NeverPay Unveils a Way to Spend Crypto While HODLing It

Hey Payments Fanatic!

Today, I’m bringing you a different kind of payment concept. Okay, I know crypto payments aren’t exactly new anymore… they’re not mainstream yet, but this isn’t exactly about that; this one is a niche within crypto payments. Let’s take a look:

A San Francisco company, named NeverPay, has launched a crypto payment platform that lets users make purchases without selling their crypto or taking on debt. They claim to be the first of their kind. Their platform has a catchy name: “Buy Now, Pay Never.” It works by using yield generated from staked crypto to pay merchants in stablecoins.

Here’s how it works: users stake their crypto, like Solana (SOL), for a year. In return, they receive two tokens: one representing the staked principal, and another giving access to the staking rewards. Those rewards are what actually fund purchases, and they're received by merchants. Meanwhile, the original crypto stays untouched and is returned after the lock-up ends. Users get to keep their holdings, make instant purchases, and avoid any risk of liquidation.

NeverPay doesn't rely on lending models that use collateral and can be volatile, but leans entirely on staking. If users want out early, they can sell their position on a secondary market, offering liquidity without needing to unwind the whole setup. Their plan is to make crypto useful for HODLers without being sold or borrowed against.

On the merchant side, they’re paid instantly in stablecoins, with no fees or onboarding hurdles. The platform is still in waitlist mode, but according to their website, they say they’re aiming to integrate with big players like Stripe, Moonpay, and Shopify.

So, what do you think about this new concept?

Enjoy more payments industry updates below👇 and I'll be back tomorrow!

Cheers,

Discover FinTech innovation across APAC. Stay informed with weekly updates—join now!

