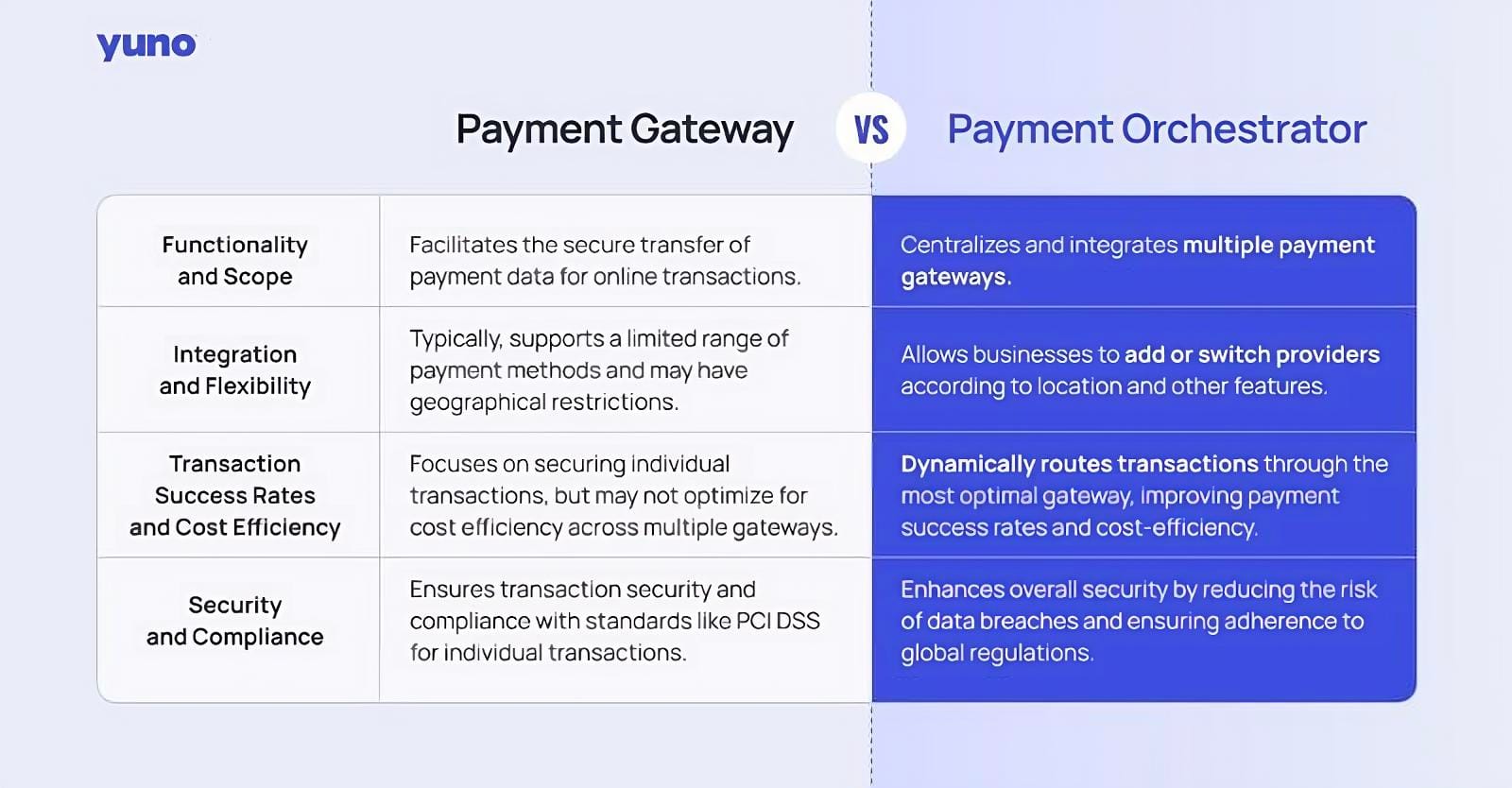

📊 Payment Gateway 🆚 Payment Orchestrator, by Yuno

Let’s dive in:

The e-commerce landscape is evolving rapidly, with global e-commerce sales projected to reach $8.034 billion by 2027, comprising 22.6% of total retail sales.

Amidst this transformative surge, businesses increasingly rely on payment gateways to manage their payment processes.

Every day, payment gateways are projected to process over 1.57 trillion transactions in 2024 🤯

Highlighting their immense impact on global commerce. Their primary objective is to ensure a seamless shopping experience for customers while equipping businesses to streamline their payment operations.

𝗪𝗵𝗮𝘁 𝗶𝘀 𝗮 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗚𝗮𝘁𝗲𝘄𝗮𝘆?

A payment gateway serves as a vital technology in the realm of e-commerce, enabling online payments for e-commerce sites and digital retailers.

It acts as an intermediary between the customer and the merchant, ensuring that payment data is transferred securely.

𝗛𝗼𝘄 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗚𝗮𝘁𝗲𝘄𝗮𝘆𝘀 𝗪𝗼𝗿𝗸:

The process begins when a customer proceeds to checkout. The payment gateway securely transmits the transaction details to the acquiring bank, who forwards these details to the issuing bank (the customer's bank) for authorization.

Once authorized, the payment gateway communicates the approval or decline to the merchant and the customer. This entire process takes place within seconds, providing a seamless shopping experience.

𝗪𝗵𝗮𝘁 𝗔𝗿𝗲 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗢𝗿𝗰𝗵𝗲𝘀𝘁𝗿𝗮𝘁𝗼𝗿𝘀?

Payment orchestrators act as a centralized platform that integrates and manages multiple payment gateways, providing businesses with a unified interface to handle their payment processes.

By acting as a middle layer, payment orchestrators simplify the complexity associated with managing multiple gateways, offering a host of benefits that enhance operational efficiency and customer experience.

Businesses leveraging payment orchestrators report a 25% increase in transaction success rates and a 30% reduction in operational costs.

I highly recommend reading the deep dive article for more interesting info on this topic.

Source: Yuno

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()