Pay.com.au Reaches a $633 Million Valuation after New Funding Round

Hey Payments Fanatic!

Pay.com.au raised $25 million as the Melbourne-based FinTech prepares for its US expansion.

The round was led by Morgans Corporate with participation from Wilson Asset Management, Thorney Group, and Ophir.

The raise values the platform at $633 million pre-money. Revenue more than doubled year-on-year to $73 million, while losses reached $8.5 million. A further $28 million in existing shares changed hands in a secondary process.

In earlier rounds, Pay.com.au secured $18 million this year at a $300 million valuation. The platform’s rewards model lets businesses earn and redeem points with partners including Qantas, Singapore Airlines, Virgin, Visa, and Mastercard.

With fewer than 20% of Australian businesses using rewards programs, the team sees room to scale a broader loyalty ecosystem for SMEs. An ASX listing may also be considered in the coming years.

As Payments keep evolving, I’ll keep you close to what really matters. Stay tuned. I’ll be back in your inbox tomorrow!

Cheers,

INSIGHTS

🇮🇳 India’s payments story has entered its next chapter, from scale to sophistication.

NEWS

🇬🇧 3S Money appoints Cyber Security Expert Don Randall MBE as Non-Executive Director. In his new role on the 3S Money Board, Don will provide strategic guidance on strengthening cybersecurity and data practices, ensuring that the company continues to champion client safety and trust.

🇺🇸 Pay.com.au hits $633 million valuation after $25 million raise. The funds are earmarked for local expansion alongside international expansion in the US market, with partners including Amex, as well as improvements to the core payments and rewards offering.

🇧🇷 PicPay's solution grows by more than 30% in the number of customers. This increase reflects the expansion of the use of the PicPay Wallet, which brings together different forms of integration for e-commerce and applications and is gaining ground as a practical and secure checkout alternative.

🇧🇷 Pix gains a new tool to recover money for victims of fraud, scams, or coercion. With the new rules, which will become mandatory for all banks starting in February 2026, the PIX refund system will more accurately track the path of the money and allow diverted funds to be recovered, even after they have left the scammer's original account.

🇺🇸 Worldpay accelerates the future of agentic commerce with model context protocol, a publicly available server powering AI-driven, agent-enabled payments. Developers and merchants can download, modify, and deploy the protocol immediately, enabling the rapid creation of AI agents and direct payment integrations with Worldpay’s API.

🇧🇭 BENEFIT and Ant International partner to launch Alipay+ in Bahrain to achieve global e-wallet connectivity. Partnership will integrate Alipay+ with BENEFIT, Bahrain’s national QR payment scheme, to enable all Bahraini merchants to accept cross-border digital payments from leading digital wallets and explore outbound payment capabilities.

🇮🇳 PayU India clocks $397 Mn revenue in H1 FY26. PayU India reported 20% year-on-year revenue growth during the six months ended September 2025, while adjusted EBITDA margins improved from -6% to breakeven, turning profitable in Q2 FY26.

🇬🇧 TerraPay launches Xend to power borderless payments for billions of wallet users. TerraPay’s collaboration with inclusion-led powers Xend to unlock seamless global interoperability, allowing wallet users to receive funds from any bank worldwide and make payments across extensive merchant networks.

🇺🇸 PayTrace has partnered with TreviPay to enable B2B merchants to extend net-terms financing and invoicing capabilities to commercial buyers through TreviPay’s Universal Acceptance solution. The integration leverages the Mastercard acceptance network, aiming to streamline trade credit processes and reduce friction in B2B transactions.

🇯🇵 Binance Japan and PayPay launch PayPay Money Linkage Service for crypto trading. The service allows users to buy crypto with funds from PayPay Money and withdraw proceeds from crypto sales back to their PayPay Balance. Keep reading

🇳🇬 Trade payments FinTech JuniGo closes oversubscribed pre-seed round. This funding enables the company to launch in Nigeria and expand across Africa-Asia corridors, unlocking billions in working capital that’s currently trapped in slow, expensive banking systems.