INSIGHTS

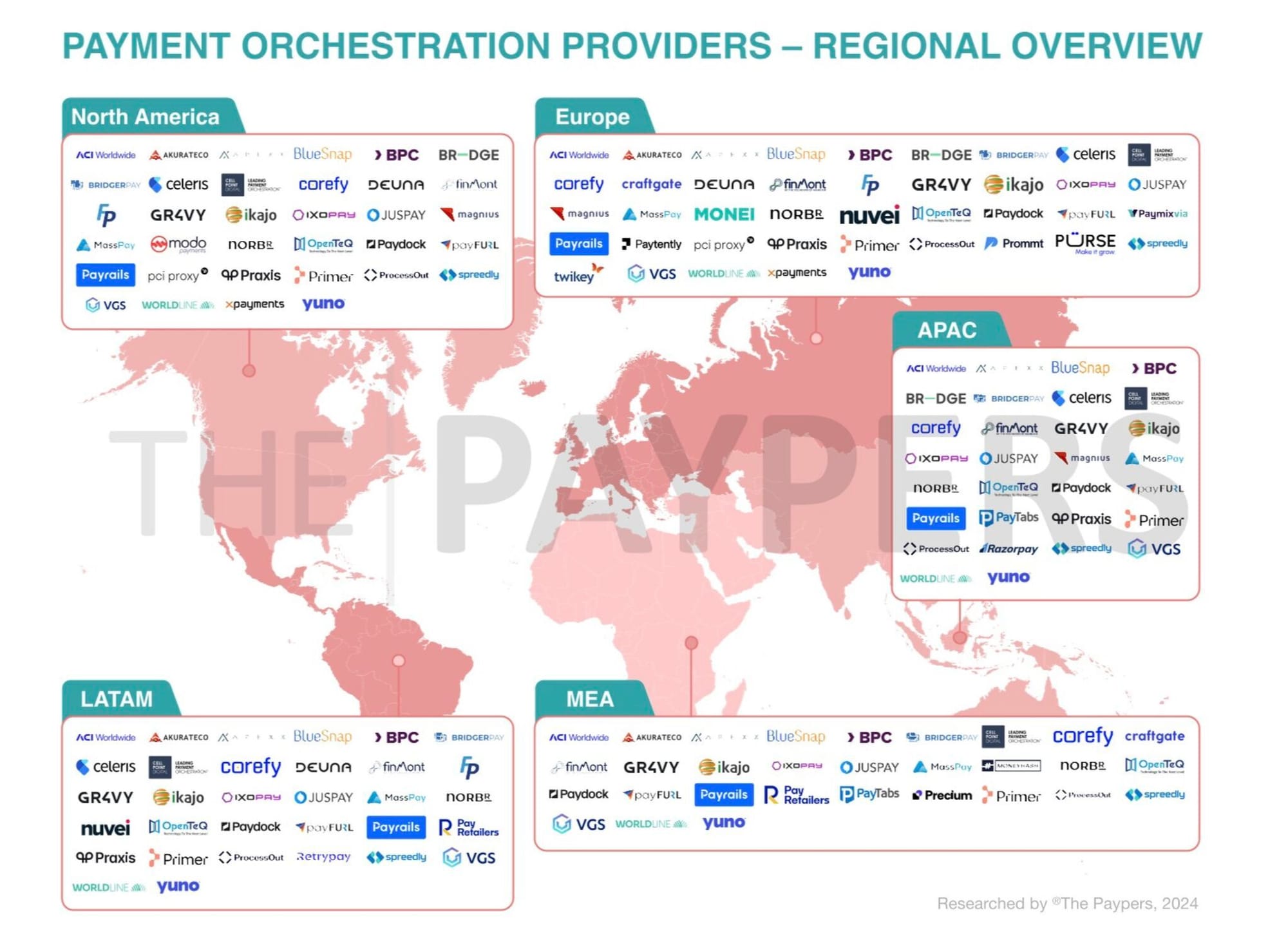

📊 Global Map of 𝗣𝗮𝘆𝗺𝗲𝗻𝘁 𝗢𝗿𝗰𝗵𝗲𝘀𝘁𝗿𝗮𝘁𝗶𝗼𝗻 𝗣𝗿𝗼𝘃𝗶𝗱𝗲𝗿𝘀 👇

NEWS

🇺🇸 ACI Worldwide appoints Robert Leibrock as Chief Financial Officer. Thomas Warsop, President and CEO, said: “His extensive experience leading finance organizations in global, complex environments will be invaluable as we continue to execute our growth strategy. His strategic acumen and proven financial expertise position him well to drive our financial discipline and operational excellence.”

🇺🇸 Walmart is using its FinTech firm to offer credit cards after parting ways with Capital One. OnePay is partnering with Synchrony, a major behind-the-scenes player in retail cards, which will issue the cards and handle underwriting decisions starting in the fall, the companies said.

🇳🇱 Buckaroo is joining EPI Company as a principal member to deploy Wero. This initiative aims to create a European payment solution that is secure, seamless, and sovereign. Keep reading

🇬🇧 Mercuryo integrates Passkey to boost Web3 payment speed and security without inputting a Time Passcode (OTP) delivered via text message or email. Passkey, available on iPhone, Android, or Windows, will be rolled out across Mercuryo’s 200+ partner network, including non-custodial wallets.

🇵🇭 Atome to get $75 million from lending Ark as credit demand grows. The financing will help Atome to broaden its credit offerings and expand financial access in the Philippines. Atome offers insurance, savings, cards, and lending services. Continue reading

🇮🇳 Zaggle to acquire Dice Enterprises for $14.7m, eyes SaaS expansion. By integrating Dice’s skilled tech talent, Zaggle aims to accelerate innovation and enhance the feature set of its platform. The deal is expected to be finalised within 90 days.

🇧🇷 Brazilian Startup Barte raises $3 million for B2B payments platform. One of Barte’s products simplifies B2B payments by automating transactions and processes before and after the payment. The other product uses payment information to enable access to credit through the platform.

🌏 Western Union appoints Vince Tallent as Senior VP, Head of Asia Pacific. Tallent said: “This is an exciting opportunity to build on Western Union’s growth momentum in the region by delivering customer-centric, innovative solutions that empower individuals as they send and receive money, ultimately making financial services accessible for all.”

🇳🇿 Westpac partners with Akahu to boost open banking access. With this new connection, open banking will quickly come to life for Westpac customers who will be able to seamlessly and securely link their accounts to an established ecosystem of innovative financial tools and services.

🇳🇬 PayU GPO strengthens Africa presence with A2A rollout and senior appointment. The solution allows consumers in Nigeria to pay merchants directly from their bank accounts without the need for a card. The benefits include lower transaction costs, real-time transactions, a frictionless user experience, and accessibility and choice for consumers.

🌍 Onafriq links 1 billion connected mobile wallets, 500 million bank accounts across Africa. Onafriq has transformed into a full omnichannel payments network. It facilitates cross-border disbursements, collections, card issuance and processing, offline agent banking services, and FX & treasury services.

🇺🇸 Selfbook chooses PayPal as a commerce partner. It will integrate PayPal and Venmo as payment options for its hotel customers. The partnership will advance travel booking into the age of agentic AI by leveraging conversational AI to help customers book and pay.

