PayPal Approved by RBI to Act as Cross-Border Payments Aggregator

Hey Payments Fanatic!

The Reserve Bank of India (RBI) has granted in-principle approval to PayPal Payments Private Limited to operate as a cross-border payment aggregator for exports. While the designation may sound technical, it opens up broader access for Indian exporters to global markets through a more formal and regulated digital channel.

With services like PayPal Checkout, Invoicing, and No-Code Checkout, the company offers localized solutions aimed at simplifying global transactions for Indian sellers. This approval allows PayPal to legally facilitate regulated and secure transactions across nearly 200 markets, connecting Indian entrepreneurs to customers across borders, with systems built for speed, compliance, and scale.

“The in-principle PA-CB-E approval by RBI is a significant milestone for PayPal,” said Nath Parameshwaran, Senior Director, Government Relations, PayPal India. “It reflects the strength of India’s regulatory vision and the progress toward seamless, secure cross-border transactions.”

This approval is part of a wider push by the RBI to formalize digital cross-border payments under the Payment Aggregator–Cross Border (PA-CB) framework introduced in 2021. While PayPal still awaits final authorization, this step strengthens its long-standing presence in India’s evolving export ecosystem.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

Stay ahead in FinTech! Subscribe to my Daily FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

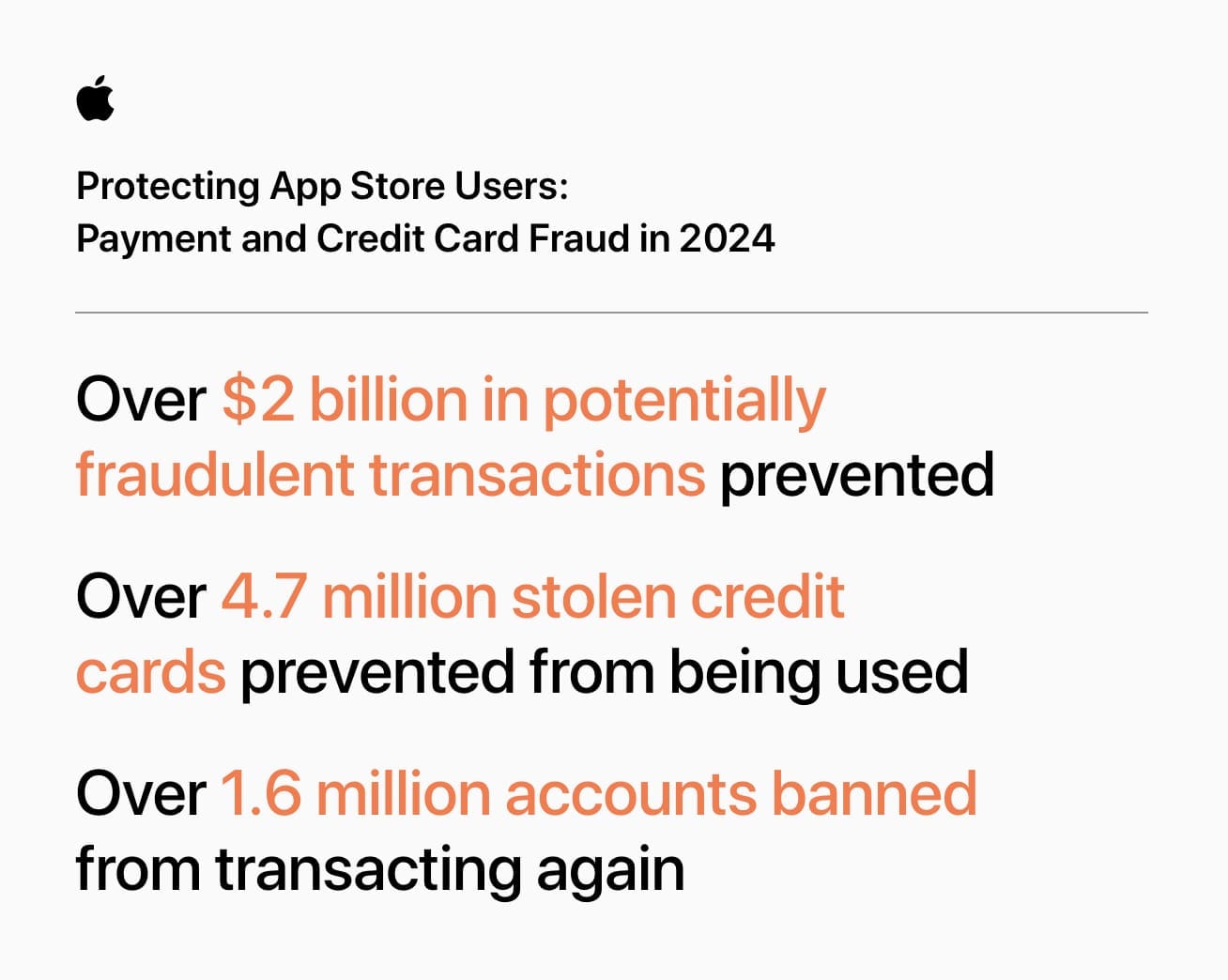

🇺🇸 Apple’s $9B Fraud Transactions Block — A Blueprint for FinTech Security. Apple just dropped a stunner revelation: over the last five years, the App Store blocked a jaw-dropping $9 billion in fraudulent transactions. Get all the details: click here to read the full article

NEWS

🇺🇸 X to launch X Money in partnership with Visa. The payments feature is expected to allow peer-to-peer (P2P) payments through the use of a debit card, as well as instantly transfer funds to its bank account. Continue reading

🇩🇪 Tink and Adyen partner to bring Pay by Bank to Vodafone customers in Germany. Pay by Bank allows consumers to quickly transfer money directly from one bank account to another. It also provides end-to-end payments capabilities, data-driven insights, and financial products in a single global solution.

