Nedbank Acquires SME Payment Startup iKhokha for $90M

Hey Payments Fanatic!

Nedbank, one of South Africa’s largest banks, is set to acquire payments startup iKhokha in an all-cash deal worth $90 million.

This move will merge Nedbank’s established banking infrastructure with a platform already relied on by thousands of SMEs for payments, working capital, and business management tools.

“By combining their innovative technology with our deep banking experience, we will provide small business clients with best-in-class tools to thrive,” said Ciko Thomas, Group Managing Executive for Personal & Private Banking at Nedbank.

Keep scrolling to dive deeper into the Nedbank and iKhokha deal and get today’s Payments dose 👇

See you tomorrow!

Cheers,

INSIGHTS

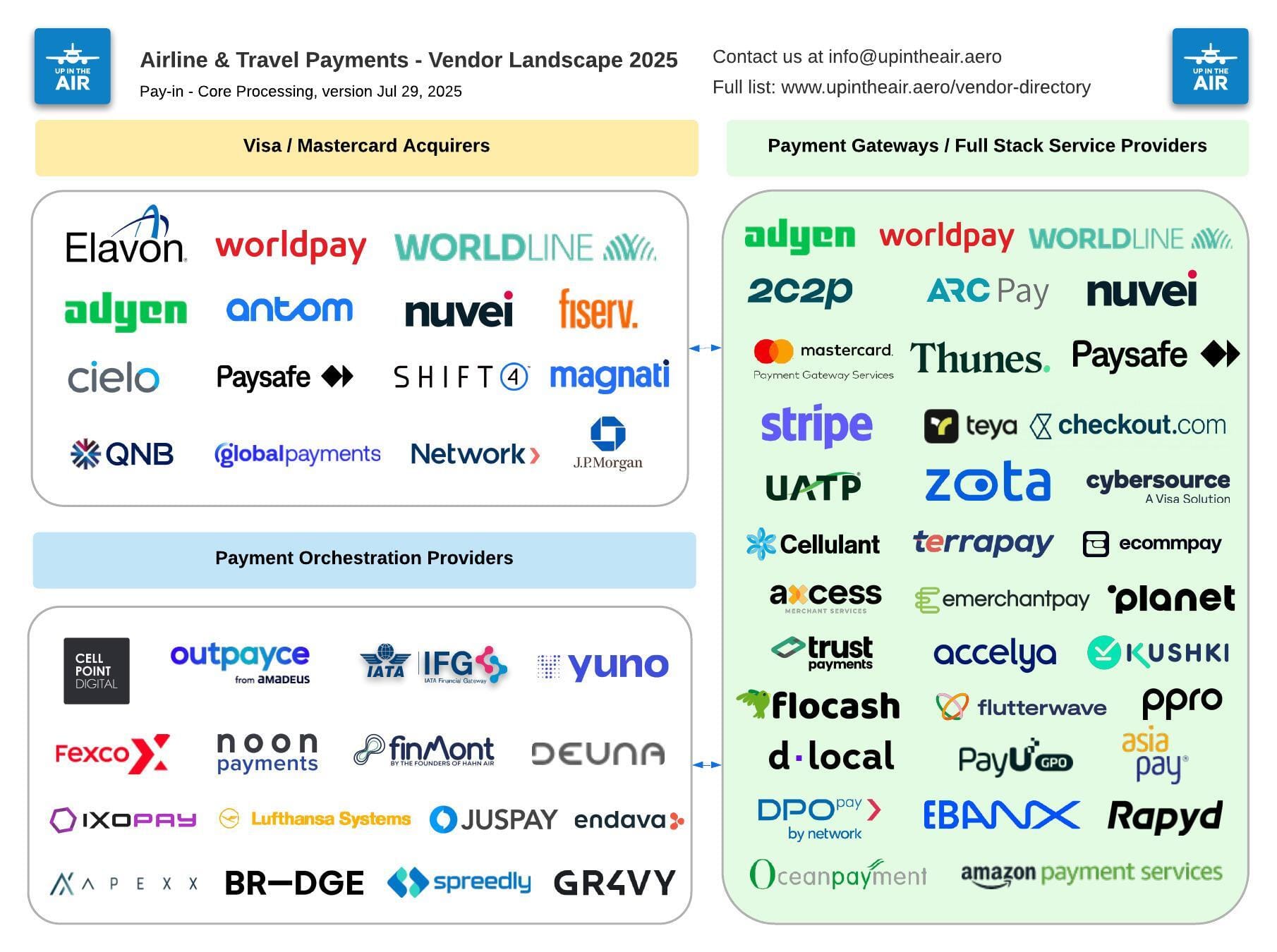

🌍 Airline & Travel Payments Vendor Landscape infographics👇

Are any companies missing on these maps?

