PayPal Just Dropped Its Biggest P2P Upgrade in Years

Hey Payments Fanatic,

PayPal just made sending money as easy as dropping a link — literally.

With PayPal Links, users can now fire off personalized one-time links in any chat, text, or email to get paid instantly. It’s PayPal meeting people where they already are: in conversations.

But the real kicker? Crypto is next. Soon you’ll be able to send Bitcoin, ETH, PYUSD, and more through the same flow — connecting PayPal, Venmo, and an expanding network of global wallets.

For a company that’s been shaping P2P for 25 years, this feels like its biggest leap since “Send Money with PayPal” became a verb.

What do you think?

Cheers,

Get the Latest in Paytech! Join my new Telegram channel for daily updates on paytech trends and exclusive insights. Connect with industry enthusiasts and stay on top of innovation!

NEWS

🇸🇦 Hala, a Saudi Arabia-based FinTech company, raised $157 million. Hala offers payment services to more than 142,000 small businesses in the Gulf region, making it similar to Block Inc.’s Square or SumUp Inc. The company has also been expanding into other financial services, like corporate cards, business accounts, and financing.

🇧🇷 Getnet and Eyemobile launch a payment split solution integrated with card machines. Integrated with Eyemobile's sales management system, the technology allows for automatic payment splitting between different recipients without altering the end consumer's experience. The solution operates through smart card machines, which allow you to install apps.

🇬🇧 From Unbanked to Empowered: How Africa is reimagining payments to drive financial inclusion by David King, VP MEASA, ACI Worldwide. According to ACI Worldwide’s Real-Time Payments: Economic Impact and Financial Inclusion 2024 report, real-time payments are projected to contribute more than $15 billion in additional GDP growth to Nigeria and South Africa by 2028.

🇺🇸 The top 25 payments companies of 2025. The companies selected are united by their focus on building payment systems that are scalable, secure, and responsive to evolving market and regulatory demands. ACI Worldwide delivers real-time payment orchestration software that helps banks, billers, and merchants modernize their infrastructures and deliver secure, seamless transactions.

🇺🇸 PayPal Ushers in a new era of peer-to-peer payments, reimagining how money moves to anyone, anywhere. Crypto will soon be directly integrated into PayPal's new P2P payment flow in the app. This will make it more convenient for PayPal users in the U.S. to send Bitcoin, Ethereum, PYUSD, and more to PayPal and Venmo, as well as a rapidly growing number of digital wallets across the world that support crypto and stablecoins.

🇯🇵 GoPay expands QRIS payments to Japan and eyes China next. Users can now make payments at QRIS-enabled merchants, following Bank Indonesia´s move to expand its cross-border QR code payment system to the country in August 2025. This allows Indonesian travelers to pay at Japanese merchants by scanning JPQR codes using the GoPay app.

🇺🇸 MoonPay to acquire payments startup Meso Network. Buying Meso will allow MoonPay to provide enhanced support for US banking rails such as electronic transfers and real-time payments, MoonPay CEO Ivan Soto-Wright said, as well as an improved developer platform to help other companies integrate with the New York-based firm’s products.

🇮🇳 Pine Labs gets Sebi nod for likely $1 billion IPO. The IPO, potentially valued at $1 billion, aims for a valuation of up to $6 billion. Pine Labs intends to utilize the IPO proceeds for overseas investments, technology development, and debt reduction, as it competes with major players like Paytm and PhonePe.

🇬🇧 PayPal-backed Modulr reports increased revenues, pulls back from crypto clients. Modulr says it is expanding internationally but is pulling back from working with crypto, remittance, and consumer banking clients. Continue reading

🇺🇸 Zelle Operator joins stablecoin race with Bank-Led Token. Early Warning Services (EWS) is exploring the launch of its own stablecoin for retail bank customers. The initiative would likely begin with a small-scale pilot designed to test infrastructure for issuing and circulating a regulated dollar-pegged token across bank networks.

🇸🇦 Thunes expands real-time cross-border payments to Saudi Arabia. Through its Direct Global Network, Thunes' Members can now deliver instant payouts directly to bank accounts and wallets in the Kingdom in Saudi Riyals (SAR), streamlining transactions for both individuals and businesses.

🇺🇸 Remitly creates a membership tier and expands product offerings. Remitly expanded its digital remittance offerings and created a monthly subscription offering for users, as the international payments platform is seeking to vertically expand its customer base and take advantage of stablecoins in the near future.