🇨🇦 Trust Payments partners with Trulioo to streamline verification, reduce onboarding costs, and accelerate global growth. In addition, both will continue to focus on meeting the needs, preferences, and demands of clients and users in an ever-evolving market.

🇺🇸 Plaid now offers instant pay-ins and payouts through its multi-rail platform, Plaid Transfer. In partnership with Cross River, the solution features real-time settlement, Plaid Link bank authorization, account verification, balance checks, and smart routing via a single integration.

🇻🇳 Visa introduces Click to Pay with leading banks and payment facilitators in Vietnam, transforming the online shopping experience. It provides consumers with a fast, secure, and convenient checkout experience with global acceptance, as Click to Pay is now enabled in even more places where cardholders want to shop online.

🇧🇷 Pix registers new daily record for transactions. According to the Central Bank, there were 276.7 million transactions in a single day, surpassing the 252.1 million operations recorded on December 20, 2024. It also reported that the financial value of these 276.7 million transactions is R$135.6 billion.

GOLDEN NUGGET

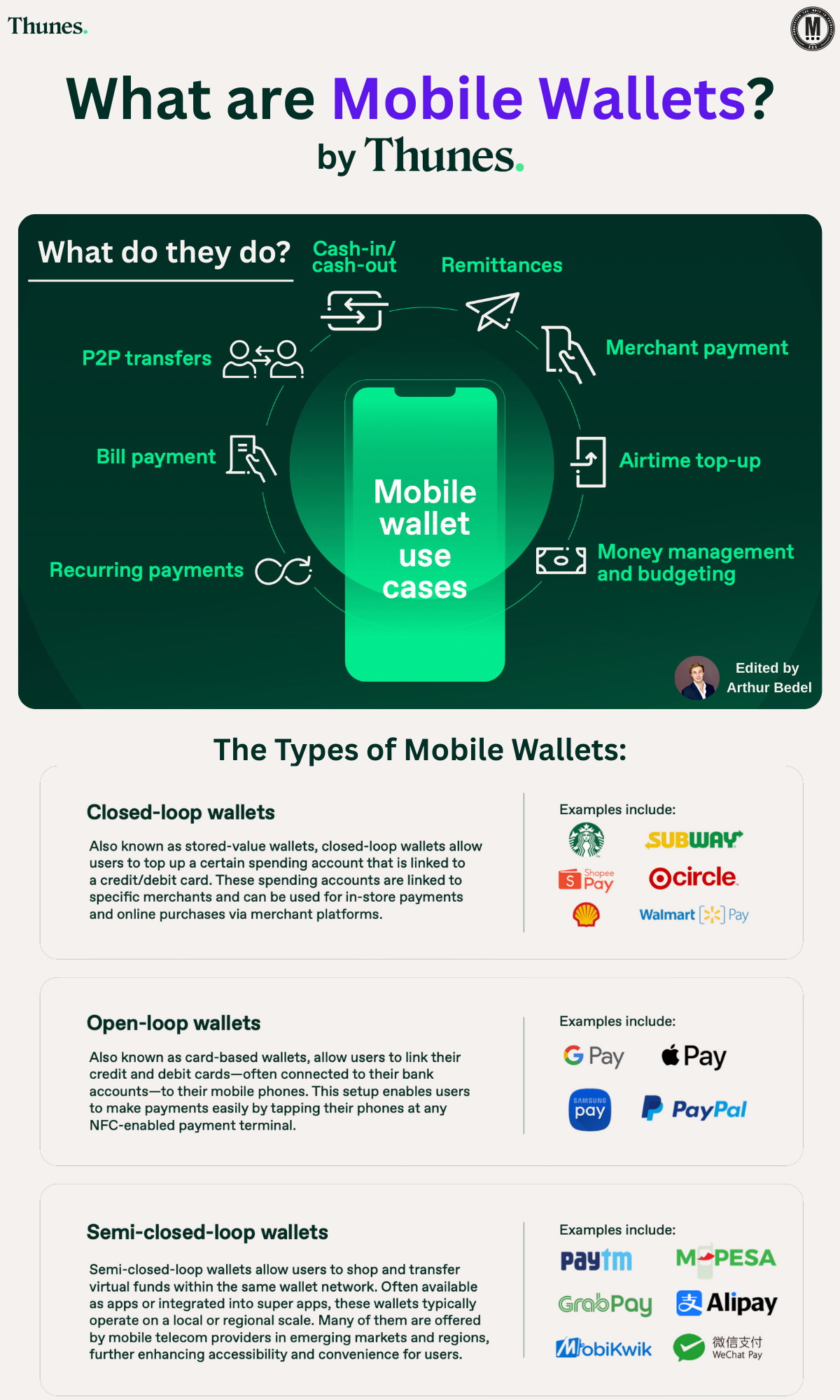

𝐖𝐡𝐚𝐭 𝐚𝐫𝐞 𝐌𝐨𝐛𝐢𝐥𝐞 𝐖𝐚𝐥𝐥𝐞𝐭𝐬? — an introduction to one of the most transformative payment experiences globally by Thunes 👇 Created by Arthur Bedel 💳 ♻️

