PayPal Launches First Contactless Mobile Wallet in Germany, Introducing Flexible In-Store Payments

Hey Payments Fanatic!

PayPal is rolling out its first-ever contactless mobile wallet in Germany this summer. Through the latest PayPal app, users can tap to pay in-store wherever Mastercard contactless is accepted, blending PayPal’s online power with offline shopping.

Another first for Europe, PayPal is launching “Ratenzahlung To Go”, letting German shoppers split in-store purchases into 3, 6, 12, or 24 monthly installments. Plus, in-app cashback offers sweeten the deal at select retailers.

Jörg Kablitz, Managing Director of PayPal Germany, Austria, and Switzerland, emphasized the shift: “Cash has a role to play, but many consumers and businesses are ready for innovative alternatives. Put simply, we believe PayPal is better than cash. Our app will make it easy and safe to pay with your phone in stores; it will give you more choice in how and when you pay; and even better-PayPal will help put money back in your pocket.”

This marks a significant step in PayPal’s European omnichannel push, driving convenience for users and new growth for merchants as digital wallet use soars.

Read more global payment industry updates below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

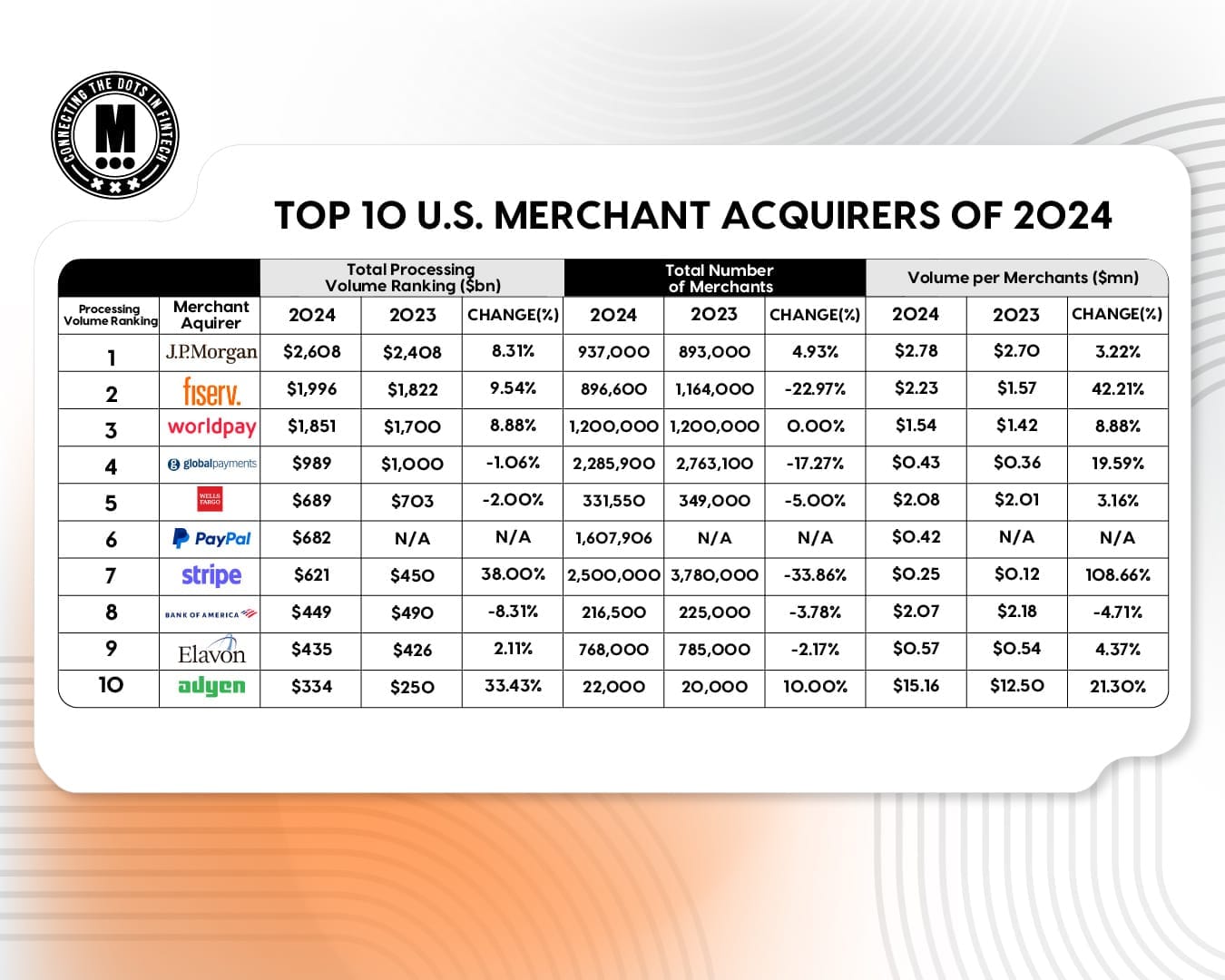

🇺🇸 The Top 10 U.S. Merchant Acquirers in 2024. The five largest players, J.P. Morgan, Fiserv, Worldpay, Global Payments, and Wells Fargo, accounted for about $8.1 trillion of that total.

PAYMENTS NEWS

🌎 How is ACI Worldwide Transforming the Real-Time Payments Landscape? Alberto Olivares, Director for Latin America at ACI Worldwide, shares his vision and experience on the Global IT Media technology program. Watch the full interview here

🇨🇴 Women leading financial inclusion with real-time payments. More than 740 million women remain excluded from banking services, especially in developing regions where they face social and structural barriers. However, according to ACI Worldwide’s 2024 report, real-time payments are transforming this reality, with women leaders driving decisive progress toward financial inclusion.

🇺🇸 X Money's new updates are revealed ahead of the official launch. X Money, an X payment platform, will reportedly offer users cashbacks on their payments, with Elon Musk’s X set to partner with Persona for ID checks. X Money is expected to launch soon, allowing international users to exchange money.

🌍 The European Central Bank partners with the private sector through the digital euro innovation platform. The innovation platform simulates the envisaged digital euro ecosystem, in which the ECB provides the technical support and infrastructure for European intermediaries to develop innovative digital payment features and services at the European level.