🌍 Kredete raises a $22M Series A round to expand credit-building infrastructure with stablecoin transfers to Africa. The company combines international money transfers with a proprietary credit-building engine, enabling users to send money to over 30 African countries while improving their credit history in the U.S. and beyond.

🇺🇸 Circle enables AI agents to pay for online services using USDC. This technology enables web services to request an on-chain payment before fulfilling a data request, opening up new possibilities for API monetization. The new model allows an AI agent to complete a transaction without any human intervention.

🇬🇧 Bank of England proposals to cap stablecoin holdings draw fire. The central bank is considering the measures as a means to fend off a drain of deposits from traditional financial institutions as users opt for the 24/7 convenience of stablecoins for real-time payments and yield-bearing interest rates.

🇦🇪 UPI joins hands with the Universal Postal Congress in Dubai to reshape cross-border payments. It has been hailed as a landmark moment in the global payments industry, with FinTech leaders highlighting its potential to reshape cross-border remittances and set new benchmarks for financial inclusion.

🇺🇸 Stripe’s head of crypto, John Egan, departs to join Polygon Labs as Chief Product Officer. Egan said he will focus on improving payments across Polygon’s ecosystem, which includes a handful of blockchains built on top of the Ethereum blockchain.

🇸🇦 Goldman and Citi among lenders for Tamara’s $1.4 Billion Debt Deal. The transaction will refinance and expand a previous debt facility arranged by Goldman. The commitment could rise to about $2.4 billion. The deal is still being finalized, and terms may change.

GOLDEN NUGGET

🚨 𝐓𝐡𝐞 𝐈𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐭𝐨 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐂𝐮𝐫𝐫𝐞𝐧𝐜𝐢𝐞𝐬 by Travel & Payments 👇 Created by Arthur Bedel 💳 ♻️

