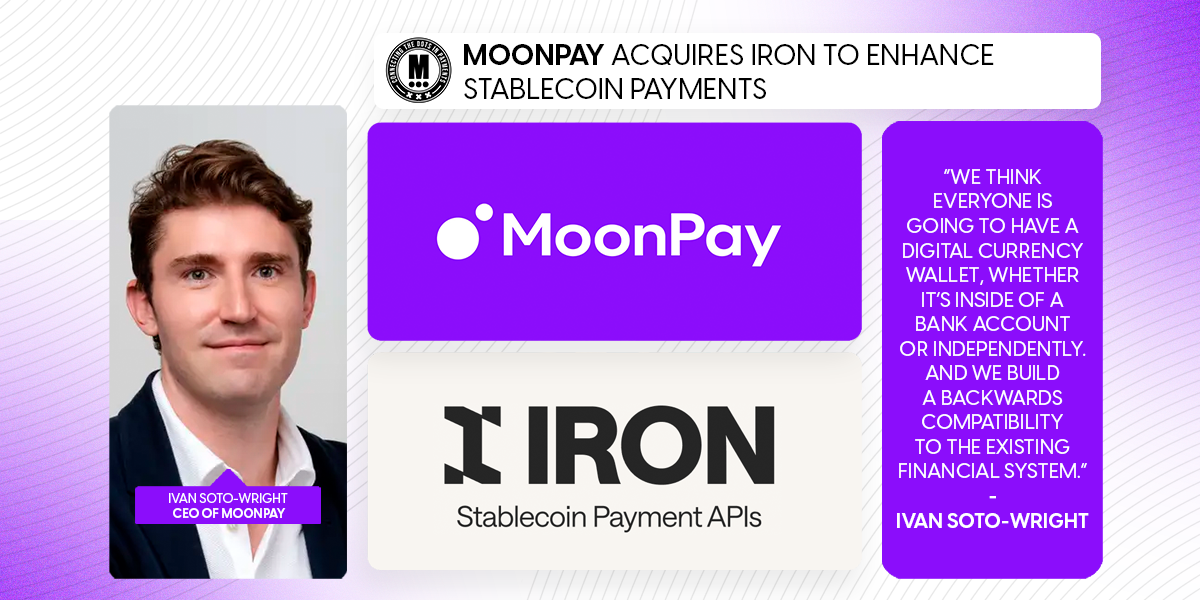

MoonPay Acquires Iron To Enhance Stablecoin Payments

Hey Payments Fanatic!

MoonPay is once again expanding its reach in crypto payments with the acquisition of Iron, an API-first stablecoin infrastructure platform. Having already simplified access to the crypto economy by integrating traditional payment methods like debit cards, bank transfers, PayPal, Venmo, Apple Pay, and Google Pay, MoonPay now seeks to enhance its capabilities further.

The deal, reportedly valued in the nine-digit range, will allow businesses using MoonPay to accept stablecoin payments, enabling instant, cost-efficient, and borderless transactions.

This marks MoonPay’s second major acquisition this year, following its $175 million purchase of Helio in January.

Ivan Soto-Wright, MoonPay's CEO, highlighted the company’s long-term vision, stating, “We think everyone is going to have a digital currency wallet, whether it’s inside of a bank account or independently. And we build a backwards compatibility to the existing financial system.”

This acquisition follows just 1 month after Stripe finalized its $1.1 billion deal to acquire Bridge Network, marking a key move for both Stripe and the broader crypto ecosystem. With this acquisition, MoonPay is positioning itself to challenge Stripe, merging fiat and crypto payments providers start to compete in a single market.

MoonPay, serving over 30 million accounts across 180 countries, was last valued at $3.4 billion in 2021 and remains cash-flow positive.

Check out more global Payments updates below👇, and I’ll see you again on Monday!

Cheers,

Discover FinTech innovation across APAC. Stay informed with weekly updates—join now!

PAYMENTS NEWS

🇵🇪 Lemon launches the VISA Lemon Card powered by Pomelo, allowing users in Peru to make payments at any merchant worldwide that accepts VISA, using soles or cryptocurrencies, and earn Bitcoin cashback on all purchases. This alliance represents a key step in the adoption of crypto asset payments in LatAm.

🇬🇧 Curve and Infact partner to bolster financial inclusivity. Curve Flex will now have transactions reported in real-time through Infact’s API-based system, uniquely suited to represent Credit Card and BNPL activity accurately to enable customers to build credit profiles instantly.

🇦🇹 Santander and Amazon introduce Visa card in Austria that rewards customers with cashback for shopping on Amazon and other sites. The fee-free card does not require the opening of a new bank account. Keep reading

🇮🇱 Rapyd raises $500m at $4.5b valuation to complete $610m PayU acquisition. Upon completion of the acquisition, the company will be able to execute transactions in over 100 countries using more than 1,200 payment methods. It will also hold a financial activity permit in 41 countries and maintain a wide range of partnerships.

🇺🇸 Shift4 Payments has acquired Global Blue. This acquisition aims to enhance Shift4's merchant services platform by integrating Global Blue's tax refund processing and multi-currency conversion capabilities, thereby connecting merchants with a broader base of affluent international shoppers.

🇦🇺 Boost Payment Solutions and transferMate collaborate on cross-border payments. This collaboration combines Boost's Boost 100XB solution with TransferMate's extensive payment infrastructure and aims to streamline processing and reconciliation for accounts payable and receivable teams dealing with international payments.

🌍 B2B payment platform Nilos expands to West Africa. As part of its mission to simplify cross-border transactions, the company is introducing instant payouts in the West African CFA franc (XOF) and integrating mobile money services to enhance accessibility for businesses and individuals.

🇺🇸 Mastercard moves to end manual card entry as fraud losses projected to exceed $91b by 2028. The company introduced tokenization to replace actual card numbers with randomly generated tokens for better security. It is working with banks, FinTechs, and merchants to implement a universal one-click checkout button across all online platforms.

🇬🇧 Mastercard joins Visa and Revolut in claim against UK payments regulator. The companies are challenging certain regulatory decisions made by the FCA, which they argue are unfair or detrimental to their operations. This lawsuit underscores tensions between financial institutions and regulators over payment rules.

🌏 Pine Labs and Visa team up to offer Instalment Solutions in Southeast Asia. The collaboration will enable merchants more flexibility and affordability to offer seamless instalment payment options for domestic and cross-border transactions.

🇬🇧 Apexx Global joins JPMorgan payments partner network. As merchants continue to demand more flexibility, speed, and choice in payments, they will provide a holistic solution that simplifies global transactions for merchants while optimizing acceptance rates and cost efficiencies.

🇦🇪 Finseta secures licence to expand payment services in the UAE. This license allows the company to offer multi-currency accounts and payment services to businesses and individuals across the country through its proprietary technology platform.

🇺🇸 Sezzle adds smarter spending features to BNPL platform to make shopping smarter, simpler, and more transparent. With the Sezzle app, consumers can shop anywhere and instantly find the best deals, reinforcing Sezzle's mission to financially empower the next generation.

🇨🇭 Alpian Bank partners with Amex to bring clients even more benefits. Through this collaboration, Alpian clients can apply for the American Express Platinum Card®, gaining access to premium services such as travel benefits, concierge services, and various rewards.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()