🇪🇸 Neobank bunq adds Bizum to its Spanish customers. Users with a Spanish IBAN can send or receive money through the app, a service that will be available for bunq Core, bunq Pro, and bunq Elite individual plans. The plan is to facilitate payments for merchants once they complete the integration of Bizum.

🇬🇧 OpenPayd to roll out stablecoin infrastructure, allowing businesses to move and manage digital assets and fiat through a single platform. Through this, OpenPayd seeks to make money movement instant and more optimal by connecting local and international fiat rails to major blockchains.

🇸🇪 Klarna wants to break away from BankID. Sebastian Siemiatkowski, co-founder and CEO of Klarna, believes that BankID's dominant position hinders the development and the opportunity for alternative solutions to establish themselves. BankID is currently the largest identification service in Sweden.

🇺🇸 Fiserv reaffirms Clover revenue goal. The company’s Chief Financial Officer contended that the point-of-sale unit will still deliver $3.5 billion in revenue this year despite a recent volume growth slowdown. Read more

🇺🇸 Citcon and Splitit partner to enable merchants to offer credit card-linked installments. Partnering with Splitit allows Citcon to offer flexible omnichannel installments, bringing over 190 million U.S. cardholders with available credit, driving new sales at high average-ticket merchants.

🇲🇽 Belvo is betting on alternative data in Mexico as open finance pauses. The firm has identified a key opportunity in the use of alternative data to improve access to credit, a resource they believe has potential in the Mexican financial ecosystem.

🇦🇪 Dubai FinTech Qashio secures $19.8mln from US and MENA investors. The new funding is expected to help expand the company’s business across the GCC and beyond. Qashio operates a platform that helps businesses manage expenses and payments with integrated corporate cards and accounts payable automation.

🇫🇷 French regulators approve the merger of Fiat and stablecoin payment services. The dual licences enable Merge to support businesses in Europe and globally with services ranging from collecting and holding funds to executing cross-border payments and converting between fiat and digital currencies.

🇬🇧 UK paytech Dojo lands $190m from Vitruvian Partners. The investment, the first equity raise in Dojo’s history, will be used to fuel the company's European expansion strategy, supporting growth across Ireland, Italy, and Spain, where Dojo already maintains operations.