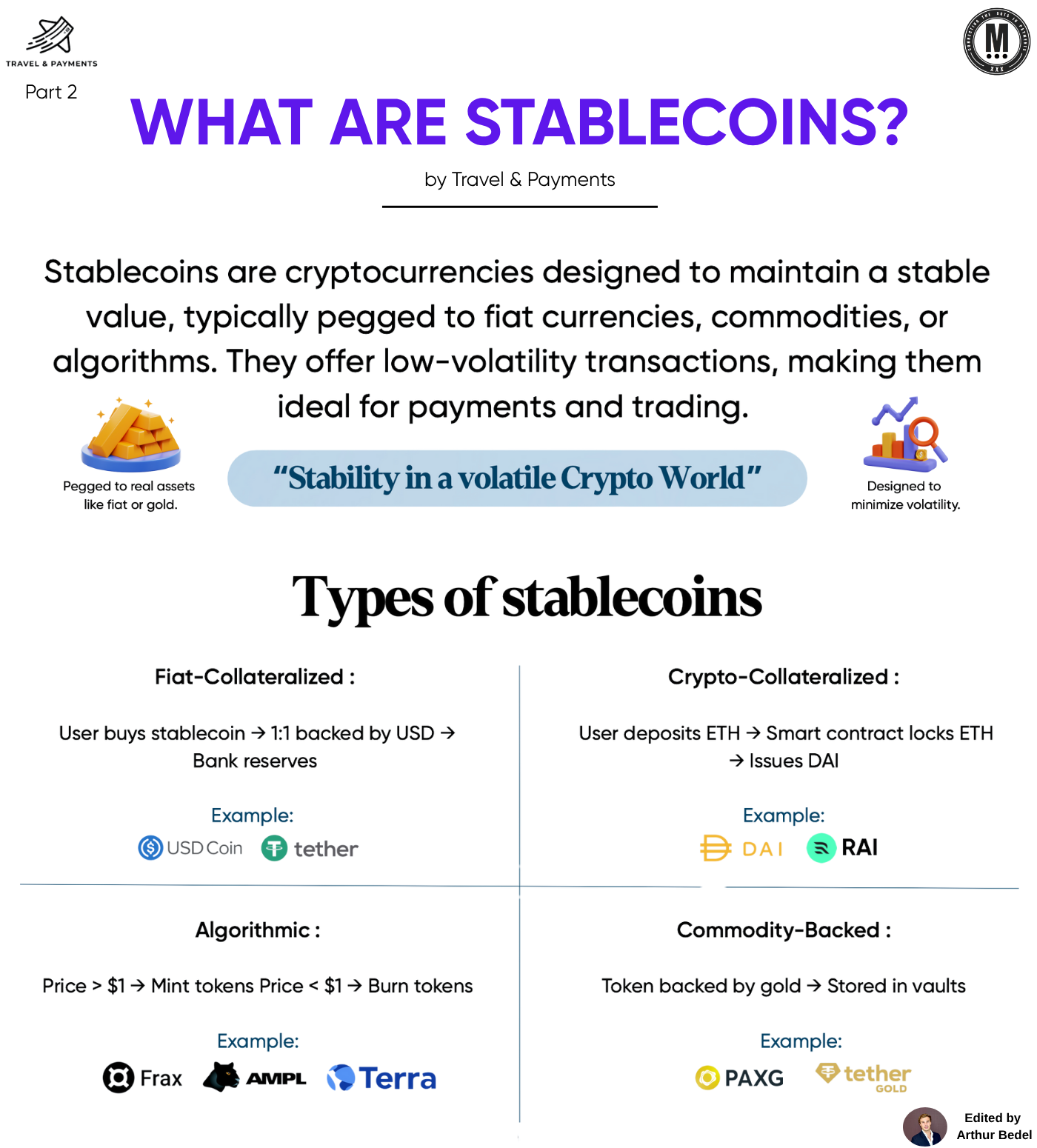

𝐖𝐡𝐚𝐭 𝐀𝐫𝐞 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬? — Edition #2

In Edition #1, we explored digital currencies — electronic forms of money that range from decentralized cryptocurrencies to central bank-issued CBDCs.

Stablecoins are a specific category within this space — cryptocurrencies engineered to maintain a stable value, typically pegged to a fiat currency such as USD, a commodity like gold, or governed by algorithmic rules. Their purpose is to reduce volatility, making them ideal for payments, remittances, and trading. In other words, “stability in a volatile crypto world.”

𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐂𝐮𝐫𝐫𝐞𝐧𝐜𝐢𝐞𝐬 vs 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬

While digital currencies as a whole can experience significant price swings, stablecoins are designed for price stability. This makes them a bridge between traditional money and digital assets — providing the speed, programmability, and borderless nature of crypto without the same volatility risk.

𝐓𝐡𝐞 𝐌𝐚𝐢𝐧 𝐓𝐲𝐩𝐞𝐬 𝐨𝐟 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬

1️⃣ 𝐅𝐢𝐚𝐭-𝐂𝐨𝐥𝐥𝐚𝐭𝐞𝐫𝐚𝐥𝐢𝐳𝐞𝐝 — Backed 1:1 by reserves in a traditional currency, held in banks.

→ 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬: Predictable value, trusted by merchants, straightforward fiat conversion.

→ 𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬: USD Coin (USDC), Tether (USDT), TrueUSD (TUSD). High stability, strong liquidity, and easier conversion to and from fiat.

2️⃣ 𝐂𝐫𝐲𝐩𝐭𝐨-𝐂𝐨𝐥𝐥𝐚𝐭𝐞𝐫𝐚𝐥𝐢𝐳𝐞𝐝 — Backed by other cryptocurrencies locked in smart contracts, often over-collateralized to manage volatility.

→ 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬: Fully decentralized, transparent, borderless.

→ 𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬: DAI, RAI. Maintains decentralization and accessibility without reliance on banks.

3️⃣ 𝐀𝐥𝐠𝐨𝐫𝐢𝐭𝐡𝐦𝐢𝐜 — Peg maintained by algorithms controlling token supply (mint/burn).

→ 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬: Scalable without large reserves; useful for DeFi experimentation.

→ 𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬: Frax (FRAX), Ampleforth (AMPL). Highly capital-efficient but more vulnerable to confidence shocks.

4️⃣ 𝐂𝐨𝐦𝐦𝐨𝐝𝐢𝐭𝐲-𝐁𝐚𝐜𝐤𝐞𝐝— Pegged to assets like gold, stored in secure vaults.

→ 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬: Combines physical asset security with instant global transfers.

→ 𝐄𝐱𝐚𝐦𝐩𝐥𝐞𝐬: Pax Gold (PAXG), Tether Gold (XAUT). Offers inflation protection with digital transferability.

𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧𝐬 𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐞𝐧𝐚𝐛𝐥𝐞:

→ 24/7 settlement without banking hours.

→ Cross-border transfers in seconds, not days.

→ Lower fees compared to card or SWIFT payments.

→ Programmability through smart contracts.

→ Financial inclusion in markets with unstable local currencies.

𝐍𝐞𝐱𝐭 𝐔𝐩: Stablecoins — Storage, Adoption & Scale

Source: Travel & Payments | Vishal Mehta

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()