NEWS

🇨🇱 VTEX and Getnet simplify online payments for E-commerce businesses. This collaboration streamlines payment gateway integration by enabling both Web Checkout and Smart Checkout, offering customers a faster, more seamless, and secure shopping experience.

🇿🇦 Nedbank acquires FinTech startup iKhokha for $90m to empower SMEs. The acquisition marks a significant milestone in Nedbank’s strategy to deepen its support for small and medium-sized enterprises (SMEs) through innovative digital solutions. Continue reading

🇺🇸 PayPal trial set for 2026 as judge blocks revived Ioengine claim. The lawsuit over portable data-storage technology used for secure online transactions will proceed on the two claims of US Patent No. 9,059,969 that survived earlier rulings, the Judge said in an opinion issued in the US District Court.

🇧🇭 TransferMate applies for a representative office license in Bahrain. This means partners and their customers doing business in Bahrain will be able to access TransferMate’s full suite of services, including payments, receivables, and stored funds globally, subject to regulatory approval.

🇬🇧 GoCardless launches industry-leading AI tool for faster, more reliable same-day payments. The tool, Same Day Settlement+, leverages proprietary machine learning algorithms and transaction data from over 38 million accounts to significantly cut payout times and reduce late payment failures by over 80%.

🇺🇸 Payoneer adopts Citi Token services to facilitate global intracompany transfers. With this capability, Payoneer can transfer funds between its global accounts in participating branches and currencies with greater speed, automation, and transparency, the companies said.

🇬🇧 Zilch boosts loss provisions as customer numbers soar in 'record year' for UK FinTech. The London-based company elevated provisions for credit losses, funds reserved to cover anticipated losses from defaulted repayments to £27.4m – a 116 per cent rise from £12.7m the previous year.

🇦🇺 Zip launched the latest Google Wallet experience on iOS. In one seamless step, Zip Pay and Zip Plus customers can now access their Zip Visa Card across the entire Google ecosystem in one click, making it even easier to spend anywhere Visa is accepted, globally and in-store.

🇺🇸 Top crypto VC Matt Huang to lead Stripe blockchain Tempo as CEO, stay at Paradigm. Through his role on Stripe’s board, Huang has long been a close partner to the FinTech firm, but his decision to lead the new blockchain represents a major bet on Stripe’s future dominance in the crowded stablecoin landscape.

🇦🇺 Tyro Payments receives acquisition Interest and maintains market transparency. However, the company has determined that the current offers do not reflect its intrinsic value. Tyro is committed to keeping the market informed in line with its disclosure obligations.

🇬🇧 Bluechain and Visa partner to launch B2B payments infrastructure for UK businesses. The partnership introduces a critical infrastructure layer, enabling businesses to pay any supplier with Visa cards while Bluechain handles billing, collection, reconciliation, and merchant-of-record requirements.

🇺🇸 BurraPay secures U.S. patents to advance compliant cryptocurrency payments. The innovation allows cryptocurrencies to be seamlessly integrated with existing USD cashless wallets, opening up new channels for operators to engage with the growing number of players in the field.

🇺🇸 NMI Ushers in next era of embedded payments with new CEO appointment. Steven Pinado brings nearly 30 years of experience in FinTech, embedded payments, and scaling growth-stage businesses. His diverse background spans payment processors, issuers, and SaaS platforms, uniquely positioning him to lead NMI into its next chapter of growth and innovation.

🇬🇧 UK FinTech Privalgo gains Dutch regulatory approval for EU payment operations. The license authorises Privalgo to provide payment accounts, issue electronic money, and execute payment transactions across Europe through its subsidiary Privalgo BV, which operates under the leadership of Managing Director Ronald Wallroth.

🇬🇧 Wirex expands Web3 payments in Europe with Visa-backed EURC settlements. The integration of EURC settlement allows Wirex to further streamline cross-border payments and enhance the efficiency of its crypto-to-fiat conversion infrastructure, enabling fast, secure, and cost-effective transactions for users.

