PalmPay in Talks for $100M Raise Amid Profitability Milestone

Hey Payments Fanatic!

PalmPay is reportedly in talks to raise between $50-$100 million, just as it reaches profitability. The Nigeria-based Fintech has raised nearly $140 million so far, with its last round in 2021 valuing the company at $800-$900 million, placing PalmPay among Africa’s biggest Fintechs. While the valuation for this round hasn’t been disclosed, sources say the funding may include both equity and debt.

Founded in 2019, PalmPay set out to build a digital bank focused on payments that fit the realities of Africa’s informal economy. It started in Nigeria, offering instant onboarding, zero transfer fees, and financial services for underbanked individuals and small businesses. Over time, it combined digital access with a massive agent network, now +1 million small businesses use PalmPay to serve customers face-to-face.

Now, the company says it processes +15 million transactions daily from 35 million registered users. Revenue reportedly hit $64 million back in 2023 and has more than doubled in the last year. PalmPay says one in four users opened their 1st financial account through its platform.

With profitability now achieved, PalmPay is looking to scale further. In Nigeria, it’s introducing device financing and expanding its business payments offering. It’s also growing its footprint in Ghana, Tanzania, and Bangladesh, its 1st market outside Africa. In each location, the strategy is similar: start with core products like credit or payments, then gradually add more.

Read more global Payments industry updates below 👇 and I'll be back with more on Monday!

Cheers,

NEWS

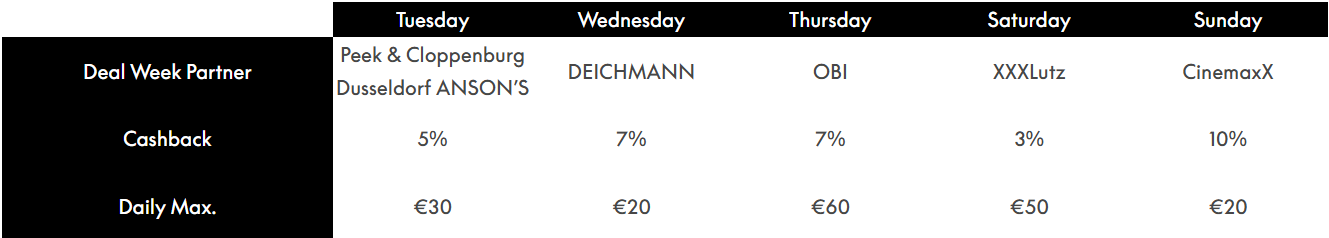

🇩🇪 PayPal launches ‘Deal Week’ in-store rewards at 2,000 locations. On different days of the week, customers can earn up to 10% cashback when they pay contactless in-store with the PayPal app. The offers recur every week, allowing consumers to earn hundreds of euros in cashback each month.

🇺🇸 Wise is planning to list its shares in the US, the latest blow to London’s stock market. Wise said the move will allow institutional and retail investors in the US to purchase its shares, noting that many of them are currently unable to do so. The move should increase liquidity in the firm’s stock, allowing current shareholders greater flexibility and opportunity to buy and hold our shares.

🇸🇪 Klarna saved $2 million after cutting ties with Salesforce. The company is consolidating data from multiple platforms into one place and using AI to make sense of it, having closed down 1,200 small software services. Meanwhile, Sebastian Siemiatkowski, CEO, says the company will use humans to offer VIP customer service. He spoke about how the company plans to balance employees and AI workers.

🇺🇸 Square AI, now in open beta, unlocks business insights. With Square AI, sellers can visit their dashboard and ask questions about their business using natural language. The AI interprets the query and delivers direct, instant answers, eliminating the need for sellers to locate specific reports, apply the right filters.

🌎 ProntoPaga Launches SMARTPIX and Expands Payment Innovation Across Latin America. It allows operators to process high-volume transactions directly from their bank accounts. This eliminates exposure to third-party handling, reduces latency, enhances availability, and ensures total control and security for merchants.

🇬🇧 Allpay becomes the first signatory of Enfuce’s Fortitude Pledge, leading the way in responsible finance. By integrating Enfuce’s cloud-based technology, allpay is modernising public sector payments across the UK, making them more secure, efficient, and less vulnerable to fraud.

🇺🇸 Shift4 Payments announces CEO Isaacman’s resignation. The announcement also indicated that Isaacman will assume the role of Executive Chairman of Shift4 Payments. As Executive Chairman, he will continue to serve as an executive officer and Class I member of the board of directors.

🇺🇸 Bill taps PayPal veteran Rohini Jain as CFO. The incoming finance chief will join Bill’s executive team on July 7, replacing John Rettig, who will stay on as president while also taking on the new role of chief operating officer, the company said. Read more

🇺🇸 California advances bill on unclaimed crypto and merchant payments. California’s lower house has passed a sweeping crypto payments-regulating bill that would also allow the state to take idle crypto holdings from exchanges if an owner hasn’t accessed their account in three years.

🇧🇷 EQT's top payment company receives prestigious permit. Zimpler is now officially a certified Payment Institution (PI) in Brazil, approved by the Central Bank of Brazil. This means businesses can now offer instant bank payments via Pix with fewer clicks, less friction, and no detours.

🇺🇸 Worldpay enables Paze℠, bringing new levels of convenience and speed to online checkout. The convenient Paze checkout experience enables consumers to pay online with their preferred credit and debit cards via added security through tokenization and seamless digital authentication.

🇨🇳 LianLian and UnionPay forge a strategic partnership. The alliance aims to facilitate seamless, secure, transparent, and efficient international transfers, particularly for clients remitting funds to China's mainland. Keep reading

🇺🇸 Keeta and SOLO create the first-ever blockchain credit bureau, fueling traditional finance's adoption of blockchain technology. Features will include a lending marketplace with verified reputations, stablecoin-based loan origination offering real-world APR relief to crypto-native borrowers, and bank integrations.

🇬🇧 BIS and BoE test ‘modern AI techniques’ to spot criminality in retail payments data. Transaction analytics could be a valuable supplementary tool to help banks and payment service providers identify financial crime patterns in real-time retail payment systems, an 18-month collaboration between the banks has concluded.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()