🇺🇸 Palla lands $14.5M for embedded cross-border payments. Miami-based Palla plans to use the new funding to expand into Europe-to-Latin America corridors and integrate additional payment systems. Keep reading

🇺🇸 Global Payments to sell payroll unit to FinTech Acrisure for $1.1 billion. The company will use the transaction proceeds to return capital to shareholders. The deal is expected to close in the second half of 2025. Continue reading

🇱🇹 MyTu integrates Apple Pay. With this integration, customers simply hold their iPhone or Apple Watch near a payment terminal to make a contactless payment. The updated myTU app supports instant issuance of virtual cards, allowing users to begin spending within minutes, without the need to wait for physical cards.

🌏 Stablecoin company Conduit raises $36 million from Dragonfly Capital and Altos Ventures. The company plans to use the money raised in this round to introduce its product in five Asian countries by the end of the year and expand its client base to include new types of businesses.

🇺🇸 Chargebacks911 appoints Donald Kossmann as CTO to lead AI-driven innovation in payments. Possessing more than 30 years of experience in computer science, AI, data systems, and fraud protection, Kossmann brings a rare blend of academic distinction and enterprise innovation to the role.

GOLDEN NUGGET

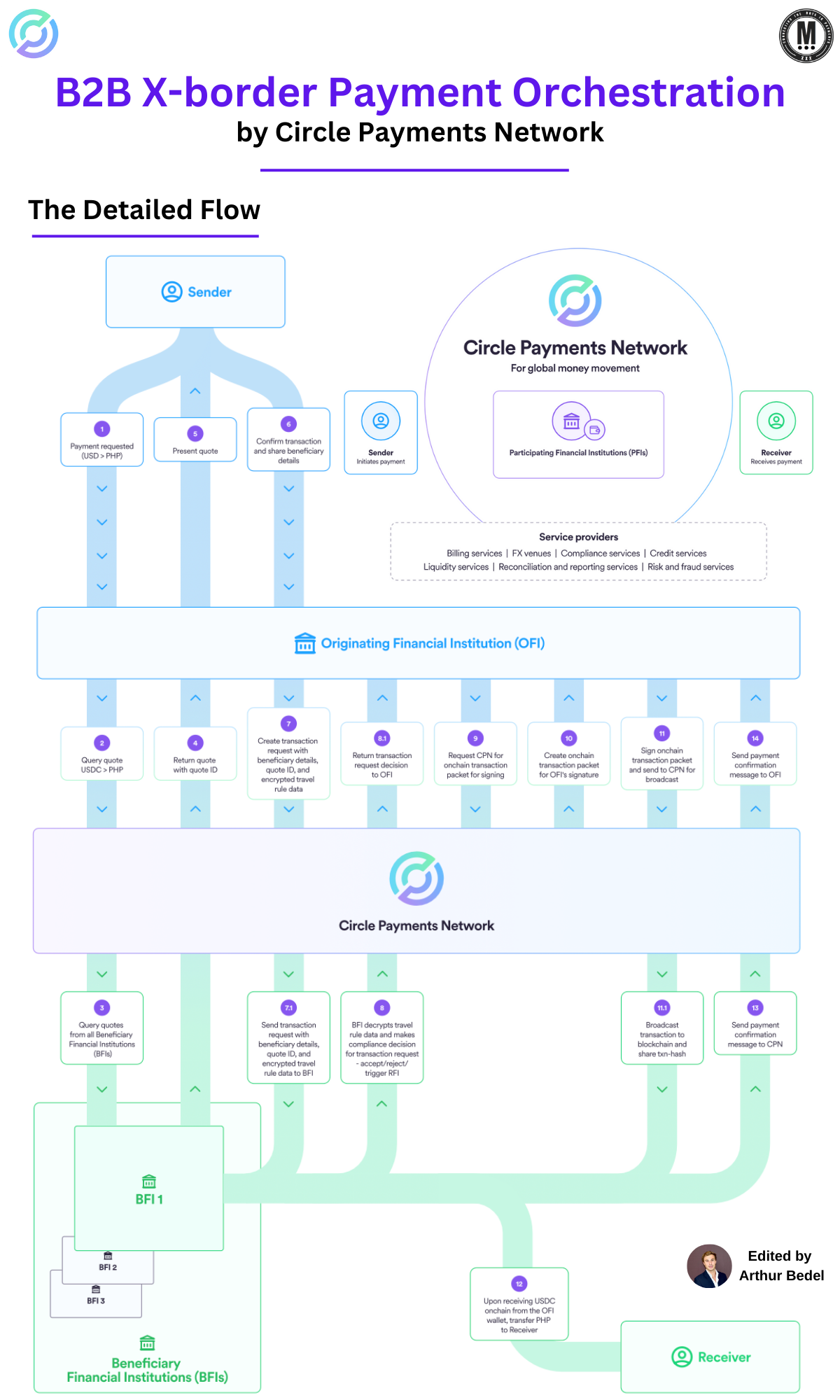

𝐁𝟐𝐁 𝐗-𝐛𝐨𝐫𝐝𝐞𝐫 𝐏𝐚𝐲𝐦𝐞𝐧𝐭 𝐎𝐫𝐜𝐡𝐞𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 — by Circle 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐍𝐞𝐭𝐰𝐨𝐫𝐤 🌍 Created by Arthur Bedel

𝐖𝐡𝐚𝐭 is the Circle Payments Network (𝐂𝐏𝐍)?

► CPN is a programmable, interoperable infrastructure enabling compliant global payments via FIAT, USDC, and regulated stablecoins.

► It connects Originating Financial Institutions (OFIs) and Beneficiary Financial Institutions (BFIs) through open blockchain protocols — optimizing payments for speed, compliance, and cost.