🇨🇳 Ant Group in talks for international unit IPO in Hong Kong. It has received indications that there are currently no policy obstacles. Zhou Zhifeng, a senior Vice President and General Counsel of the group, is leading the discussions with regulators in Hong Kong and Singapore.

🇮🇳 Zillion partners with FinTech major PayU. The company said that the integration expands its ecosystem, offering customers opportunities to accumulate and utilise their Zillion Coins across a more extensive portfolio of brands. Read more

🇨🇦 Dream Payments enables Interac e-Transfer payouts in Canada. This feature enables the transfer of funds using only an email address or mobile number, eliminating the need for banking information. Keep reading

🇩🇪 The undiscovered 400-million exit of Sevdesk. Sevdesk, a cloud-based accounting software startup from Offenburg, Germany, was acquired by French company Cegid for nearly €400 million. The acquisition strengthens Cegid's position in the SME market, especially ahead of the upcoming e-invoicing mandate in 2025.

🇺🇸 JPMorgan uses a new feature to limit Zelle payments originating from social media. CNBC’s Leslie Picker breaks down the latest details on JPMorgan’s new restrictions to Zelle payments. Watch the full video

🇧🇷 Why is Brazil so important for Global FinTech Jeeves? The firm sees Brazil as a key market for expansion, citing its strategic importance and potential for innovation. At the Web Summit in Rio, Jeeves’ CEO emphasized plans to scale locally and export Brazilian-born solutions to other global markets.

🇦🇺 Adyen selects Fiskil as its partner in Australia. Through this collaboration, both firms intend to simplify how businesses connect their financial data, minimising complexities and ensuring an optimal and secure process. By utilising Fiskil’s banking API, Adyen is set to offer merchants a more efficient onboarding process, mitigating delays and augmenting the customer experience.

🇮🇳 PhonePe unveils made-in-India smart speaker to power offline payments. The device offers real-time audio payment confirmations in 21 languages, including a celebrity voice option with prominent Indian actors, which allows shopkeepers to focus on customers instead of checking their phones for payment alerts.

🇧🇷 Crypto broker Kraken debuts with Pix in Brazil and promises low fees. This integration allows faster and more efficient transactions, aligning with its commitment to providing low fees and Portuguese-language support. Kraken does not yet accept Brazilian Real deposits. However, the addition of Pix facilitates smoother fiat-to-crypto conversions for Brazilian traders.