🇺🇸 New York Attorney General James sues Zelle parent company, alleging it enabled fraud. James’ office said in a press release that its investigation found that Early Warning Services, the owner and designer of the peer-to-peer money transfer company, designed Zelle “without critical safety features.”

🇳🇬 Strowallet launches card issuing solution for Nigerian FinTechs and MFBs. The new platform allows partners to issue Physical Naira ATM Cards for cash withdrawals and in-store payments, Virtual Naira Cards for secure local online transactions, and Virtual Dollar Cards for international payments, subscriptions, and e-commerce.

🇺🇸 Fundwell acquires EveryStreet, Uniting Payments, Cash Flow, and Capital in One Platform. The acquisition expands Fundwell’s platform with EveryStreet’s receivables and payments technology, giving SMBs faster access to capital and greater control over cash flow.

GOLDEN NUGGET

🚨 Part 4: What is 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 & 𝐕𝐚𝐮𝐥𝐭𝐢𝐧𝐠 by CellPoint Digital 👇 Created by Arthur Bedel 💳 ♻️

𝐕𝐚𝐮𝐥𝐭𝐢𝐧𝐠 refers to the secure storage of sensitive payment data (e.g., PANs, CVV, expiry) within a PCI-compliant environment.

Once stored, this data is tokenized, allowing it to be reused for future transactions — such as rebookings, upgrades, or refunds — without exposing the original card details.

𝐄𝐧𝐜𝐫𝐲𝐩𝐭𝐢𝐨𝐧 𝐯𝐬. 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

Although both protect sensitive data, their core functions differ:

🔐 𝐄𝐧𝐜𝐫𝐲𝐩𝐭𝐢𝐨𝐧 converts plain text into unreadable ciphertext using an algorithm and a key. It’s reversible — if the key is compromised, so is the data.

🔐 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 replaces sensitive data with a unique token. The token has no intrinsic value and can’t be decrypted — only mapped back to the original data via the secure vault.

→ Tokenization aligns with PCI-DSS compliance requirements, not Encryption.

𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

𝐀𝐜𝐪𝐮𝐢𝐫𝐞𝐫 𝐓𝐨𝐤𝐞𝐧𝐬 — Issued by acquiring banks to enable processing continuity and reconciliation across merchant portfolios.

𝐈𝐬𝐬𝐮𝐞𝐫 𝐓𝐨𝐤𝐞𝐧𝐬 — Created by the issuing bank, often linked to risk scoring and lifecycle management.

𝐍𝐞𝐭𝐰𝐨𝐫𝐤 𝐓𝐨𝐤𝐞𝐧𝐬 — Issued by card networks (Visa, Mastercard...); dynamically updated when cards are reissued, enhancing approval and fraud protection.

𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐓𝐨𝐤𝐞𝐧𝐬 — One-time-use tokens tied to a specific transaction or session, ideal for guest checkout or dynamic CVV use cases.

𝐌𝐞𝐫𝐜𝐡𝐚𝐧𝐭 𝐓𝐨𝐤𝐞𝐧𝐬 — Proprietary tokens issued by the merchant or orchestration layer; enable unified identity and checkout across multiple PSPs

→ A 𝐥𝐚𝐲𝐞𝐫𝐞𝐝 𝐭𝐨𝐤𝐞𝐧 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲 ensures flexibility, security, and optimization across the payment stack.

𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐏𝐫𝐨𝐜𝐞𝐬𝐬: How It Works

1️⃣ Customer enters card information during checkout

2️⃣ Sensitive data is transmitted to the vaulting service

3️⃣ A token is returned and stored by the merchant (or orchestration platform)

4️⃣ This token is reused for future payments — recurring, refunds, upgrades — without re-entering the card

5️⃣ When network tokens are used, they are automatically updated upon card expiration or reissuance

𝐓𝐡𝐞 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧

→ Reduced PCI Scope — PANs are never stored in merchant systems

→ Stronger Security Posture — Even if intercepted, tokens are meaningless to attackers

→ Operational Efficiency — Tokens streamline refunds, cancellations, and rebookings

→ Improved Approval Rates — Network tokens align with issuer preferences

Tokenization is no longer a security add-on — it’s a core component of modern, intelligent travel payment infrastructure.

Source: CellPoint Digital

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()