► Built for cross-border B2B transactions, CPN replaces complex correspondent banking with smart contracts, encrypted data packets, and multichain rails.

𝐂𝐏𝐍 𝐂𝐨𝐫𝐞 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬

► 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐞𝐫 𝐓𝐨𝐨𝐥𝐬 → Wallet SDKs, Paymasters, Contracts

► 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐀𝐬𝐬𝐞𝐭𝐬 → USDC, EURC, and Tokenized Funds

► 𝐋𝐢𝐪𝐮𝐢𝐝𝐢𝐭𝐲 → On/off-ramp FX, credit, minting

► 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 → Native multichain support + global banking integration

► 𝐂𝐨𝐦𝐩𝐥𝐢𝐚𝐧𝐜𝐞 & 𝐑𝐞𝐩𝐨𝐫𝐭𝐢𝐧𝐠 → Encryption, AML/CFT, KYC, and travel rule enforcement

► 𝐁𝐢𝐥𝐥𝐢𝐧𝐠, 𝐑𝐞𝐜𝐨𝐧𝐜𝐢𝐥𝐢𝐚𝐭𝐢𝐨𝐧, 𝐑𝐢𝐬𝐤 𝐒𝐞𝐫𝐯𝐢𝐜𝐞𝐬 → Embedded across all endpoints

𝐓𝐡𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐅𝐥𝐨𝐰 — B2B Cross-Border Payment Journey

1️⃣ A Sender initiates a payment (e.g., USD → PHP), confirms transaction and recipient details.

2️⃣ The Originating Financial Institution (OFI) queries Circle for USDC > PHP rates, shares quote, and generates an encrypted transaction packet.

3️⃣ The Circle Payments Network facilitates orchestration, routing, and packet signing using smart contracts.

4️⃣ The Beneficiary Financial Institution (BFI) receives transaction data, performs compliance checks, and transfers local currency (PHP) to the Receiver.

Every step — from quote to final payout — is secured with blockchain signatures, onchain record-keeping, and real-time compliance workflows.

𝐊𝐞𝐲 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 in this new blockchain-payment wave:

► Dfns → Digital Wallet Infrastructure

► Lightspark → Open protocol for money

► Zero Hash → Blockchain Payments Infrastructure

► Mural Pay → Stablecoins Payments

► Lyzi → Online & In-store Crypto Payments

Source: Circle Payments Network

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()