🇺🇸 SEC closes PayPal PYUSD probe as rollback of Gensler-Era crypto enforcement barrage continues. The decision offers another insight into the current SEC’s stance on stablecoins. PayPal is looking to make strides in the cryptocurrency industry with PYUSD as the focus.

GOLDEN NUGGET

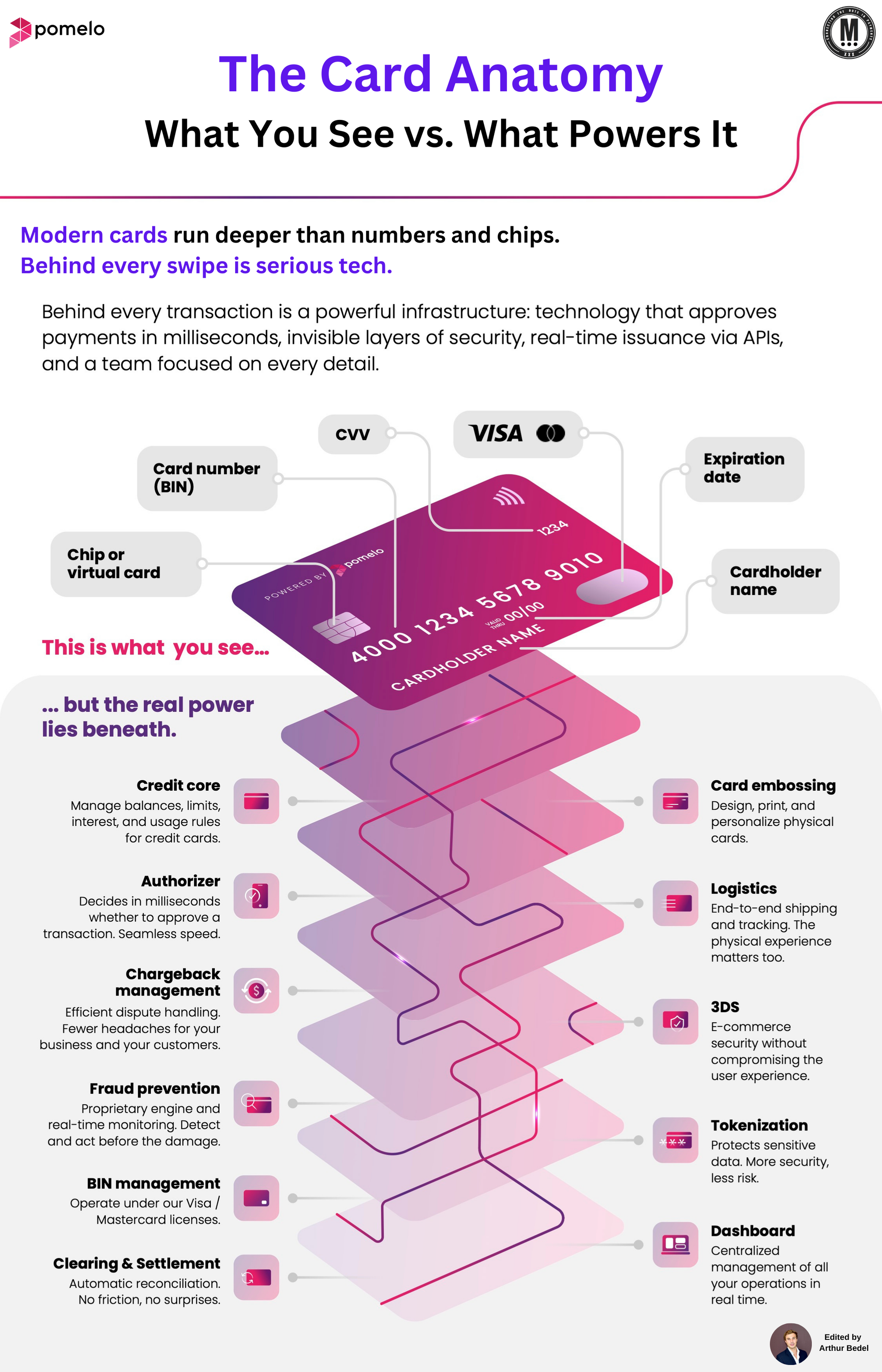

𝐓𝐡𝐞 𝐂𝐚𝐫𝐝 𝐀𝐧𝐚𝐭𝐨𝐦𝐲 — 𝐖𝐡𝐚𝐭 𝐘𝐨𝐮 𝐒𝐞𝐞 vs. 𝐖𝐡𝐚𝐭 𝐏𝐨𝐰𝐞𝐫𝐬 𝐈𝐭 by Pomelo 👇 Created by Arthur Bedel

Modern cards run deeper than numbers and chips. Behind every swipe lies a full-stack infrastructure — built for security, speed, personalization, and real-time control.

