PayNearby Eyes IPO in 2026

Hey Payments Fanatic!

Indian FinTech PayNearby is gearing up for a public listing next year. The company has already met with 3 merchant bankers and will begin the DRHP process after selecting the one to go ahead with.

Unlike Paytm, PhonePe, or BharatPe, PayNearby built its edge through 1.2M+ neighborhood retailers powering services like cash withdrawal, remittances, and bill pay. The firm plans to grow its network over the next 2 years and its team by the end of March 2026.

Scroll for the full scoop, including how many more retailers and employees PayNearby plans to add. More of today’s top headlines in the payments space👇

See you Monday!

Cheers,

INSIGHTS

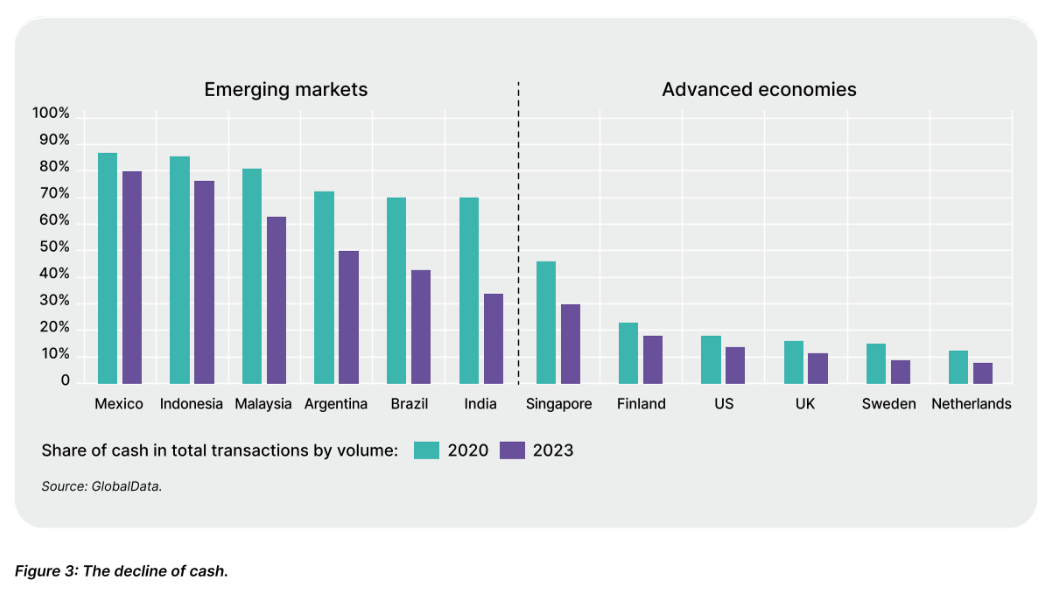

📊 Navigating Digital Payments Report.

NEWS

🇺🇸 How stablecoins could impact payments: Philip Bruno, ACI Worldwide’s Chief Strategy and Growth Officer, offers insights. In an interview, He talked about how ACI has been advising clients in the new stablecoin regulatory regime and how customers are reacting to the opportunities and challenges cryptocurrencies present.

🇮🇳 PayNearby plans to go public next year. Indian FinTech firm PayNearby plans to launch an initial public offering in the next financial year to fund expansion, its Chief Executive said, making it the latest to target a red-hot market that raised record sums in 2024.

🇨🇭 More than 6 million people in Switzerland rely on TWINT. People in Switzerland use TWINT to pay easily, quickly, and securely with their smartphones and to send money to friends, family, or acquaintances. The company also offers users and retailers a degree of independence from global tech corporations.

🇵🇭 Wise integrates with PESONet. Parents can now effortlessly transfer substantial amounts for their children’s overseas education in a single transaction, and overseas foreign workers can send significant amounts home without worrying about daily caps or multi-day processing times.

🇨🇦 Zum Rails launches suite of Mastercard-powered prepaid card programmes in Canada. These reloadable cards will enable businesses to offer seamless expense management, faster wage access, consumer rewards, and real-time disbursements and spending flexibility, empowering the business and its customers to control funds with speed, security, and precision.

🇨🇳 Indonesian QR code payments to launch in China by the end of 2025. The central bank has tested QRIS in China since August 2025 with partners including the Indonesian Payment System Association, UnionPay International, and payment providers.

🇵🇰 State Bank declares 1LINK a designated payment system. The SBP has further strengthened oversight of the country’s payment ecosystem, recognizing 1LINK’s role as Pakistan’s only interbank network operator. The platform facilitates ATM withdrawals, bill payments, interbank fund transfers, and a wide range of digital financial services used by millions nationwide.

🇸🇬 Singapore FinTech firm Nium reports $50 billion in annual transactions, with most activity coming from enterprise clients. Prajit Nanu, CEO of Nium, said this was the company’s highest month for both revenue and transaction volumes since its founding ten years ago.

🇲🇾 PayNet and Ant International expand their tie-up to boost DuitNow QR’s global reach. The agreement will allow Malaysian travellers to use their local e-wallets or banking apps across Alipay+’s global merchant network of 100 million. The partnership will also focus on strengthening fraud defences, talent development, and sustainability initiatives.

🇺🇸 Cash App, Afterpay, and Caleres step into fall with an expanded partnership. Through this partnership, U.S. shoppers can use Afterpay's Pay in 4 and Pay Monthly options to purchase from beloved brands. The collaboration also brings Afterpay's in-store payment solution to select retail locations.

🇱🇧 Whish Money collaborates with Mastercard Move to bring seamless cross-border payments to Lebanon. With the collaboration, Whish Money users in the country will be able to start sending money cost-effectively through the Whish Money mobile application to 50+ countries in near real-time.

🇺🇸 Mastercard and Alloy combine to speed onboarding. The new Mastercard Alloy joint onboarding solution will leverage identity verification and open finance to streamline the end-to-end onboarding process while combating fraud. Alloy intends to leverage Mastercard’s best-in-class global digital identity verification capabilities.

🇳🇿 Corpay partners with New Zealand Football as official FX provider ahead of World Cup. The arrangement will give the soccer body access to currency risk management tools and international payment processing through Corpay's platform. Keep reading

🇮🇩 Collaborate with BNI and JCB to launch the JCB corporate card in Indonesia. This premium credit card is thoughtfully designed to meet the diverse needs of Japanese corporations operating in the country, supporting both their business operations and collaborations with local partners.

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()