🇺🇸 Cross River launches stablecoin payments with infrastructure to power the future of on-chain finance. Integrated directly with Cross River’s real-time core, the offering unifies fiat and stablecoin flows through a single, interoperable system, enabling companies to move value across chains and traditional rails, leveraging bank-grade compliance.

🇲🇽 Shein launches co-branded credit card with Stori. According to information published by Stori, the product aims to expand access to credit among first-time users and is not available to customers who already hold a Stori card. The initiative aligns with Mexico’s accelerating digital-payment adoption.

🇬🇧 VALR adds multi-currency fiat capabilities through OpenPayd. Through the integration, VALR expands its offering to enable customers to fund their accounts in euros, pound sterling, and US dollars, via OpenPayd’s dedicated virtual IBANs and extensive global payment network.

GOLDEN NUGGET

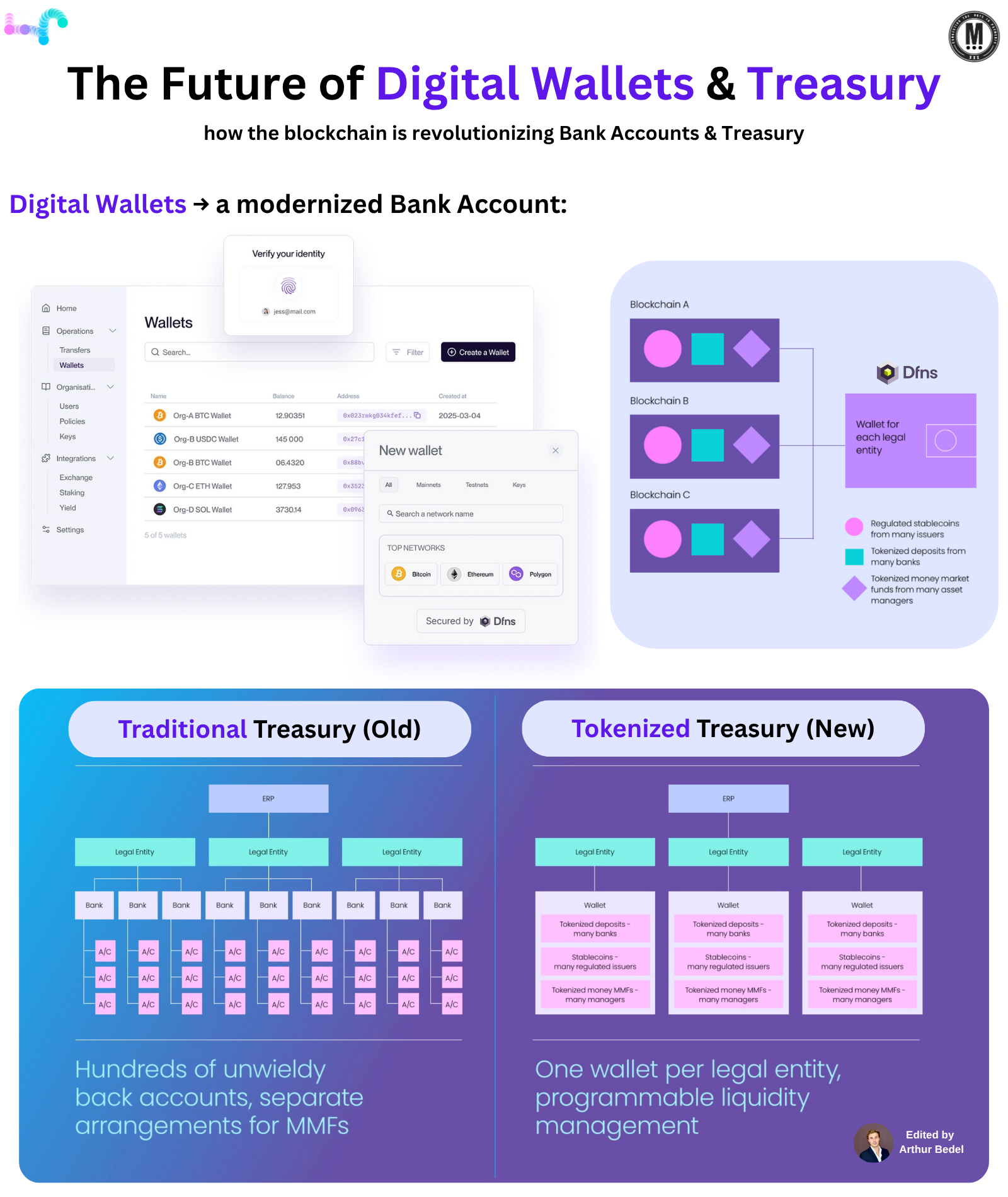

🚨 The Future of 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐖𝐚𝐥𝐥𝐞𝐭𝐬 & 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 — by Finmo, Ubyx Inc. & Dfns👇 Created by Arthur Bedel 💳 ♻️

The next chapter of finance isn’t about replacing banks — it’s about upgrading the financial infrastructure with blockchain as the new back-end infrastructure.

1️⃣ Digital Wallets → a modern version of a Bank Account

→ A place to hold funds safely

→ A tool to send & receive money

→ A system that manages balances across entities with financial products

What’s new is not the concept — it’s the technology behind it. Instead of siloed accounts in banks, wallets can hold tokenized deposits, regulated stablecoins, and even tokenized money market funds.

2️⃣ The future of Bank Accounts → Digital Wallets with Programmability & Global Reach

✔ Store assets across issuers (deposits, stablecoins, tokenized funds)

✔ Operate 24/7 with instant settlement

✔ Manage liquidity across multiple entities & regions