𝐃𝐞𝐟𝐢𝐧𝐢𝐧𝐠 𝐌𝐨𝐛𝐢𝐥𝐞 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

► Mobile wallets are digital financial applications that enable users to store value, initiate payments, manage transactions, and access financial services directly from a mobile device. From embedded wallets in super apps to card-linked wallets enabling NFC payments, they are replacing cash & cards.

📈 In 2023, mobile wallet users surpassed 4.3 billion globally, with projections reaching nearly 6 billion by 2026.

𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐌𝐨𝐛𝐢𝐥𝐞 𝐖𝐚𝐥𝐥𝐞𝐭𝐬

1️⃣ 𝐂𝐥𝐨𝐬𝐞𝐝-𝐋𝐨𝐨𝐩 𝐖𝐚𝐥𝐥𝐞𝐭𝐬

→ Operate within a single merchant or platform ecosystem. Funds can only be spent with that provider.

▪️ Best for: Brand loyalty and controlled ecosystems

▪️ Subway App, Starbucks Rewards, Walmart Pay, ShopeePay

2️⃣ 𝐎𝐩𝐞𝐧-𝐋𝐨𝐨𝐩 𝐖𝐚𝐥𝐥𝐞𝐭𝐬

→ Linked to payment cards or bank accounts and accepted across a wide range of merchants. Often enabled by tokenization and NFC (tap-to-pay).

▪️ Best for: Cross-merchant usability, & international acceptance

▪️ Apple Pay, Google Pay, PayPal

3️⃣ 𝐒𝐞𝐦𝐢-𝐂𝐥𝐨𝐬𝐞𝐝 𝐋𝐨𝐨𝐩 𝐖𝐚𝐥𝐥𝐞𝐭𝐬

→ Can be used across multiple merchants or services — but only within a pre-approved network. They often include financial services like lending, insurance, or savings.

▪️ Best for: Super apps, ecosystems in emerging markets

▪️ Alipay (China), Paytm (India), GCash (Philippines), M-PESA Africa (Kenya), GrabPay (Southeast Asia), JazzCash (Pakistan)

4️⃣ 𝐏𝐞𝐞𝐫-𝐭𝐨-𝐏𝐞𝐞𝐫 (𝐏2𝐏) 𝐅𝐨𝐜𝐮𝐬𝐞𝐝 𝐖𝐚𝐥𝐥𝐞𝐭𝐬

→ Built around social payments and direct transfers, often with embedded social features.

▪️ Best for: Domestic transfers, informal payments, splitting bills

▪️ Venmo, Cash App, Zelle

5️⃣ 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 & 𝐖𝐞𝐛3 𝐖𝐚𝐥𝐥𝐞𝐭𝐬

→ Enable crypto-based payments, digital asset storage, and on-chain transactions.

▪️ Best for: DeFi use cases, borderless payments, token economy

▪️ Dfns, MetaMask, Phantom, Trust Wallet

𝐊𝐞𝐲 𝐃𝐫𝐢𝐯𝐞𝐫𝐬 𝐨𝐟 𝐌𝐨𝐛𝐢𝐥𝐞 𝐖𝐚𝐥𝐥𝐞𝐭 𝐆𝐫𝐨𝐰𝐭𝐡

► Digitization of government and financial services

► Expansion of QR and NFC merchant infrastructure

► Growing demand for contactless and cardless payments

► Embedded finance capabilities in mobility, delivery, and social platforms

► Real-time Payment (#RTP) rails and wallet interoperability

𝐓𝐡𝐞 𝐂𝐨𝐫𝐞 𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬

► P2P transfers

► Remittances

► Bill payments & recurring subscriptions

► Airtime top-ups

► Merchant & QR payments

► Money management & budgeting

► Cash-in / cash-out at agents and ATMs

𝐍𝐞𝐱𝐭 𝐔𝐩: The Benefits of Mobile Wallets

→ How consumers, merchants, and payment networks are being reshaped by wallet-driven commerce.

Source: Thunes

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()