Every transaction activates a powerful backend system — authorizers, fraud models, tokenization engines, and compliance services — designed to respond within milliseconds, at scale.

𝐖𝐡𝐚𝐭 𝐘𝐨𝐮 𝐒𝐞𝐞 𝐨𝐧 𝐚 𝐂𝐚𝐫𝐝:

► Card Number (BIN)

► CVV

► Expiration Date

► Card Network (Visa / Mastercard)

► Cardholder Name

► Chip or Virtual Card

► Branding and Personalization

These are essential for visual identity and compliance, but they’re only the surface.

𝐖𝐡𝐚𝐭 𝐏𝐨𝐰𝐞𝐫𝐬 𝐚 𝐂𝐚𝐫𝐝 — 𝐁𝐞𝐧𝐞𝐚𝐭𝐡 𝐭𝐡𝐞 𝐒𝐮𝐫𝐟𝐚𝐜𝐞

► 𝐂𝐫𝐞𝐝𝐢𝐭 𝐂𝐨𝐫𝐞 – Configures credit rules, interest rates, balance logic, and usage limits.

→ Providers: Marqeta, Highnote, Experian, TransUnion®

► 𝐀𝐮𝐭𝐡𝐨𝐫𝐢𝐳𝐞𝐫 – Executes real-time decisioning on every transaction based on balance, fraud risk, merchant MCC, and network rules.

→ Providers: Visa DPS, Marqeta, Adyen, Checkout.com

► 𝐂𝐡𝐚𝐫𝐠𝐞𝐛𝐚𝐜𝐤 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 – Enables dispute resolution and evidence submission.

→ Providers: Verifi Inc. (Visa), Ethoca (Mastercard), Chargebacks911

► 𝐅𝐫𝐚𝐮𝐝 𝐏𝐫𝐞𝐯𝐞𝐧𝐭𝐢𝐨𝐧 – Uses ML and behavioral analytics to detect risk signals (e.g., velocity checks, device ID).

→ Providers: Sift, Forter, Ravelin Technology, Socure

► 3𝐃𝐒 (Three-Domain Secure) – Adds authentication during online checkout (compliant with PSD2).

→ Providers: G+D Netcetera, CardinalCommerce, GPayments

► 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 – Replaces PAN data with merchant or network tokens, protecting card data.

→ Providers: Visa VTS, Mastercard MDES, VGS

► 𝐁𝐈𝐍 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 – Determines product logic, pricing, routing, and branding under Visa/Mastercard licenses.

→ Providers: Qolo, Marqeta, Galileo Financial Technologies

► 𝐂𝐥𝐞𝐚𝐫𝐢𝐧𝐠 & 𝐒𝐞𝐭𝐭𝐥𝐞𝐦𝐞𝐧𝐭 – Automates reconciliation between issuer/acquirer and card networks.

→ Networks: VisaNet, Mastercard Banknet

→ Providers: FIS, Fiserv, Worldline

► 𝐂𝐚𝐫𝐝 𝐄𝐦𝐛𝐨𝐬𝐬𝐢𝐧𝐠 & 𝐋𝐨𝐠𝐢𝐬𝐭𝐢𝐜𝐬 – Manages physical card production and shipping.

→ Providers: IDEMIA

► 𝐃𝐚𝐬𝐡𝐛𝐨𝐚𝐫𝐝 & 𝐂𝐨𝐧𝐭𝐫𝐨𝐥𝐬 – APIs and real-time issuer interfaces for card lifecycle and operations.

→ Providers: Marqeta, Highnote, Unit, Paymentology

𝐂𝐚𝐫𝐝 𝐩𝐫𝐨𝐠𝐫𝐚𝐦𝐬 today are not just about plastic or virtual credentials — they’re API-driven, modular platforms connecting dozens of microservices.

A card may appear simple, but powering it is a full-stack orchestration of decision engines, compliance protocols, fraud defenses, and settlement systems — all in real time.

The real power lies beneath.

Source: Pomelo

Want your message in front of 100.000+ FinTech fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.

Comments ()