✔ Provide transparent audit trails through blockchain

Bank Accounts (old) → Digital Wallets (new)

3️⃣ Treasury: Traditional vs Tokenized

🔹 Traditional Treasury (Old):

→ Hundreds of fragmented bank accounts across legal entities

→ Settlement delays, cut-off times, trapped liquidity

→ Manual reconciliation & heavy admin

🔹 Tokenized Treasury (New):

→ One wallet per entity, programmable liquidity flows

→ Stablecoins + tokenized deposits + MMFs in a unified structure

→ Real-time, automated settlement across jurisdictions

→ Lower costs, reduced friction, global visibility

Traditional Treasury → Tokenized Treasury 2.0

4️⃣ Blockchain is becoming the operating layer of Financial Markets:

→ Banks are joining initiatives like the #Canton blockchain to tokenize assets & move funds

→ Stablecoins (USDC, EURC) are now trusted money-movement rails, on and off-ramped into cards, accounts, and APMs

→ Crypto and tokenized funds enable transactions that don’t touch fiat until the very end — or never at all

Money movement → Stablecoins & Blockchain Rails

5️⃣ The Ecosystem is Ready

→ Banks are issuing tokenized deposits (JPMorganChase, Lloyds Banking Group)

→ Stablecoins are regulated and adopted at scale

→ Asset managers like Franklin Templeton are tokenizing MMFs

Companies like Dfns, Finmo, Ubyx Inc. are creating the modern infrastructure, the digital gateway and banking infrastructure alongside traditional players for enterprises:

→ CFOs will run liquidity through AI-driven wallet infrastructures

→ Settlement will become atomic, global, and programmable

→ Wallets will evolve into the 2nd cash rail for enterprises, as essential as bank accounts

🚨 This isn’t about abandoning banks. It’s about building on top of them — upgrading financial plumbing with blockchain, stablecoins, and tokenization.

→ The question is: how fast will enterprises embrace wallets as the new operating system for money?

Source: Finmo | Ubyx Inc. | Dfns

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()